Updated June 27, 2023

Difference Between 403(b) vs 457

403(b) vs 457 are well-designed postretirement plans for the employees of the United States people.

403(b)

This is for Private & non-profit organizations, Public Educational Institutions. If any other entity qualifies under IRS (Internal Revenue Service Charitable Institutions work exclusively for tax exemption. This is the Defined-Contribution plan. This plan saves money on a tax-deferred basis. It was invested only in Tax-Deferred Annuity Plans (TDA) annuity contracts. Deferral means a small amount of money is saved for future income purposes post-retirement. Elective deferral is often used as nothing but a contribution made from salary to Retirement plans (403(b)). The employee should authorize before every transaction occurs for safety purposes. All employee deferrals are made with pre-tax. The deducted amount will reflect on the gross income.

457

457 has two types:-

- 457 (b) – This is for state & local government employees.

- 457(f) – This is for highly paid non-profit employees. 457 plan requires an employee to work until the agreed time. This is the plan only for the selected employees. Because this plan allows 100% contribution towards this plan from your income, so to receive 457(b), You should be highly talented and highly paid.

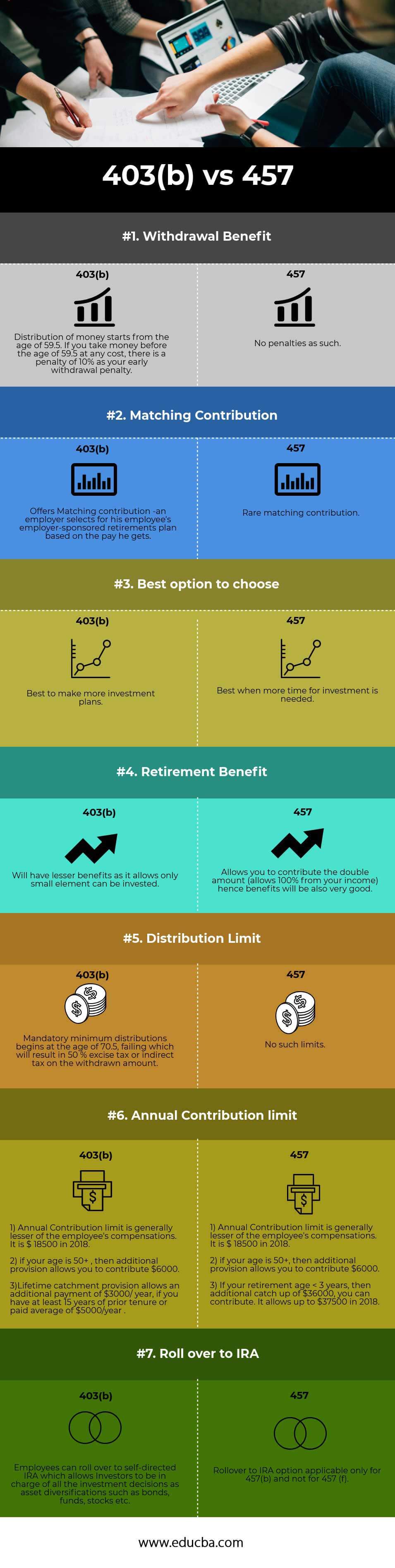

Head To Head Comparison Between 403(b) vs 457 (Infographics)

Below is the top 7 difference between 403(b) vs 457

Key Differences Between 403(b) vs 457

Both 403(b) vs 457 are popular choices in the market; let us discuss some of the major Difference Between 403(b) vs 457:

- 403(b) plan is offered to save money for retirement benefits for Private & non-profit organizations, Public sectors, and Public educational Institutions such as schools.

- Whereas the 457 plan is of two types:-

1. 457 (b) – this is for state & local government employees.

2. 457(f) is for highly paid non-profit employees.

