Updated July 25, 2023

Definition of Return on Equity

The term “Return on Equity” or ROE refers to a profitability metric that helps assess a company’s ability to generate profits by leveraging investments made by its shareholders.

In other words, ROE indicates the dollar profit generated by each dollar of common stockholders’ equity. ROE is calculated as the sum of net income and dividends paid to preference shareholders from the income statement, divided by shareholder’s equity from the balance sheet.

ROE can serve as an industry benchmark, and a company with a relatively higher ROE than its industry peers can possess a competitive advantage. Additionally, ROE can provide insights into a company’s financial management or ability to grow its business by leveraging equity.

Formula

One can derive the formula for return on equity by dividing the difference between net income and dividends paid to preference shares by the average value of shareholder’s equity. The value of ROE is expressed as a percentage.

Mathematically, one represents it as:

Return on Equity = (Net Income – Preferred Dividend) / Average Shareholder’s Equity

Examples of Return on Equity (with Excel Template)

Here is an example to understand the calculation of Return on Equity in a better manner:

Example #1

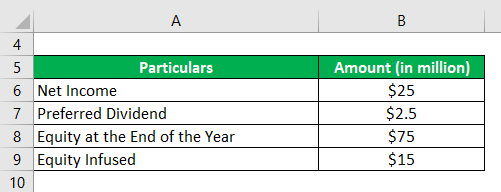

Let us take the example of a company and explain how to compute return on equity (ROE). In 2018, the company booked a net income of $25 million, out of which $2.5 million was paid to preference shareholders as dividends. Furthermore, the company infused equity of $15.0 million in the middle of the year to reach a total of $75.0 million. Calculate the ROE of the company based on the given information.

Solution:

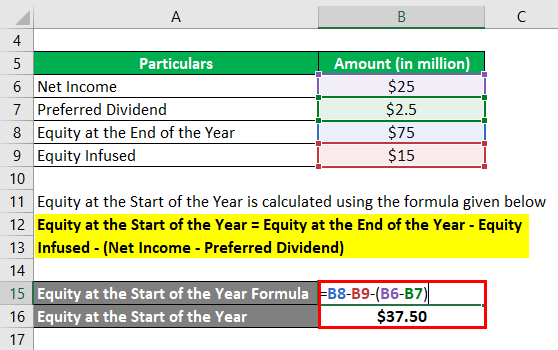

One uses the below formula to calculate the Equity at the Start of the Year:

Equity at the Start of the Year = Equity at the End of the Year – Equity Infused – (Net Income – Preferred Dividend)

- Equity at the Start of the Year = $75.00 million – $15.00 million – ($25.00 million – $2.50 million)

- Equity at the Start of the Year = $37.50 million

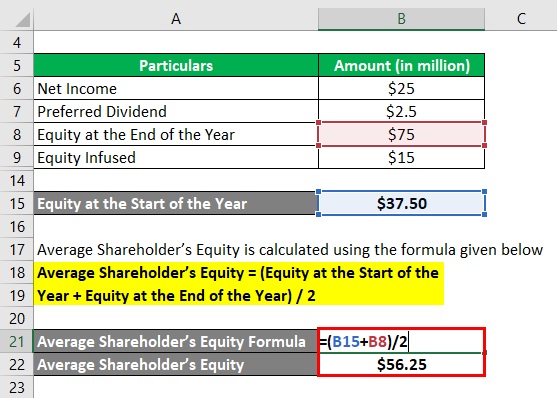

One calculates the Average Shareholder’s Equity using the formula given below:

Average Shareholder’s Equity = (Equity at the Start of the Year + Equity at the End of the Year) / 2

- Average Shareholder’s Equity = ($37.50 million + $75.00 million) / 2

- Average Shareholder’s Equity = $56.25 million

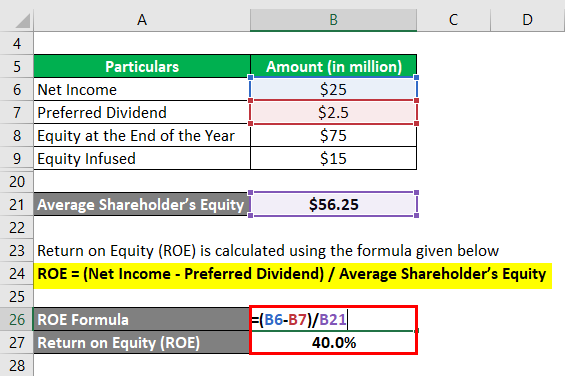

One calculates (ROE) using the formula given below:

ROE = (Net Income – Preferred Dividend) / Average Shareholder’s Equity

- (ROE) = ($25.00 million – $2.50 million) / $56.25 million

- (ROE) = 40.0%

Therefore, the company generated a profit at an ROE of 40.0% during the year 2018.

Example #2

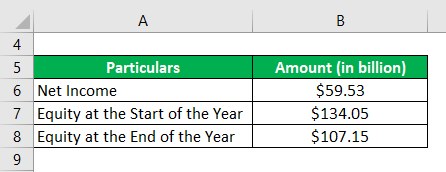

Let us take Apple Inc.’s example to illustrate the ROE computation. According to the annual report, the company generated a net income of $59.53 billion in 2018. Further, the value of shareholder’s equity at the start and at the end of the period was $134.05 billion and $107.15 billion. Calculate the ROE of Apple Inc. based on the given information.

