Updated November 23, 2023

Interest Coverage Ratio Formula (Table of Contents)

- Interest Coverage Ratio Formula

- Interest Coverage Ratio Calculator

- Interest Coverage Ratio Formula in Excel (With Excel Template)

Interest Coverage Ratio Formula

The interest coverage ratio is a ratio that measures the ability of a company to pay interest on its debt on time. It does just calculate the ability of a company to make payment of interest, not principle.

The investor uses this to calculate a risk associated with a company and also to help understand the profitability of a company. An investor also checks whether a company can pay its dues on time without affecting its business and profitability. Borrowing can be short-term or long-term.

The interest coverage ratio represents a margin of safety. The interest coverage ratio formula can be written about EBIT and EBITDA. There are two types of formulas. Let’s discuss the same.

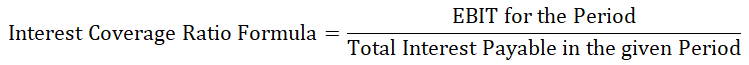

- Interest Coverage Ratio Formula using EBIT-

The interest coverage ratio formula is EBIT for the period upon total interest payable in the given period. EBIT is earnings before interest and tax. The formula for the same can be written as:-

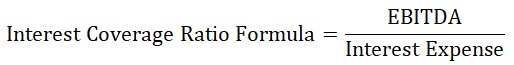

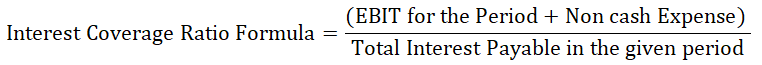

- Interest Coverage Ratio Formula using EBITDA-

Here, non-cash income is also added to EBIT. A formula for the same can be written as EBIT for the period plus non-cash expenses divided by total interest payable in the given period. Here, EBITDA is Earnings before interest, tax, depreciation, and amortization. An Interest Coverage Ratio formula can be written as:-

This Interest Coverage Ratio Formula can be written as:-

Examples of Interest Coverage Ratio Formula

Let’s take an example to understand the Interest Coverage Ratio calculation better.

Interest Coverage Ratio Formula – Example #1

Suppose a company, R&R Pvt. Ltd, has an EBIT of $100,000 for 2018, and the total interest payable for 2018 is $40,000.

Solution:

Now, let’s calculate the interest coverage ratio using EBIT.

- Interest Coverage Ratio = EBIT for the Period / Total Interest Payable in the given Period

- Interest Coverage Ratio = 100,000 / 40,000

- Interest Coverage Ratio = 2.5

The interest coverage ratio for R&R Pvt. Ltd. is 2.5

Interest Coverage Ratio Formula – Example #2

A consulting company has the financial statements for 2017 and 2018 below. A company is new in the market and growing. The company had a total revenue of $165,000 in 2018, $150,000 in 2017, expenses of $25,300 in 2018, and $18,450 in 2017. Through this and considering other income and other expense earned before tax and income are calculated, which help to find profit before tax and profit after tax, and finally, one can get an interest coverage ratio.

Solution:

Assuming an income tax of 10%.

| Particulars | 2018 | 2017 |

| Revenue: | ||

| Advisory Fees | $ 75,000.00 | $ 90,000.00 |

| Consultancy Fees | $ 90,000.00 | $ 60,000.00 |

| Total Revenue(A) | $ 165,000.00 | $ 150,000.00 |

| Expenses: | ||

| Direct Expense | $ 14,500.00 | $ 12,000.00 |

| Advertisement Expense | $ 3,000.00 | $ 2,000.00 |

| Commission Paid | $ 500.00 | $ 300.00 |

| Miscellaneous Expense | $ 300.00 | $ 150.00 |

| Depreciation | $ 7,000.00 | $ 4,000.00 |

| Total Operating Expense(B) | $ 25,300.00 | $ 18,450.00 |

| Operating Income(A-B) | $ 139,700.00 | $ 131,550.00 |

| Other Income | $ 8,000.00 | $ 7,000.00 |

| Other Expense | $ 700.00 | $ 500.00 |

| Earning before tax and income | $ 147,000.00 | $ 138,050.00 |

| Interest | $ 9,000.00 | $ 7,000.00 |

| Profit Before Tax | $ 138,000.00 | $ 131,050.00 |

| Tax (10%) | $ 13,800.00 | $ 13,105.00 |

| Profit after Tax | $ 124,200.00 | $ 117,945.00 |

Now, let’s calculate the interest coverage ratio using EBIT for 2017.

- Interest Coverage Ratio = EBIT for the Period / Total Interest Payable in the given Period

- Interest Coverage Ratio for 2017 = 138,050 / 7000

- Interest Coverage Ratio for 2017 = 19.72

Now, let’s calculate the interest coverage ratio using EBIT for 2018.

