Updated November 23, 2023

Average Collection Period Formula

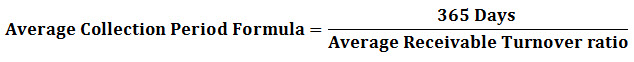

The formula for calculating the Average Collection Period Formula is as follows:

Alternatively, the collection period can also be calculated as –

Where,

The average collection period can be assumed as the Average number of days between the following:

- The date at which credit sales are made and

- The date at which money has been received from the customers.

The average collection period can also be denoted as the Average days’ sales in accounts receivable.

Examples of Average Collection Period Formula

Let’s take an example to find out the Average Collection Period for a company:-

Average Collection Period Formula – Example #1

Jagriti Group of Companies books of accounts have the following details as per its financials for the year ended 2017-18

- Total sales = $2,00,000

- Cash sales = $70,000

- Closing Balance of Accounts receivables = $10,000

- Closing Balance of Notes receivables = $5,000

We must calculate the Average collection period for the Jagriti Group of Companies.

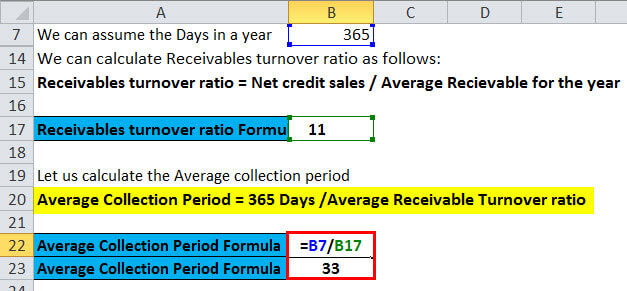

To calculate the Average collection period, we need the Average Receivable Turnover, and we can assume the Days in a year as 365.

We have calculated credit sales by using the below formula:

- Credit Sales = Total Sales – Cash Sales

- Credit Sales= $2,00,000 – $70,000

- Credit Sales= $1,30,000

We can calculate the Receivables turnover ratio as follows:

- Receivables turnover ratio = Net credit sales / (Receivables + Notes receivables)

- Receivables turnover ratio = $1,30,000 / ($10,000 + $5,000)

- Receivables turnover ratio = $1,30,000 /$15,000

- Receivables turnover ratio = 8.7 or 9 Times

Now we can calculate the Average collection period for Jagriti Group of Companies using the formula below.

- Average Collection Period Formula= 365 Days /Average Receivable Turnover ratio

- Average Collection Period = 365/9

- Average Collection Period = 40 Days

On average, the Jagriti Group of Companies collects the receivables in 40 Days.

Average Collection Period Formula – Example #2

Anand Group of companies have decided to change their credit policy. They have asked the Analyst to compute the Average collection period to analyze the current scenario.

The following details have been shared with the Analyst for calculating the Average collection period of the company–

- Net Credit Sales = $2,50,000

- Opening Balance of Accounts Receivables = $25,000

- Closing Balance of Accounts Receivables = $35,000

In the above case, the Analyst has to calculate the average accounts receivable for the Anand group of companies based on the above details.

We need the Average Receivable Turnover to calculate the Average collection period, and we can assume the Days in a year as 365.

And,

We have Opening and Closing accounts receivables Balances of $25,000 and $35,000 for the Anand Group of companies.

- The average accounts receivables for the year = ($25,000 + $35,000) / 2

- The average accounts receivables for the year = $60,000 / 2

- The average accounts receivables for the year = $30,000.

Now, we can calculate Average Receivable Turnover by using the formula:

- Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

- Accounts Receivable Turnover Ratio = $2,50,000 / $30,000

- Accounts Receivable Turnover Ratio = 8.3 or 8x.

Now, we can calculate the Average Collection period for the Anand Group of companies using the below formula:

- Average Collection Period Formula= 365 Days /Average Receivable Turnover ratio

- Average Collection Period = 365/ 8

- Average Collection Period = 45.62 or 46 Days.

Anand Group of companies can change its credit term depending on the collection period policy.

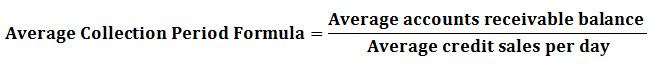

Average Collection Period Formula – Example #3

For example, Jagriti Company, Inc. has accounts receivable outstanding of $50,000 for the year beginning 2017. And accounts receivable due of $60,000 at the end of the same financial year. Net Credit Sales for Jagriti Company Inc for the same financial year is $600,000.

We can calculate the Average Accounts Receivable for the year by adding the Beginning and Ending Accounts receivable and dividing the total by 2. This brings the average accounts receivable for Jagriti Company, Inc. as

- Average Accounts Receivable for the year = ($50,000+$60,000)/2

- Average Accounts Receivable for the year = ($110,000)/2

- Average Accounts Receivable for the year = 55,000

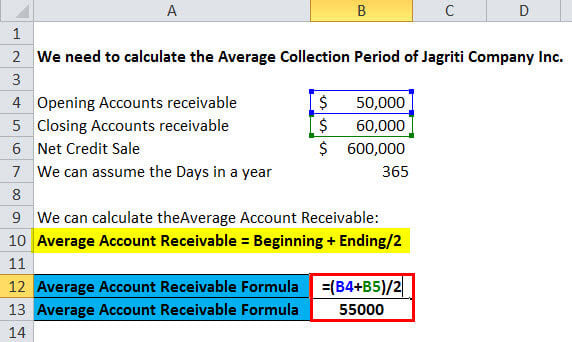

We can calculate the Average Collection period by using the below formula:

- Average Collection Period = 365 Days /Average Receivable Turnover ratio

- Average Collection Period = 365/ ($600,000/$55,000)

- Average Collection Period=365/11

- Average Collection Period = 33 Days

Explanation

The average Collection Period can be calculated by using these formulas:

- Average Collection Period Formula= 365 Days /Average Receivable Turnover ratio

- Average Collection Period Formula= Average accounts receivable balance / Average credit sales per day

The first formula is mostly used for calculation by investors and other professionals.

In the first formula, we need the average receiving turnover to calculate the average collection period, and we can assume the days in a year to be 365.

We can calculate the Average Accounts Receivable for the year by adding the Beginning and Ending Accounts receivable and dividing the total by 2.

We can calculate the Average Collection period by using the below formula:

For the second formula, we need to compute the average accounts receivable per day and the average credit sales per day. Average accounts receivable per day can be calculated as average accounts receivable divided by 365, and Average credit sales per day can be calculated as average credit sales divided by 365.

Significance and Use of Average Collection Period Formula

We must know the company’s Average Collection period ratio to gain valuable insight. But to get a meaningful insight, we can use the Average Collection period ratio compared to other companies’ balances in the same industry or can be used to analyze the previous year’s trend. This ratio shows the ability of the company to collect its receivables, and the average period is going up or down. The company can change the collection policy to handle the business’s liquidity.

We can also compare the company’s credit policy with the competitors on the average days taken by the company from credit sale to collection. We can judge how well a company is doing.

Suppose the company has an average collection period of 40 days but has a credit policy to collect the receivables in 30 days. There is a problem with the company’s collection team. If the average collection period is 40 days, and the company has announced a credit policy of 15 days, then this situation is significantly worse. The customers are not following the credit agreement terms, which needs a look at your company’s credit policy and the introduction of measures to change the current scenario. The following measures can be taken to make the present scenario abiding:

- Require Tightening of credit.

- Instructing the customers on the credit terms.

- Offering Discounts to the customers in case they are paying the credit in advance, offering a 2 % discount in case customers pay in the first ten days.

- Follow-up with the credit team on delinquent accounts.

- Charging interest on delay in paying the account receivables.

Average Collection Period Calculator

You can use the following Average Collection Period Calculator

| 365 Days | |

| Average Receivable Turnover Ratio | |

| Average Collection Period Formula | |

| Average Collection Period Formula |

|

|

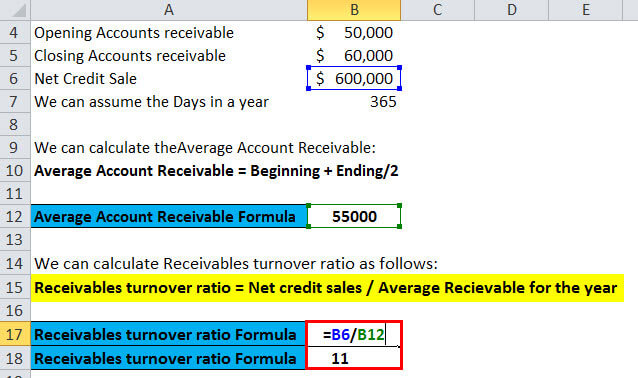

Average Collection Period Formula in Excel (With Excel Template)

Here, we will do the same example of the Average Collection Period formula in Excel. It is very easy and simple. You need to provide only one input, i.e., Average Receivable Turnover ratio

You can easily calculate the Average Collection Period using the Formula in the template provided.

In this template, we have to solve the Average Collection Period Formula

First, we have calculated the Average Account Receivable

Here, we have to Find out the Receivables Turnover Ratio

Here, we have calculated the Average Collection Period

Recommended Articles

This has been a guide to the Average Collection Period Formula. Here, we discuss its uses along with practical examples. We also provide the Average Collection Period calculator and a downloadable Excel template.