Updated July 29, 2023

Average Rate of Return Formula (Table of Contents)

- Average Rate of Return Formula

- Examples of Average Rate of Return Formula (With Excel Template)

- Average Rate of Return Formula Calculator

Average Rate of Return Formula

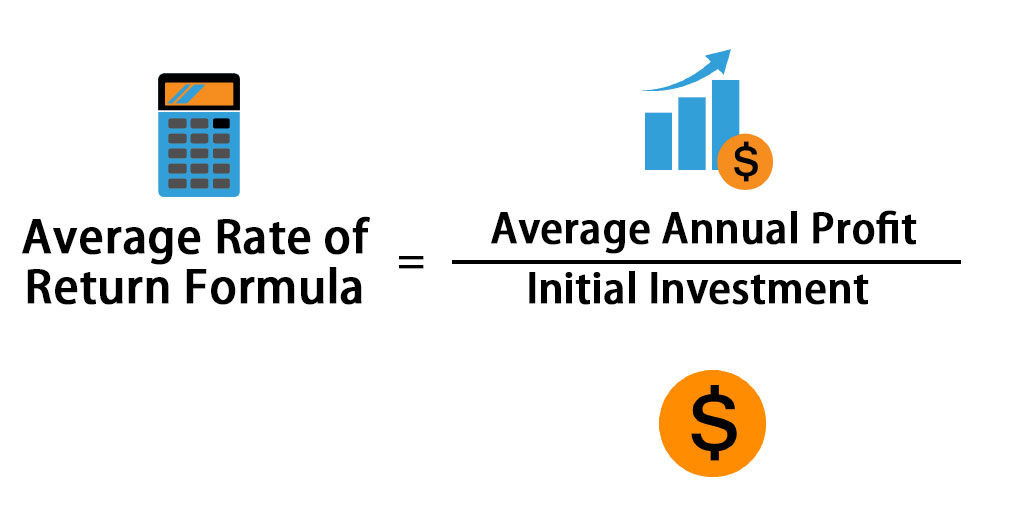

As its name suggests, the average rate of return is the average return which is expected out of an investment in its life. It is basically the amount of cash flows which is getting generated during the investment period. The average rate of return, also known as the accounting rate of return, is the method to evaluate the profitability of the investment projects and very commonly used for the purpose of investment appraisals. But we should keep in mind that this method does not take into consideration the time value of money which is a very critical factor while evaluating a capital project. The average rate of return can be derived by dividing the average return expected from the investment/asset with initial money needed as investment

Formula for Average Rate of Return

Where Average Annual Profit is calculated as:

How to calculate the Average Rate of Return

- The first step is to find out the annual profit from the investment. This can be calculated by subtracting all the required costs from the sales we have generated from the investment

- We need to see if there is any fixed investment like property, plant etc. in the project. If yes, we also need to include depreciation expense and subtract it from sales

- Repeat this for all the years for which the project will last. Once we have all the annual profit numbers with us, find the average profit by dividing it by the number of years. After that, use that average profit and divide it by initial cost of investment

Examples of Average Rate of Return Formula (With Excel Template)

Let’s take an example to understand the calculation of the Average Rate of Return formula in a better manner.

Average Rate of Return Formula – Example #1

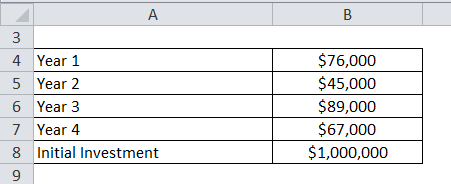

Consider a retail company X’s which has invested $1 million in a project which has a life of 4 years. During the project, year wise profit which the X has earned is given below:

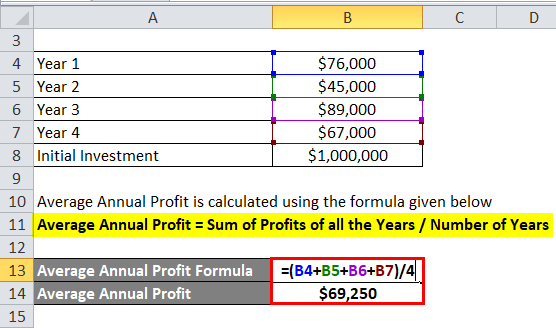

Average Annual Profit is calculated using the formula given below

Average Annual Profit = Sum of Profits of all the Years / Number of Years

- Average Annual Profit= ($76,000 + $45,000 + $89,000 + $67,000) / 4

- Average Annual Profit = $69,250

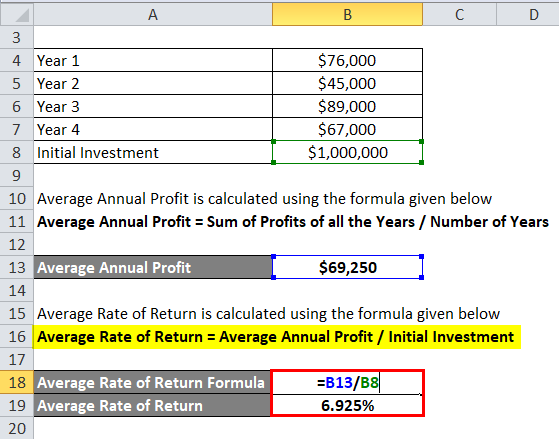

Average Rate of Return is calculated using the formula given below

Average Rate of Return = Average Annual Profit / Initial Investment

- Average Rate of Return = $69,250 / $1,000,000

- Average Rate of Return = 6.925%

We need to keep in mind that the time value of money has not to be considered here. So the yearly cash flow, if the time value is there, will not worth the same and their present value should be less. So for example, $45000 which we have received in year 2 will could have been less if the time value has been considered.