- Interest Coverage Ratio = EBIT for the Period / Total Interest Payable in the given Period

- Interest Coverage Ratio for 2018 = 147,000 / 9000

- Interest Coverage Ratio for 2018 = 16.33

Interest Coverage Ratio Formula – Example #3

Suppose a company ADC Pvt. Ltd has an EBIT of $100,000 for 2018, non-cash expense is $4,000, and total interest payable for 2018 is $40,000.

Now, let’s calculate the interest coverage ratio using EBITDA.

Interest Coverage Ratio = (EBIT for the period + Non-cash Expense) / Total Interest Payable in the given period

- Interest Coverage Ratio = (100,000 + 4000) / 40,000

- Interest Coverage Ratio =104,000 / 40,000

- Interest Coverage Ratio = 2.6

The interest coverage ratio for ADC Pvt. Ltd. is 2.6

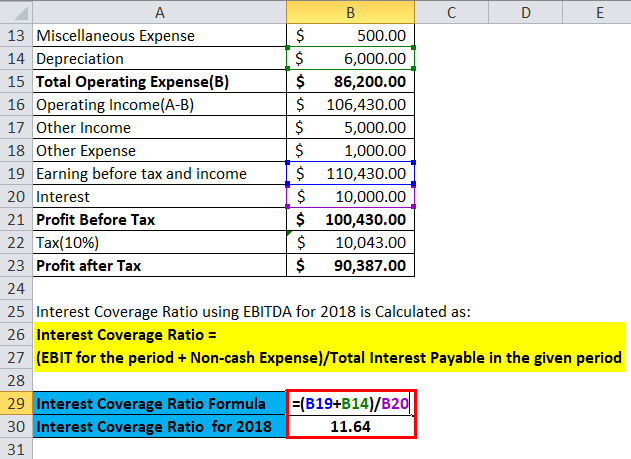

Interest Coverage Ratio Formula – Example #4

The company has the financial statement for the year 2018 below. Through this, let’s calculate the Interest coverage ratio. The company is applicable for 10% Tax.

| Particulars | 2018 |

| Revenue: | |

| Advisory Fees | $ 100,000.00 |

| Consultancy Fees | $ 92,630.00 |

| Total Revenue(A) | $ 192,630.00 |

| Expenses: | |

| Direct Expense | $ 74,000.00 |

| Advertisement Expense | $ 5,000.00 |

| Commission Paid | $ 700.00 |

| Miscellaneous Expense | $ 500.00 |

| Depreciation | $ 6,000.00 |

| Total Operating Expense(B) | $ 86,200.00 |

| Operating Income(A-B) | $ 106,430.00 |

| Other Income | $ 5,000.00 |

| Other Expense | $ 1,000.00 |

| Earning before tax and income | $ 110,430.00 |

| Interest | $ 10,000.00 |

| Profit Before Tax | $ 100,430.00 |

| Tax (10%) | $ 10,043.00 |

| Profit after Tax | $ 90,387.00 |

Now, let’s calculate the interest coverage ratio using EBITDA.

- Interest Coverage Ratio = (EBIT for the period + Non-cash Expense) / Total Interest Payable in the given period

- Interest coverage ratio = (110,430 + 6,000) / 10,000

- Interest coverage ratio = 116,430 / 10,000

- Interest Coverage Ratio = 11.64

Explanation

For calculating, either of the formulas can be used to find the interest coverage ratio. It also depends on the person calculating to decide which formula needs to be used.

Now, let us analyze the interest coverage ratio. The interest coverage ratio is calculated to understand the risk associated with a company. It also helps the financial institution check a company’s repayment capacity. It is used to check solvency. Let’s see interest coverage ratio values and their meaning. They are as follows:-

- If a company has an interest coverage ratio of less than 1, it is risky and unable to pay the interest or principal against its debt. Financial institutions never give them loans as there is a high chance that loans can become NPA i.e. non-performing assets.

Interest Coverage Ratio < 1

- If a company has an interest coverage ratio equal to 1, that means the company is quite risky. It can pay just the interest amount to the lender, not the principal. These types of companies also never get any loans from financial institutions as a risk is involved in principle.

Interest Coverage Ratio = 1

- If a company has an interest coverage ratio greater than 1, it has money to pay interest against its debt and an extra amount to pay against the principal.

Interest Coverage Ratio > 1

- Ideally, the interest coverage ratio should be greater than 1.5. In this scenario, a financial institution will give a loan easily. A risk associated with a company will also be low as a company will have a sufficient amount to repay interest and principal to a lender.

Interest Coverage Ratio >= 1.5

- If the interest coverage ratio goes below 1.5, it is a red alert for a company, and this risk associated with the company will also increase.

