5 Important Insights About Crypto Trading Psychology

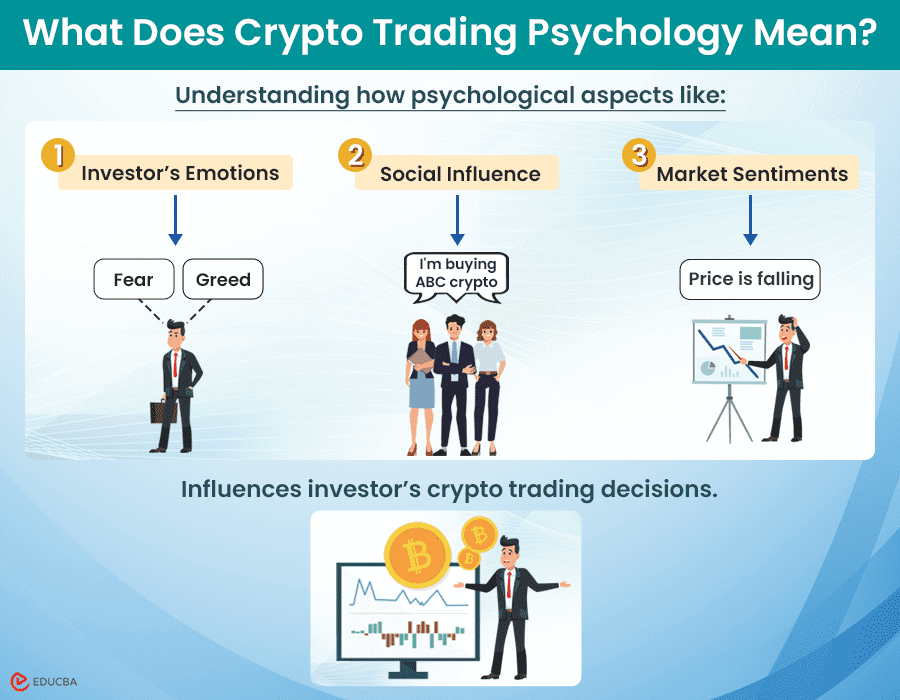

Crypto trading is when people trade cryptocurrencies like Bitcoin, Ether, Ripple and Moo Deng crypto. These markets don’t just work on economic factors but also the emotions, biases, and behaviors of the individuals participating in them. As a potential investor, you must know about crypto trading psychology. It studies how investors’ emotions and surroundings influence their crypto trading choices.

In recent years, many investors are seeking opportunities for profit in cryptocurrency trading. While technical analysis and market trends are essential aspects of trading, it’s also important to understand the underlying psychology of cryptocurrency trading to make smart investments. Understanding the psychology of crypto trading makes it easier to trade with a cool head. Moreover, your awareness will pay off in your choice of a reliable Monero wallet, for example, for storing and transacting with your Monero (XMR) or assessing your risk appetite and tolerance.

Let’s see what aspects of psychology can impact your trading decisions:

#1. Emotions

Emotions are powerful drivers of trading and investment decisions, and fear and greed, in particular, are prevalent emotions that often lead to impulsive and irrational behavior among traders. Investors may enter trades hastily because of a fear of missing out (FOMO) or being left behind as prices surge. On the other hand, fear of loss can trigger panic selling, causing investors to abandon their positions prematurely during market downturns.

Solutions to reduce the influence of your emotions:

- Set predefined entry and exit points.

- Practice mindfulness to cultivate your emotional resilience.

- Avoid impulsive decisions based on fleeting emotions.

The goal is to keep your emotions from ruling your trading activities.

#2. Cognitive Biases

Sometimes, cognitive biases (when our brains make automatic decisions based on impulsive thinking rather than logic) can distort judgment and lead to poor trading decisions.

For example,

- One cognitive bias is confirmation bias. It occurs when you only seek information that supports your beliefs, ignoring evidence that might challenge your investment decisions.

- Overconfidence is another common bias where traders believe that they can easily predict market movements. It often results in excessive risk-taking and losses.

Ways to mitigate your own cognitive biases are:

- Be aware of them. Once you recognize these biases, it won’t be as hard to make more objective trading decisions.

- You can also explore strategies such as diversifying your investments to reduce your reliance on single sources of information and actively seeking out dissenting opinions to counter your confirmation bias.

- Many traders also swear by maintaining a trading journal to track their performances and identify patterns of bias. Such a method may help you overcome your cognitive biases and make you a sharper decision-maker and trader.

#3. Market Sentiment and Social Influence

Market sentiment and social media also heavily influence investor behavior, influencing cryptocurrency prices. News events, social media trends, and celebrity endorsements can cause investors to panic buy or panic sell cryptocurrencies, leading to sudden price changes and increased market volatility.

Ways to stay unaffected by market and social sentiment:

- Remember that relying solely on external sources of information and following herd mentality (doing what others do) can be harmful to your own trading success.

- It’s best to conduct independent research, stay informed about market fundamentals, and maintain a critical mindset for any transaction involving crypto.

- Making thoughtful decisions based on objective analysis, rather than following speculative hype, can help you stay vigilant against external influences and improve your trading choices.

#4. Risk Perception

Risk perception varies among traders and definitely influences their individual approaches to trading. While some investors seek out high-risk, high-reward opportunities, others prioritize capital preservation and adopt more conservative investment strategies. To minimize your losses, you need to know where you swing and what effective risk management looks like for you.

Some risk management techniques include:

- Spreading investments across different assets to reduce exposure to any single risk.

- Using position sizing so that one single trade does not risk a large portion of their capital.

Try these strategies to get a good grip on your risk situation.

#5. Discipline

Maintaining discipline is paramount to successful crypto trading. An investor deviating from a trading strategy based on short-term market movements can undermine long-term profitability.

Ways to plan your cryptocurrency investments:

- Clearly define your entry and exit criteria.

- Adhere to predefined risk management rules you have for yourself.

- Exercise patience and restraint in the face of market volatility.

- Cultivate your self-awareness and recognize your strengths and weaknesses as a trader to ensure consistency and profitability in your crypto trading.

Final Thoughts

Emotions, cognitive biases, risk perception, market sentiment, and discipline will all play pivotal roles in shaping your trading decisions and outcomes with crypto. Your understanding of how all of these may affect you will make you a master of both your assets and your trading attitude.

Recommended Articles

We hope you understand these crypto trading psychology aspects and make better trading decisions. For more crypto-based articles, check these resources.