Updated July 29, 2023

Difference Between Historical Value vs Fair Value

Assets and liabilities are an integral part of any business, which tells the financial analyst the strength of the business and how strong the business is to repay its obligations. Assets and liabilities are valued under the IFRS and US GAAP valuation policies. IFRS uses the cost or revaluation model, but US GAAP solely uses the cost model. Under the revaluation model, there are a few kinds of values in which one can value the asset. Therefore, one such parameter is Historical Value and Fair Value. In this article, we will try and understand the key differences and work between Historical Value vs Fair Value.

Key Takeaways

- As stated on the balance sheet, the historical Cost is the Cost at which one initially acquires an asset, liability, or equity.

- The fair value represents a company’s assets at their current market worth, which differs from the original price. The former is distinct from the latter since it remains constant even if the asset increases in Value.

- The historical cost principle is one of the leading accounting methods for fixed assets under the US Generally Accepted Accounting Principles (GAAP). It helps minimize asset overvaluation in a fluctuating market.

- Because one reports profit/loss after every quarter, fair value accounting adds volatility to accounting statements like balance sheets and profit and loss. Fair Value is commonly in use, and both the standards, i.e., International Financial Reporting Standards (IFRS) and the US General Accepted Accounting Principles (GAAP) permit it.

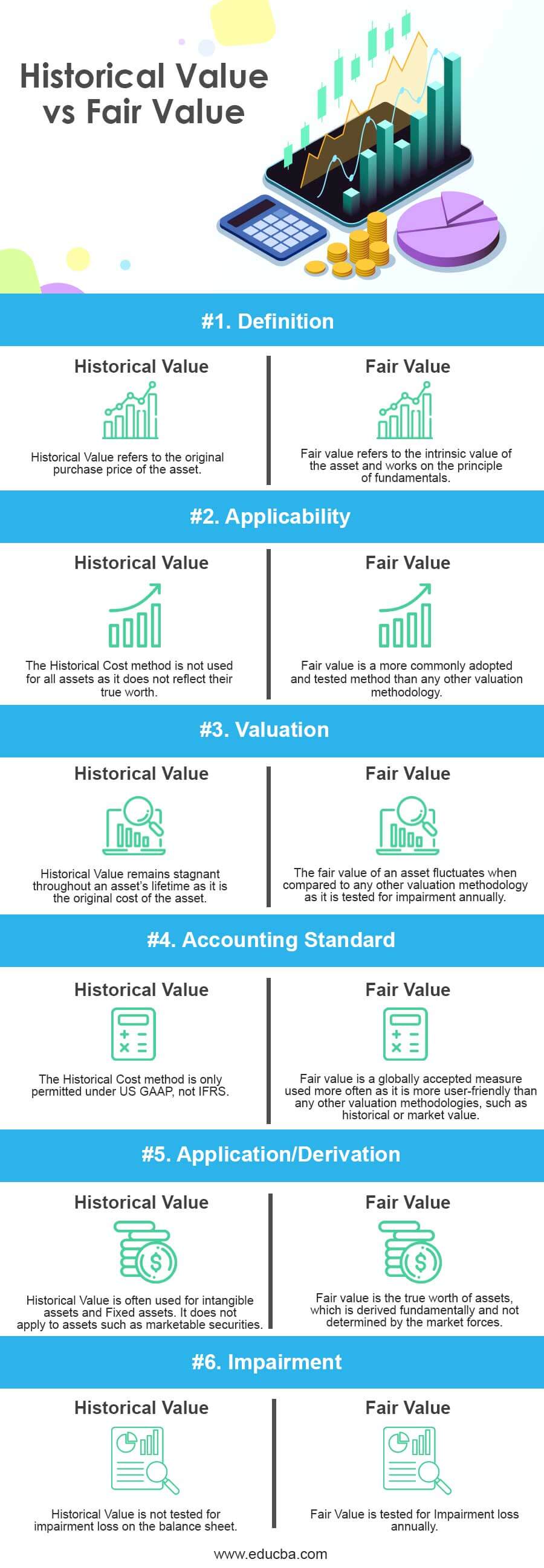

Head-to-Head Comparison Between Historical Value vs Fair Value (Infographics)

Below is the top 6 difference between Historical Value vs Fair Value.

Key Differences Between Historical Value vs Fair Value

Let us discuss some of the major differences between Historical Value vs. Fair Value:

- Companies frequently adopt Fair Value when valuing any asset on their balance sheet. One can explain Fair Value as the true worth of an asset and the Value at which it should be recorded. Historical Cost, on the contrary, refers to the asset’s original Value at the time of acquisition by the company.

- Fair Value is not affected by external sources, and it is independent in itself as it is the basic intrinsic Value of the asset. Therefore, after holding an asset for several years, the Historical Cost typically has little to no bearing on the market value.

- Under the fair value method, the asset goes through impairment testing annually. Thus a loss from the impairment is booked in the income statement of that year. On the other hand, the historical Value does not account for an impairment loss.

- The land is an example of an asset generally at the historical Value of purchase until one sells the land and the profit recorded in the books of accounts. Marketable Securities are another example of an asset.