Solution:

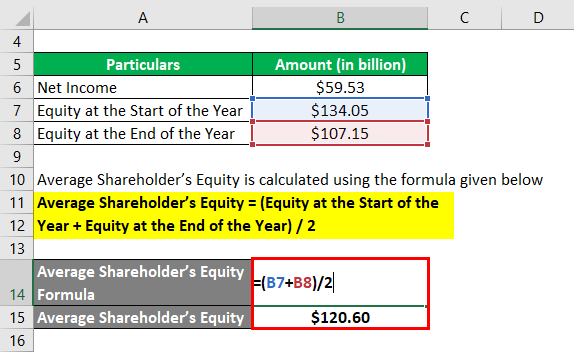

One calculates the Average Shareholder’s Equity using the formula given below

Average Shareholder’s Equity = (Equity at the Start of the Year + Equity at the End of the Year) / 2

- Average Shareholder’s Equity = ($134.05 billion + $107.15 billion) / 2

- Average Shareholder’s Equity = $120.60 billion

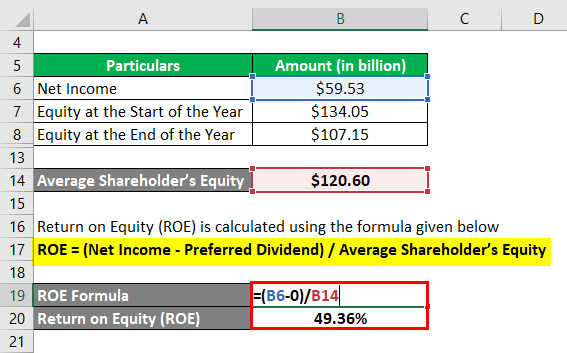

Return on Equity (ROE) is calculated using the formula given below:

ROE = (Net Income – Preferred Dividend) / Average Shareholder’s Equity

- Return on Equity (ROE) = ($59.53 billion – 0) / $120.60 billion

- Return on Equity (ROE) = 49.36%

Therefore, Apple Inc.’s ROE stood at 49.36% for the year 2018.

Source Link: Apple Inc. Balance Sheet

Example #3

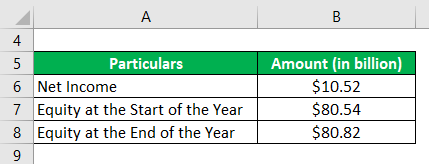

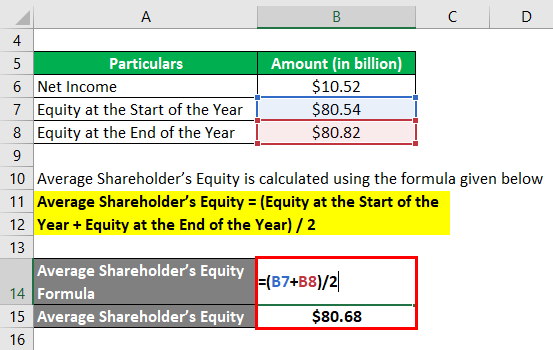

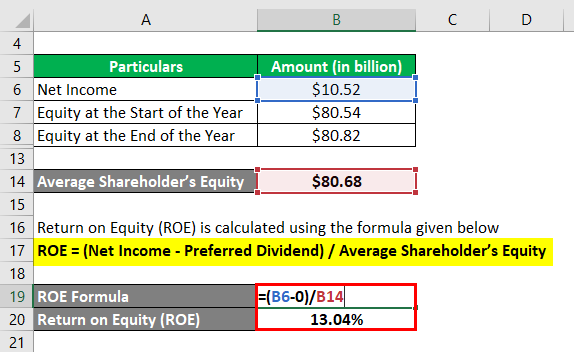

Let us take the example of Walmart Inc. to illustrate the computation of ROE. In 2018, the company made a net income of $10.52 billion. The year started with a shareholder’s equity of $80.54 billion, ending with $80.82 billion. Calculate the ROE of Walmart Inc. based on the given information.

Solution:

The Average Shareholder’s Equity is calculated using the formula given below:

Average Shareholder’s Equity = (Equity at the Start of the Year + Equity at the End of the Year) / 2

- Average Shareholder’s Equity = ($80.54 billion + $80.82 billion) / 2

- Average Shareholder’s Equity = $80.68 billion

Return on Equity (ROE) is calculated using the formula given below:

ROE = (Net Income – Preferred Dividend) / Average Shareholder’s Equity

- Return on Equity (ROE) = ($10.52 billion – 0) / $80.68 billion

- Return on Equity (ROE) = 13.04%

Therefore, Walmart Inc.’s ROE stood at 13.04% for the year 2018.

Advantages of Return on Equity (ROE)

Some of the major advantages of return on equity are:

- It clearly indicates the percentage return earned by the equity shareholders.

- It also helps investors compare the performance of different equity investments, thereby influencing their future investment strategy.

Limitations of Return on Equity (ROE)

Some of the major limitations of return on equity are:

- It can be misleading in the case of new companies where the initial capital requirement is high, resulting in a lower ROE.

- The ROE can be manipulated using various accounting techniques, such as increasing the project life or decreasing the depreciation rate.

Conclusion

ROE is one of the primary return metrics equity investors use as it captures the investment quality validated through actual figures. However, investors need to read between the lines of financial items to avoid being misled by the ROE alone.

Recommended Articles

The above article on Return on Equity discussed calculating ROE and practical examples. We have also provided a downloadable Excel template. Here are some further articles for expanding understanding: