![]()

Expense Tracker in Excel (Table of Contents)

Introduction to Expense Tracker in Excel

Expense planning or tracker helps you to keep your finances in check, i.e. spending. The expense tracker is essential for your monthly, quarterly, half-yearly or yearly spendings. As there are many expense tracker templates available, it may be in excel or with a third party, but it is always better to make your own for a better understanding. It is always better to document your expenses every time you spend; there are two types of expenses: fixed and variable expenses.

- Fixed Expenses: Monthly Loan amounts (car, home, personal) & mortgage remains constant month after month, whereas.

- Variable Expenses: Groceries, Home & utilities, Personal, medical expenses & Entertainment fluctuate month on month & variation will be based on your spending.

- Goal Settings: We can set a short or long-term goal with expense planning (monthly, quarterly, half-yearly, or yearly).

Definition of Expense Tracker

It is an estimate or track of expenditure or expense for a particular set of time period.

How to Create Expense Tracker in Excel?

Let’s check out the step-by-step procedure to create an expense tracker in Excel.

If I want to create a family expense planner, the following criteria should be kept in mind while creating an expense tracker; I can add the below-mentioned categories to create a template.

You should know your monthly expenses or spending, categorized into various sections.

1. Home & Utilities

- House rent

- Furniture & appliances

- House Renovations & maintenance

- Electricity

- Gas

- Cleaning Services

- Water

- Internet

- Cable

- Home phone

- Mobile

- Lawn/Garden maintenance

2. Insurance & Financial Section

- Personal & life insurance (Monthly, Quarterly or Half-yearly or Yearly)

- Car insurance (Annual)

- Health insurance (Annual)

- Home insurance (Annual)

- Paying off debt if you have taken from someone

- Savings

- Investments & super contributions (Stock market or mutual funds)

- Charity donations to save tax (Annual)

- Gifts are given on any wedding or other occasion

3. Obligations

- Car loan

- Study Loan (Taken during graduation or postgraduation studies)

- Credit Card bills payment

- Child Support

- State/Local Taxes

- Legal Fees

4. Groceries

- Supermarket

- Fruit & veg market (Veg)

- Butcher or Fish shop (Non-veg)

- Bakery products

- Pet food, in case you own a pet

5. Personal & Medical Expenses

- Doctors & medical expense

- Emergency (Any accidents you met with)

- Medicines & Pharmacy

- Glasses & eye care

- Dental

- Cosmetics & toiletries spending

- Hair & beauty products

- A health club (Annual or monthly memberships & spending)

- Clothing & shoes

- Jewellery & accessories

- Computers & Gadgets

- Sports & gym

- Education – Online or offline course fees

- Pet care & veterinary expense

6. Entertainment & Dine Out

- Coffee & tea

- Lunch

- Takeaway & snacks

- Cigarettes

- Drinks & Alcohol

- Bars & clubs

- Restaurants

- Books

- Newspapers & magazines

- Theater or Movies & Music

- Concerts/Plays

- Film/Photos

- Sports

- Outdoor Recreation

- Celebrations & gifts

- Club Memberships

- Videos/DVDs taken on rent or purchased

- Music

- Games

- Toys/Gadgets

7. Transportation Fares

- Bus & train fare

- Taxi fare

- Airfares

- Petrol

- Road tolls & parking

- Registration & license

- Vehicle Repairs & maintenance

- Fines paid

8. Child Care

- Baby products

- Toys

- Play home or babysitting fare

- Childcare

- Sports & other activities

- School tuition fees

- Excursions

- School uniforms

- Other school needs

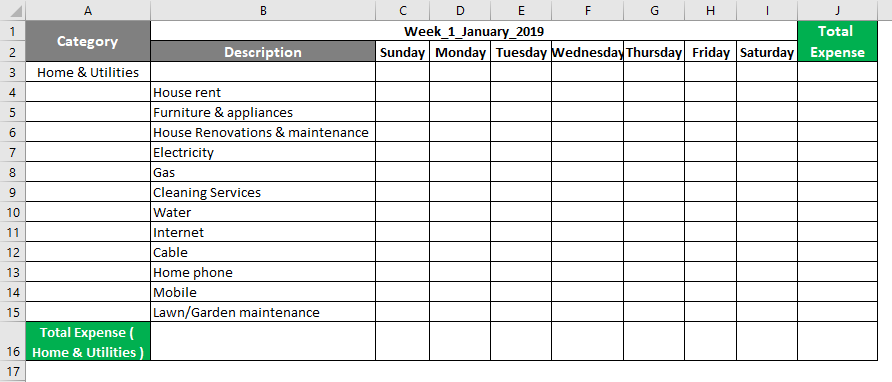

Now, you can add these in Excel with each category separately & need to create a category-wise batch. If we create a monthly expense tracker, we must create day-wise for each week, i.e., 5 sheets for 5 weeks. Let’s create for week 1 with a day-wise breakup. The category section in column A, i.e., adds each category and its total expense.

