Updated July 25, 2023

Definition of Cash Flow Return on Investment

The term “cash flow return on investment” or CFROI refers to the financial ratio that is used as the proxy for economic return against the overall investment made in the subject company.

In other words, it is a valuation technique that is based on the premise that financial metric based on cash flow is better than those based on corporate earnings. In effect, it is the internal rate of return that is compared with the hurdle rate to check whether or not the subject company is performing better than the set expectations.

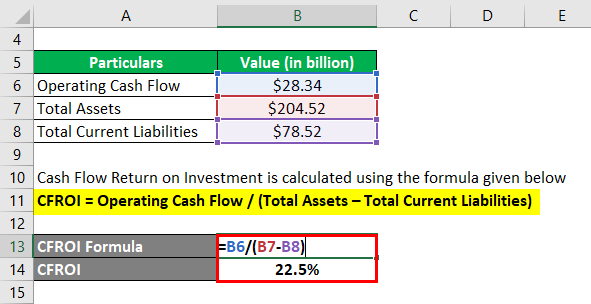

Formula

The formula for CFROI can be derived by dividing cash flow from operating activities by the difference between total assets and total current liabilities, which is then expressed in terms of percentage. Mathematically, it is represented as,

The cash flow from operating activities can be computed by (using the indirect method) adding back all non-cash expenses and changes in working capital to the net income as shown below.

Examples of Cash Flow Return on Investment (With Excel Template)

Let’s take an example to understand the calculation of Cash Flow Return on Investment(CFROI) in a better manner.

Example #1

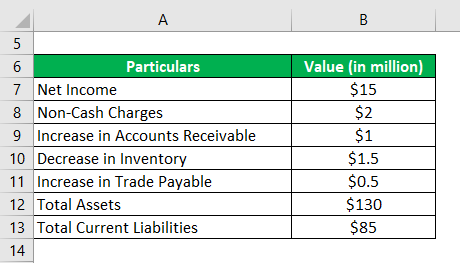

Let us take the example of a company that is engaged in manufacturing precision parts for the aerospace and defense industry. During the year 2018, the company generated a net income of $15 million. In the process it incurred depreciation & amortization of $2 million, while accounts receivables increased by $1 million, inventory decreased by $1.5 million and trade payables increased by $0.5 million. It reported total assets and the total current liabilities of $130 million and $85 million respectively as on the balance sheet date. Calculate the CFROI of the company based on the given information.

Solution:

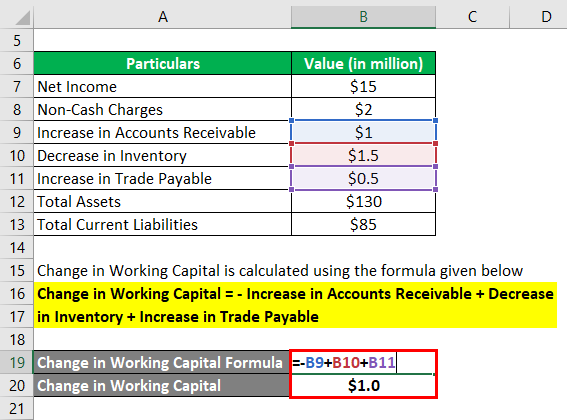

Change in Working Capital is calculated using the formula given below

Change in Working Capital = – Increase in Accounts Receivable + Decrease in Inventory + Increase in Trade Payable

- Change in Working Capital = – $1 million + $1.5 million + 0.5 million

- Change in Working Capital = $1.0 million

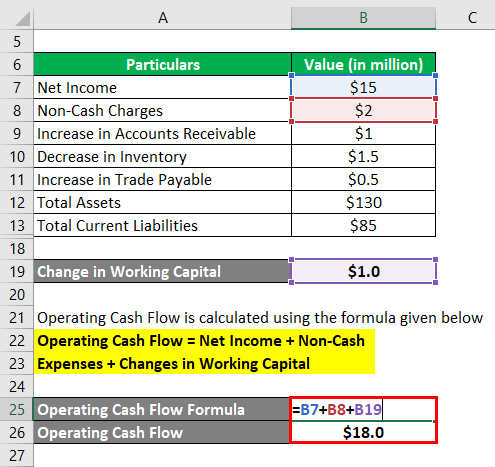

Operating Cash Flow is calculated using the formula given below

Operating Cash Flow = Net Income + Non-Cash Expenses + Changes in Working Capital

- Operating Cash Flow = $15 million + $2 million + $1 million

- Operating Cash Flow = $18.0 million

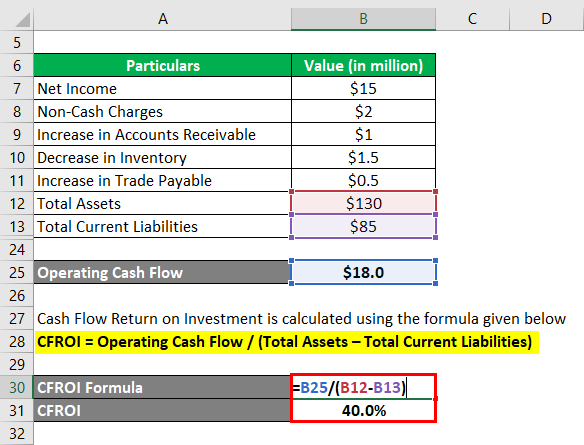

Cash Flow Return on Investment is calculated using the formula given below

CFROI = Operating Cash Flow / (Total Assets – Total Current Liabilities)

- CFROI = $18 million / ($130 million – $85 million)

- CFROI = 40.0%

Therefore, the company made CFROI of 40.0% during the year.

