Updated July 25, 2023

Definition of Vertical Analysis of Income Statement

The term “vertical analysis of income statement” refers to the proportional analysis of a financial statement in which each line item of the income statement is presented as a percentage of the total sales.

In other words, it indicates the relative size of each line item of the income statement of the subject company. It is also known as a common-size income statement. It is used by many financial managers because

- Vertical Analysis expresses the expense accounts in terms of percentage, thus eliminating the base effect of the scale of operation. So, it is useful in comparing the performance of companies with different scales of operations.

- It helps in assessing the performance trend of a company across periods.

- As it indicates the relative proportion of accounts, it is useful in identifying the cost centers that witness a sudden spike to negatively impact the profitability of a company.

Formula

The formula for vertical analysis of income statement can be derived by dividing any item in the income statement by the total sales and express it in terms of percentage. Mathematically, it is represented as,

Examples of Vertical Analysis of Income Statement (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

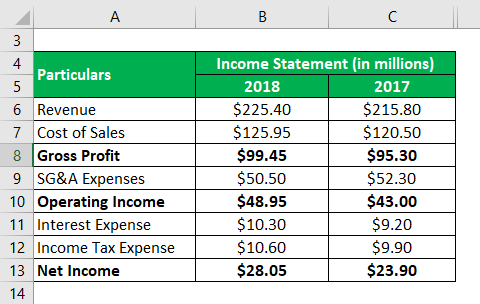

Example #1

Let us take the example of a company named DFG Ltd. that is engaged in the manufacturing of precision components for various tier I OEMs. As per the latest annual report of the company, the following information is available:

Solution:

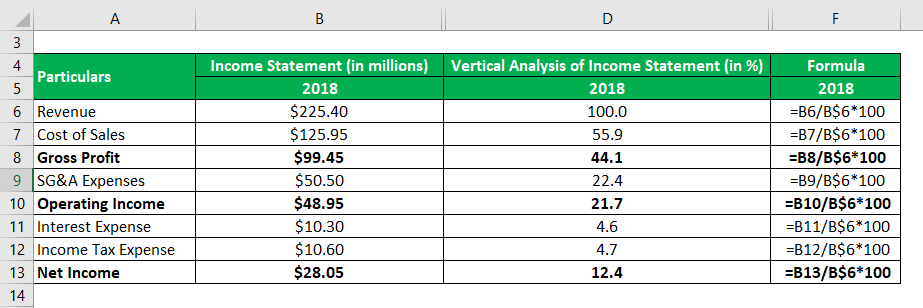

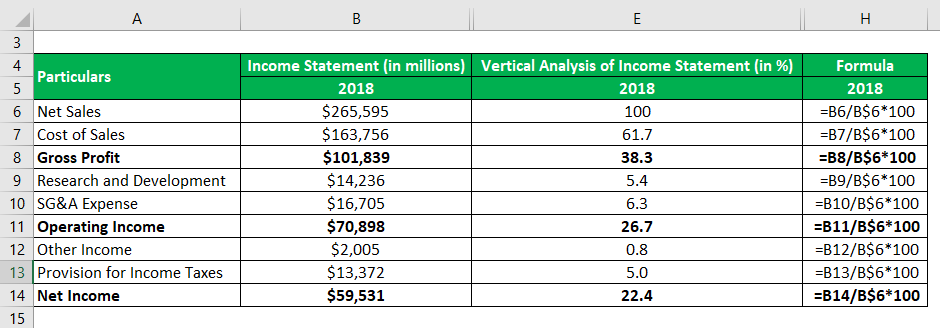

Vertical Analysis of Income Statements for the year 2018 is calculated as

Vertical Analysis of Income Statement = Income Statement Item / Total Sales * 100

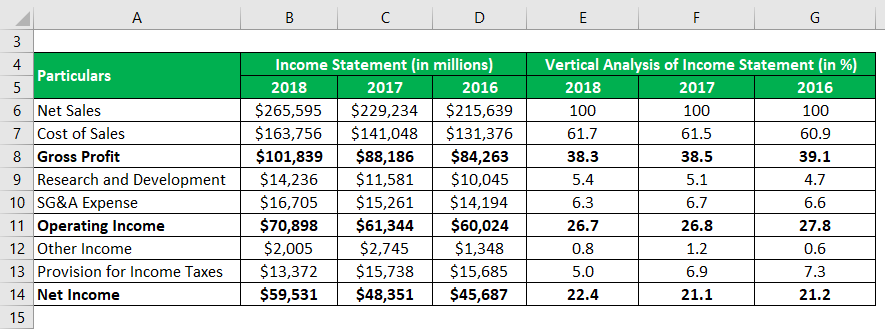

similarly, calculate for the years 2017.