- The model of fair Value is commonly used, and it is in both the standards, i.e., International Financial Reporting Standards (IFRS) and the US General Accepted Accounting Principles (GAAP). Historical Value is less used, and only US GAAP permits it.

- The Fair Value accounting method needs constant updating and review as the asset value keeps changing and assets get an impairment test annually on the company balance sheet. On the other hand, an asset’s Historical Value does not change and gets recorded in the balance sheet at the same amount every year and does not need constant updating and review.

Historical Value vs Fair Value Comparison Table

Let’s look at the top 6 Comparisons between Historical Value and Fair Value.

| Historical Value | Fair Value |

|

Definition |

|

| Historical Value refers to the original purchase price of the asset. | Fair value refers to the intrinsic value of the asset and works on the principle of fundamentals. |

|

Applicability |

|

| The Historical Cost method is not used for all assets as it does not reflect their true worth. | Companies commonly adopt and test Fair Value as a valuation methodology more frequently than any other method. |

|

Valuation |

|

| Historical Value remains stagnant throughout an asset’s lifetime as it is the original cost of the asset. | As companies test Fair Value for impairment annually, the Fair Value of an asset fluctuates when compared to any other valuation methodology. |

| Accounting Standard | |

| The Historical Cost method is only permitted under US GAAP, not IFRS. | As Fair Value is more user-friendly than other valuation methodologies, such as historical or market value, it is a globally acceptable measure that companies use more frequently. |

| Application/Derivation | |

| Historical Value is often used for intangible and Fixed assets. It does not apply to assets such as marketable securities. | Fair Value, which is fundamentally derived and not determined by market forces, represents the true worth of assets. |

| Impairment | |

| Historical Value is not tested for impairment loss on the balance sheet. | Fair Value goes through a test for Impairment loss annually. |

Advantages and Disadvantages of Historical Value

Advantages:

- Because the historical Cost is not susceptible to future changes, users do not need to conduct market research to determine the financial products’ current price or market value.

- Users can easily read and interpret financial reports even if they lack financial knowledge.

- The historical cost accounting concept is unbiased, affirmed, and reliable.

Disadvantages:

- The historical cost accounting notion is of fixed nature, meaning it is on the basis of the initial Cost in the invoice or receipt. As a result, it does not account for inflation or shifting pricing.

- It does not reflect the company’s assets at their genuine Value. Companies record all assets at their Value on the date of acquisition.

- Financial reporting, such as income statements, does not accurately reflect a company’s genuine profit since the company’s sales are reported at current prices. However, recording expenses at historical costs leads to an overestimation of profits.

Advantages and Disadvantages of Fair Value

Advantages:

- Valuations are more precise with fair value accounting, allowing them to track changes in pricing.

- Since a company’s total asset value reflects its actual revenue, it does not depend on a report of profits and losses but only considers the assets’ worth.

- Fair value accounting permits asset reduction, which aids businesses in surviving financially challenging times.

Disadvantages:

- In particular, volatile assets that might report changes in income that are inaccurate to the long-term financial picture and result in deceptive profits or losses in the short-term picture can cause significant swings in Value that occur several times during the year.

- As the loss of Value in the net income also constitutes an income loss for the investors, it may lower investor satisfaction.

- Establishing a fair value estimate becomes more challenging if a market for a specific item is not present in the active market, as it provides the most accurate data.

Conclusion

A good financial analyst should take care of the valuation methods that different companies use and make necessary adjustments in the financial statements to make an apple-to-apple comparison among companies. One should analyze valuation methodologies should critically in order to do better analysis and cross-sectional analysis also. However, an analyst should dive deep into the reason for the adoption of valuation methods for a particular asset.

Frequently Asked Questions(FAQs)

Q1. What is the definition of fair Value?

Answer: The buyer and seller voluntarily agree on a price called fair value and purchase or sell the asset at the projected price. Hence, by comparing the item’s present market worth, growth potential, and replacement cost, one can calculate the Fair value of an asset.

Q2. What is Historical Value?

Answer: The asset’s original purchase price is also the asset’s historical value. Since it is the asset’s original price, it does not fluctuate over the course of the asset’s lifetime.

Q3. Why is Historical Value important?

Answer: Historical Value makes it simpler for businesses to easily discover the original price of items when needed. It reduces overvaluation in a volatile market and is a helpful tool for evaluating capital expenditures.

Q4. How is Fair Value different from Market Value?

Answer: The main distinction between fair Value and market value is that market value is not a suitable metric for assessing an asset’s actual or intrinsic Value because market factors such as supply and demand will heavily influence it, which are again very inconsistent and dynamic in nature. On the other hand, determining Fair Value relies solely on assessing the asset’s genuine or intrinsic value. Market forces like supply and demand do not influence it.

Q5. What approaches do companies use to assess Fair Value?

Answer: A market method calculates Fair Value by using prices from actual market transactions for comparable assets. To calculate the fair value of the present, an income approach also employs projected future cash flows or earnings. Hence, to determine an asset’s fair Value, a cost approach considers the expected Cost of replacing it.

Recommended Articles

This has been a guide to the top differences between Historical Value vs. Fair Value. Here we also discuss the key differences with infographics and a comparison table. You may also check out the following articles to learn more –