Updated July 27, 2023

Activity Based Costing Formula (Table of Contents)

- Activity Based Costing Formula

- Examples of Activity Based Costing Formula (With Excel Template)

- Activity Based Costing Formula Calculator

Activity Based Costing Formula

Among various costing method which is used in the manufacturing and the production sector and industry one of the methods which is fairly used is the Activity-based costing method which is used today widely in manufacturing companies and units and it is a new method to cost all the indirect cost based on the various products and service lines. It is a more practical and more refined approach which has been introduced and is now practiced all over the world these days. The method involves the following steps:-

- First, the user needs to identify the activities which are pertaining to the production process.

- Then the activities need to be classified based on the type of cost and type of activity.

- Identification of the appropriate cost drivers.

- Calculating the activity rate of each unit.

- Application of the various cost identified and appropriating it to various cost in the service line of the production process.

Activity-based costing can be computed by assigning all the indirect cost which is incurred to the identified various types of cost umbrella,

So the formula for Activity Based Costing –

Examples of Activity Based Costing Formula (With Excel Template)

Let’s take an example to understand the calculation of Activity Based Costing formula in a better manner.

ABC Formula – Example #1

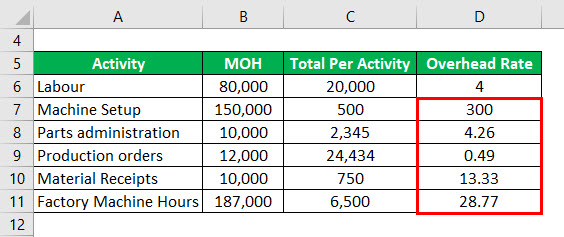

Trans Industries and Production Pvt. Ltd. Wants to determine it’s overhead cost using activity Based Costing method. The following data has been provided by the company to determine the costing of overheads for a particular period.

Solution:

Overhead Rate is calculated using Activity Based Costing formula

Activity Based Costing = Cost Pool Total / Cost Driver

Similarly, we calculate the overhead rate for all data.

ABC Formula – Example #2

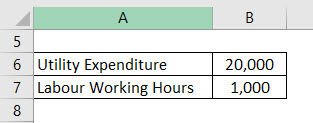

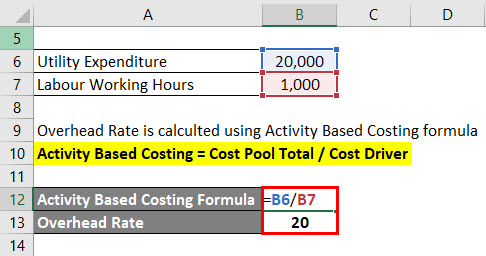

Trans Industries and Production Pvt. Ltd. Now wants to figure and calculate it’s expenditure on utilities for a particular period. The total estimated utility expenditure is 20,000 for the year 2008-2009. The utility cost is directly mapped to direct labor working hours which is totaling to 1,000 hours per year in 2008-2009. Calculate the overhead applicable rate for that year using ABC Formula.

Overhead Rate is calculated using Activity Based Costing formula

Activity Based Costing = Cost Pool Total / Cost Driver

- Overhead Rate = 20,000 / 1,000

- Overhead Rate= $20 per working hour

ABC Formula – Example #3

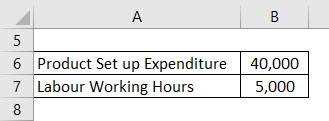

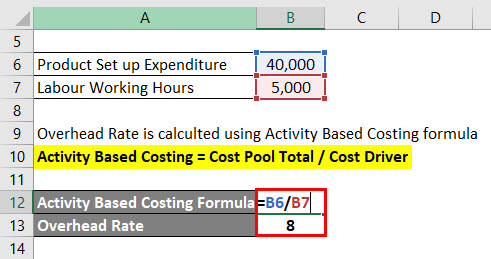

Trans Industries and Production Pvt. Ltd. Now wants to figure and calculate it’s expenditure on utilities for a particular period. The total estimated product set-up expenditure is 40,000 for the year 2007-2008. The utility cost is directly mapped to direct labor working hours which is totaling to 5,000 hours per year in 2007-2008. Calculate the overhead applicable rate for that year using ABC Formula.

Solution:

Overhead Rate is calculated using Activity Based Costing formula

Activity Based Costing = Cost Pool Total / Cost Driver

Overhead Rate = 40,000 / 5,000

Overhead Rate = $8 per working hour

Explanation

The activity-based formula simply gives us the dollar value of amount per activity which is then can be multiplied to determine the cost of the total products assigned or produced in that particular cost pool. By computing and using this method of activity-based costing the manufacturing company can successfully and more accurately determine the various product cost and hence can have a detailed cost analysis report.

Relevance and Uses of Activity Based Costing Formula

- Because activity-based costing breaks down the costs that go into creating a product, it has many uses in business.

- For small businesses, activity-based costing is great for making overhead decisions and pricing products.

- Using specific product allocation, you can very well determine the exact cost which is being used for the product type and can also be used for detailed cost analysis. A company can analyze its historical trends and other business trends to make a more detailed and meaningful cost analysis which can also help in the reduction of cost and remove irrelevant and redundant product cost.

- Activity Based Costing method creates new bases for assigning overhead costs to items such that costs are allocated based on the activities that generate costs instead of on volume measures, such as machine hours or direct labor costs.

Activity Based Costing Formula Calculator

You can use the following Activity Based Costing Calculator

| Cost Pool Total | |

| Cost Driver | |

| Activity Based Costing | |

| Activity Based Costing | = |

|

|

Recommended Articles

This has been a guide to Activity Based Costing Formula. Here we discuss how to calculate Activity Based Costing along with practical examples. We also provide an Activity Based Costing calculator with downloadable excel template. You may also look at the following articles to learn more –