Updated November 20, 2023

Marginal Cost Formula

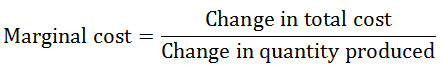

The marginal cost formula is the mathematical representation to capture the incremental cost impact of producing additional units of a good or service.

It is computed by dividing the change in total cost due to the production of additional goods by the change in the number of goods produced. Although the total cost comprises fixed and variable costs, the variation in total cost due to a change in the production quantity is primarily because of variable cost, which includes labor and material cost. On the other hand, there might be a few occasions when there is an increase in fixed costs, including administration, overhead, and selling expenses. Mathematically,

The marginal cost formula can be useful in financial modeling to arrive at the optimum level of production required to ensure a positive impact on the generation of cash flow.

Examples

Marginal Cost Formula Example No. 1

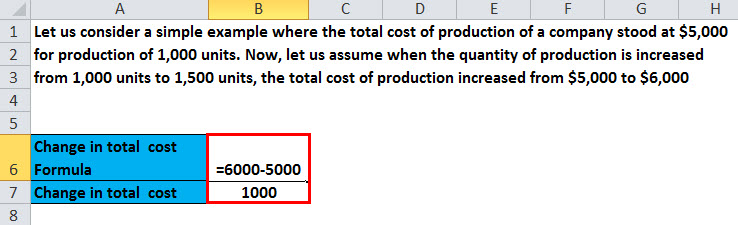

Let us consider a simple example where a company’s total production cost stood at $5,000 for the production of 1,000 units. Now, let us assume when the quantity of production is increased from 1,000 units to 1,500 units, the total cost of production increases from $5,000 to $6,000.

Therefore,

- Marginal cost = ($6,000 – $5,000) / (1,500 – 1,000)

- Marginal cost = $1,000 / 500

- Marginal cost = $2, which means the marginal cost of increasing the output by one unit is $2

Marginal Cost Formula Example No. 2

A public limited automobile company manufactured 348,748 vehicles (including M&HCV, LCV, Utility, and Cars) during FY2017, incurring a total production cost of $36.67 billion. The following year, in FY2018, driven by positive market demand, the production increased substantially, requiring more raw materials and hiring more manpower. Such a spurt in demand resulted in an overall production cost increase to $39.53 billion to produce a total of 398,650 units that year.

Therefore,

- Marginal cost = ($39.53 billion – $36.67 billion) / (398,650 –348,748)

- Marginal cost = $2.86 billion / 49,902

- Marginal cost = $57,312, which means the marginal cost of increasing the output by one unit is $57,312

Explanation of Marginal Cost Formula

The following three simple steps can determine it:

- Compute the change in the total cost

- Compute the change in the quantity of production

- Divide the change in total cost by the change in quantity produced

Change in the Total Cost

At each production level, the total cost of production may witness a surge or decline based on whether there is a need to increase or decrease production volume. Suppose the production of additional units warrants an increase in the purchase cost of raw materials and requires hiring an additional workforce. In that case, the overall production cost is expected to change. To compute the change in total production cost, just deduct the initial production cost incurred during the first batch from the production cost incurred during the next batch when the output has been increased.

Change in Quantity Produced

From a manufacturing unit’s perspective, tracking the quantities involved at each production level is quintessential. A rise or decline in the output volume production is eventually reflected in the overall production cost; it is important to know the change. To compute the change in production quantity, the quantity of units produced in the initial production run is deducted from the number of units produced in the next production run.

Significance and Uses

In a perfectly competitive market, a company arrives at the volume of output to be produced based on marginal costs and selling price. Whenever a company performs financial analysis to arrive at product pricing and check production feasibility, marginal cost analysis forms an important part of the overall analysis based on which the management can assess the price of each good or service offered to consumers. Now, let us consider the following two scenarios to understand the relevance of the marginal cost formula.

Scenario 1: Let us assume that the selling price for a product is greater than the marginal cost of production; then, in this scenario, the additional production will generate incremental cash flow, which is a valid reason to increase production.

Scenario 2: Let us assume that the selling price for a product is less than the marginal cost of production, which means that the company will incur losses and, therefore, either the additional production should not be continued or the selling price should be increased. As such, the marginal cost formula forms an important part of business decisions about the continuation of production operations.

Marginal Cost Formula Calculator

You can use the following Calculation

| Change in Total Cost | |

| Change in Quantity Produced | |

| Marginal Cost Formula= | |

| Marginal Cost Formula= | = |

|

|

Marginal Cost Formula in Excel (With Excel Template)

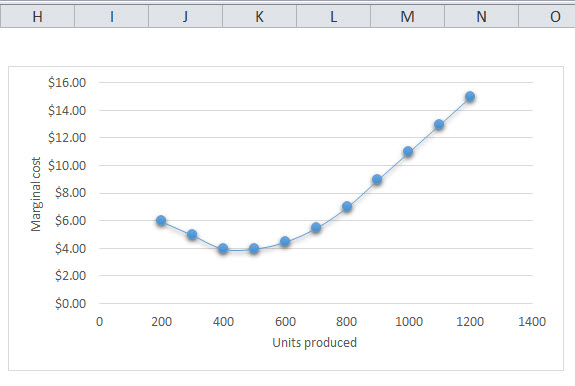

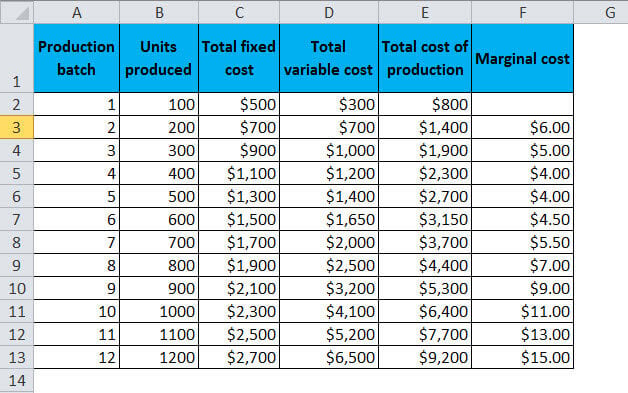

The following table gives a snapshot of how marginal cost varies with the change in quantity produced. Further, the graph for marginal cost reverses the trend after a certain when, which indicates that after a certain level of production, the cost of production starts to increase after an initial phase of moderation. At this stage, one needs to check if the cost of production is less than the selling price, and if that is the case, then stop the incremental production.

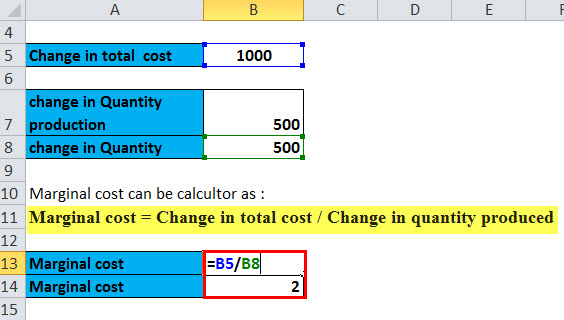

Here, we will do the same Excel marginal cost formula example. It is very easy and simple. You need to provide two inputs: a change in the total cost and a change in Quantity.

You can easily calculate the marginal cost Formula in the template provided.

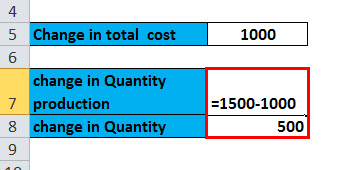

First, we have to find out the change in total cost:

Then, we have found out a change in Quantity:

After that, we get the Marginal cost by using the marginal cost formula:

Recommended Articles

This has been a guide to the Marginal Cost Formula. Here, we discuss its uses along with practical examples. We also provide a marginal cost calculator and a downloadable Excel template. You may also look at the following articles to learn more –