Updated September 27, 2023

Definition of Bank Reconciliation Examples

Bank reconciliation is useful for identifying differences and making necessary changes in accounting records to ensure the balance between the bank’s passbook and the company’s cash book is equal. Regular preparation of the bank reconciliation statements ensures transparency in financial transactions.

This article will explain how to create various types of bank reconciliation statements.

Examples of Bank Reconciliation (With Excel Template)

Let’s understand how to compare and create bank reconciliation statements using the following examples.

Bank Reconciliation Example – 1

Consider Emily, a financial accountant working for a well-known company. On 1st June 2023, she noticed a discrepancy of $50 between the company’s cash book and the bank’s passbook. Let’s help Emily analyze the difference between the company’s financial records and the bank statement.

Solution:

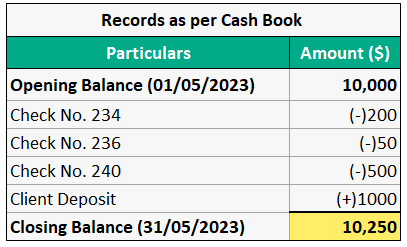

The following are the transaction details from the company’s cash book.

The following are the transaction details according to the bank passbook.

Analysis:

- The closing balance of Emily’s company record is $10,250, and the closing balance of the bank is $10,300.

- Emily didn’t mention the interest earned of $100 in her company record.

- Also, the bank deducted $50 as their service charge, which she forgot to enter in her company record.

So, after comparing both the record statements, the adjusted balance of the company’s cash book becomes $10,300 ($10,250 + $100 -$50). Therefore, in this example, we could easily find the reason for the imbalance just by comparing both record statements.

Bank Reconciliation Example – 2

Fosterson’s & Group company wants to make bank reconciliation statements as of 31st March 2023. Their bank balance closes at $1,000 on 31st March 2023, and the cash book shows the balance of $1,050. Here, we need to create a reconciliation statement by adjusting the balance with the help of the following details.

- The company deposited a check for $300 not recorded in the bank statement.

- A bank service charge of $50 is in the bank’s passbook but not in the cash book.

- Checks worth $200 were issued but not deposited for payment in the bank.

- The cash book doesn’t show a record of bank interest of $100.

Solution:

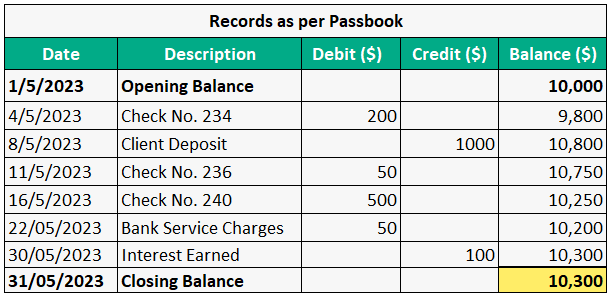

The below image displays Fosterson’s & Group’s bank reconciliation statement as of 31st March 2023.

Analysis:

- There is a difference in the balance between the bank’s and the company’s records.

- For adjusting the cash book balance, add cash book balance, check issued, and interest earned.

- For adjusting the cash passbook balance, add the passbook balance, checks deposited, and bank charges.

- Hence, the adjusted cash book and passbook balance will become $1,350.

Bank Reconciliation Example – 3

Let’s make a bank reconciliation statement for Clark Enterprises as of 31st August 2023 from the following details:

- The passbook balance is $10,000, and the cash book balance is $14,200.

- The company deposited three checks of $2,000, $1,500, and $2,500 in the bank on 31st August 2023, which the bank recorded in their statement on 1st September 2023.

- The company issued a check of $500 on 31st August 2023 but did not present for payment.

- The company received a dividend of $1,000 on stocks present in the bank passbook but not recorded in the cash book.

- A customer made a direct deposit of $400 in the company’s bank account, only recorded in the bank statements.

- Bank charges of $100 are present only in the passbook.

