Updated July 26, 2023

Equity Ratio Formula (Table of Contents)

What is the Equity Ratio Formula?

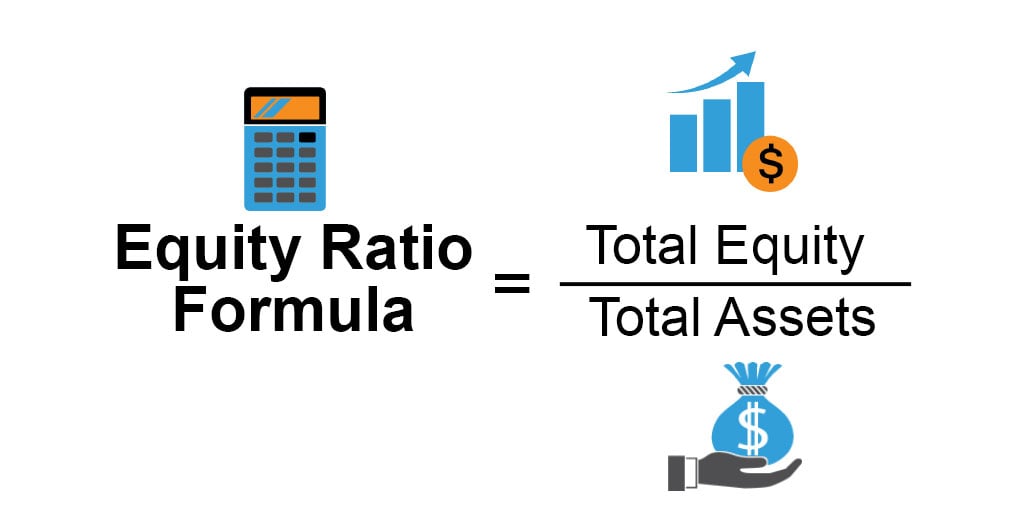

The term “equity ratio” refers to the solvency ratio that assesses the proportion of the assets funded by the capital contributed by the shareholder.

In other words, the ratio is also indicative of the remaining assets after all the liabilities are paid off. The formula for equity ratio can be derived by dividing the total equity of the subject company by its total assets. Mathematically, it is represented as,

Examples of Equity Ratio Formula (With Excel Template)

Let’s take an example to understand the calculation of Equity Ratio in a better manner.

Equity Ratio Formula – Example #1

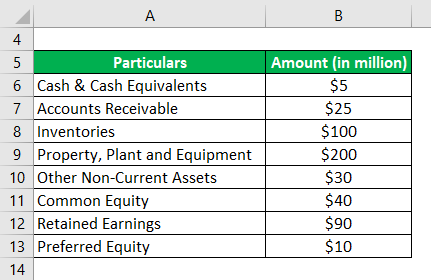

Let us take the example of GHJ Ltd which is engaged in the business of auto parts manufacturing. As per the recently published annual report of the company, the following information is available,

Calculate the equity ratio of GHJ Ltd. based on the above-given information.

Solution:

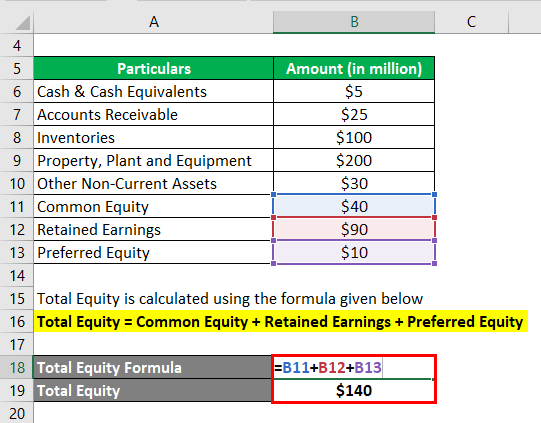

Total Equity is calculated using the formula given below

Total Equity = Common Equity + Retained Earnings + Preferred Equity

- Total Equity = $40 million + $90 million + $10 million

- Total Equity = $140 million

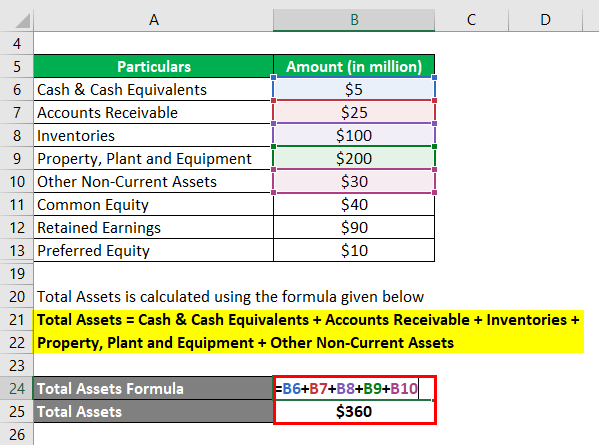

Total Assets is calculated using the formula given below

Total Assets = Cash & Cash Equivalents + Accounts Receivable + Inventories + Property, Plant and Equipment + Other Non-Current Assets

