Updated November 15, 2023

Difference Between SOA and CAS

This article provides an outline of SOA vs CAS. Casualty Actuarial Society (CAS) and the Society of Actuaries (SOA) are professional organizations for actuaries and actuarial sciences. SOA has always been the dominant society for all career tracks related to actuarial sciences besides those related to Casualty and Property. The careers include life insurance, health benefits, and pensions. CAS has always been the dominant society for those in Casualty and Property. The main presence is in the USA and Canada, with a limited presence in other parts of the world.

Let us study much more about CAS vs SOA in detail:

- Casualty actuaries and property pursue their credentials through CAS; all other actuaries pursue their credentials through SOA. SOA administers the basic preliminary examinations for P, FM, and MFE, and credit is honored by CAS. As many actuarial aspirants are always in the dilemma of choosing between SOA vs CAS, we aim to provide you with a better understanding of SOA vs CAS by providing relevant differences.

- SOA has been recently seen to expand in non-traditional areas and domains, such as risk management and Property and Casualty. This current part has contributed to much friction between CAS vs SOA societies.

- The choice-making between SOA and CAS depends on what you wish to do and what you are doing now. It is evident and probable that unless you are working in some company until then, you won’t decide which path to choose. If they work in a P&C company, they would most likely choose a CAS path.

- If the candidate lands a job with some insurance domain company, then most likely, he/she would choose SOA as their career path. The first 3 basic preliminary exams between SOA and CAS overlap, so it becomes a win-win situation if you plan to start your actuarial journey. If you are a student more into mathematics, particularly statistics, then CAS is the way to go. If you like a contingency actuarial course, you should go for SOA.

- CAS vs SOA differ in the exam process, type of work, and salary type. On the one hand, SOA provides standards and regulations for actuaries who work in health, life, pensions, and retirement. CAS exams aim to provide information related to P&C content. Since CAS is responsible only for P&C actuaries, there is just one track of exams, i.e., everyone who becomes a fellow of CAS or FCAS has to take the exams.