Solution:

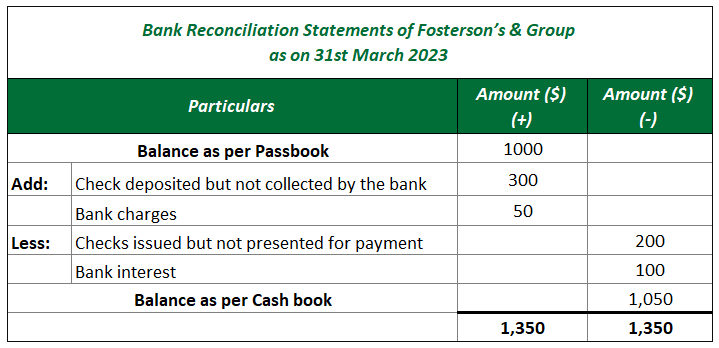

The bank reconciliation statement of Clark Enterprises as of 31st August 2023 is as follows:

The adjusted balance of the bank’s passbook and the company’s cash book becomes $16,100.

Bank Reconciliation Example – 4

In this example, we will create a reconciliation statement with another format that most companies adopt.

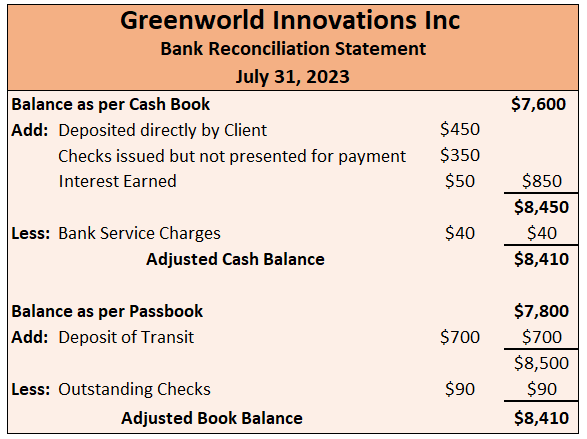

Suppose Greenworld Innovations Inc. has a cash book balance of $7,500 and a passbook balance of $7,800 as of July 2023. We have to create a bank reconciliation statement for July 2023 using the following details:

- The company deposited a check of $700 into the bank that hasn’t appeared on the bank statement.

- The bank charges $40 as service fees and deposits $50 as interest, but these transactions are not in the cash book.

- A client directly deposited $450 into the company’s bank account, noted only in the passbook.

- The bank issued the company’s check for $350, which is only present in their passbook.

- The company issued an uncleared check of $90 that the bank hasn’t processed yet.

Solution:

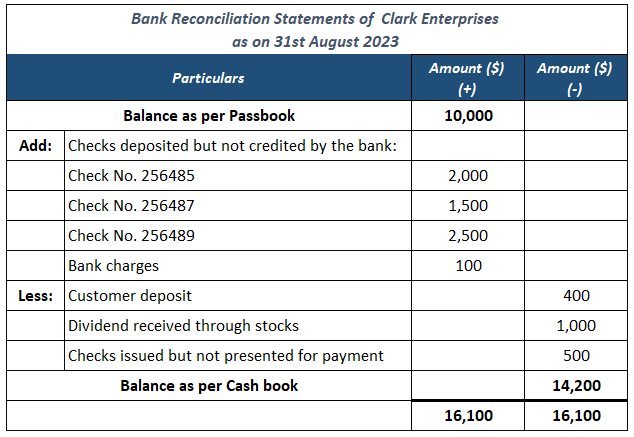

The following is the bank reconciliation statement of Greenworld Innovations Inc. as of 31st July 2023.

Note:

- The above reconciliation statement format shows the “Add” and “Less” transaction details separately for the cash book and passbook.

- The formula to calculate adjusted balance is as follows:

Adjusted Balance = Balance + total “Add” amount – total “Less” amount

Final Thoughts

A bank reconciliation statement is a valuable tool to identify discrepancies between the balance as per the cash book and bank statement. It also helps detect missing or incorrect data, errors, fraudulent transactions, and money laundering activities. Companies must regularly carry out this exercise to maintain financial transparency in the account records.

Recommended Articles

This article is a comprehensive guide to the bank reconciliation example. Here, we discuss its formats with the top 4 practical examples. You will also get a downloadable Excel template. You can also refer to our other suggested articles to learn more.