Updated July 29, 2023

Coupon Rate Formula (Table of Contents)

- Coupon Rate Formula

- Examples of Coupon Rate Formula (With Excel Template)

- Coupon Rate Formula Calculator

Coupon Rate Formula

A bond/fixed-income security issuer pays the Coupon Rate, which represents the interest rate. The Coupon Rate is a percentage of the bond’s face value at issuance and remains constant until the bond reaches maturity.

Once established on the issue date, the bond’s coupon rate remains unaltered throughout its tenure, and the bondholder receives a fixed interest payment at predetermined intervals.

The coupon Rate is calculated by dividing the Annual Coupon Payment by the Face Value of the Bond. The result is expressed in percentage form.

The formula for Coupon Rate –

Below are the steps to calculate the Coupon Rate of a bond:

Step 1: In the first step, the amount required to be raised through bonds is decided by the company, then based on the target investors (i.e. retail or institutional or both) and other parameters, face value or par value is determined as a result, of which, we get to know the number of bonds that will be issued.

Step 2: In the second step, we determine the amount of interest and the payment frequency, then calculate the total annual interest payment by multiplying the interest amount by the payment frequency.

Step 3: In the final step, you divide the amount of interest paid yearly by the face value of a bond to calculate the coupon rate.

Examples of Coupon Rate Formula (With Excel Template)

Let’s take an example to understand the calculation of the Coupon Rate formula in a better manner.

Example #1

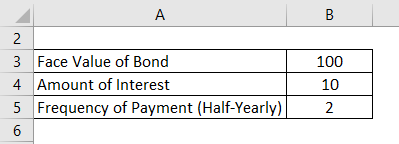

Company ABC issued a bond of Rs. 100 Face Value and Rs. 10 as half-yearly interest.

Solution:

The formula to calculate Annual Interest Payment is as below:

Annual Interest Payment = Amount of Interest * Frequency of Payment

- Annual Interest Payment = 10 * 2

- Annual Interest Payment = Rs. 20

The formula to calculate Coupon Rate is as below:

Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100

- Coupon Rate = (20 / 100) * 100

- Coupon Rate = 20%

Now, if the market interest rate is lower than 20%, the bond will be traded at a premium as this bond gives investors more value than other fixed-income securities. However, if the market rate of interest is higher than 20%, then the bond will be traded at a discount.

Example #2

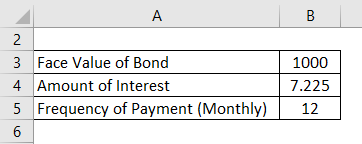

L&T Finance issued secured NCDs in March 2019. Following are the details of the issue:

- NCD Issue Open: 06 March 2019

- NCD Issue Close: 07 March 2019

- NCD Issue Size: Rs.1500 Crore

- Price Band/Face Value/Issue Price: Rs.1000

- NCD’s: 15,000,000 of Rs.1000 Each

- Listing: BSE, NSE

- Credit Rating: IndRA AA/Stable, CARE AA/ Stable, ICRA AA/Stable

- Interest Payment: Rs. 7.225

- Frequency of Payment: Monthly

Solution:

Annual Interest Payment = Amount of Interest * Frequency of Payment

- Annual Interest Payment = 7.225 * 12

- Annual Interest Payment = Rs. 86.7

Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100

- Coupon Rate = (86.7 / 1000) * 100

- Coupon Rate= 8.67%

Example #3

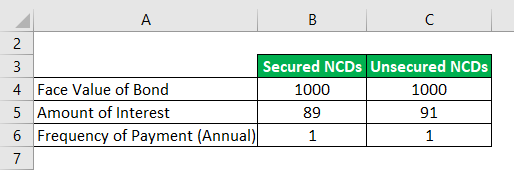

Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

- NCD Issue Open: 10 Sept 2018

- NCD Issue Close: 21 Sept 2018

- NCD Issue Size: Rs. 2000 Cr with an option to retain oversubscription up to limit of Rs. 7,500 Cr

