Updated July 31, 2023

Difference Between Bank Draft vs Certified Cheque

A Bank Draft is a payment mode wherein the issuing bank guarantees the payment of the amount on behalf of the payer. To request a Bank draft from the Bank, the payer must have an account with that bank. Once the bank receives the request, they usually review the payer’s account details to check whether it has sufficient funds. A certified check is a cheque signed by the payer and guaranteed by the bank that the payer has sufficient balance to cover the amount. It is a safer version of regular cheques since the bank itself checks and guarantees the availability of the funds.

Bank Draft

The bank will freeze an amount from the account so that the payer cannot use that amount, and the amount payable to the payee is secured. Then after that, they issue the bank draft. Once the bank draft is issued, it is impossible to cancel it. This is simply because the transaction occurred earlier when that amount was set aside from the payer’s account. It can only be canceled in case it has been lost or destroyed, or stolen.

Certified Cheque

In the case of certified cheques, most of the time, but not always, banks set aside the stipulated amount. Similar to the bank draft, this cheque cannot be reversed or stopped once issued.

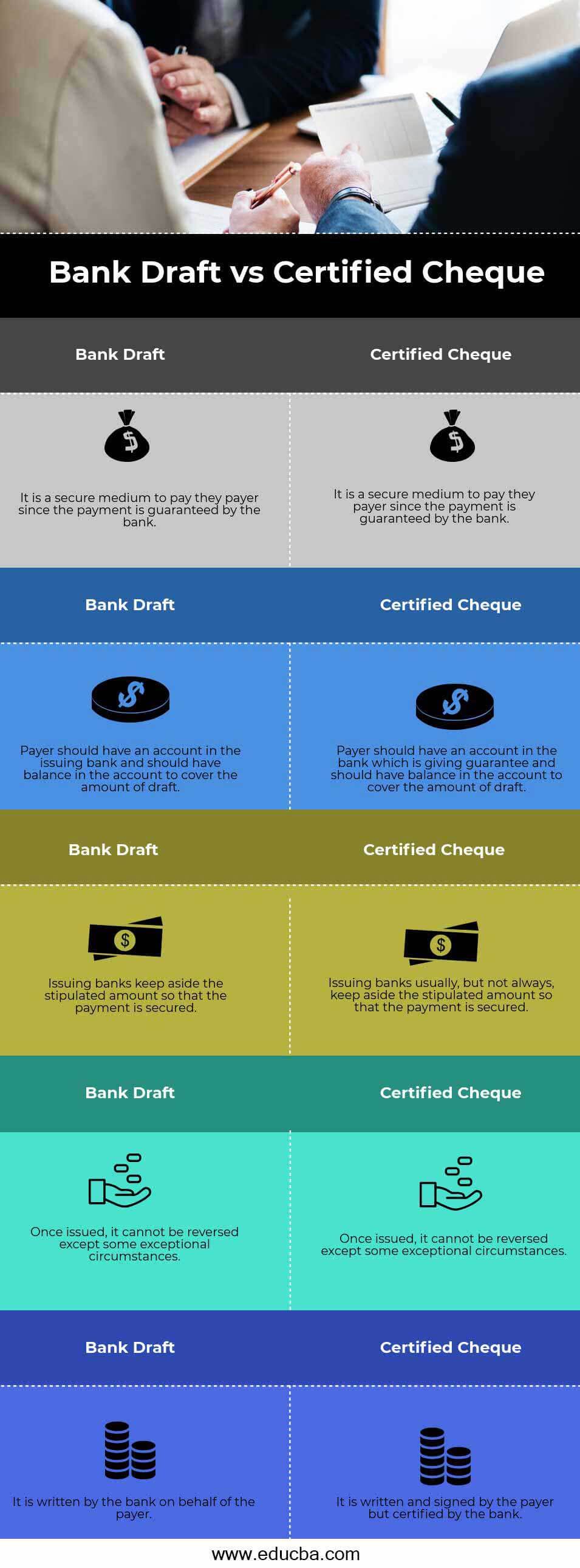

Head To Head Comparison Between Bank Draft vs Certified Cheque (Infographics)

Below is the top 5 difference between Bank Draft vs Certified Cheque

Key Differences Between Bank Draft vs Certified Cheque

Let us discuss some of the major differences :

- As mentioned, when the amount is larger, both bank draft and certified cheque transfer funds to the payee. Both parties have a professional relationship, and the funds’ safety is a priority.

- Transferring funds using any of these fund transfer methods limits the risk of bounced cheques or drafts since the respective banks back and guarantee them.

- Both bank draft vs certified cheques cannot be canceled or stopped. In both cases, the amount gets blocked/set aside by the bank and then transferred to the payee. So it means the transaction already occurred when the bank allocated those funds. Once written, the payer can only take them back with unprecedented circumstances.

- Although in both cases, banks usually keep aside the stipulated amount, sometimes, banks do not perform this step in the case of a certified cheque. When the payer writes the certified cheque, the bank will review the balance and gives the green signal if the funds are sufficient. They will not keep aside the money, and the payer may withdraw it afterward (a rare case). In the Bank draft case, it is the bank’s responsibility that the payee should receive the money to keep aside the funds from the account.

- In the case of a certified cheque, it is written by the payer and backed by the bank. Bank will not write that on behalf of a payer. But for a bank draft, a bank will make that draft on the payer’s behalf and guarantees the payment.

Bank Draft vs Certified Cheque Comparison Table

Let’s look at the top 5 Comparisons between Bank Draft vs Certified Cheque.

|

Bank Draft |

Certified Cheque |

| It is a secure medium to pay the payer since the bank guarantees the payment. | It is a secure medium to pay the payer since the bank guarantees the payment. |

| The payer should have an account in the issuing bank and balance the account to cover the amount of the draft. | The payer should have an account in the bank, which gives the guarantee and a balance to cover the draft amount. |

| Issuing banks keep aside the stipulated amount so that the payment is secured. | Issuing banks usually, but not always, keep aside the stipulated amount so that the payment is secured |

| Once issued, it cannot be reversed except for some exceptional circumstances. | Once issued, it cannot be reversed except for some exceptional circumstances. |

| The bank writes it on behalf of the payer. | The payer writes and signs it, but the bank certifies it. |

Conclusion

Both bank drafts and certified cheques work similarly in terms of functioning and operating. The main goal of these two instruments is to provide additional comfort and reassurance to the person receiving the payment, ensuring that the payment will be honored. Although these two have some small dissimilarities, they are similar branches of the same tree.

Recommended Articles

This has been a guide to the top difference between Bank Draft vs Certified Cheque Here. We also discuss the Bank Draft vs Certified Cheque key differences with the infographics and comparison table. You may also have a look at the following articles to learn more.