Example #2

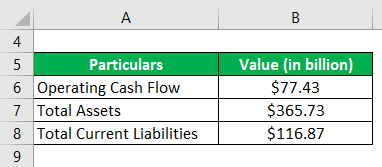

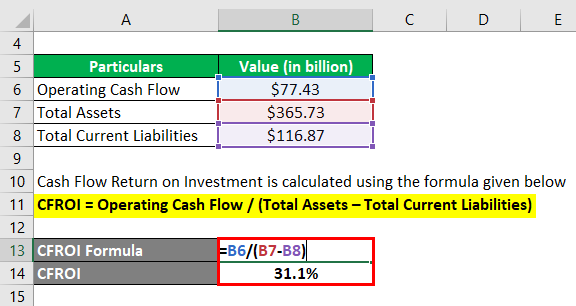

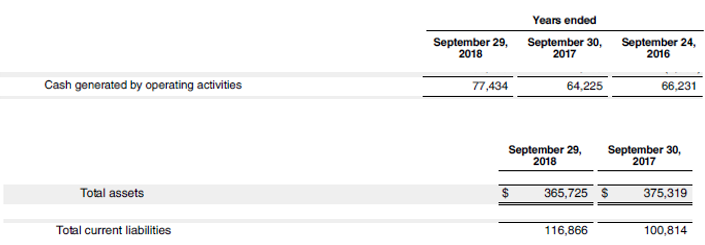

Let us take the example of Apple Inc. to illustrate the calculation of CRFOI. According to an annual report for 2018, the company generated an operating cash flow of $77.43 billion, while its total assets and total current liabilities stood at $365.73 billion and $116.87 billion respectively as on the balance sheet. Calculate the CRFOI of Apple Inc. for 2018 based on the given information.

Solution:

Cash Flow Return on Investment is calculated using the formula given below

CFROI = Operating Cash Flow / (Total Assets – Total Current Liabilities)

- CFROI = $77.43 billion / ($365.73 billion – $116.87 billion)

- CFROI = 31.1%

Therefore, Apple Inc. managed a CFROI of 31.12% during 2018.

Source Link: Apple Inc. Balance Sheet

Example #3

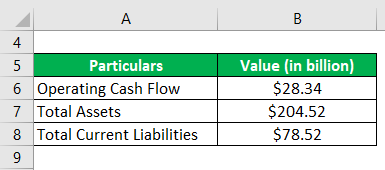

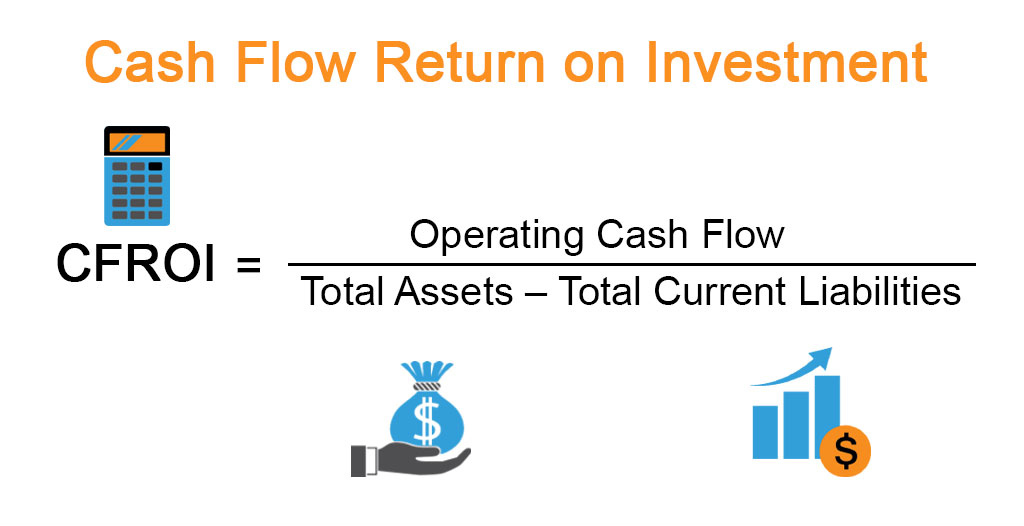

Let us take the example of Walmart Inc. to demonstrate the calculation of CFROI. During 2018, operating cash flow generated by the stood at $28.34 billion, while its total assets and total current liabilities stood at $204.52 billion and $78.52 billion respectively as on balance sheet. Calculate the CFROI of Walmart Inc. for 2018 based on the given information.

Cash Flow Return on Investment is calculated using the formula given below

CFROI = Operating Cash Flow / (Total Assets – Total Current Liabilities)

- CFROI = $28.34 billion / ($204.52 billion – $78.52 billion)

- CFROI = 22.5%

Therefore, Walmart Inc.’s CFROI for 2018 stood at 22.49%.

Advantages of Cash Flow Return on Investment

Some of the major advantages of cash flow return on investment are:

- It takes into account the cash flow from the operating activities which effectively captures actual cash flow and avoids the shortcomings of various accounting adjustments.

- It is helpful in comparing of companies with a varied scale of operations.

Limitations of Cash Flow Return on Investment

Some of the major limitations of cash flow return on investment are:

- CFROI computation involves many complicated calculations as it requires a large number of accounting adjustments.

- This metric is not very useful in the case of start-ups because their operations are associated with large capital outlays coupled with low or negative cash flows.

Conclusion

So, CFROI is a very good indicator of tracking the financial performance of companies as it focuses on cash flow rather than accounting profits. However, this metric involves a lot of accounting adjustments that result in a set of complicated calculations.

Recommended Articles

This is a guide to the Cash Flow Return on Investment. Here we discuss how it can be calculated by using a formula along with the Advantages and Limitations of Cash Flow Return on Investment and a downloadable excel template. You can also go through our other suggested articles to learn more –