- In the 403(b) plan, the Distribution of money starts from the age of 59.5. If you take money before the age of 59.5 at any cost, there is a penalty of 10% as your Early Withdrawal Penalty. In the 457 plan, No penalties as such. However, you cannot take any deductions until you attain 70.5 years of age. If you are still working, you can contribute to plans until you attain 70.5 years of age. There is no penalty if you are not working and want to make money before 59.5 years of age.

Mandatory minimum distributions are calculated based on life expectancy. It begins at the age of 70.5. Failure to take it will result in a 50 % excise tax or indirect tax on the withdrawn amount. In the 457 plan, there are no such criteria.

- 403(b)If an investor wants to have only one investment plan throughout his life, he can do it unless if he did not roll over to a self-directed IRA. If he rolled over to IRA, the investor would be responsible for all his investment decisions. 457(b) also as such an asset diversification option, but 457(f) does not have this option.

- 403(b):

1) The annual Contribution limit is generally lesser than the employee’s compensation. It was $ 18500 in 2018.

2) if you are 50+, an extra $6000 contribution is allowed.

3) Lifetime catchment provision allows an additional payment of $3000/ year if you have at least 15 years of prior tenure or a paid average of $5000/year.

- 457:

1) The annual Contribution limit is generally lesser than the employee’s compensation. It was $ 18500 in 2018.

2) if you are 50+, an extra $6000 contribution is allowed.

3) If your retirement age is < 3 years, an extra $37500 payment/year is allowed.

- If an employee needs more investments, 403(b) is the best option. If an investor needs more time to invest for retirement, 457 is the best option.

- 403(b) has a lesser contribution limit, whereas 457 allows you to contribute 100 % of your income (almost double 403(b)’s contribution limit).

- 403(b) has a wider choice of providers than 457(b).

- Unlikely 403(b), 457 is sometimes a measure to find out talented employees as it is offered only for a special set of members by its employer, not for everyone.

403(b) vs 457 Comparison Table

Below is the 7 topmost comparison between 403(b) vs 457:

| Basis of comparison |

403(b) |

457 |

| Withdrawal benefit | The distribution of money starts from the age of 59.5. If you take money before the age of 59.5 at any cost, there is a penalty of 10% as your early withdrawal penalty. | No penalties as such. |

| Matching contribution | Offers Matching contribution -an employer selects his employee’s employer-sponsored retirement plan based on his pay. | Rare matching contribution. |

| The best option to choose | Best to make more investment plans. | Best when more time for investment is needed. |

| Retirement benefit | It will have lesser benefits as it allows only a small element can be invested. | Allows you to contribute double the amount (allows 100% of your income); hence benefits will also be excellent. |

| Distribution limit | Mandatory minimum distributions begin at age 70.5, failing which will result in a 50 % excise tax or indirect tax on the withdrawn amount. | No such limits. |

| Annual Contribution limit | 1) The annual Contribution limit is generally lesser than the employee’s compensation. It was $ 18500 in 2018. 2) if your age is 50+, then an additional provision allows you to contribute $6000. 3)Lifetime catchment provision allows an additional payment of $3000/ year if you have at least 15 years of prior tenure or a paid average of $ 5000/year. |

1) The annual Contribution limit is generally lesser than the employee’s compensation. It was $ 18500 in 2018. 2) if your age is 50+, then an additional provision allows you to contribute $6000. 3) If your retirement age is < 3 years, an additional catch-up of $36000 can contribute. It allowed up to $37500 in 2018. |

| Rollover to IRA | Employees can roll over to a self-directed IRA, which allows Investors to be in charge of all the investment decisions as asset diversifications such as bonds, stocks, funds, etc. | The rollover to IRA option applies only for 457(b) and not 457 (f). |

Conclusion – 403(b) vs 457

When these 2 retirement plans have numerous advantages, an individual; investor does not need to depend on only the employer’s default pension scheme. Employees can avail of these plans and can get a benefit.

Recommended Articles

This has been a guide to the top difference between 403(b) vs 457. Here we also discuss the 403(b) vs 457 key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.