Difference Between ACA vs ACCA

Finance is the backbone of any business, whether a small vendor shop or an MNC. Thus, there is a demand for professionals who can understand the pulse of any business. Extensive professional courses and practical training are required to enhance business efficiency, cut expenses, and increase profitability. Thus, Chartered Accountants are in huge demand and have the expertise to handle several business situations, allowing the company to grow. Several countries grant the Chartered Accountant degree, which has its uniqueness. We will discuss the degree of Chartered Accountants, which the Global and Region-based Institutes provide.

ACA stands for Associate Chartered Accountant, whereas ACCA stands for Association of Certified Chartered Accountants. This degree is given by the Institute of Chartered Accountants of England situated in Wales. The course structure is more or less adjacent to the accounting principles followed in the UK. The first one is the Chartered Accountant degree, which can be passed in three years after completing 15 modules and adding 2-3 years of experience. ACA course is classified into three modules: certified, Professional, and Advanced. Certified level constitutes the following principles: Accounting, Assurance, Business and Finance, law, Management information, and Principle of taxation. The Professional level constitutes Business Planning, Business Strategy, Audit and Assurance, Financial Accounting and Reporting, Financial Management, and Tax Compliance. The advanced level includes Corporate Reporting, Strategic Business Management, and Case Studies.

Association of Certified Chartered Accountants (ACCA) is also a Chartered Accountant degree from the Association of Chartered Accountants with headquarters in London. The term charter in ACCA stands for Royal Charter, granted in 1974. The degree was given to give protection. They are fellow inspectors or auditors who must pass through a series of procedures to carry out public practice engagements, comply with additional procedures, and hold certificates for public inspections, audits, etc. The exam also consists of 14 papers and its core values of integrity, accountability, diversity, innovations, etc. The degree holds global recognition across 180 countries. The qualification is based on international Accounting principles and is also the key regulatory body of international accounting. ACCA has over one hundred years of reputation of more than 7500 satisfied employers across the Globe. The three stages of ACCA are Applied knowledge (Diploma), Applied Skills (advanced diploma), and essentials.

The diploma comprises AB Accountant in Business, MA Management Accounting, and FA Financial Accounting. Applied Skills include LW Corporate and Business Law, PM Performance Management, TX Taxation, FR Financial Reporting, AA Audit and Assurance, and FM Financial Management. The last module i.e. Essential, consists of SBR Strategic Business Reporting and BL Strategic Business Leader. The course holds a high global recognition and possesses an edge over ACA.