- Total Assets = $5 million + $25 million + $100 million + $200 million + $30 million

- Total Assets = $360 million

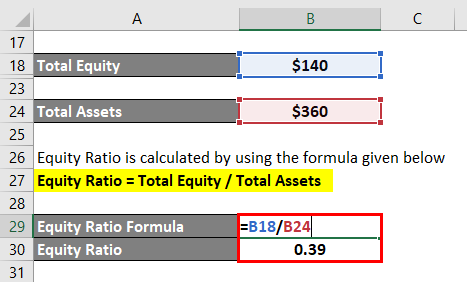

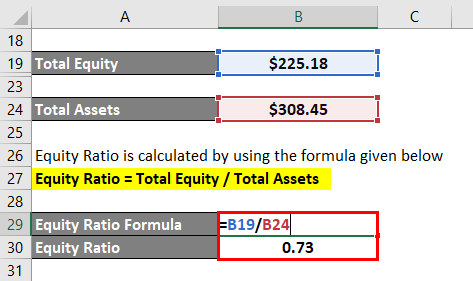

Equity Ratio is calculated by using the formula given below

Equity Ratio = Total Equity / Total Assets

- Equity Ratio = $140 million / $360 million

- Equity Ratio = 0.39

Therefore, ~39% of the total assets of GHJ Ltd. is currently funded by the equity shareholders.

Equity Ratio Formula – Example #2

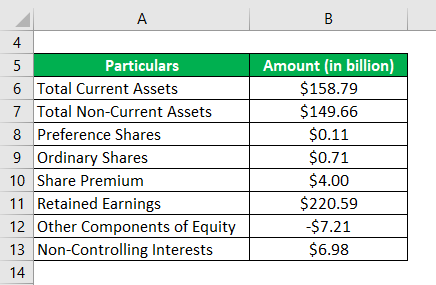

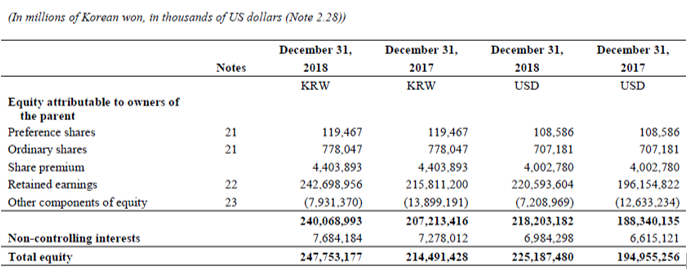

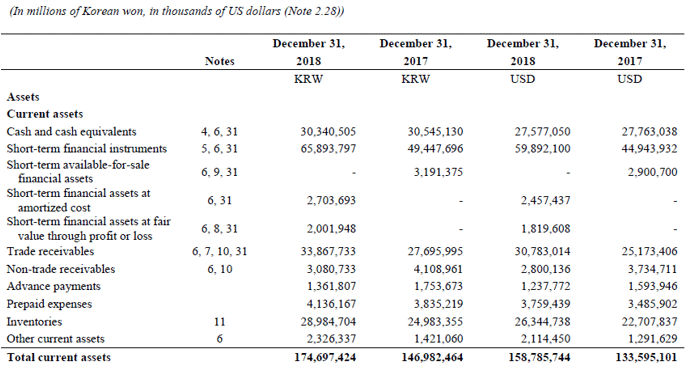

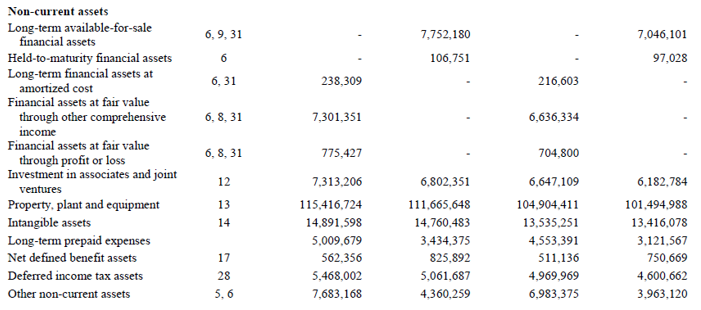

Let us take the example of Samsung Electronics Co. Ltd. to demonstrate the calculation of the equity ratio. As per the annual report for 2018, the following balance information is available, Calculate the equity ratio of Samsung Electronics Co. Ltd. for the year 2018 based on the above-given information.

Solution:

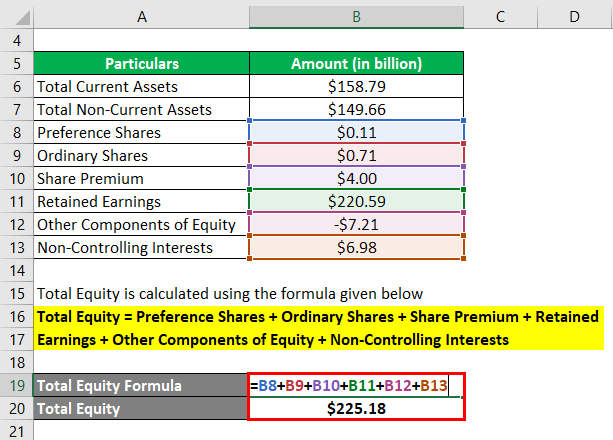

Total Equity is calculated using the formula given below

Total Equity = Preference Shares + Ordinary Shares + Share Premium + Retained Earnings + Other Components of Equity + Non-Controlling Interests

- Total Equity = $0.11 billion + $0.71 billion + $4.00 billion + $220.59 billion – $7.21 billion + $6.98 billion

- Total Equity = $225.18 billion

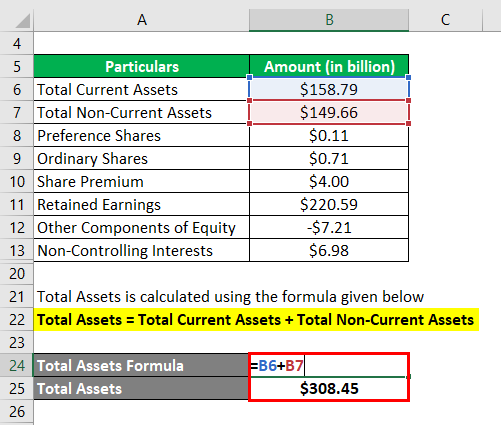

Total Assets is calculated using the formula given below

Total Assets = Total Current Assets + Total Non-Current Assets

- Total Assets = $158.79 billion + $149.66 billion

- Total Assets = $308.45 billion

Equity Ratio is calculated by using the formula given below

Equity Ratio = Total Equity / Total Assets

- Equity Ratio = $225.18 billion / $308.45 billion

- Equity Ratio = 0.73

Therefore, Samsung Electronics Co. Ltd.’s equity ratio for the year 2018 stood at 0.73 times.

Source Link: Samsung Balance Sheet

Equity Ratio Formula – Example #3

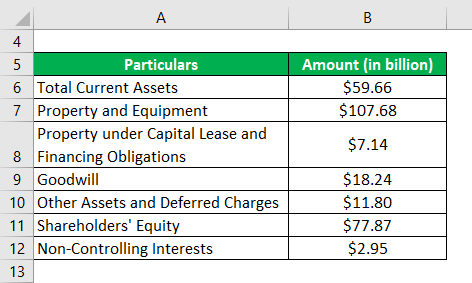

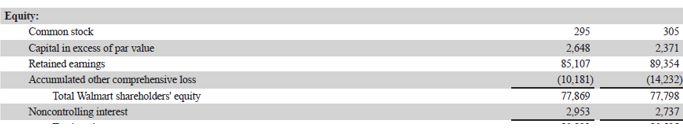

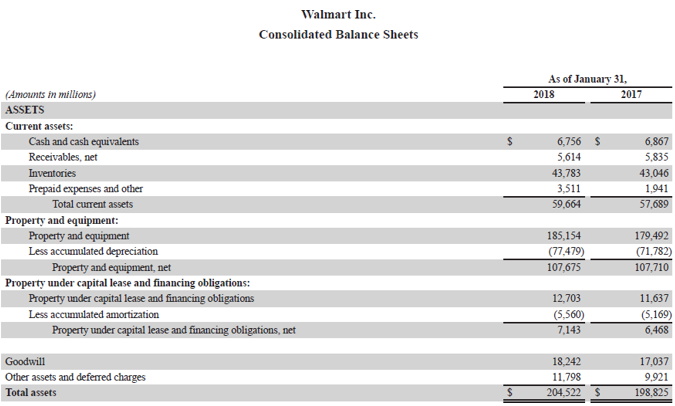

Let us take the example of Walmart Inc.’s annual report for the year 2018. From the annual report, the following balance information is available, Calculate the equity ratio of Walmart Inc. for the year 2018 based on the above-given information.

