Updated July 25, 2023

Definition of Financial Market

A financial market is a term that is used to describe any marketplace in an economy where the trading of securities takes place, such as the trading of equities, trading of bonds, trading of currencies, and trading of derivatives.

Financial markets help create an open and regulated system for companies to acquire large amounts of capital from the market. It also allows businesses to offset their risk. Since markets are public, they provide a transparent way of setting up the prices for everything being traded in the market. A financial market is a broad term with different types of financial markets like bonds, money, derivatives, and stock markets. In this article, the most important functions of financial markets are discussed

Functions of Financial Market

There are different types of functions that the financial market in any economy performs. Some of the functions are as follows:

- The financial market gives liquidity to tradable assets as it facilitates the exchange of securities by making it accessible to the investor, who can easily sell the securities he holds, thus helping convert the assets to cash.

- In the financial market, prices at which the financial instruments will be traded are determined by the demand and supply forces i.e., frequent interaction between the investors helps decide the price of the securities. Thus Determination of the securities prices is one of the important functions of the financial market.

- The financial market provides a platform for the probable seller and the buyer to easily trade with each other, which helps them save their time, effort, and money in finding other required parties.

- Some of the persons require the money, whereas some other has spare money which is lying idle. The financial market facilitates the connection between investors who possess savings and industries requiring funds, thereby mobilizing and channeling them into the most productive uses.

- Various types of information are required by different traders while trading in the market, which requires time and effort. The financial market offers readily accessible information to traders, saving them time and resources.

Example of Financial Market Functions

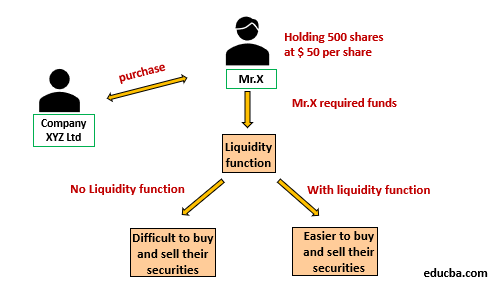

For example, Mr. X is holding 500 shares of company XYZ Ltd. The current market price of the share is $ 50 per share. Now due to some urgency, Mr. X requires the funds. He can get the required funds from selling his holding in the shares of company XYZ Ltd. If there is no proper functioning of the financial market, the investor could find it difficult to buy and sell their securities.

In the present case, with the liquidity function of the financial market, it will become easier for Mr. X to sell its holding at its fair value prevailing in the market during trading hours. In case if there is no liquidity function, then the investor forcefully has to hold the financial securities or the financial instrument until the conditions arise in the market to sell those assets arise in the market.

Advantages

The functions of the financial market provide various advantages to investors and companies involved in it. Some of the advantages are as follows:

- It helps create an open and regulated system for companies to acquire large amounts of capital from the market.

- It provides the medium using which the savings of the potential investors flow into the economy. This will lead to capital formation in the country.

- It helps save the parties’ time, effort, and money because the traders don’t have to spend their resources to find the potential sellers or buyers of the security.

Disadvantages

The Limitations and drawbacks of the Functions of the financial market include the following:

- There is no function of the financial market which may indicate a stock’s true intrinsic value. There is no stock’s true intrinsic value because of the different macroeconomic factors such as taxes etc.

- The trader requires Various types of information, which is provided by the financial market. It is very much required that this information is correct as the prices of the securities rely heavily on informational transparency to ensure that the market is setting the appropriate prices for the securities.

Important Points of the Financial Market Functions

- Financial markets provide a platform where the different participants such as investors and debtors, receive fair and proper treatment, regardless of the size of their working and other aspects.

- The financial market offers various employment opportunities as well, helping to lower the unemployment rate in the country.

- Along with the other financial market, the market of real estate is also a financial market as financing is provided when buying and selling physical properties.

Conclusion

Thus it can be concluded that the Functions of the financial market play an important role in the economy of any country. There are different basis on which the financial market can be classified, including by Nature of the Claim, the maturity of the claim, the timing of the delivery, or the organizational structure. But whatever the classification, the role of the financial market remains the same and important. It provides the medium using which the savings of the potential investors flow into the economy. This will lead to capital formation in the country. From the last few years, the role and functions of the financial market have seen a drastic change because of the different number of the factors such as the measures taken to protect the investors, dispute settling procedures, low cost of the transactions, provision of high liquidity, price information transparency, etc.

Recommended Articles

This is a guide to the Functions of the Financial Market. Here we discuss the Function, examples, Advantages, and Disadvantages of the Financial Market. You can also go through our other suggested articles to learn more –