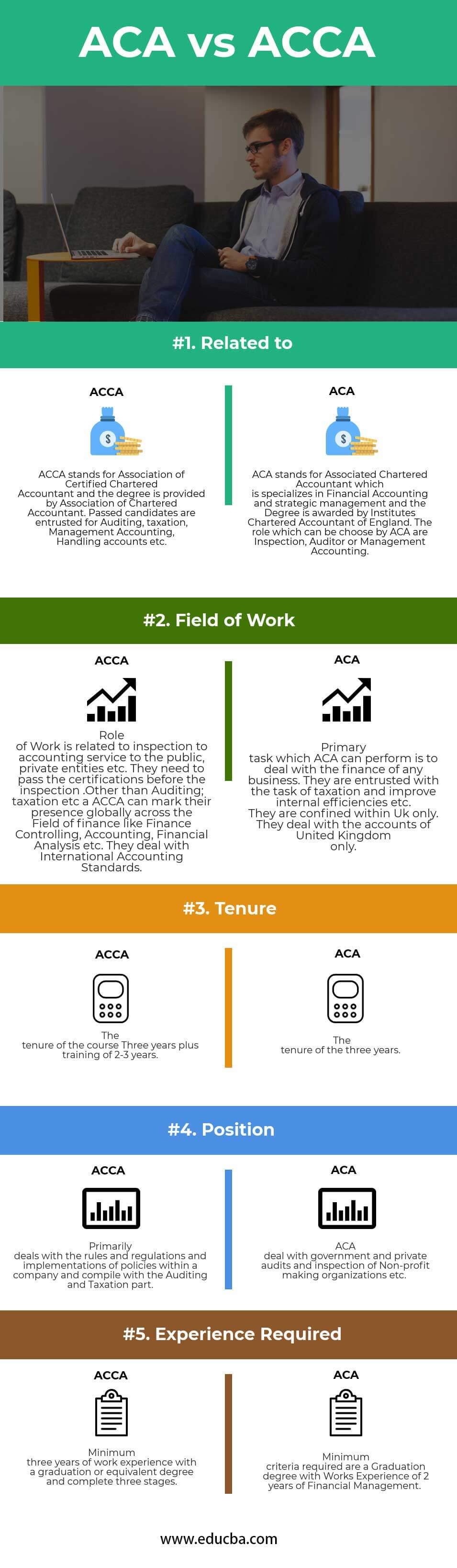

Head To Head Comparison Between ACA vs ACCA (Infographics)

Below is the top 5 difference between ACA and ACCA :

Key Differences Between ACA vs ACCA

Both ACA vs ACCA are popular choices in the market; let us discuss some of the major differences:

- ACA is specifically designed for the United Kingdom, while ACCA caters to the accounting needs of countries worldwide. ACCA is an international degree.

- ACA was established in 1974, and ACCA is a more than 100 years old Course. Both ACA and ACCA are related to Finance and Public taxation, Auditing, etc.

- Global acceptance of ACCA is due to its advanced course content and relevance to international accounting standards, whereas ACA focuses solely on the accounting principles of England.

- ACCA requires candidates to have a compulsory work experience of 2-3 years, while ACA does not require mandatory work experience.

ACA vs ACCA Comparison Table

Here are some of the Comparison between ACA vs ACCA –

|

The basis Of Comparison |

ACCA |

ACA |

| Related to | ACCA stands for Association of Certified Chartered Accountants, and the Association of Chartered Accountants provides the degree. Passed candidates are entrusted with auditing, taxation, management accounting, and handling accounts, among other responsibilities. | ACA stands for Associated Chartered Accountant, specializing in Financial Accounting and strategic management, and Institutes Chartered Accountants of England awarded the Degree. The roles which ACA can choose are Inspection, Auditor, or Management Accounting, |

| Field of Work | The role of Work is related to inspection to accounting services to the public, private entities, etc. They need to pass the certifications before the inspection. Other than Auditing, taxation, etc, an ACCA can mark its presence globally across the fields of finance like Finance Controlling, Accounting, Financial Analysis, etc. They deal with International Accounting Standards. | A primary task that ACA can perform is to deal with the finances of any business. They are entrusted with handling taxation, improving internal efficiencies, etc. Also, their scope is confined to the UK only. They deal with the accounts of the United Kingdom only. |

| Tenure | The tenure of the course is Three years plus training of 2-3 years. | The tenure the three years. |

| Position | Primarily deals with the rules and regulations and implementations of policies within a company and compiles with the Auditing and Taxation part. | ACA deals with government and private audits, inspection of Non-profit organizations, etc. |

| Experience required | Minimum three years of work experience with graduation or equivalent degree and complete three stages. | The minimum criteria required are a Graduation degree with Work Experience of 2 years of Financial Management. |

Conclusion

However, Every space of business requires the presence of Chartered Accountants. As the world of Business is expanding, the need for a Chartered Accountant is also in demand. The rules and regulations of each country are unique and also have a huge difference from each other. Thus, several bodies have designed Chartered Accountant Courses as per their suitability. ACCA covers all the latest modules and is way more advanced than ACA. In addition, Chartered Accountancy holds global recognition, unlike ACA, which specifically intends for England.

The language of business is changing and innovating. In contrast, ACA has the edge over other accounting courses as its modules are highly advanced and encompass every aspect of finance necessary for the current business scenario.

Recommended Articles

Moreover, This has been a guide to the top difference between ACA vs ACCA. We also discuss the ACA vs ACCA key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –