Updated July 24, 2023

Difference Between Capitalizing vs Expensing

There are two ways of treating costs in the financial statements, i.e. expensing and capitalizing. If we expense a cost, then it is included in the income statement by subtracting it from the revenue and determining profit. Whereas if we capitalize on the cost, then it means that we have accounted for it as an asset on the balance sheet with only depreciation showing up on the income statement. Capitalizing vs Expensing is one of the biggest business decisions on the accounting front as it impacts the company’s balance sheet and profitability in the long run.

What is Capitalizing?

Recording of an expense as an asset is defined as capitalizing. When it is believed that the benefit of such an expense will be derived for an extended period of time, the cost is capitalized. For example- if we buy stationery, it gets spent fast, so it is an expense whereas, if we purchase an immovable asset, its benefit is derived for an extended period of time, and the wear and tear are recorded in the form of depreciation on the income statement.

What is Expensing?

Recording of expenditure as an operating expense and not a capital investment is termed as expensing. When the costs are used up or expired or have no future economic value, then it is reported as an expense. For example- if there is a cost of repairs to bring the machinery back to the same condition, there is no future economic value-added, then this cost is treated as an expense.

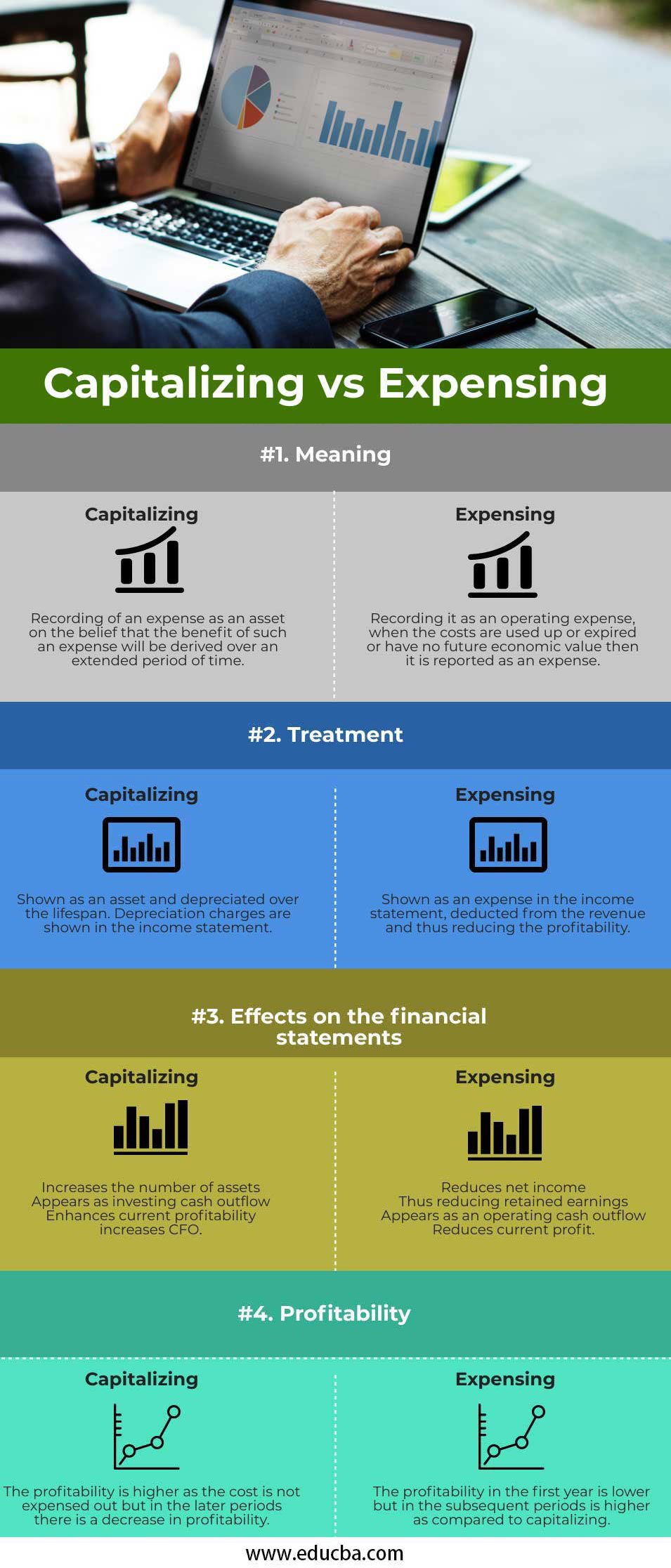

Head To Head Differences Between Capitalizing vs Expensing (Infographics)