Interest Coverage Ratio < 1.5

Significance and Use of Interest Coverage Ratio Formula

Uses of the Interest coverage ratio formula are as follows:-

- A lender can check the risk and creditworthiness of a company through an interest coverage ratio.

- It is used as a measurement device by an investor, stakeholder, and company management to make a decision.

- It also helps in trend analysis and helps to check the stability of a company.

There are some limitations to the interest coverage ratio. For example, sometimes, it will not give a true picture of a company’s financial condition because seasonal factors affect the ratio. It does not show an effect of tax payment. To get the best result with this formula, use another formula like quick ratio, cash ratio, etc., that will give a clear picture of the financial position of the company and the risk associated with it.

Interest Coverage Ratio Calculator

You can use the following Interest Coverage Ratio Calculator

| EBIT for the Period | |

| Total Interest Payable in the given Period | |

| Interest Coverage Ratio Formula | |

| Interest Coverage Ratio Formula | = |

|

|

Interest Coverage Ratio Formula in Excel (With Excel Template)

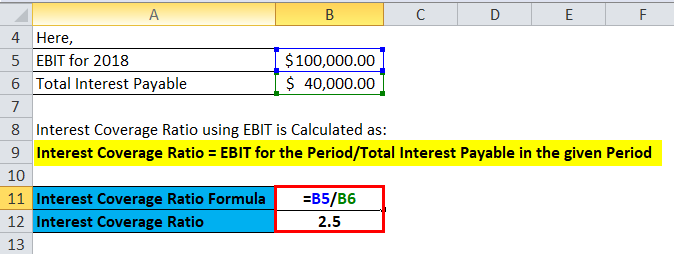

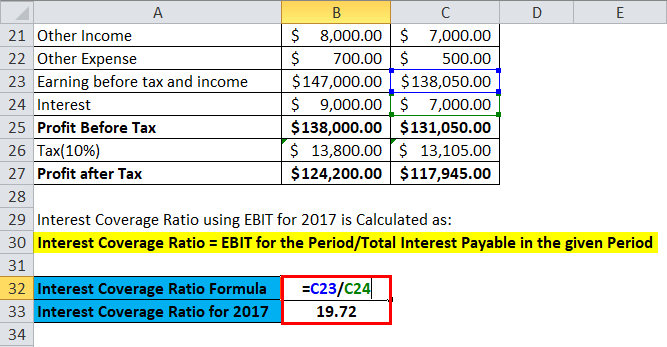

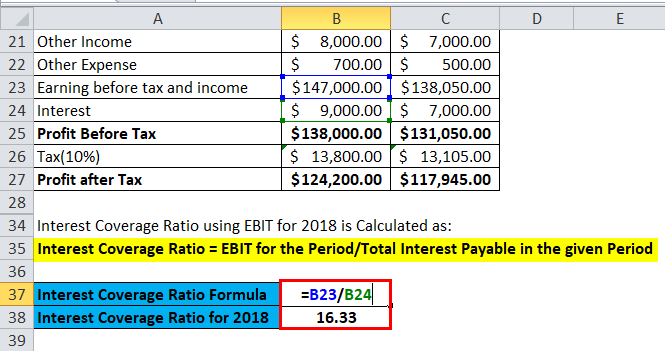

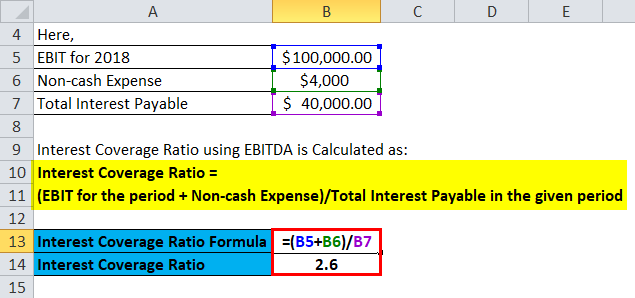

Here, we will do the same example of the Interest Coverage Ratio formula in Excel. It is very easy and simple. You need to provide the three inputs, i.e, EBIT, Interest, and EBITDA

You can easily calculate the Interest Coverage Ratio using the Formula in the template provided.

The interest coverage ratio for R&R Pvt. Ltd is Calculated as follows:

Interest Coverage Ratio for 2017 is Calculated as follows:

Interest Coverage Ratio for 2018 is Calculated as follows:

The interest coverage ratio for ADC Pvt. Ltd. is Calculated as follows:

Interest Coverage Ratio Using EBITDA is Calculated as follows:

Recommended Articles

This has been a guide to an Interest Coverage Ratio formula. Here we discuss its uses along with practical examples. We also provide the Interest Coverage Ratio Calculator with a downloadable Excel template. You may also look at the following articles to learn more –