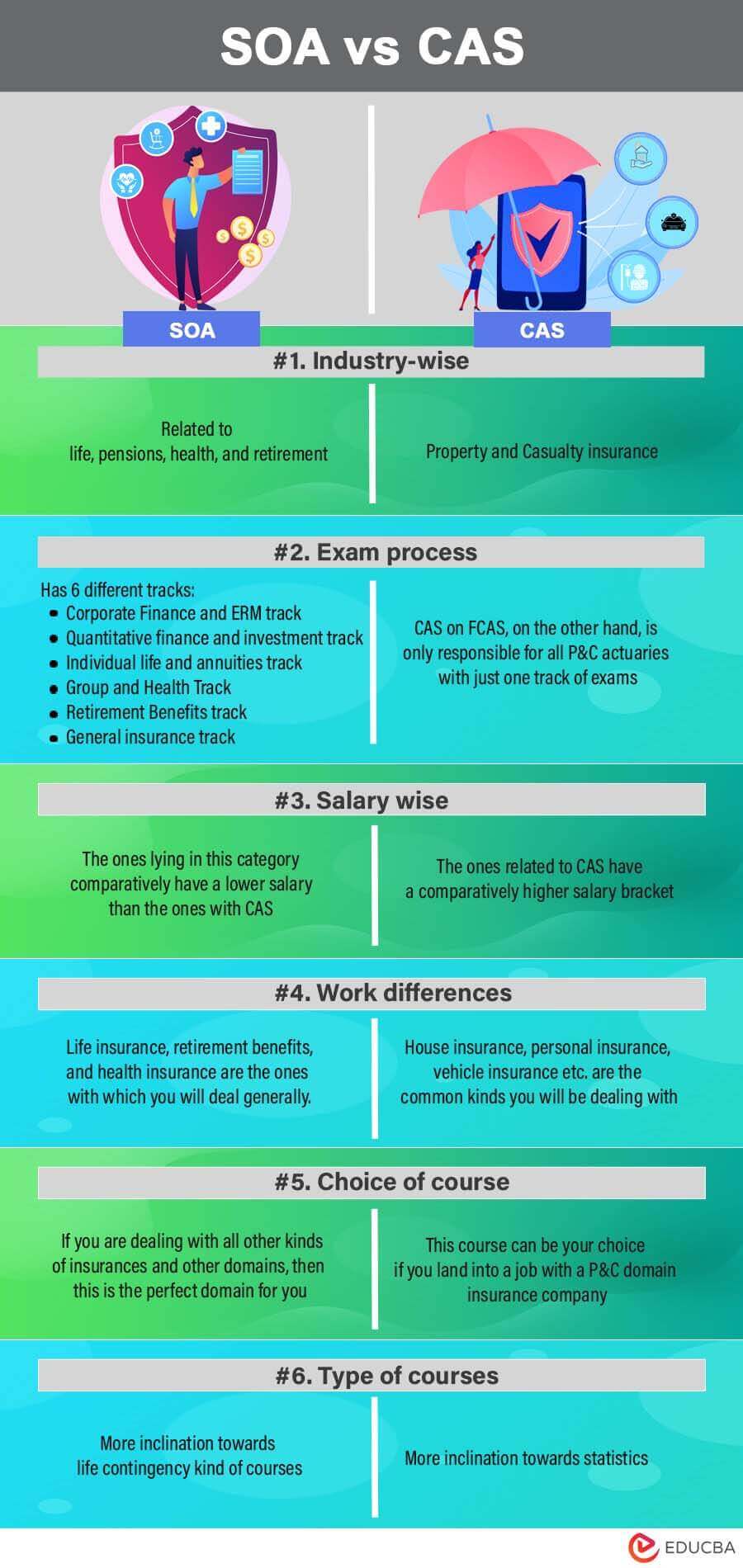

Head To Head Comparison Between SOA and CAS (Infographics)

Below is the top 6 difference between SOA vs CAS.

Key Differences Between SOA and CAS

Both are popular choices in the market; let us discuss some of the major differences:

Both SOA and CAS support actuaries in their own way. On the one hand, CAS provides regulations and standards for all property and casualty insurance candidates. In contrast, SOA does the same for all those actuaries who work in areas related to health, life, retirement, and pensions.

Regarding exams, the CAS exams aim to teach all those concepts the P&C actuaries need to know. In contrast, SOA exams aim to teach you concepts related to health, pension, retirement, and life, which the actuaries need to know.

Regarding the parameter related to salary, all those with P&C salaries are comparatively higher than the ones otherwise. It can also be inferred that domain-related insurance companies pay their actuaries slightly better than their counterparts. It may be due to more demand for the P&C candidates or something else; the cause is unknown.

If you talk about work-related differences, the biggest difference will be the kind of insurance products you would be dealing with. CAS actuaries will work with house, personal, and vehicle insurance, whereas SOA actuaries will deal with health insurance, retirement benefits, or health insurance.

Whether you choose SOA or CAS, 3 exams must be cleared before getting exam credits; therefore, path choosing will be done in the 4th step. If you are based out of the US, then clearing only 3 sets of exams will be enough to land a handsome job where you can choose wisely and make a more informed decision. The kind of your first job majorly governs the choice of your career.

Comparison Table of SOA vs CAS

Below is the topmost comparison between SOA vs CAS

| Basis of Comparison | SOA | CAS |

| Industry-wise | Related to life, pensions, health, and retirement | Property and Casualty insurance |

| Exam process | It has 6 different tracks:

|

CAS on FCAS, on the other hand, is only responsible for all P&C actuaries with just one track of exams. |

| Salary wise | The people in this category have a lower salary than those with CAS. | The ones related to CAS have a comparatively higher salary bracket. |

| Work differences | Life insurance, retirement benefits, and health insurance are the ones with which you will deal generally. | House insurance, personal insurance, vehicle insurance, etc., are the common kinds you will be dealing with |

| Choice of Course | This is the perfect domain for you if you deal with all kinds of insurance and other domains. | This course can be your choice if you land a job with a P&C domain insurance company. |

| Type of Courses | More inclination towards life contingency kind of courses | More inclination toward statistics |

Conclusion

Both the tracks, SOA vs CAS, are good in their own genre and domains. Choosing the right track can be a tough task, but as explained in the article above, it is just a matter of interest, and the job you work for will define and determine the course of your actions ahead. Stay tuned to our blog for more articles like these.

Recommended Articles

This is a guide to the top difference between SOA vs CAS. Here we also discuss the key differences between infographics and comparison tables. You may also have a look at the following articles to learn more.