Updated November 30, 2023

Difference Between Index Funds vs Mutual Funds

Have you ever considered investing in funds like an index fund and ETF? As both are collective investment tools, most people get perplexed by the 2 investment vehicles. Funds are usually divided into 2 types: Index Funds and Mutual Funds. The fund uses both terms to refer to its underlying key objective. Nevertheless, they are not the same in the sense that an Exchange Traded Fund (i.e. ETF) is a type of Index fund, a basket of securities or stocks traded on the exchange. On the other hand, an index fund is a kind of mutual fund that will attempt to track the performance of any specific index.

Index funds can be ETFs (i.e. exchange-traded funds) or mutual funds that track an index, like the S&P 500 Index. The term mutual funds typically refers to funds that are actively managed and employ stock pickers to beat the stock market’s performance.

The benefits of index funds over mutual funds are

- They don’t require you to hold cash,

- They don’t have any minimum purchase criteria as in mutual funds,

- They are generally more liquid and of lower cost than mutual funds

- Some ETF funds have a tax advantage over open-ended funds.

However, there are a few disadvantages as well.

- An index fund is traded throughout the day and is subject to price manipulation.

- They are subject to market volatility as well.

- One can reinvest capital gains and dividends in mutual funds while the same is less offered in an index fund.

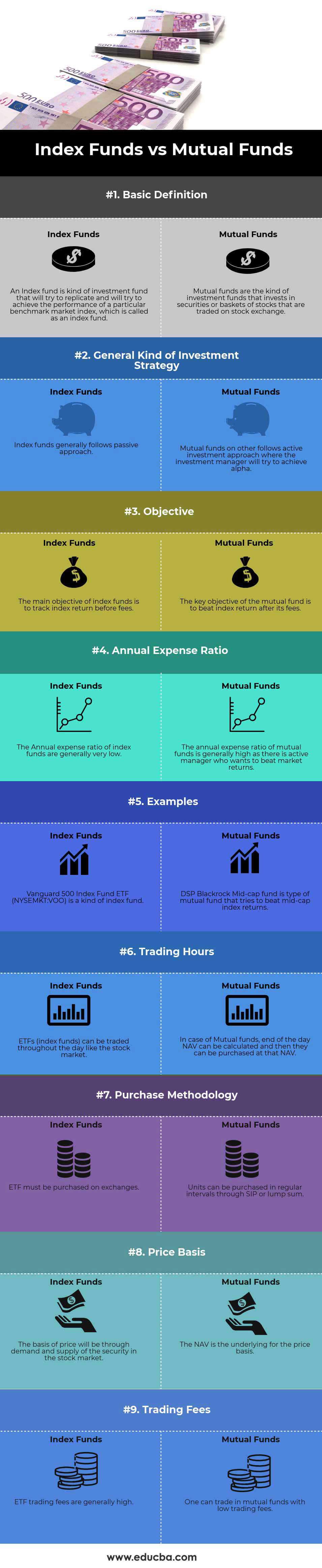

Head To Head Comparison Between Index Funds vs Mutual Funds (Infographics)

Below is the top 9 difference between Index Funds vs Mutual Funds:

Key Differences Between Index Funds vs Mutual Funds

Both Index Funds vs Mutual Funds are popular choices in the market; let us discuss some of the major differences:

- An index fund is defined as a fund that will track a security market index and it’s traded like ordinary securities or stocks. An index fund is a type of investment vehicle that will track the performance of the benchmark market index.

- A recognized exchange trades index funds. On the other hand, direct investment cannot be made in an index fund. But you can purchase an ETF and mutual fund that can be bought at regular intervals through a Systematic Investment Plan (i.e. SIP) or in a lump sum.

- Index funds actively trade and receive pricing throughout the day, while mutual funds determine their net asset value (NAV) at the close of the trading day and price accordingly.

- The pricing of an Index fund is based on the supply and demand of the securities in the capital market. On the contrary, a mutual fund is priced as per that underlying asset’s Net Asset Value (i.e. NAV).

- In Index funds only, manual orders will be placed; that is, you need to sign in to place the buy order, while in the case of a mutual fund, one can automate its investment through a Systematic Investment Plan by giving standing instructions to the bank.

- The liquidity and flexibility are comparatively higher in index funds than in a mutual fund.

- The trading fees of index funds like ETF are high. Contrary to an index fund, in the case of mutual funds, there are no or low trading fees.

Index Funds vs Mutual Funds Comparison Table

Below is the 9 topmost comparison between Index Funds vs Mutual Funds

| Basis Of Comparison |

Index Funds |

Mutual Funds |

| Basic Definition | An Index fund is a kind of investment fund that will try to replicate and achieve the performance of a particular benchmark market index, called an index fund. | Mutual funds invest in securities or baskets of stocks traded on a stock exchange. |

| General Kind of investment

Strategy |

Index funds generally follow a passive approach. | Mutual funds, on the other, follow an active investment approach where the investment manager will try to achieve alpha. |

| Objective | The main objective of index funds is to track index returns before fees. | The key objective of the mutual fund is to beat an index return after its fees. |

| Annual Expense ratio | The annual expense ratio of index funds is generally very low. | The annual expense ratio of mutual funds is generally high as an active manager wants to beat market returns. |

| Examples | Vanguard 500 Index Fund ETF (NYSEMKT: VOO) is a kind of index fund. | DSP Blackrock Mid-cap fund is a mutual fund that tries to beat mid-cap index returns. |

| Trading hours | Investors can trade ETFs (index funds) throughout the day, just like trading stocks on the stock market. | Mutual funds calculate the end-of-day NAV, and investors can purchase them at that NAV. |

| Purchase methodology | Investors must purchase ETFs on exchanges. | Investors can purchase units in regular intervals through SIP or lump sum. |

| Price Basis | The basis of the price will be through the supply and demand of security in the stock market. | The NAV is underlying for the price basis. |

| Trading Fees | ETF trading fees are generally high | One can trade in mutual funds with low trading fees. |

Conclusion

Index funds, similar to stocks and closed-end mutual funds, trade on regular stock exchanges and have specific purposes or objectives when created. For example, an ETF’s (type of index fund) components may replicate and try to mirror the performance of a broader stock index, like the S&P 500 (one of the biggest stock indexes in the world), or a commodity like lithium. ETFs, labeled as index funds, undergo real-time valuation changes throughout the trading day on regular stock exchanges, irrespective of their underlying Net Asset Values.

A mutual fund is a kind of fund that combines the funds of hundreds or thousands of investors to buy securities, which includes bonds, stocks, CDs, money market funds, and many others. All mutual funds, as stated above, do have specific purposes or objectives; for example, they might focus on a particular industry or sector or generate a predetermined income or rate of return.

Recommended Articles

This has guided the top difference between Index Funds and Mutual Funds. Here, we also discuss the Index Funds vs Mutual Funds key differences with infographics and comparison tables. You may also have a look at the following articles to learn more.