Updated August 3, 2023

Salary Formula (Table of Contents)

- Salary Formula

- Examples of Salary Formula (With Excel Template)

- Case Study

- Relevance and Uses

- Salary Formula Calculator

Salary Formula

The term “salary” has its roots in ancient times when Roman soldiers received an additional payment known as “Salarium” on top of their regular wages. Fast forward to today, and we have the salary formula calculator, a valuable tool for employees to know their growth and estimate various additions and deductions in their salary.

There are several components to consider regarding salaries, and it’s essential to differentiate between gross and net salaries. Let’s take a closer look at the components included in an employee’s salary formula:

- Basic Salary

- House Rent Allowance

- Transport Allowance

- Leave Travel Allowance

- Statutory Bonus

- Provident Fund

- Income Tax

- Insurance

The salary formula for calculating salary is as follows:

The salary structure can vary significantly between countries due to cultural norms, economic factors, industry practices, job market conditions, cost of living, and local labor laws. Additionally, individual companies may have their policies regarding salary components. Some companies might include additional deductions not mentioned above, while others may have fewer deductions.

In India, for instance, companies often operate under a cost-to-company (CTC) model, which means that formal sector employees experience several deductions from their salary. On the other hand, employees in the informal sector typically receive their full salary amount. In the United States, salaries are often defined by pay scales or hourly wages.

Basic Salary vs. Gross Salary vs. Net Salary

Before we delve into using the salary formula to calculate various types of salaries, we must understand the distinctions between salary computation format. The table below provides an overview of the differences:

| Salary Component | What is the Basic Salary? | What is Gross Salary? | What is Net Salary? |

| Definition | The fixed amount of salary before any addition of allowances and deductions of taxes. | The amount of salary after adding all benefits and allowances to basic pay but before deducting any taxes. | The amount of salary that is credited to your bank account after all deductions. |

| Salary Formula | Basic Salary = Gross Salary – Total Allowances (DA + HRA + Medical Insurance + Other Allowances)

or Basic salary = CTC x Percentage |

Gross salary = Basic Salary + HRA + Other Allowances | Net salary = Gross Salary – Income Tax – Professional Tax – TDS – EPF – ESIC |

| Components | – | Allowances (DA, HRA, LTA, Conveyance, Medical, Special, etc.)

Perquisites (e.g., car for personal use, rent-free accommodation, phone, internet services, etc.) |

Income Tax, Professional Tax, TDS, EPF, ESIC, etc. |

| Taxable | Yes | Depending on the Income Tax Act of 1961 provisions, some allowances may be fully or partially exempt from tax, while others may be taxable. | Yes |

| Affected by Income Tax | No | No | Yes |

Examples of Salary Formula (With Excel Template)

Let’s learn the salary formula with the following examples by creating a salary sheet in excel with formula.

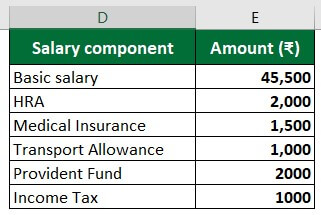

Example #1: How to Calculate Basic Salary?

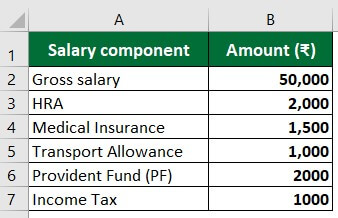

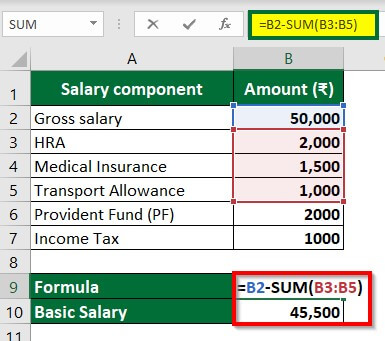

Let’s consider the below salary structure of Mr. X. Here, we have to find the basic salary.

Solution:

The formula for calculating basic salary from gross salary is as follows:

According to the above data:

Basic Salary = 50,000–(2,000+1,500+1,000)

= 45,500

Example #2: How to Calculate Gross Salary?

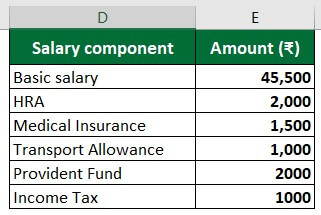

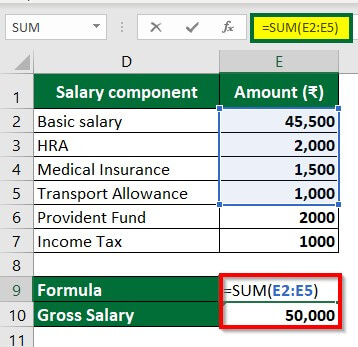

Let’s consider the below salary structure of Mr. X. We have to find the gross salary from the basic salary.