Average Rate of Return Formula – Example #2

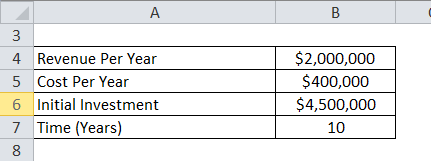

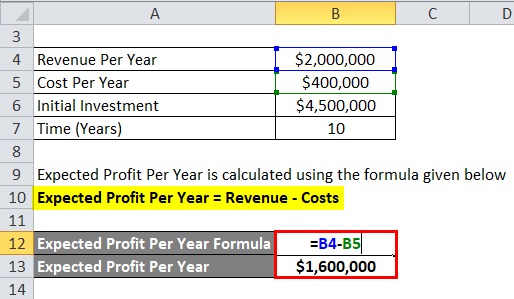

Now let see another example which is more detailed. A company XYZ has implemented a project which has the following parameters:

So here, Profit per year is not given directly but can be calculated using revenue and cost.

Expected Profit Per Year is calculated using the formula given below

Expected Profit Per Year = Revenue – Costs

- Expected Profit Per Year = $2,000,000 – $400,000

- Expected Profit Per Year = $1,600,000

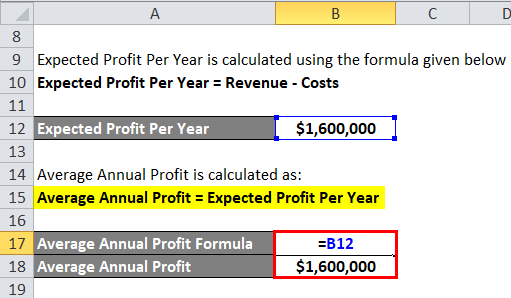

Since profit for each year is the same, Average Annual Profit = Expected Profit Per Year

Average Annual Profit = $1,600,000

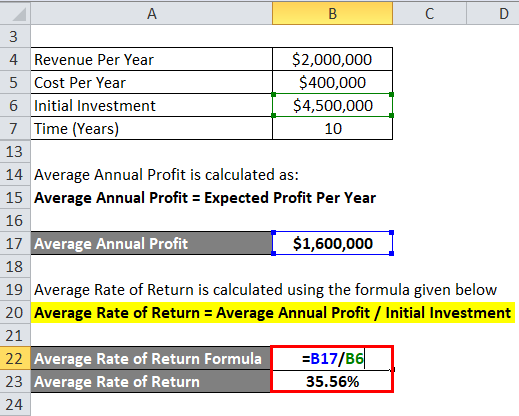

Average Rate of Return is calculated using the formula given below

Average Rate of Return = Average Annual Profit / Initial Investment

- Average Rate of Return = $1,600,000 / $4,500,000

- Average Rate of Return = 35.56%

Explanation

The average rate of return will give us a high-level view of the profitability of the project and can help us access if it is worth investing in the project or not. But there are few limitations of using the average rate of return while making investment decisions. Let us see some critical factors which we need to keep in mind while using an average rate of return formula

- Like we have discussed above, the time value of money has been ignored in the average rate of return formula. That can be detrimental and can lead us to make the wrong capital investment decision. For example: If the required rate of return from the project is sat 10% and the average rate of return is coming out to be 15%, that project will look worth investing. But after taking time value of money in picture, the return of the project is said 8%. Then this project will not be worth investing

- Secondly, the average rate of return is not based on the actual cash flow and only use the accounting information.

- Another thing is that if two projects have a similar return, we cannot differentiate between these project based on the amount of investment required

- Different analyst or persons can calculate this in a different way, so it has a problem of consistency as well

Relevance and Uses

Average rate of return formula is quite easy to understand and calculate if you want to have a quick look at the profitability of the project. Although it does not take into consideration the time value of money, this can give you a high level picture of the project. Below mentioned are some advantages of using the average rate of return

- Like mentioned above, it is very simple to calculate and easy to understand

- Secondly, the accounting information on which it is based, is easily accessible and relatively easy to interpret by anyone

In a nutshell, if a business want to start off with a project and wants to have a high level view of the project’s profitability, the average rate of return can be used. And if using this formula, if the project is not worth investing, scrap the project but if project look profitable, they should investigate other parameters also and shall not rely only on the average rate of return.

Average Rate of Return Formula Calculator

You can use the following Average Rate of Return Calculator.

| Average Annual Profit | |

| Initial Investment | |

| Average Rate of Return Formula | |

| Average Rate of Return Formula | = |

|

|

Recommended Articles

This has been a guide to Average Rate of Return formula. Here we discuss How to Calculate the Average Rate of Return along with practical examples. We also provide Average Rate of Return Calculator with downloadable excel template. You may also look at the following articles to learn more –