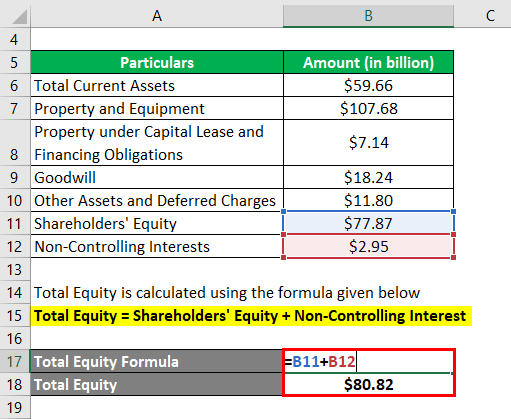

Total Equity is calculated using the formula given below

Total Equity = Shareholders’ Equity + Non-Controlling Interest

- Total Equity = $77.87 billion + $2.95 billion

- Total Equity = $80.82 billion

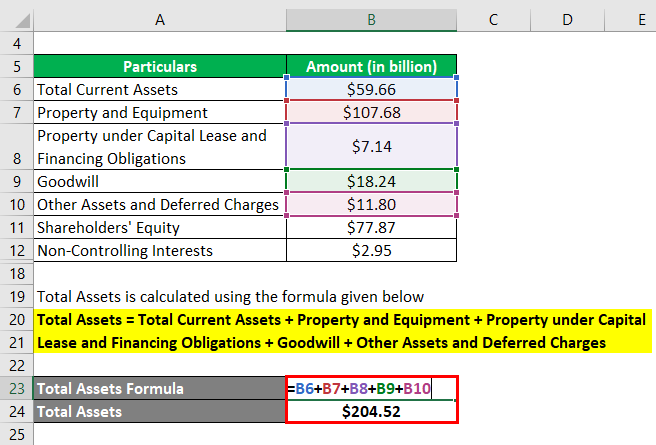

Total Assets is calculated using the formula given below

Total Assets = Total Current Assets + Property and Equipment + Property under Capital Lease and Financing Obligations + Goodwill + Other Assets and Deferred Charges

- Total Assets = $59.66 billion + $107.68 billion + $7.14 billion + $18.24 billion + $11.80 billion

- Total Assets = $204.52 billion

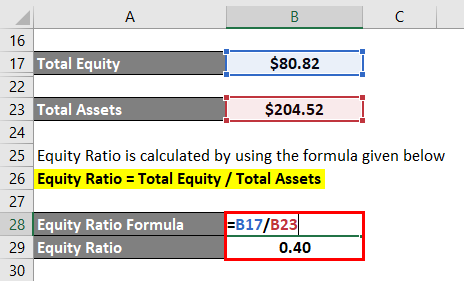

Equity Ratio is calculated by using the formula given below

Equity Ratio = Total Equity / Total Assets

- Equity Ratio = $80.82 billion / $204.52 billion

- Equity Ratio = 0.40

Therefore, ~40% of the total assets of Walmart Inc. is funded by the equity shareholders as on January 31, 2018.

Source: Walmart Annual Reports (Investor Relations)

Explanation

The formula for equity ratio can be derived by using the following steps:

Step 1: Firstly, determine the total equity of the company. It is the aggregate of common equity, preferred equity, retained earnings, additional paid-in capital, etc.

Step 2: Next, determine the total assets of the company which includes both short-term (current) and long-term (non-current) assets.

Step 3: Finally, the formula for equity ratio can be derived by dividing the total equity (step 1) of the company by its total assets (step 2) as shown below.

Relevance and Uses of Equity Ratio Formula

It is important to understand the concept of equity ratio as it is used to determine a company’s degree of leverage. A higher equity ratio is seen as positive as it indicates that the company is more sustainable and less risky on the back higher investment form the shareholders. Inherently, equity financing is cheaper than debt financing and as such companies with higher equity ratios are expected to have lower financing costs than companies with lower ratios resulting in better profitability.

Equity Ratio Formula Calculator

You can use the following Equity Ratio Formula Calculator

| Total Equity | |

| Total Assets | |

| Equity Ratio | |

| Equity Ratio | = |

|

|

Recommended Articles

This is a guide to the Equity Ratio Formula. Here we discuss how to calculate Equity Ratio along with practical examples. We also provide an Equity Ratio calculator with a downloadable excel template. You may also look at the following articles to learn more –