Updated July 29, 2023

Nominal Interest Rate Formula (Table of Contents)

- Nominal Interest Rate Formula

- Examples of Nominal Interest Rate Formula (With Excel Template)

- Nominal Interest Rate Calculator

Nominal Interest Rate Formula

The nominal rate of interest is the term we hear in economics and finance. We used the nominal rate of interest to know the interest rate excluding the inflation rate. We also can consider a nominal interest rate for calculating interest on loans before taking any factor into consideration.

The federal rate can also take it as a nominal interest rate. The nominal interest rate also considers the real interest rate because it is calculated before taking the inflation rate into consideration. A real interest rate is effective for the lender and the investor both. There is a difference between real interest rates and nominal interest rates, and that difference is inflation. Real interest takes into account inflation, and nominal doesn’t take the inflation.

The formula for Nominal Interest Rate –

Examples of Nominal Interest Rate Formula (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

For Ex- If a bank offers a nominal rate on a 4-year deposit is 6% and the inflation rate during the period is 4 %, and the real interest rate is 3%.On the other hand, if the nominal interest rate is 5% and the inflation rate is 4%, then we can see that the purchasing price of an investor erodes by 1%( 5% – 4%).

Example #1

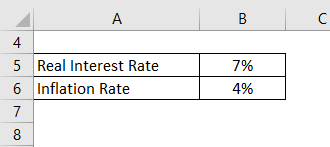

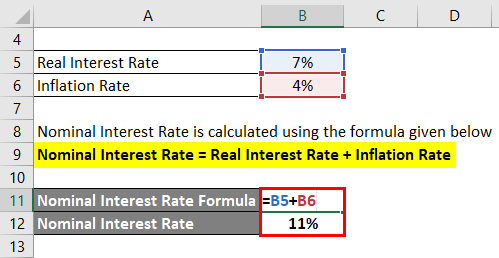

ICICI bank provides a real interest rate which includes inflation of 7% on a 5-year bond, and at that time inflation rate is 4%, so calculate the nominal interest rate during that period of time.

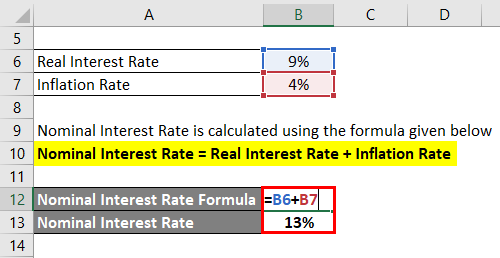

The formula to calculate the Nominal Interest Rate is as below:

Nominal Interest Rate = Real Interest Rate + Inflation Rate

- Nominal Interest Rate = 7%+4%

- Nominal Interest Rate = 11%

So here we are considering the inflation rate in nominal interest rate; so in this example, we can see that the purchasing power of an investor and consumer erodes by 4%, and the reason for purchasing price erosion is inflation.

Example #2

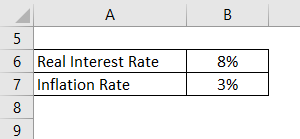

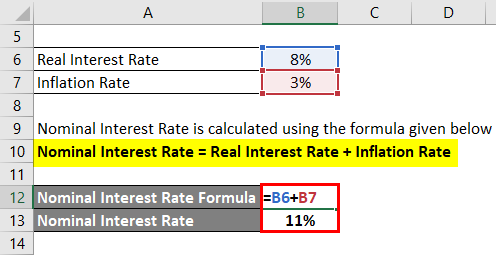

HDFC Ltd is the third private sector bank. HDFC Bank provides 8% of return to their customers if they keep deposits for more than 5 years. And the inflation rate at that time is 3%, so from the above information, calculate the nominal interest rate, which the bank can use for the calculation of the return amount.

Nominal Interest Rate = Real Interest Rate + Inflation Rate

- Nominal Interest Rate = 8% + 3%

- Nominal Interest Rate = 11%

Example #3

Lakshmi Vilas Bank is newly come to the market and wants to attract customer money through deposits. For this, they come with a scheme that they will provide a 9% of return if customers deposit their money for 3 years. The inflation rate in that particular time period is 4%. From the data available, calculate the nominal interest rate.

Nominal Interest Rate = Real Interest Rate + Inflation Rate

- Nominal Interest Rate = 9% + 4%

- Nominal Interest Rate = 13%

Explanation

In Nominal Interest, two major things we consider are the real interest rate and the inflation rate for a particular period of time. The nominal interest rate is called the rate, which we can use to calculate both the return for the borrower and lender. The feral also used the nominal interest rate for the federal reserve. The nominal interest rate includes the real rate of return, which does not include the inflation rate. For the calculation of nominal interest, we must consider inflation because inflation is one of the major things which erose the purchasing power, so for calculating the exact return, we must include inflation in it. So in nominal interest rate, we have to make a total of real interest rate and inflation during the particular period.

Relevance and Uses of Nominal Interest Rate Formula

- The nominal interest rate is relevant in the banking world, finance, and economics.

- Banks also use nominal interest to calculate the interest on a loan.

- A nominal interest rate is a rate calculated by the federal reserve.

- To avoid purchasing price erosion through inflation.

- The central bank sets the short-term nominal interest rate, which forms the basis for other interest rates charged by other banks and financial.

So Nominal interest rate particularly not taking inflation into consideration, so with the actual or real interest rate, we have to add inflation to get a nominal rate of return which many banks use for calculating interest for the lender, and it is also useful for borrower who wants to take a loan from the bank for the particular time being. Even the federal reserve used this nominal rate. We can say nominal interest rate as a benchmark that other banks use. The nominal rate of return is held low at the time of recession, which means that low-interest rates and, therefore, people taking loans and spending more, so there are chances of the overflow of money in the economy. So nominal interest rates play a very important role because the central bank calculates the nominal rate, and all banks use that rate for lending and borrowing purposes.

Nominal Interest Rate Calculator

You can use the following Nominal Interest Rate Calculator

| Real Interest Rate | |

| Inflation Rate | |

| Nominal Interest Rate Formula = | |

| Nominal Interest Rate Formula = | Real Interest Rate + Inflation Rate | |

| 0 + 0 = | 0 |

Recommended Articles

This has been a guide to the Nominal Interest Rate Formula. Here we discuss How to Calculate Nominal Interest Rates along with practical examples. We also provide a downloadable Excel template. You may also look at the following articles to learn more –