Updated July 28, 2023

Definition of Disposable Income

Disposable Income is the money left with the person after paying all the direct taxes. It is the actual income that individuals and families spend on consumption after paying direct taxes. This is the purchasing power of households. An individual can either consume or save it. It is generally spent on necessities that are food, clothing, and housing.

Types of Disposable Income

Given below are different types:

1. National

This is the sum of income of all citizens and institutions of the Nation. It is derived from overall national income and measures the cash or Income available with the nation for final consumption and saving. National Disposable Income can be gross or net.

2. Personal

Personal type refers to that part of the personal income of an individual available for the use or disposal of a household. So, it is the actual amount available to individual households and non-corporate businesses after paying all government tax obligations.

Disposable Formula

- Disposable Income = Gross Annual Income – Direct taxes

- Net National Disposable Income = NNP(Factor Cost)+Net Indirect Taxes+Net current transfer from the rest of the world

- Gross National Disposable Income = Net National Disposable Income+ Depreciation

Examples of Disposable Income

Given below are the examples mentioned:

1. A family from United Nations has an annual household income of $85,000, paying 15% tax annually, so what is the family’s disposable income?

So 15% of $85,000 is $12,750 (Annual taxes paid to family)

- Disposable Income = $85,000 – $12,750 = $72,250

2. Robert is planning to buy a new home in the near future, so he is looking to invest in a new home. So, before making an investment decision in new, he wants to ensure that his disposable personal income is not committed towards something else. Robert has to calculate disposable personal income using the disposable Formula.

- Robert Annual Income = $90,000

- Tax expenses and Payroll Deduction = $15,000

DPI = Annual Income – Taxes and Other Payroll Deductions

= ($90,000 – $15,000)

DPI = $75,000

So Robert’s Net Income is $75,000, and the new home has a retail price of $45,000 and a loan payment of $10,000, which is approximately 13% of Robert’s DPI. So depending on Robert’s other expenses, it seems reasonable to buy a new home.

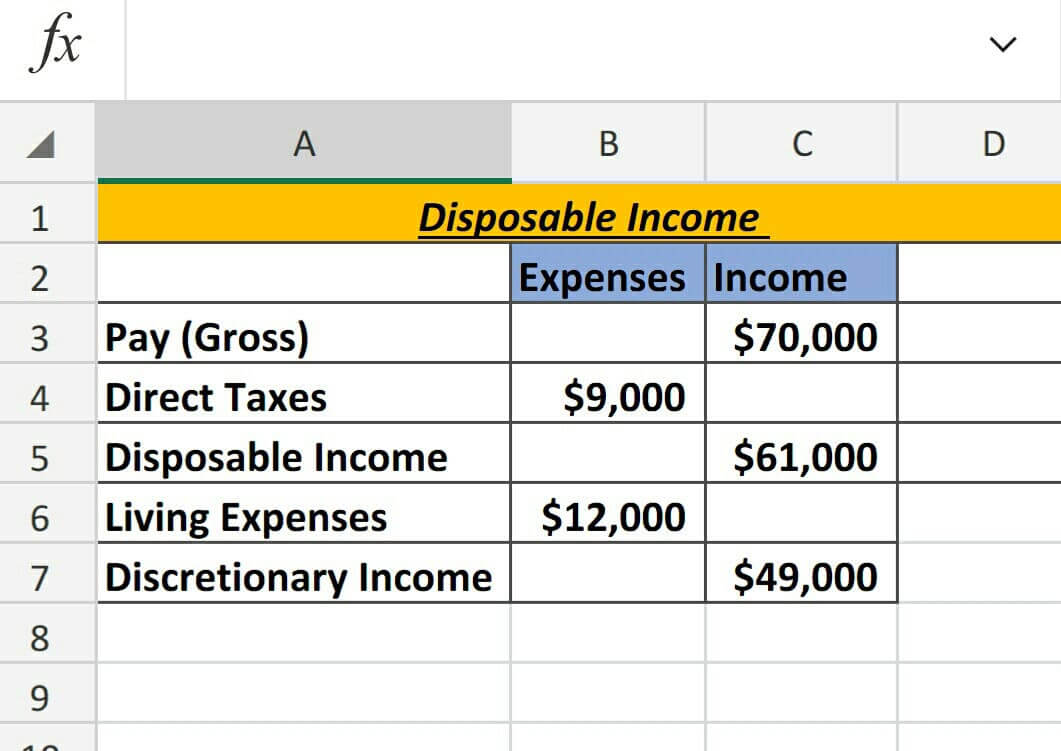

Excel Application Snapshot.

Advantages

- This impacts the stock market, and if the company’s income increases, it increases the stock valuation, and due to this overall value of the stock market increases.

- If an individual income increases, in that case, the household has more money either to save or spend, and indirectly, consumption also increases.

- The higher DPI allows them to buy luxury goods.

- If it increases, it is a good sign for small businesses as customers have more money to buy goods and services.

- A nation uses this to calculate the overall Nation’s net disposable and Gross Disposable income.

- Lastly, it is an important economic indicator for the nations to maintain the economy’s health when needed.

Disadvantages

- If it decreases, in that case, households have less amount in hand to spend and save.

- If consumption decreases, it decreases corporate sales and earnings, and the individual stock’s value also decreases.

- Direct taxes impact DPI. If it increases, it reduces an individual’s purchasing power.

- It depends on real disposable, employment, job security, household wealth, expectations and sentiment, and market factors.

- Taxes play an important role in disposable depending on the increase and decrease of taxes by the government of different nations.

Maintaining disposable income nations at the desired level is the government’s job. If it fails to do so, consumers will have less money to spend on goods and services, and the economy will impact due to these counties.

Important Points

- If disposable decreases, the household has less money to spend and save.

- If Disposable increases, households will have more money to spend and save, and consumption will increase.

- This fluctuates as taxes and tax rates differ from country to country.

- When income changes, it changes the consumption level of goods and services, called induced consumption, and varies with income.

- A change in the permanent income of a household leads to a change in the consumption pattern of the household rather than changes in temporary income.

Conclusion

So from the above description, it is clear that disposable income is the amount available to individuals’ households after paying all government taxation. Different government agencies monitor citizens of the country for economic purposes and the economy’s health. Nations continuously make efforts to increase or maintain disposable at a certain level as it is an important economic indicator for the nations. It has been observed that if the country’s National Income is higher, then income is also higher. It mainly depends on taxes, and it fluctuates as taxes fluctuate. Personal disposable income is an important indicator of the nation’s economy and determines the individual’s ability to consume goods and services.

This amount is important for a household to spend on daily necessities. Personal income in the United States in January 2019 was 15913.40 USD billion, which increased to 15944.70 USD billion in February 2019. Personal Disposable Income averaged 5273.04 USD Billion in the United States from 1959 to 2019.

Recommended Articles

This article has guided the calculation and examples, including advantages and disadvantages. You may also take a look at the following articles to learn more –