Below are the top 4 differences between Capitalizing vs Expensing:

Key Differences Between Capitalizing vs Expensing

Let us discuss some of the major key differences :

- Capitalizing leads to an increase in the total assets on the balance sheet of the company, whereas expensing does not record any asset on the balance sheet

- When an expense is capitalized, it becomes a part of the cash flow statement and is recorded under cash outflow from investing, and Cash-flow From Operations is higher, whereas when we expense it out, Cash flow from operations is reduced.

- Capitalizing the expense means increasing the assets on the balance sheet, which leads to higher turnover ratios like return on equity and return on assets; on the other hand, expensing leads to lower turnover ratios in the earlier years but increases in the later years.

- Capitalized amount is depreciated or amortized over the life of the asset, whereas under expensing, there is no expense related to depreciation or amortization in the later periods.

- Undercapitalization, in the initial years, there is an increase in profitability until the capital expenditure is more than the depreciation expense, and in the later periods, the profitability decreases. Whereas under expensing, the profitability in the first year is lower but in the subsequent periods is higher as compared to capitalizing.

Example:

Let us consider a company XYZ, which has made a revenue of $5000 and recorded an expense of $3000 in the financial year of 2018. Additionally, XYZ incurred an expense of $600 in repair and maintenance. However, the accountant of the company is not sure if this cost should be capitalized or expensed. The accountant wants to understand the impact of the cost if it decides to either capitalize it or expense it –

- Expense: If XYZ decides to expense it, then $600 will be a part of the total expenses, and the total expense of the company for the 2018 financial year will be $3600, and the revenues will also decrease by a similar amount. The accountant also understands that accounting for this as an expense will also reduce total assets and shareholder equity.

- Capitalizing: If XYZ decides to capitalize $600, the total expense and income will remain as it is and will not be impacted. However, over the years, this capitalized asset will have to be depreciated, which will lead to a reduction in income over the future years.

Capitalizing vs Expensing Comparison Table

Let’s discuss the top comparison between Capitalizing vs Expensing:

| Basis of Comparison | Capitalizing | Expensing |

| Meaning | Recording of an expense as an asset on the belief that the benefit of such an expense will be derived over an extended period of time | Recording it as an operating expense, when the costs are used up or expired or have no future economic value, then it is reported as an expense. |

| Treatment | Shown as an asset and depreciated over the lifespan. Depreciation charges are shown in the income statement. | Shown as an expense in the income statement, deducted from the revenue and thus reducing the profitability. |

| Effects on the financial statements | Increases the number of assets

It appears as investing cash outflow Enhances current profitability increases CFO |

Reduces net income

Thus reducing retained earnings It appears as an operating cash outflow Reduces current profit |

| Profitability | The profitability is higher as the cost is not expensed out, but there is a decrease in profitability in the later periods. | The profitability in the first year is lower but in the subsequent periods is higher as compared to capitalizing. |

Conclusion

So, whether to opt for capitalizing an expenditure or expensing it out is a huge decision to make from a company’s perspective at large. Since undercapitalization, you are taking an item off the income statement and putting it on the balance sheet so that only depreciation shows up as a charge against profits. This leads to an increase in profitability and also presents all the profitability ratios positively.

This provision of capitalizing vs expensing is also manipulated by companies and can play a huge role in financial scandals. WorldCom is an example of how such a decision can ultimately lead the company to bankruptcy. This judgment alone can have a huge impact on the company’s profit and hence its stock price. Therefore, the choice between expensing and capitalizing should be made wisely.

Recommended Articles

This is a guide to Capitalizing vs Expensing. Here we discuss the difference between Capitalizing vs Expensing, along with key differences, infographics,& a comparison table. You can also go through our other related articles to learn more–