Updated August 1, 2023

Enterprise Value Formula (Table of Contents)

- Enterprise Value Formula

- Examples of Enterprise Value Formula (With Excel Template)

- Enterprise Value Formula Calculator

Enterprise Value Formula

Enterprise value is the measurement of a company’s total value. It is one of the important parameters to market capitalization evaluation of the company’s stock value.

Enterprise value takes over the price of a company that means it tells us about the company’s net worth. It includes all ownership interests, an asset from debt and asset from equity. Enterprise value in a simple way said as a sum of market capitalization, a market value of debt subtracting cash and equivalents.

A formula for enterprise value can be expressed as:-

Enterprise value can be written as a sum of common shares, preferred shares, a market value of debt, minority interest subtracting cash and equivalent,

A formula for enterprise value can be expressed as:-

Where,

- Market Capitalization = Value of common shares of the company.

- Common Share = Share available with the company.

- Preferred Shares = If shares are redeemable, it is treated as debt.

- Market Value of Debt = Value of all debt of the company.

- Cash and Equivalent = Cash and investment of a company.

Examples of Enterprise Value Formula (With Excel Template)

Now, let us see an example to understand the enterprises value formula in a better manner.

Example #1

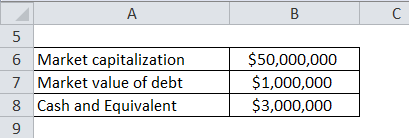

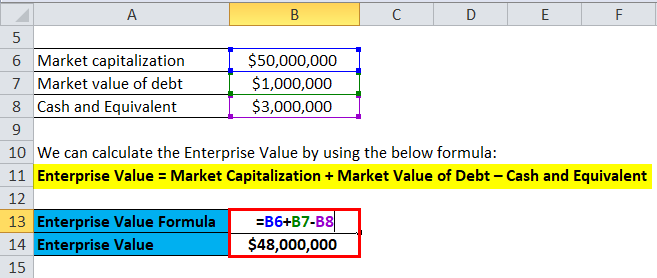

A software company named Firefox Pvt. Ltd wants to know its enterprise value. Market capitalization $50,000,000, market value of debt is $1,000,000 and cash and equivalent value is $3,000,000. Now enterprise value is as follows:-

We can calculate the Enterprise Value using below formula

Enterprise Value = Market Capitalization + Market Value of Debt – Cash and Equivalent

- Enterprise Value = $50,000,000 + $1,000,000 – $3,000,000

- Enterprise Value = $48,000,000

The value of Firefox Pvt. Ltd is $48,000,000.

Example #2

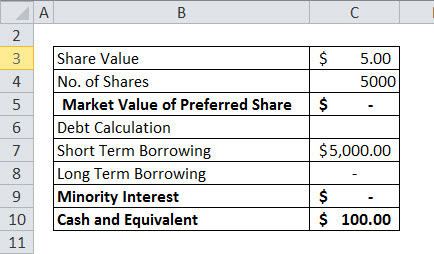

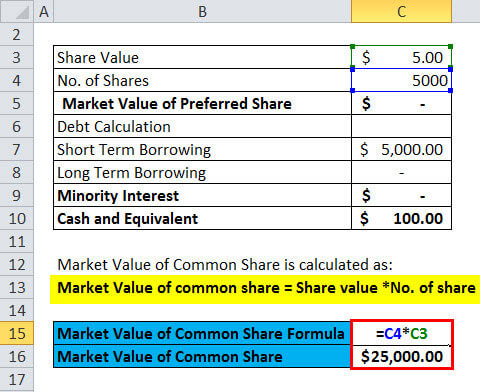

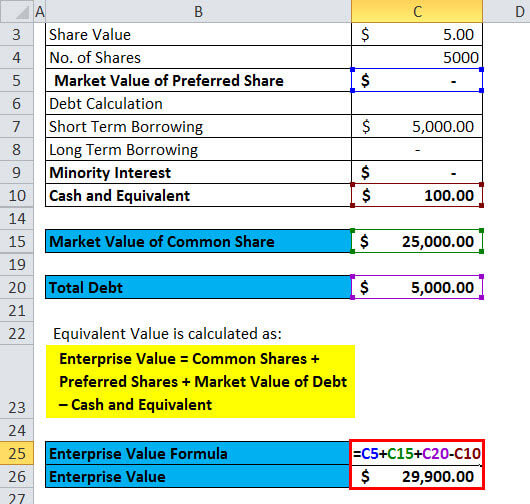

A company named Oracle Pvt. Ltd has below component in an annual report.