Each description in column B and weekdays in a respective column, i.e., Sunday, Monday, Tuesday, Wednesday, Thursday, Friday, and Saturday in columns C, D, E, F, G, H, & I, respectively.

Total expense for each description in column J.

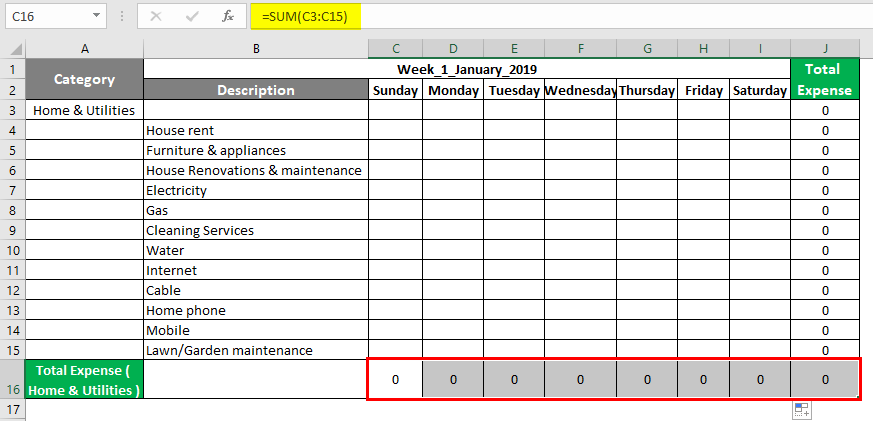

Now add the SUM function for each category & its description in a vertical & horizontal range from column C to column I cells.

After using the SUM formula, the result is shown below.

Similarly, the above step is also followed for another category; now, the Week 1 Tracker is ready.

Simultaneously, you need to create 4 weekly trackers apart from this week 1 tracker, based on the number of weeks in a month.

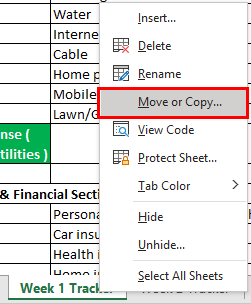

Simultaneously, you need to create 4 weekly trackers apart from this week 1 tracker, based on the number of weeks in a month. It can be created by moving a copy and placing a mouse cursor on a Week 1 Tracker sheet.

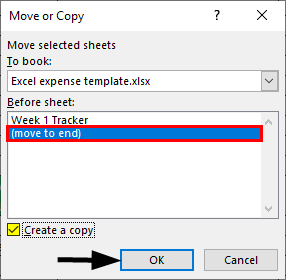

Once you click “Move or Copy”, its window appears; check the box to create a copy & click on the move to end. So that another copy of the weekly tracker is created so that you can name that sheet “Week 1 Tracker“.

In that Week 1 Tracker(1), you just need to update the heading of the week tracker name i.e.

WEEK_2_JANUARY_2019.

Similar steps are followed to create another 3 weeks tracker. Once all the five weeks tracker is created, you need to create one more final sheet, i.e., EXPENSE_TRACKER; it is an overall combination of all the 5 weeks’ expense tracker to analyze & sum up all the expenses & create a total monthly expense data.

You can create a table, category wise, where you need to link each cell to the weekly category total expense for each week. Let’s link the cell reference for week 1; for cell “C4”, you need to link it to cell “J16” of the Week 1 Tracker sheet, i.e., It is a Total expense of the home & utility category for week 1.

Simultaneously, all the weekly category total expenses are linked to relevant cells. In row 12 & column G, you can do the sum for a weekly category total expense.

The expense tracker is ready; once you add expense data to a weekly tracker, it automatically gets updated.

Things to Remember

- It will help to spend the right expense items at the right ratios at the right time when you are in financial difficulty or debt-ridden; an expense tracker analyzes your way and the nature of your spending habits.

- There are various expense templates you can create based on the criteria; we can choose any of the expense templates below that fit your needs.

- Family & Household Expense.

- Project expense in an organization.

- Home construction expenses when you are building a house of your own.

- Wedding expenses for your daughter or son.

- Academic club expenses when you have a yearly membership.

- College or School expenses for your children.

- Holiday & shopping expenses when you are on vacation leave.

Recommended Articles

This is a guide to Excel Expense Tracker. Here we discuss How to create Excel Expense Tracker, practical examples, and a downloadable Excel template. You can also go through our other suggested articles –