Introduction to E-wallet Security Tips

The number of e-wallet users in the Philippines has rapidly increased over the years, showing how more Filipinos are embracing digital payments for everyday transactions. According to a 2023 report by the Bangko Sentral ng Pilipinas (BSP), e-wallet accounts surged by 52.8% from 2022, reaching 393.6 million accounts in 2023. This surge is no surprise, given the convenience and efficiency e-wallets provide. However, with this growing adoption, following E-wallet Security Tips is essential to protect your digital transactions from potential threats.

Using an e-wallet like Maya, you can easily send and receive money, pay bills, and shop online from your smartphone. E-wallets also record real-time transactions, helping you track spending and detect suspicious activity. However, some people hesitate to use e-wallets despite their benefits due to security concerns.

Fortunately, e-wallet providers like Maya implement strong security measures, such as:

- Multi-factor authentication (MFA) (e.g., face and biometric authentication).

- One-Time Passwords (OTP) for large transactions.

- Advanced encryption methods to protect user data.

- 24/7 in-app customer support for quick issue resolution.

If you are wondering, “Is Paymaya safe?” the answer is yes! However, security is not just the provider’s responsibility; users must also adopt e-wallet security tips to keep their accounts and money safe.

E-wallet Security Tips

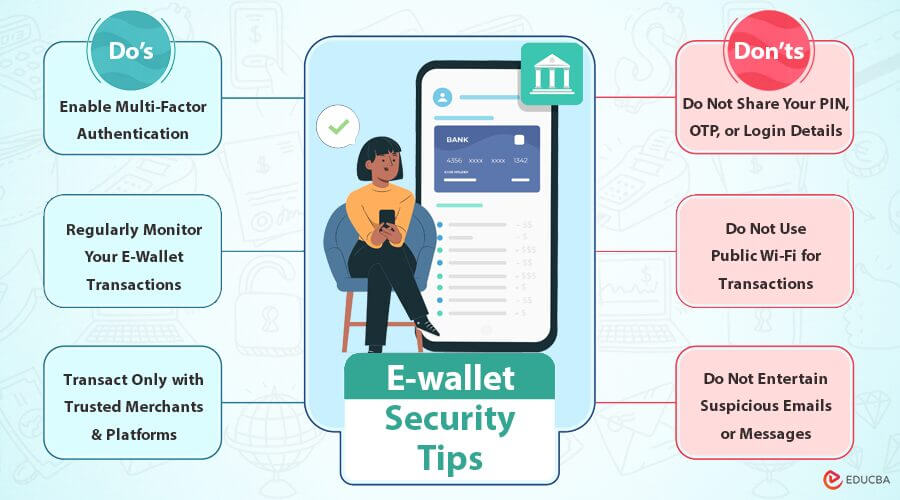

To help you maximize security and enjoy a hassle-free digital experience, here are 10 essential do’s and don’ts when using your e-wallet for online transactions.

Do’s: Best Practices for Secure E-Wallet Use

1. Enable Multi-Factor Authentication (MFA)

Multi-factor authentication (MFA) enhances security by requiring extra verification besides your password. This could be a biometric scan (fingerprint or face ID), or a one-time password (OTP) sent to your registered mobile number. MFA makes it much harder for anyone to access your account, even if they have your password.

2. Regularly Monitor Your E-Wallet Transactions

Make it a habit to check your transaction history frequently. This helps you quickly spot any unauthorized transactions, such as double charges or fraudulent transfers. Most financial institutions have a limited window for disputing transactions, so the sooner you identify an issue, the faster you can report and resolve it.

3. Transact Only with Trusted Merchants and Platforms

Check the seller’s trustworthiness before paying online. Here is how:

- Check for “https” and a padlock icon to ensure security.

- When shopping on platforms like Shopee or Lazada, buy from official stores (Shopee Mall or LazMall Flagship Stores).

- Be cautious of deals that seem too good to be true—they usually are!

4. Set Spending Limits

Most e-wallets allow you to set daily or per-transaction spending limits. This prevents overspending and reduces potential losses in case of fraud. Maya, for example, lets you toggle off foreign transactions or limit certain transaction types for added security.

5. Use Built-in Bill Payment Features

Many e-wallets have dedicated bill payment features that send funds directly to service providers. These features reduce errors, ensure payments go to the correct account, and may even offer cashback or discounts.

6. Update Your Password Regularly

Changing your password frequently is a simple yet effective way to enhance security. Hackers keep finding new ways to steal credentials, so update your password regularly and use different passwords for each account.

Don’ts: Security Risks to Avoid

1. Do Not Share Your PIN, OTP, or Login Details

Your password, PIN, and OTP are strictly private information. Do not share these details even if someone you trust asks for them. Scammers often pose as family members, bank representatives, or customer service agents to trick users into revealing sensitive information.

2. Do Not Use Public Wi-Fi for Transactions

Public Wi-Fi networks are not secure, making them easy targets for cybercriminals. Hackers can intercept data transmitted over unsecured networks, including your e-wallet credentials. Use a VPN to keep your e-wallet safe when in public.

3. Do Not Entertain Suspicious Emails or Messages

Phishing scams are common, and scammers often impersonate legitimate e-wallet providers to steal user credentials. Remember:

- Maya and other e-wallet providers will never ask for your password, PIN, or OTP via email or text.

- If you get a suspicious message, block and report the sender.

4. Do Not Ignore Security Alerts and Notifications

E-wallets send transaction and security alert notifications. If you receive a suspicious login attempt alert or an unauthorized transaction notification, act fast! Report the issue via your e-wallet’s app or the customer support hotline. Ignoring these alerts can lead to financial loss.

5. Do Not Forget to Update Your E-Wallet App

E-wallet providers regularly update their apps to fix security vulnerabilities and enhance protection. If you get a suspicious message, block and report the sender.

6. Do Not Save Your Card Details on Websites or Apps

Although saving your card details for faster checkouts is convenient, doing so increases the risk of unauthorized transactions. If a website gets hacked, stored payment information can be compromised. To stay safe, manually enter your card details for each transaction instead of saving them.

Final Thoughts

E-wallets have revolutionized how we handle money, making transactions fast, convenient, and efficient. However, with convenience comes responsibility. By following these e-wallet security tips, you can protect yourself from fraud and maximize the benefits of cashless transactions.

Recommended Articles

We hope you found these e-wallet security tips helpful. Check out these recommended articles for more insights on digital payments, fraud prevention, and online financial safety.