- Price Band/Face Value/Issue Price: Rs.1000

- NCD’s: 2,00,00,000 of Rs.1000 Each

- Listing: BSE, NSE

- Credit Rating: CRISIL AAA/Stable, CARE AAA/ Stable

- Interest Payment

- For Secured NCD: Rs. 89

- For Unsecured NCD: Rs. 91

- Frequency of Payment: Annual

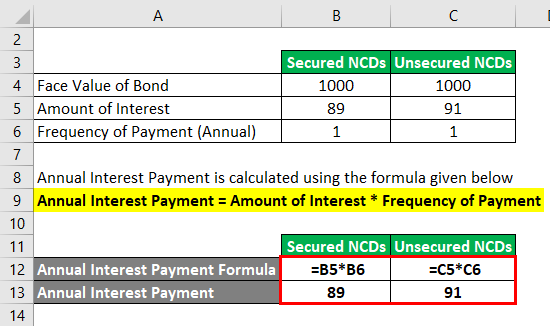

Solution:

Annual Interest Payment = Amount of Interest * Frequency of Payment

For Secured NCDs

- Annual Interest Payment = 89 * 1

- Annual Interest Payment = Rs. 89

For Unsecured NCDs

- Annual Interest Payment = 91 * 1

- Annual Interest Payment = Rs. 91

Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100

For Secured NCDs

- Coupon Rate = (89 / 1000) * 100

- Coupon Rate= 8.9%

For Unsecured NCDs

- Coupon Rate = (91 / 1000) * 100

- Coupon Rate= 9.1%

As we know, an investor expects a higher return for investing in a higher-risk asset. Hence, as we can witness in the above example, the unsecured NCD of Tata Capital fetches higher returns than the secured NCD.

Explanation

The coupon rate of a bond is determined after considering various factors. Still, two of the key factors are the interest rates of different fixed-income security available in the market at the time of the bond issue and the company’s creditworthiness.

A bond’s coupon rate is determined so that it remains competitive with other available fixed-income securities. However, the coupon rate of newly issued fixed-income securities may increase or decrease during the tenure of a bond based on market conditions, which results in a change in the bond’s market value. The market value of a bond is a derivation of the difference in the coupon rate of the bond and the market interest rate of other fixed-income securities. If a bond’s interest rate is below the market interest rate, the bond is said to be traded at a discount. In contrast, if the bond’s interest rate is higher than the market interest rate, the bond is said to be traded at a premium. Similarly, a bond is said to be traded at par if the bond’s interest rate is equal to the market interest rate.

The coupon rate is also depending on the creditworthiness of the company. Companies must undertake a credit rating of the bond from a credit rating agency before issuing the bond. Credit rating agencies assign a credit rating to the bond issue after assessing the issuer on various parameters, the riskiness of the company’s business, financial stability, legal history, default history, ability to repay money borrowed through the bond, etc. The credit Rating hierarchy starts from AAA and goes up to D, with ‘AAA’ being most safe and ‘D’ being Default. Generally, bonds with a credit rating of ‘BBB and above are considered investment grade. A higher bond rating means higher safety and hence a lower coupon rate and vice versa.

Relevance and Uses

The coupon Rate Formula helps calculate and compare the coupon rate of different fixed-income securities and helps choose the best as per the requirement of an investor. It also helps assess the cycle of interest rates and the expected market value of a bond. For eg. If market interest rates are declining, the market value of bonds with higher interest rates will increase, resulting in higher yield and hence higher return on investment and vice versa in an increasing market interest rate scenario.

Coupon Rate Formula Calculator

You can use the following Coupon Rate Calculator

| Annual Coupon (or Interest) Payment | |

| Face Value of Bond | |

| Coupon Rate Formula | |

| Coupon Rate Formula | = |

|

||||||||

| = |

|

Recommended Articles

This has been a guide to Coupon Rate Formula. Here we discuss How to Calculate Coupon Rates along with practical examples. We also provide Coupon Rate Calculator with a downloadable excel template. You may also look at the following articles to learn more –