Solution:

The formula for calculating gross salary from basic salary is:

According to the above data:

Gross Salary = 45,000+2,000+1,500+1,000

= 50,000

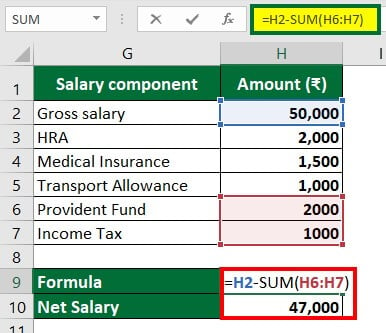

Example #3: How to Calculate Net Salary?

Let’s consider the below salary structure of Mr. X. We will calculate the net salary from the gross salary.

Solution:

The formula for calculating net salary from gross salary is as follows:

According to the above data:

Gross Salary=50,000-(2,000+1,000)

= 47,000

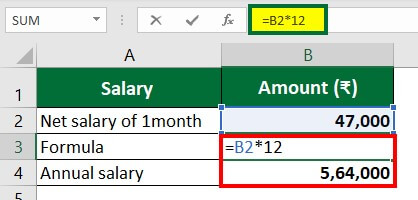

Example #4: How to Calculate Annual Salary?

Let’s calculate the annual salary of Mr. X from his gross salary.

Solution:

The formula for calculating annual salary from gross salary is as follows:

According to the data of the previous example:

Annual Salary = 47,000 x 12

= 5,64,000

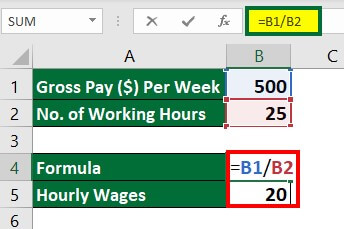

Example #5: How to Calculate Hourly Wage?

Suppose Mr. Y’s gross pay is $500 a week, and he has worked 25 hours a week. Now, we want to calculate his hourly wages.

Solution:

The formula to calculate hourly wages is

According to our data,

Hourly wages = 500/25

= 20

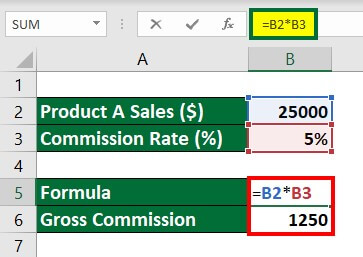

Example #6: How to Calculate Commission-Based Pay

Let’s consider a scenario in which you are a salesperson of XYZ company. You made $25,000 worth of sales on Product A, and your commission rate is 5%. Here, you want to know your gross commission on Product A.

Solution: Here,

Commission Base (Sales Amount) =$25,000

Commission rate = 5%

The following is the formula for calculating Gross Commission:

According to the data,

Gross Commission = 25,000 x 0.05 (5%)

=1250

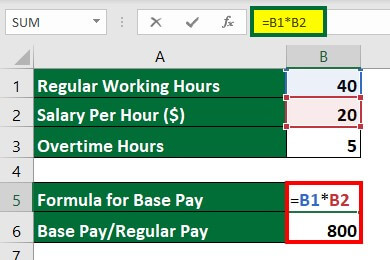

Example #7: How to Calculate Salary with Overtime?

According to the FLSA (Fair Labor Standards Act), companies must provide overtime, also known as premium pay, to nonexempt employees who work over 40 hours a week.

The formula for calculating overtime payment as per FLSA is

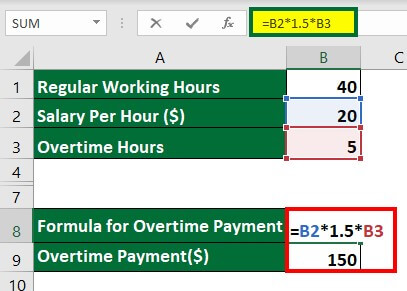

Let’s consider a scenario of a nonexempt employee who worked 45 hours in a workweek beyond the regular working hours of 40 hours. He earns $20 per hour. We have to calculate the total pay, including the overtime premium for that week.

Solution:

Base Pay/Regular Pay = $20 x 40 hours

=$800

Overtime Hours= 5 hours

= $20 x 1.5 x 5

= $150

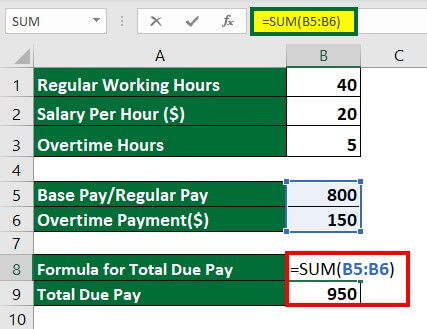

So,

Total Due Pay = $800 + $150

= $950

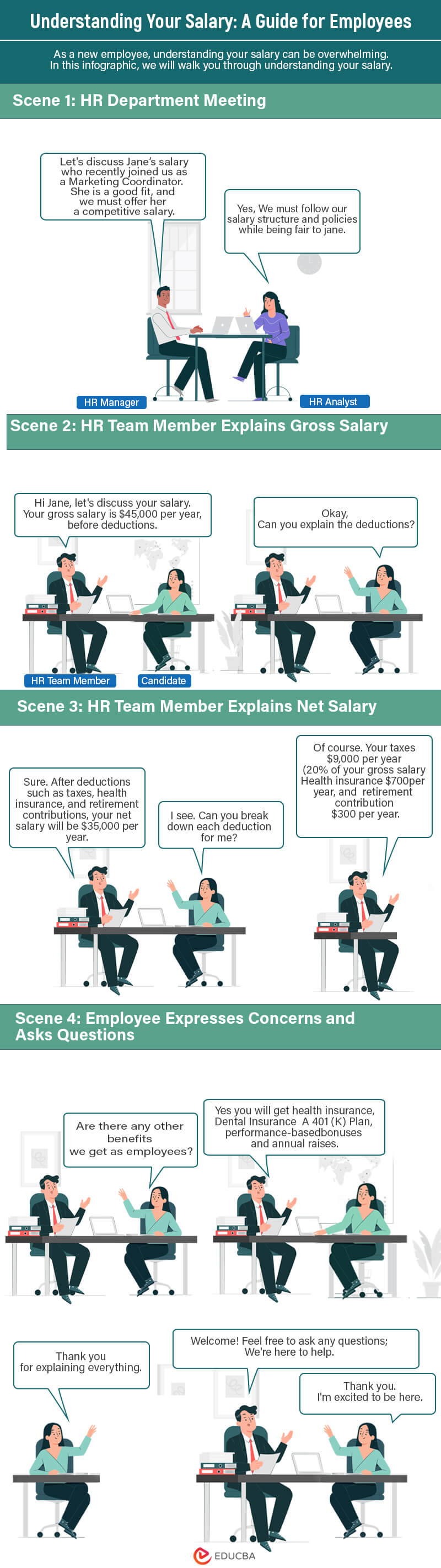

Case Study

A company has recently hired Jane. She is eager to understand how her gross salary is calculated and what deductions will be made to arrive at her net salary. In this case study, we will analyze the components of Jane’s salary and the applicable deductions and provide a step-by-step solution to calculating her net salary.

The following infographic shows her conversation with HR team members. Take a look at the conversation to understand the process of the interview. After that, you can find the solution for calculating Jane’s net salary.

Given:

- Gross salary: $45,000 per year

- Deductions:

-

- Tax Deduction: 20% of Gross Salary

- Health Insurance: $700 per year

- Retirement contributions: $300 per year

Solution:

Step 1: Calculate the total deductions

Tax Deduction = 20% of Gross Salary

= 20/100 * $45,000

= $9,000

Health Insurance: $700 per year

Retirement Contribution: $300 per year

Total Deductions = $9,000 + $700 + $300 = $9,000 + $1,000

= $10,000

Step 2: Calculate the net annual salary

= $45,000 – $10,000

= $35,000

Step 3: Calculate the net monthly salary

To find the net salary per month, we will divide the net annual salary by 12.

Net Salary per Month = $35,000 / 12

= $2,916.67

Using the monthly salary calculation formula, we find that Jane’s monthly net salary would be approximately $2,916.67. Employees like Jane must clearly understand how their net salary is calculated after accounting for all the deductions. This case study provides a comprehensive solution for job seekers to better understand their salary structure before accepting a job offer.

Relevance and Uses of Salary Formula

The salary formula calculator can be of the following use:-

- The salary formula calculator tells the employee about their growth. And if any deduction is unclear to the employee, they can seek the help of the human resource department to clarify it.

- The salary calculation formula also tells the employee about their standing in the company and determines whether they are underpaid or overpaid.

- The salary formula is useful when the company plans and implements the initiative for reducing human resource costs. Moreover, the calculator can be helpful in computing salaries and the compensation paid to the staff and top management and can help identify the roles that are overpaid or redundant.

- The salary calculation formula in Excel also reduces the workload of the human resource department, which needs to compute the salaries of different individuals on payday.

Salary Formula Calculator

| Basic | |

| HRA | |

| Transport Allowance | |

| FBP Allowance | |

| Bonus | |

| Provident Fund | |

| Income Tax | |

| Insurance | |

| Salary Formula | |

| Salary Formula = | Basic + HRA + Transport Allowance + FBP Allowance + Bonus - Provident Fund - Income Tax - Insurance |

| 0 + 0 + 0 + 0 + 0 - 0 - 0 - 0 = 0 |

Recommended Articles

This article has been a guide to the Salary Formula. Here we discuss how to calculate the salary along with practical examples. We have also provided Salary Calculator with a downloadable Excel template. You may also look at the following articles to learn more: