Updated July 27, 2023

Profit Margin Formula (Table of Contents)

What is Profit Margin Formula?

Profit Margin can be defined as one of the profitability ratios which helps one in gauging the profitability of the business activity. This is one of the most commonly used formulas to estimate how a business is performing.

The formula for Profit Margins is represented as,

Examples of Profit Margin Formula (With Excel Template)

Let’s take an example to understand the calculation of profit Margin in a better manner.

Profit Margin Formula – Example #1

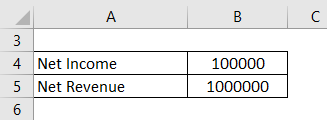

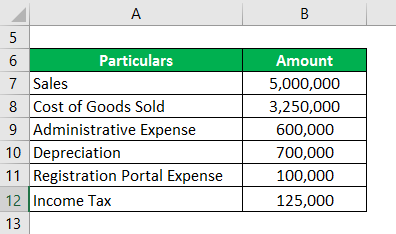

XYZ is claiming that it has a very good business and is making adequate profits. They have given you the below details. You are required to calculate the Profit Margin of XYZ Ltd.

Solution:

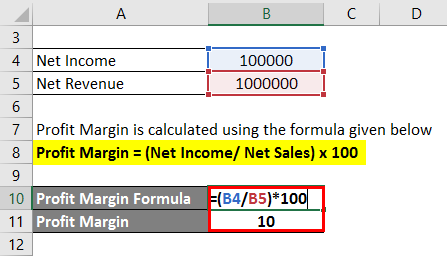

Profit Margin is calculated using the formula given below

Profit Margin = (Net Income/ Net Sales) x 100

- Profit Margin = (100,000 / 10,00,000) x 100

- Profit Margin = 10%

Profit Margin Formula– Example #2

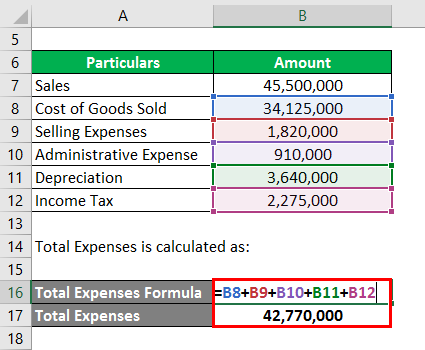

Gautam has started a new business in the gym around a year ago. He was inexperienced in the business and he feels he has made adequate sales to recover from loss and appears to be making a profit. The accountant of the firm has provided him below details and he is curious to know that margin has his newly run business has earned. You are required to compute the profit margin for this new business.

Solution:

To compute Net Profit Margin, we need net income and net revenue and we need to compute the same. Net revenue or sale figure is given which is 4,55,00,000 and from this figure, we will deduct all the expenses to arrive at net income.

Total Expenses is calculated as:

- Total Expenses = 3,41,25,000 + 18,20,000 + 9,10,000 + 36,40,000 + 22,75,000

- Total Expenses = 4,27,70,000

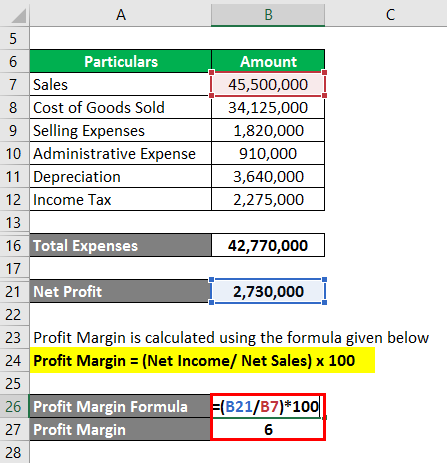

Net profit is calculated using the formula given below:

Net profit = Sales – Total Expenses

- Net profit = 4,55,00,000 – 4,27,70,000

- Net profit = 27,30,000

Profit Margin is calculated using the formula given below

Profit Margin = (Net Income / Net Sales) x 100

- Profit Margin = (27,30,000 /4,55,00,000 ) x 100

- Profit Margin = 6%

Profit Margin Formula– Example #3

Kussum rolls a small restaurant operating in Mumbai city is struggling to lure customers for its delicious dishes as there is stiff competition. Then the manager saw one advertisement for an online application where they can register themselves and the customers can order food from there by viewing their menu. They were enthusiastic to register themselves on the portal as they believe once any customer ordered food from them he/she would surely become regular customers.

The fees for registering them on the portal were 100,000 for a year. The manager was skeptical about the same as he believes any profit margin below 5% would be an issue for them in the long-term. You are required to calculate if the profit margin does fall below 5% if they opt to register themselves over the online portal?

Solution:

To calculate Net Profit Margin, we need net income and net revenue and we need to compute the same. Net revenue or sale figure is given which is 50,00,000 and from this figure, we will deduct all the expenses to arrive at net income.

Total Expenses is calculated as:

- Total Expenses = 32,50,000 + 6,00,000 + 7,00,000 + 1,00,000 + 1,25,000

- Total Expenses = 47,75,000

Net Profit is calculated using the formula given below

Net profit = Sales – Total expenses

- Net profit= 50,00,000 – 47,75,000

- Net profit= 225,000

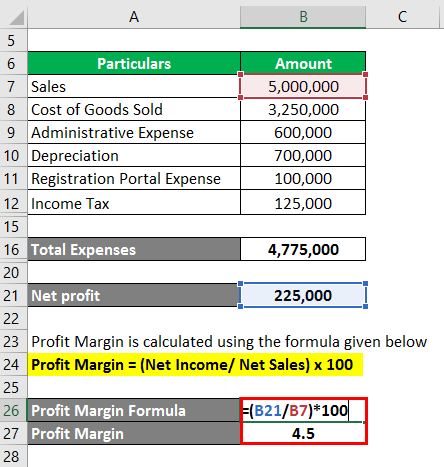

Profit Margin is calculated using the formula given below

Profit Margin = (Net Income/ Net Sales) x 100

- Profit Margin = (225,000/50,00,000 ) x 100

- Profit Margin = 4.5%

Hence, from above it can be said that 4.50% is less than 5% and it is nit worthwhile for them to register on an online portal unless they can reduce any other expenses to increase their profit margin.

Explanation

The profit margin formula is quite easy to compute when one has two figures which are net profit and net sales. When net profit is divided by net sales, the ratio becomes net profit margin. In the context of calculations of profit margin, net income and net profit are used interchangeably. On the other hand, revenue and sales can be used interchangeably. Net profit or Net income can be determined by subtracting all the expenses, including costs towards labor, raw material, rentals, operations, finance costs that are interest payments and taxes, from the total sales or the total revenue generated.

Relevance and Use of Profit Margin Formula

- Profit margin which has become the most adopted barometer, or one can say standard measure globally of the profit-generating capacity of an organization or firm or of a business and can be considered as the high-level indicator of its potential.

- Profit margin is used by most of the investors worldwide when they compare 2 or more companies or ventures for their investments so as to distinguish the better one, along with using all other parameters which they believe to be relevant.

- Simply this profit margin can be said as the percentage figure which shall indicate how many units of profit the firm or the organization or the business has generated for every unit of revenue or sale.

Profit Margin Formula Calculator

You can use the following Profit Margin Formula Calculator

| Net Income | |

| Net Sales | |

| Profit Margin | |

| Profit Margin | = |

|

||||||||

| = |

|

Recommended Articles

This is a guide to Profit Margin Formula. Here we discuss how to calculate Profit Margin Formula along with practical examples. We also provide a Profit Margin calculator with a downloadable excel template. You may also look at the following articles to learn more –