We can calculate the Market Value Of Common Share using below formula

Market Value of common share = Share value * No. of share

- Market Value of Common Share = 5000 * $5

- Market Value of Common Share = $25,000

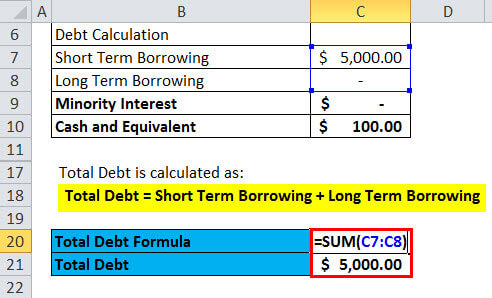

We can calculate the Total Debt using the below formula

- Total Debt = 5000 + 0

- Total Debt = $5,000

We can calculate the Enterprise value using Below formula

Enterprise Value = Common Shares + Preferred Shares + Market Value of Debt – Cash and Equivalent

- Equivalent Value = 25,000 + 0 + 5,000 – 100

- Equivalent Value = $29,900

The components of enterprise value are Equity value, total debt, preferred stock, minority interest, cash, and cash equivalents. Value of a company can be measured from its own assets. By assets, one can know both liabilities and shareholder’s equity as the source of fund can be equity or finance. Market capitalization is the product of share price and a number of shares. Enterprise value is the sum of equity, debt which is used for asset creation and from this cash is deducted as acquiring company will get the cash post-acquisition.

Now, let us see another example.

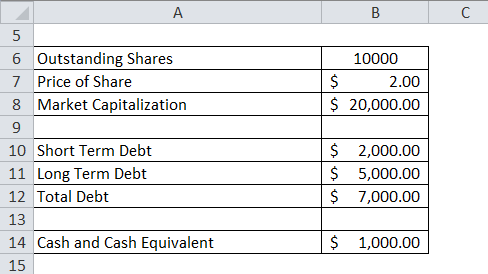

Example #3

Below is a financial statement of First data source Pvt. Ltd of the year 2018. Now, we will calculate enterprise value as TRD Ltd want to acquire First data source Pvt. Ltd hence wants to calculate enterprise value.

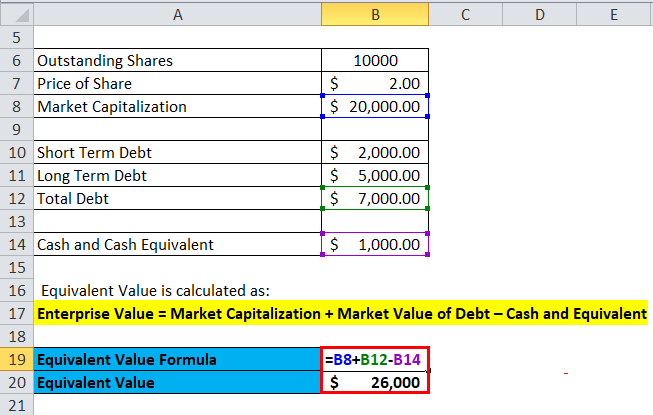

We can calculate the Enterprise value using below formula.

Enterprise Value = Market Capitalization + Market Value of Debt – Cash and Equivalent

- Equivalent Value = 20,000 + 7,000 – 1,000

- Equivalent Value = $26,000

So, enterprise value for First data source is $26,000.

Now, TRD Ltd can use $1,000 to pay a debt of First Data Source Pvt. Ltd. Then debt of the company will be.

- = Total Debt – Cash and Equivalent

- = 7,000 – 1,000

- = $6,000

Therefore the company has to pay below the amount for acquisition:-

- =Debt Outstanding + Market Value of Company

- = 6,000 + 20,000

- = $26,000

So, TRD has to pay $26,000 for the acquisition of First Data Source.

Importance of Enterprise Value Formula

Enterprise value used to find a various component of the financial analysis of a company. The formula for same is as follows:-

- EV/EBITDA

Businesses use it to calculate the value of a business and also rely on it to compare the capital structure of different companies.

EBITDA = Recurring earnings from Operations + Interest + Taxes + Depreciation + Amortizations

EV = Enterprises Value

- EV/Sales

This ratio helps to calculate its account for debt component to be paid back.

Lower the EV/Sales undervalue company is and vice versa.

Now, Let us see the application of Enterprise value.

Example #4

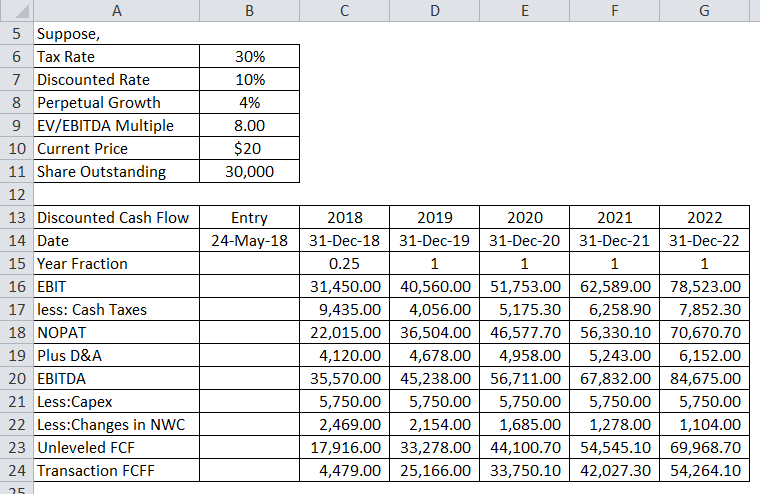

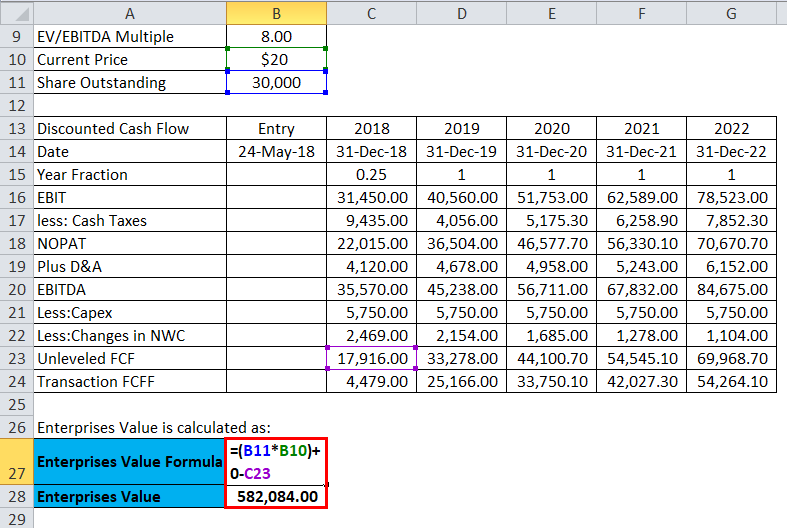

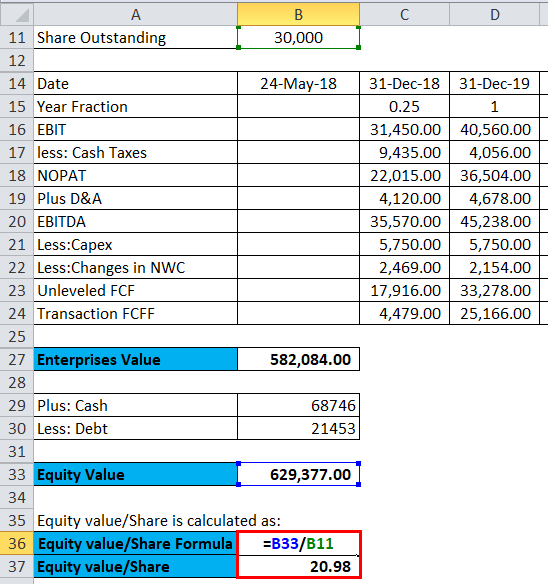

Suppose a company named Alexa Pvt. Ltd acquires other company ZEN Pvt. Ltd in the year 2018, Alexa Pvt. Ltd started to analyze its financial and below values of the different financial element using DCF concept-

Enterprise Value is calculated as:

- Enterprise Value = (30,000 * 20) + 0 – 17,916

- Enterprise Value = $582,084

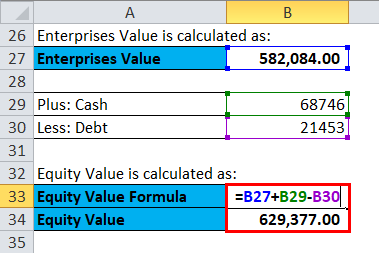

Equity Value is calculated as:

- Equity Value = 582,084 + 68,746 – 21,453

- Equity Value = $629,377

Equity Value / Share is calculated as:

- Equity Value / Share = 629,377 / 30,000

- Equity Value / Share = $21

So, a cost to company per share will be $21 and enterprise value is $582,084.

Relevance and Uses

There are multiple uses of enterprise value formula which are as follows:-

- To find the acquisition value of the company.

- It helps to compare a company with a different degree of financial leverage.

- EV also helps to compare the capital structure of two companies.

- It helps to measure the value of a company.

Enterprise Value Formula Calculator

You can use the following Enterprise Value formula Calculator

| Market Capitalization | |

| Market Value of Debt | |

| Cash and Equivalent | |

| Enterprise Value Formula | |

| Enterprise Value Formula = | Market Capitalization + Market Value of Debt - Cash and Equivalent | |

| 0 + 0 - 0 = | 0 |

Conclusion

Enterprise value of a company helps to measure the value of the company, it is very useful for an investor to take a decision on the investment of the company. Investors utilize it to compare the capital structure of two companies, aiding them in making informed investment decisions regarding the right company to invest in. But the value of a company drawn from the formula is not always right as it depends on market conditions. It is also employed for calculating other financial ratios.

Recommended Articles

This has been a guide to Enterprise Value formula. Here we discuss How to Calculate Enterprise Value along with practical examples. We also provide you Enterprise Value Calculator with a downloadable Excel template. You may also look at the following articles to learn more –