Difference Between Accounting vs Financial Management

In Accounting vs. Financing Management, accounting management refers to how a company records and reports all its financial transactions. In comparison, financing management means studying a company’s financials to check if it has enough funds for current and future projects.

What is Accounting?

In other terms, Accounting is reporting financial information using the Generally Accepted Accounting Principle (GAAP) and International Financial Reporting Standards (IFRS). The Financial Accounting Standards Board (FASB), the Financial Reporting Council, the Securities and Exchange Commission (SEC), the IRS, and other regulatory bodies set accounting standards and requirements for accounting preparation and presentation.

As per financial literature, Accounting can be divided into three broad categories:

- Financial Accounting: It deals with preparing financial statements and reporting financial information to external users like creditors, government agencies, analysts, investors, bankers, etc. Financial statements, i.e. the income statement and balance sheet, indicate the business’s financial position during a given period.

- Management Accounting: Reporting financial information to internal users like management and employees for the policy-making and running a day to day operations of the business. Management accounting is forward-looking and focuses on future activities to achieve business objectives.

- Cost Accounting: It is a part of management accounting for the cost analysis. Cost accounting elaborates on cost records regarding various products, operations, and functions. It is a process of determining and accumulating the cost of a particular product or activity.

What is Financial Management?

It refers to the effective and efficient management of monetary resources (finances and economics) by properly utilizing the organization’s fixed assets and working capital. Financial management aids management in better decision-making.

Effective procurement and efficient use of finance lead to the organization’s proper utilization of monetary resources. The main objective of financial management is profit maximization and wealth/value maximization.

Elements of Financial Management in Business Organization:

The major elements of financial management are financial planning and budgeting, financial reporting, account record keeping, and financial controls.

- Budgeting, Planning, and forecasting: It links the objective of an organization to the budget processes of planning and monitoring, and identifying any action needed by the business. Financial management helps determine the business’s financial requirements, which leads to the organization’s financial planning. Using resources efficiently is critical to financial decision-making. Since mastering budgeting and cost analysis often involves significant expenses, such as CPA courses, it’s wise to take advantage of exclusive offers and save with Beckers promo codes.

- Financial reporting: Reporting plays a crucial role in financial management. Since the management of the Company internally uses it to take a future course of action through the annual accounting statements.

- Financial controls: ensure the proper sources and uses of the organization’s economic resources.

- Financial decisions: The survival of an organization is an important consideration when the financial manager makes any financial decisions with investment, financing options, and dividends. In addition, it helps in balancing the cash inflows and outflows.

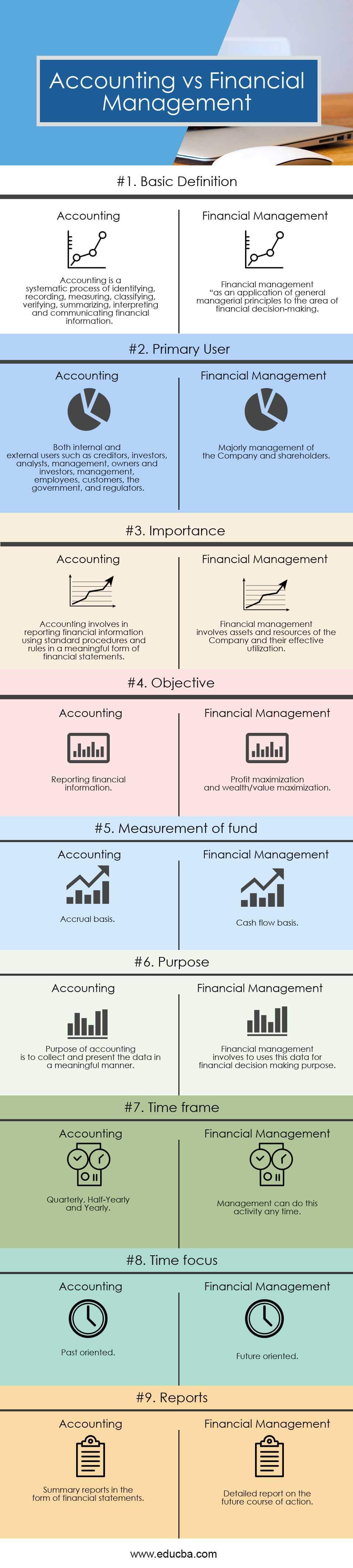

Head To Head Comparison Between Accounting vs Financial Management (Infographics)

Below is the top 9 difference between Accounting vs Financial Management

Key Differences Between Accounting vs Financial Management

Both Accounting vs Financial Management are popular choices in the market; let us discuss some of the major differences:

- Accounting is more about identifying, measuring, processing, classifying, and recording financial transactions, whereas financial management involves the effective and efficient management of finances and economic resources

- The key objective of accounting is providing financial information using standard procedures and rules, whereas the objective of financial management is profit maximization and wealth maximization.

- Accounting reports financial information to internal and external users such as creditors, investors, analysts, management, and regulators. In contrast, financial management is used internally by the organization’s management for planning and decision purposes.

- Accounting has three broad categories – financial accounting, management accounting, and cost accounting. In contrast, financial management involves financial planning and budgeting, financial reporting, account record keeping, and financial controls.

- Accounting involves reporting past financial transactions in the meaningful form of financial statements, whereas financial management involves planning the future by analyzing and interpreting financial statements.

- Accounting gives the Company’s financial position, whereas financial management gives a holistic view of the business activities and provides insight into the future wealth generation.

- In accounting, the measurement of a fund is based on an accrual basis, whereas the treatment of funds in financial management is based on cash flows.

- Accounting aims to collect and present the data meaningfully, whereas financial managers use this data for financial decision-making.

Accounting vs Financial Management Comparison Table

Below is the topmost comparison between Accounting vs Financial Management

| The basis of comparison |

Accounting |

Financial Management |

| Basic Definition | Accounting is a systematic process of identifying, recording, measuring, classifying, verifying, summarizing, interpreting, and communicating financial information. | Financial management “as an application of general managerial principles to financial decision-making. |

| Primary User | Internal and external users include creditors, investors, analysts, management, owners and investors, management, employees, customers, the government, and regulators.m | Majorly management of the Company and shareholders. |

| Importance | Accounting involves reporting financial information using standard procedures and rules in a meaningful form of financial statements. | Financial management involves the assets and resources of the Company and their effective utilization. |

| Objective | Reporting financial information | Profit maximization and wealth/value maximization. |

| Measurement of fund | Accrual basis | Cash flow basis |

| Purpose | The purpose of accounting is to collect and present the data in a meaningful manner | Financial management involves using this data for financial decision-making purposes. |

| Timeframe | Quarterly, Half-Yearly, and Yearly | Management can do this activity at any time. |

| Time focus | Past-oriented | Future-oriented |

| Reports | Summary reports in the form of financial statements | Detailed report on the future course of action. |

Conclusion

In summary, accounting and Financial Management are crucial functions for any organization, with Accounting providing necessary inputs for financial management. Accounting focuses on reporting and summarizing financial transactions for internal and external users, while Financial Management involves planning, directing, monitoring, organizing, and controlling monetary resources to achieve objectives. They are related but differ in their treatment of funds and decision-making. Accounting involves preparing and examining past financial records whereas financial management involves planning to achieve various financial objectives

Recommended Articles

This has guided the top difference between Accounting vs Financial Management. Here we also discuss the Accounting vs Financial Management key differences with infographics and comparison tables. You may also have a look at the following articles to learn more –