Updated July 27, 2023

Market Risk Premium Formula (Table of Contents)

- Market Risk Premium Formula

- Market Risk Premium Formula Calculator

- Market Risk Premium Formula in Excel (With Excel Template)

Market Risk Premium Formula

The market risk premium is defined as the difference between the expected return on a market portfolio and the risk-free rate. The market risk premium which we obtain is equal to the slope of the security market line(SML), a graphical representation of the capital asset pricing model(CAPM).

CAPM is used to calculate how much we will obtain on equity investments, which is the most important element of the modern portfolio theory and valuation of the discounted cash flow as well.

Examples of Market Risk Premium Formula

Let’s take an example to understand the calculation of Market Risk Premium in a better manner.

Market Risk Premium Formula – Example #1

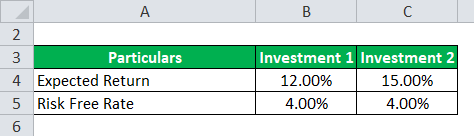

Let’s consider an example, where we have invested a certain amount in two different assets.

In this example, we have considered two different investment along with expected return and risk free rate for each investment.

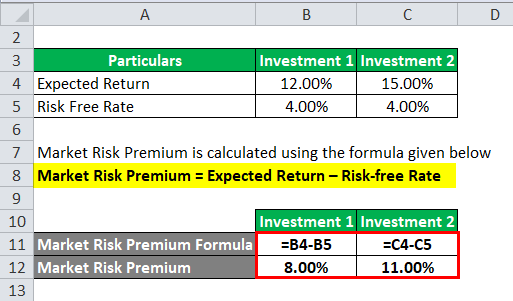

Market Risk Premium is calculated using the formula given below

Market Risk Premium = Expected Return – Risk-Free Rate

For Investment 1

- Market Risk Premium = 12% – 4%

- Market Risk Premium = 8%

For Investment 2

- Market Risk Premium = 15% – 4%

- Market Risk Premium = 11%

Most of the time, we need to base our expected return on the historical figures.it means whatever the investor is expecting the rate of return, decides its rate of premium.

Market Risk Premium Formula – Example #2

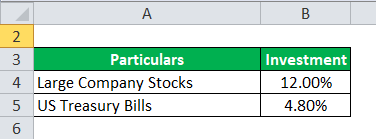

Market Risk Premium and Equity Risk Premium both are different in itself in terms of scope and concept. Now take an example of equity risk premium where equity is considered as one type of investment vehicle.

No, we deep dive into the equity risk premium. Equity risk premium calculates the difference between the expected return from the specific equity invested into it and the risk-free rate.

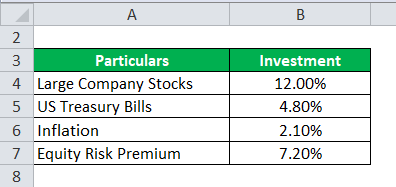

Let’s say, the investor is interested in making money, large company stocks 12.00% and US Treasury Bills 4.80%.

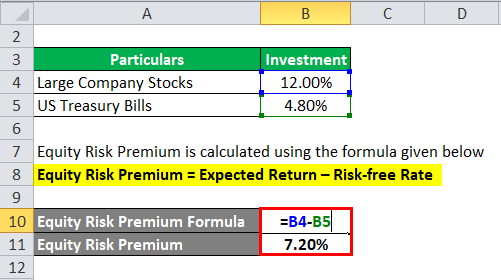

Equity Risk Premium is calculated using the formula given below

Equity Risk Premium = Expected Return – Risk-free Rate

- Equity Risk Premium = 12% – 4.80%

- Equity Risk Premium = 7.20%

Now, we calculate the market risk premium. So, we have calculated the risk premium of 7.20% that the investor would pay.

Market Risk Premium Formula – Example #3

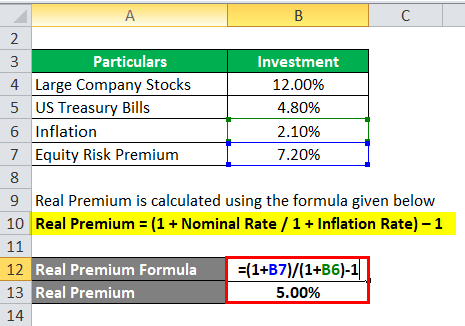

Continuing with the above example i.e example #2. Calculate the Real Premium.

To calculate the expectancy model, we need to take historical data from the same market or an idea, so we can draw out expected return out of it where premium matters a lot.

Now, we need to compute real premium for that normal premium or premium is required.

Real Premium is calculated using the formula given below

Real Premium = (1 + Nominal Rate / 1 + Inflation Rate) – 1

- Real Premium = (1 + 7.20% / 1 + 2.10%) – 1

- Real Premium = 5%

The real premium has more utility in terms of inflation and real-life data and there is a less chance of expectation failure when an investor is expecting something better.

Explanation

The market risk premium is the additional amount an investor would obtain on this investment while holding a risky market portfolio over of risk- free assets.

The market risk premium is widely used by the analysts and investors to calculate the acceptable rate of return which is the part of the Capital asset pricing model(CAPM). At the center of the CAPM is the concept of risk (Volatility of returns) and reward(rate of returns). Investors expect highest on his investment along with the lowest possible volatility of returns.

How to determine the Market Risk Premium?

There are three concepts with the help of which we measure the market risk premium.

- Required Market Risk Premium – It is the difference between the minimum rate the investors may expect while investing in any investment vehicle and the risk-free rate.

- Historical Market risk Premium – It is used to determine the return obtained from the past investment performance which is used to calculate the premium. It is the difference between the historical market rate of a particular market, e.g NYSE(New York Stock Exchange) and the risk-free rate.

- Expected Market Risk Premium – It wholly depends on the investor’s return expectation.

Whereas, the expected market risk and required premium vary investor to investor. The investor needs to bother much more about the cost of equity it takes during calculation and the investment he would do.

While in a historical market risk premium, the returns mostly depend upon the instrument the analyst uses. Majorly analysts give more emphasis to the S&P 500 as a benchmark to calculate the past performance.

A government bond yield has little or no risk associated with it and considered it to be while calculating risk-free returns.

There is a certain set of procedure to compute the Market risk premium.

Step 1: Estimate the total expected return can be obtained on stocks.

Step 2: Estimate the expected return on a risk-free bond

Step 3: Subtract the above to steps and the obtained difference is market risk premium.

Relevance and Uses of Market Risk Premium Formula

The market risk premium is computed by the difference of the expected price return and the risk-free rate which is the part of the Capital asset pricing Model. In CAPM, the return of the asset is calculated by the sum of the risk-free rate and product of the premium by the beta of the asset. The Beta of the equation speaks more about the riskiness of an asset with respect to the market. Similarly, the premium is adjusted for the risk of the asset.

An asset with zero risks represent the Zero beta, no risk involve in it. On the other hand, with highly risky asset beta would be 0.8 which consider almost full premium. And at 1.5 beta, the it is completely volatile.

Limitation of this Model

- Not accurate model, computation is done on the basis of an investor.

- Market risk calculation done on historical prices.

- Inflation rate doesn’t take into consideration.

Market Risk Premium Formula Calculator

You can use the following Market Risk Premium Calculator

| Expected Return | |

| Risk-Free Rate | |

| Market Risk Premium Formula | |

| Market Risk Premium Formula = | Expected Return – Risk-Free Rate |

| = | 0 – 0 |

| = | 0 |

Market Risk Premium Formula in Excel (With Excel Template)

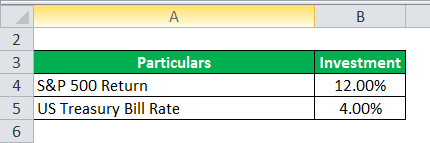

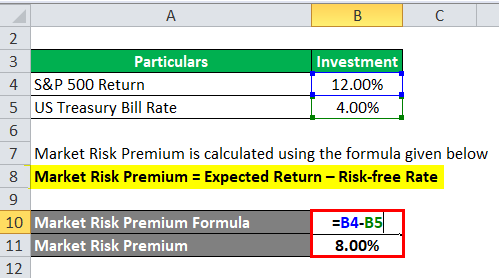

Here we will do another example of the Market Risk Premium formula in Excel. It is very easy and simple.

Now let us take the real-life example below to calculate Market Risk Premium

Market Risk Premium is calculated using the formula given below

Market Risk Premium = Expected Return – Risk-Free Rate

- Market Risk Premium = 12% – 4%

- Market Risk Premium = 8%

Recommended Articles

This has been a guide to Market Risk Premium formula. Here we discuss how to calculate Market Risk Premium along with practical examples. We also provide a Market Risk Premium calculator with a downloadable excel template. You may also look at the following articles to learn more –