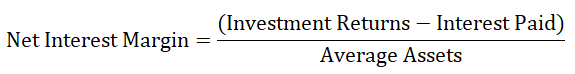

Net Interest Margin Formula

- Investment Return = Interest received or return on investment

- Interest Paid = Interest paid on the debt

- Average Assets = (Assets at the start of the year + Assets at the end of the year) / 2

Net Interest Margin tells about how profitable or good the firm is at making its decisions for its investments than just keeping up with its debtors. It is an important metric for checking financial stability and operational acumen.

Example

To have a better understanding of the concept, we will calculate the Net Interest Margin value by using the above-mentioned formula.

Deven Corporation is in the Oil trading business and takes a loan for $100,000 for an interest rate of 9% per annum, and they earn $125,000 at the end of the year. What is the net Interest Margin?

- Net Interest Received or Return on Investment = 125,000-100,000 = $25,000

- Interest to be paid = 9%

- Average Assets = 100,000

Net Interest Margin Using Formula is calculated as:

- Net Interest Margin = (Net return on investment – Interest paid) / Average Assets

- Net Interest Margin = (25,000 – 9,000) /100,000

- Net Interest Margin = 0.16 or 16 %

Therefore, the net interest margin for Deven Corporation is 16 %.

Explanation of Net Interest Margin Formula

The net interest margin formula is fundamental for evaluating a financial institution’s financial competence and stability and can effectively assess other companies.

The net interest margin represents the variance between the interest received from assets and the interest paid on liabilities relative to the average assets held. The term “net interest” accurately captures the resulting net amount gained or lost based on this calculation. Furthermore, we use the term “margin” to indicate the profit or loss generated in relation to our assets.

Using average assets is crucial in calculating the net interest margin as it provides a more comprehensive view of the actual interest paid and received throughout the year rather than solely considering the value of assets at the beginning of the year. Incorporating the average assets provides a broader perspective, encompassing all the assets over the year rather than focusing on a single point in time.

Significance and Use

The uses of the Net Interest Margin Value are immense and help us to be very informative and have a view ahead.

- With Net Interest Margin, one can get a basic understanding of how much above and over the company is earning and thus doing well on the money raised through debt by the company.

- In the finance industry, where the money is sourced from one source, retail or other institutions, and is for other banking or lending activities, the Net interest margin tells how much the company is making over the interest it is paying on all its assets.

- Individuals can use this tool to determine the difference between their investments and acquired debt.

Net Interest Margin Calculator

You can use the following Net Interest Margin Calculator

| Investment Returns | |

| Interest Paid | |

| Average Assets | |

| Net Interest Margin Formula = | |

| Net Interest Margin Formula = |

|

|

Net Interest Margin Formula in Excel (With Excel Template)

Here, we will do an example of the Net Interest Margin formula in Excel. Calculating Net Interest Margin in Excel is easy and can take many variables, which can be difficult to calculate otherwise without a spreadsheet.

You can easily calculate the Net Interest Margin using the Formula in the template provided.

Deven Corporation has taken a loan of $100,000 at the rate of 9 % per annum and makes 4 percent compounded quarterly, find Net Interest Margin.

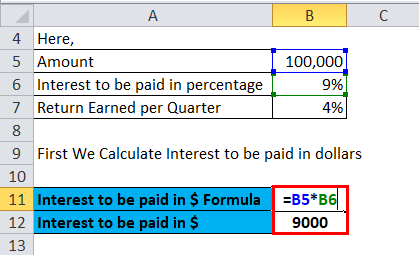

- Assets involved can be termed with Amount = B5 = 100,000

- Interest to be paid = B6 = 9%

- Interest to be paid in dollars = B5*B6

- Return earned per quarter = B7 = 4%

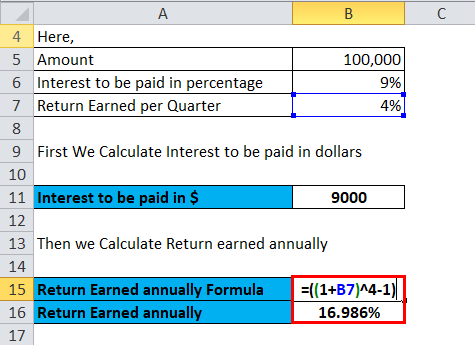

- Return earned annually = ((1+B7) ^4 -1) = B16= 16.986%

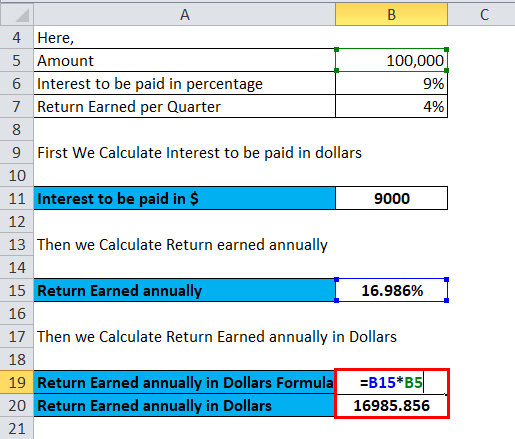

- The return earned annually in dollars = B15*B5

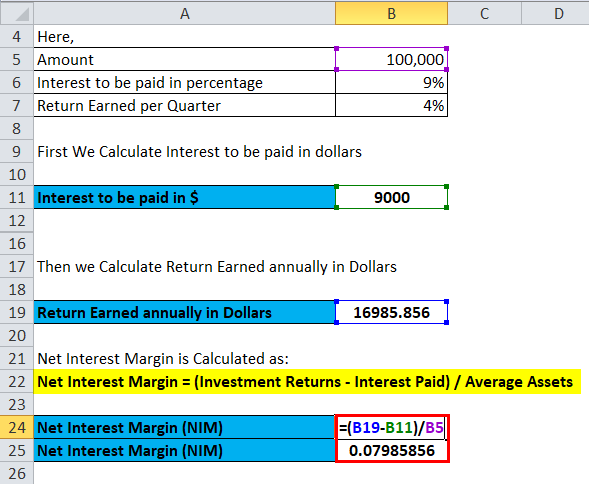

To Calculate the Net Interest Margin

To calculate the result, subtract the interest paid from the annual return earned in dollars and then divide it by the assets or the amount involved here.

- NIM = (B19-B11)/B5 = 0.07985856 = 8 %

To calculate the Net Interest Margin value (NIM), we need to ensure that we use a specific function. You can also utilize this Excel illustration in Google Sheets, provided you specify the required functions and input.

Recommended Articles

This has been a guide to a Net Interest Margin formula. Here, we discuss its uses along with practical examples. We also provide a Net Interest Margin Calculator with a downloadable Excel template. You may also look at the following articles to learn more –