In the above table, it can be seen that the gross profit margin has remained fairly stable during the last two years, while the operating margin has witnessed a slight improvement in 2018 due to a decrease in SG&A expense. The net income margin also improved in line with the operating income margin.

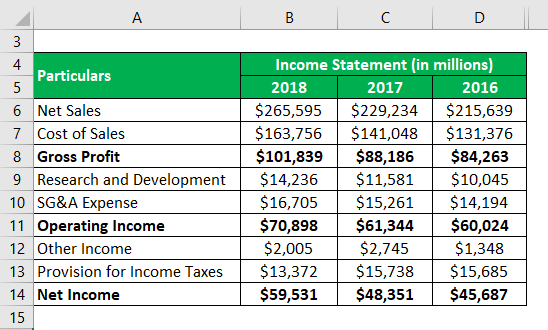

Example #2

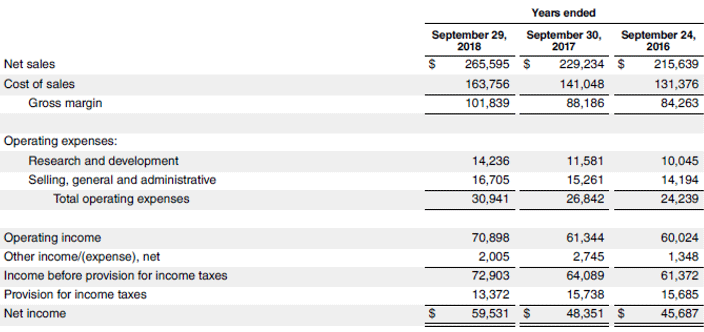

Let us take the example of Apple Inc.’s latest annual report for the year 2018. The following income statement excerpt for the last three years is available from the annual report:

Solution:

Vertical Analysis of Income Statements for the year 2018 is calculated as

Vertical Analysis of Income Statement = Income Statement Item / Total Sales * 100

similarly, calculate for the years 2017 and 2016

In the above table, it can be seen that the gross profit margin, operating income margin, and net income margin of Apple Inc. have remained quite stable during the last three years. Such a stable margin is indicative of the business strength of the company as it requires immaculate management to manage the cost accounts despite various operational challenges.

Source Link: Apple Inc. Balance Sheet

Advantages and Disadvantages of Vertical Analysis of Income Statement

Below are the Advantage and Disadvantages:

Advantages

Some of the advantages are:

- It helps in determining the effect of each line item in the income statement on the profitability of the company at each level, such as gross margin, operating income margin, etc. In case there is a sudden increase in the relative size of any of the line items, then the change can be captured easily by the vertical analysis of the income statement.

- Since this technique presents all the fields in terms of percentage, it simplifies the task of comparing the financial performances of an entity with its peer universe irrespective of their scale of operation.

Disadvantages

Some of the disadvantages are:

- There is no approved standard benchmark that can be used to judge the proportion of each line item on a standalone basis. As such, may experts avoid the use of vertical analysis of the income statement?

- This technique may result in misleading conclusions in case there is a lack of consistency in its method of preparation. For instance, a company with net sales as the base can’t be compared with a company with gross sales as a base.

Limitations

Some of the limitations are:

- Since percentage values are analyzed in place of actual financial figures, it is relatively easier to get away with the window dressing of financial statements.

- This technique is not very useful for businesses that are inherently impacted by seasonal fluctuations.

Conclusion

So, it can be concluded that the vertical analysis of the income statement helps in various financial assessments that primarily include trend analysis and peer comparison. This technique is one of the easiest methods for analyzing financial statements. However, given its lack of standard benchmark, this method finds limited use in the decision making of most of the companies.

Recommended Articles

This is a guide to Vertical Analysis of Income Statement. Here we discussed the calculation for vertical analysis of income with practical examples. We also provide a downloadable Excel template. You may also look at the following articles to learn more –