Updated July 31, 2023

Difference Between Creditor vs Debtor

Creditors and Debtors are part and parcel of every business. Purchasing and selling goods or services for credit changes the relationship between a seller and buyer to a Creditor vs Debtor. They help the business run on credit cycles, so a business doesn’t feel any liquidity pressure in its day-to-day activity. Any purchase made on credit will be added to creditors on the current liabilities side of the balance sheet, while every sale made on credit will be added in Debtors to the current assets side of your balance sheet. Creditors vs Debtors are also important to determine a credit policy for the company as they plan for its liquidity over a particular period.

What is a Creditor?

Oxford Dictionary defines a creditor as “A person or company to whom money is owing”. Simply put, Creditors are companies, organizations, or people to whom you owe money for any goods or services received or a loan taken. In business, we normally use the word creditor for any supplier who gives us goods or provides credit services. Let’s take an example: If Firm A buys goods worth ₹10,000 and promises to pay to Firm B after 90 days. The goods purchased will be called purchased on credit for Firm A. While Firm B will be called a creditor in Firm A’s books of accounts, all dues to the firm are completed. Creditors affect ratios like the Current and Quick ratios as they form part of the current liabilities in the Balance Sheet.

What is Debtor?

Oxford Dictionary defines a debtor as “A person, country, or organization that owes money.” Simply put, Debtors are companies, organizations, or people who owe money to you for any goods or services provided or a loan. In business, we normally use debtor for any customer we sell goods or provide service on credit. For example, If Firm A sells goods worth ₹10,000 and Firm B promises to pay after 90 days. The goods sold will be called sold on credit for Firm A. While Firm B will be called a debtor in Firm A’s books of accounts, all dues to the firm are completed. Debtors affect the Current ratio as they form part of the current assets in the Balance Sheet.

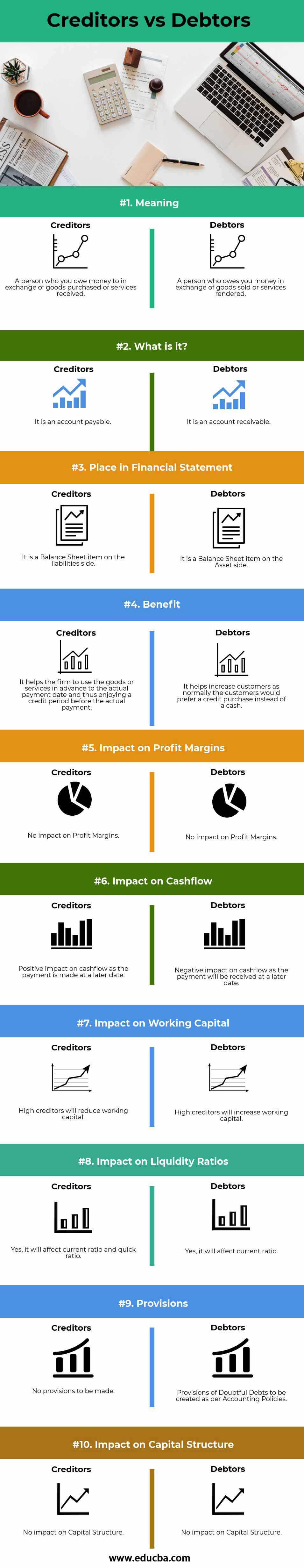

Head To Head Comparison Between Creditor vs Debtor (Infographics)

Below is the top 10 difference between Creditors vs Debtors

Key Differences Between Creditor vs Debtor

Both Creditors vs Debtor is the organization’s topmost and most important position. Let us discuss some of the major differences :

- Creditors are people/entities to whom the company has an obligation to pay a certain sum of money. Debtors are people/entities who owe a sum of money to the company.

- Creditors are Account Payable and reside under current liabilities in the Balance Sheet. Debtors are Account Receivable and reside under current assets in the Balance Sheet.

- Non-payment of dues to creditors affects the working capital cycle positively but negatively affects Credit status. Non-receipt from the Debtors positively affects the working capital cycle but does not affect Credit status.

- As a creditor, it is easier to dictate the terms to the supplier regarding the required credit amount and duration. As a debt, it is comparatively difficult to dictate terms to a customer regarding the credit period and terms thereof.

- Higher creditors harm the Working Capital and liquidity ratios. Higher Debtors have a positive impact on Working Capital and liquidity ratios.

- There is no requirement for the creation of the provision of creditors. According to the Accounting Policies, it is necessary to create a provision for doubtful debt for debtors.

Creditor vs Debtor Comparison Table

Let’s look at the topmost Comparison between Creditors vs Debtors.

| Basis of Comparison |

Creditors |

Debtors |

| Meaning | A person to who you owe money in exchange for goods purchased or services received | A person who owes you money in exchange for goods sold or services rendered. |

| What is it? | It is an account payable. | It is an account receivable. |

| Place in Financial Statement | It is a Balance Sheet item on the liabilities side. | It is a Balance Sheet item on the Asset side. |

| Benefit | It helps the firm use the goods or services before the payment date and thus enjoy a credit period before the payment. | It helps increase customers as normally; the customers would prefer a credit purchase instead of cash. |

| Impact on Profit Margins | No impact on Profit Margins | No impact on Profit Margins |

| Impact on Cashflow | Making the payment later has a positive impact on cash flow. | Negative impact on cash flow as the payment will be received later. |

| Impact on Working Capital | High creditors will reduce working capital. | High creditors will increase working capital. |

| Impact on Liquidity Ratios | Yes, it will affect the current ratio and quick ratio. | Yes, it will affect the current ratio. |

| Provisions | No provisions are to be made | Provisions of Doubtful Debts to be created as per Accounting Policies |

| Impact on Capital Structure | No impact on Capital Structure | No impact on Capital Structure |

Conclusion

For operating any business Creditor vs Debtor are very important stakeholders as most businesses run on credit. A business needs to have a good liquidity position. Ratios like the Current Ratio and the Quick ratio measure the company’s current liquidity situation. Creditor vs Debtor is an important part of the said, forming an important part of the company’s liquidity position. A credit policy is made with specific reference to the credit period received/allowed and the amount received/given on credit so the company can properly plan its credit cycle. It is important to have a robust credit policy so the business does not get working capital stress.

Thus, a Creditor vs Debtor is important for every business as they play a huge part in running the business and its liquidity.

Recommended Articles

This has been a guide to the top difference between creditor vs Debtor Here we also discuss the Creditors vs Debtors key differences with infographics and comparison table. You may also have a look at the following articles to learn more.