Updated July 29, 2023

Difference Between Account Payable vs Accrued Expense

Accounting practice takes place in each and every company, and it is essential for the smooth functioning of any corporate as every corporation needs to record the entries of cost and revenue under various heads. Various kinds of accounts are prepared when a company closes its book. Accounts payable vs accrued expense are one of these accounts that the company prepares. In this Accounts payable vs accrued expense article, we will try and understand the working nature of these kinds of accounts and their characteristics.

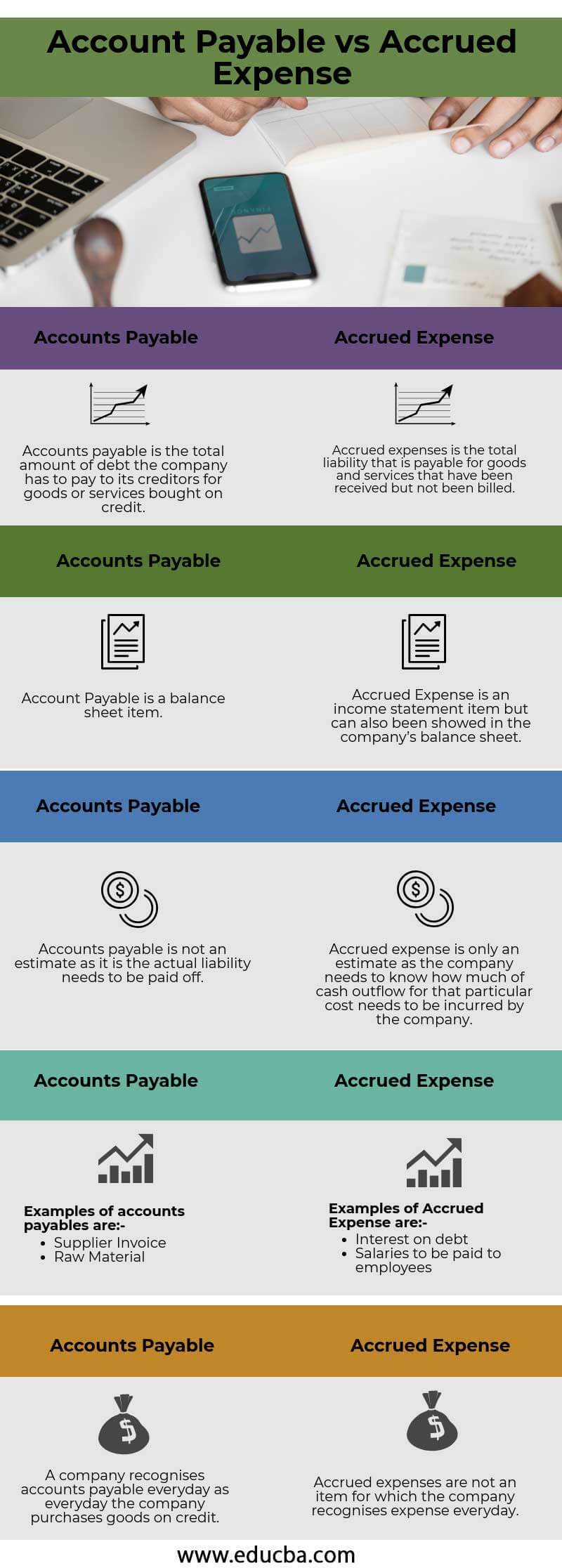

Head To Head Comparison Between Account Payable vs Accrued Expense (Infographics)

Below is the top 5 difference between Account Payable vs Accrued Expense:

Key Differences Between Account Payable vs Accrued Expense

Let us discuss some of the major differences between Account Payable vs Accrued Expenses:

- Account payables are basic financial obligations of a business classified as current liabilities. They generally do not involve any written agreement of a payment to be made within a specified period. On the other hand, accrued expenses are already accrued by the company and have been mentioned or written in the books of accounts. Still, the company has not yet incurred the cash outflow of that respective expense item as in the case of accounts payable.

- Accounts payables are generally due to suppliers or subcontractors; therefore, there is no formal interest on the instrument and no fixed obligation to pay. On the other hand, the accrued expense comes in the category where the supplier or the vendor has not raised any invoice or there is no fixed payment cycle due to the supplier as the payment has not yet been furnished.

- Account payables are always a short-term obligation and are a current liability; On the other hand, an accrued expense is only an estimate of how much money the company owes to its suppliers or vendors; there is no fixed credit payment cycle related to it. Accrued expense works on the accrual method of accounting; as a result, the accrued expense is likely to be different from the actual invoice, which is to be paid to the vendor.

- Accounts payables are an informal channel due to the vendors and suppliers, which makes the payment more flexible and without formal or written agreement. On the contrary, an accrued expense can take on formal or informal forms. It describes as a cost for which the client has not issued an invoice or for which no invoice has been received. Whereas accounts payable, the company has already received the bill.

- In Account Payables, there is no need to pass an adjusting entry in the general ledger account. However, an adjustment entry must be passed to reconcile the account for accrued expenses.

Account Payable vs Accrued Expense Comparison Table

Let’s look at the top 5 Comparison between Account Payable vs Accrued Expenses

| Accounts Payable | Accrued Expense |

| Accounts payable is the total debt the company has to pay its creditors for goods or services bought on credit. | Accrued expenses represent the total liability for goods and services the company has received but has not yet been billed for. |

| Account Payable is a balance sheet item. | Accrued Expense appears as an item on the income statement but can also be presented on the company’s balance sheet. |

| Accounts payable is not an estimate as it is the actual liability that needs to be paid off. | An accrued expense is merely an estimate as the company needs to determine the amount of cash outflow required for that specific cost to be incurred. |

Examples of accounts payables are:

|

Examples of Accrued Expenses are:

|

| A company recognizes accounts payable every day as every day the company purchases goods on credit. | Accrued expenses are not an item for which the company recognizes daily expenses. |

Conclusion

Accounting recognition is an important aspect of every company, and each company should follow the various accounting principles which are globally recognized, such as the US Generally Accepted Accounting Principles and International Financial Reporting Standards. Companies should prepare books by these two methods, whichever applies to them. Furthermore, an external auditor should check and thoroughly audit the books and provide a sign-off at the end of the audit. It enhances the credibility of the company and reassures its shareholders.

Recommended Articles

This has been a guide to the top difference between Account Payable vs Accrued Expenses. Here we also discuss the key differences between the Account Payable vs Accrued Expenses with infographics and a comparison table. You may also have a look at the following articles to learn more –