Updated July 25, 2023

Definition of Gross Profit Percentage

The term “gross profit percentage” refers to the profitability metric that measures the cost efficiency of a company after deducting the costs of goods sold (a.k.a. cost of sales), which primarily include raw material cost, direct labor cost, and factory overhead.

In other words, the GPP captures the profit after apportioning the directly assignable cost of production. Further, it determines the profit generated at the gross level by each dollar of the revenue.

The GPP usually varies from industry to industry based on its inherent characteristics. For instance, the GPP for a manufacturing company is typically higher than that of a trading company given their nature of business and as such comparing them on the basis of GPP will be foolhardy. Within an industry, an entity with a higher gross profit percentage is considered healthier as it provides more financial flexibility to cover other business expenses, such as SG&A expenses, advertising expenses, interest expenses, etc. A declining trend in GPP can be a cause of concern if it is due to the weak operating efficiency of the company.

Formula

The formula for gross profit percentage can be derived by dividing the difference between the total sales and the cost of goods sold by the total sales and then multiplying by 100% to express in terms of percentage. Mathematically, it is represented as,

The total sales are the revenue booked by the company during the given period, while the corresponding cost of goods sold includes the direct cost of production, primarily raw material cost, direct labor cost, and factory overhead.

Examples of Gross Profit Percentage (With Excel Template)

Let’s take an example to understand the calculation of the GPP in a better manner.

Example #1

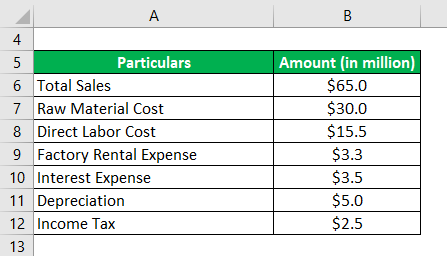

Let us take the example of a company named XYZ Inc., which is engaged in the business of manufacturing rigid and flexible packaging products. According to the latest annual report, the company has achieved total sales of $65.0 million during the year. Additionally, the following cost break-up is available, Calculate the gross profit percentage of the company for the year based on the given information.

Solution:

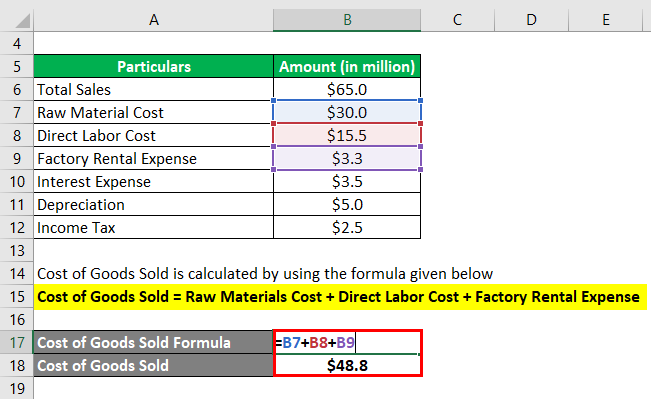

Cost of Goods Sold is calculated by using the formula given below

Cost of Goods Sold = Raw Materials Cost + Direct Labor Cost + Factory Rental Expense

- Cost of Goods Sold = $30.0 million + $15.5 million + $3.3 million

- Cost of Goods Sold = $48.8 million

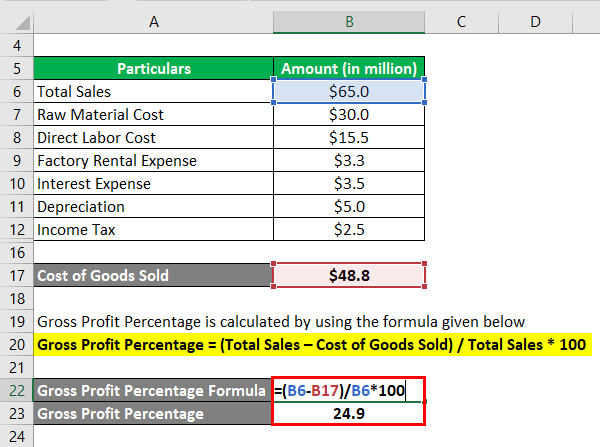

Gross Profit Percentage is calculated by using the formula given below

Gross Profit Percentage = (Total Sales – Cost of Goods Sold) / Total Sales * 100

- GPP = ($65.0 million – $48.8 million) / $65.0 million * 100

- GPP = 24.9%

Therefore, XYZ Inc.’s gross profit percentage stood at 24.9% during the year.

Example #2

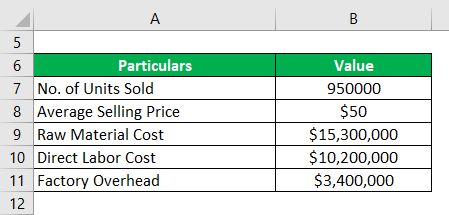

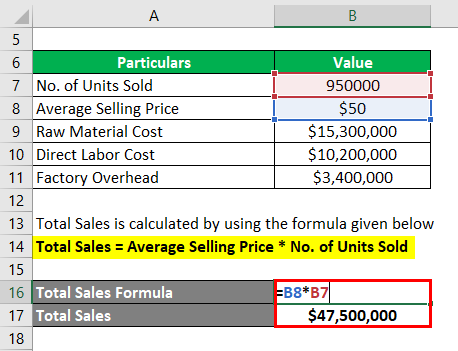

Let us take the example of another company named BNM Ltd. to illustrate the concept of gross profit percentage. It is a toy manufacturing company and it sold 950,000 units of different types of toys last year at an average selling price per unit of $50. Further, the company accordingly incurred a raw material cost of $15.3 million, the direct labor cost of $10.2 million, and factory overhead of $3.4 million during the year. Calculate the gross profit percentage of BNM Ltd for the year based on the given information.

Solution:

Total Sales is calculated by using the formula given below

Total Sales = Average Selling Price * No. of Units Sold

- Total Sales = $50 * 950,000

- Total Sales = $47,500,000

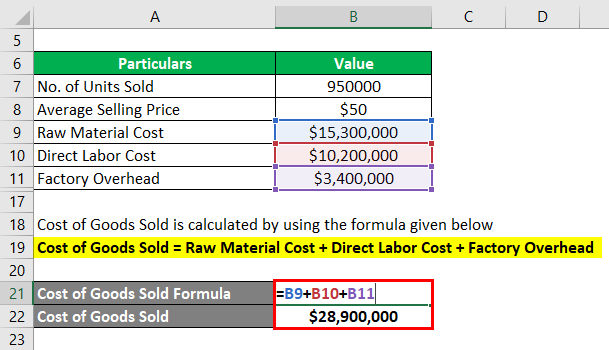

Cost of Goods Sold is calculated by using the formula given below

Cost of Goods Sold = Raw Material Cost + Direct Labor Cost + Factory Overhead

- Cost of Goods Sold = $15,300,000 + $10,200,000 + $3,400,000

- Cost of Goods Sold = $28,900,000

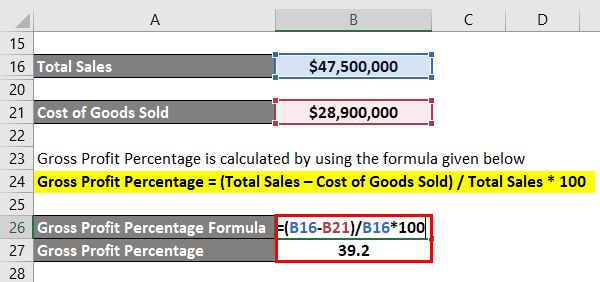

Gross Profit Percentage is calculated by using the formula given below

Gross Profit Percentage = (Total Sales – Cost of Goods Sold) / Total Sales * 100

- GPP = ($47,500,000 – $28,900,000 ) / $47,500,000 * 100

- GPP = 39.2%

Therefore, BNM Ltd. managed a gross profit percentage of 39.2% during the year.

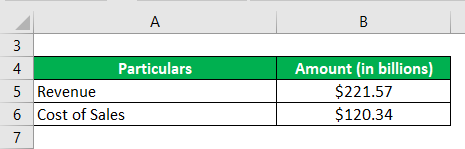

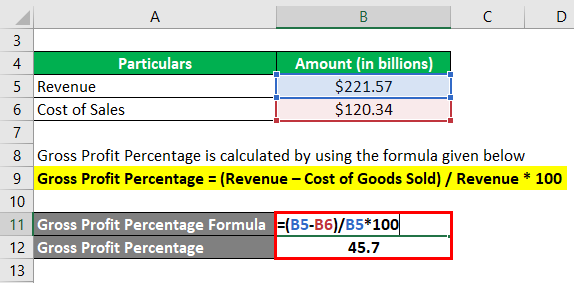

Example #3

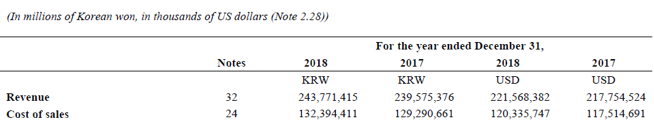

Let us take the example of Samsung to explain the calculation of GPP. As per the latest annual report, the company achieved revenue of $221.57 billion, with the corresponding cost of sales of $120.34 billion. Calculate the gross profit percentage of Samsung for the year 2018.

Solution:

Gross Profit Percentage is calculated by using the formula given below

Gross Profit Percentage = (Revenue – Cost of Goods Sold) / Revenue * 100

- GPP = ($221.57 billion – $120.34 billion) / $221.57 billion * 100

- GPP = 45.7%

Therefore, Samsung’s GPP stood at 45.7% during the year.

Source Link: Samsung Balance Sheet

Advantages of Gross Profit Percentage

Some of the major advantages of GPP are:

- It gives a fair understanding of the cost efficiency of the company.

- It can be used as a performance indicator across the time period and also for peer comparison.

Limitations of GPP

Some of the major limitations of GPP are:

- It fails to capture the impact of indirect costs and as such provides partial information about the overall profitability.

- There is no defined benchmark for an acceptable level of GPP.

Conclusion

So, it can be concluded that the GPP is a useful performance metric. But it should be used in conjunction with other metricx to draw meaningful insights.

Recommended Articles

This is a guide to the Gross Profit Percentage. Here we discuss how it can be calculated by using a formula along with a downloadable Excel template. You can also go through our other suggested articles to learn more –