Updated July 21, 2023

Definition of Cash Conversion Cycle

Cash Conversion Cycle is a periodic measure (in days) that is needed for the investments in inventory and other resources to get converted into cash flows from sales of the final product in the operating cycle of the business. It is the sum of the following individual cycles:

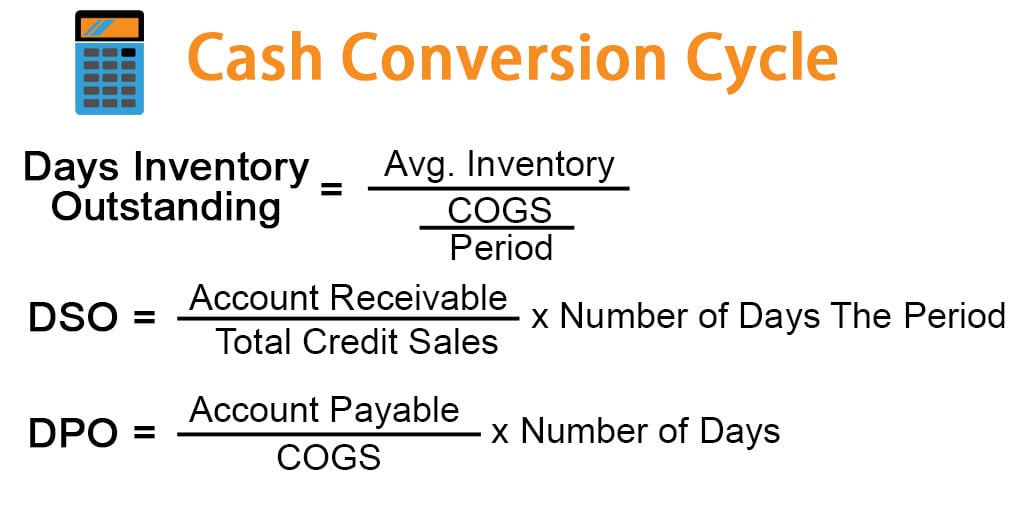

Formula of Cash Conversion Cycle

1. Days Inventory Outstanding: This is a measure of the average number of days that the company holds its inventory. The calculation takes into account the average inventory and COGS/day.

Where,

Numerator Is Average Inventory: (Inventory at the start of the Period + Inventory at the end of the Period)/2 The denominator is the Cost of Goods Sold divided by the number of days in a Period, Monthly or Yearly.

2. Days Sales Outstanding: This measures the average number of days that are taken by a concern to collect the payment after credit sales have been made. The days’ sales outstanding is calculated as follows:

3. Days Payables Outstanding: This is an accounting measure of the average number of days that the entity pays back its creditors on the bills and invoices.

Usually, Days inventory outstanding and days sales outstanding are positive in values whereas days payables outstanding is negative and is deducted from the sum of the previous two.

Examples of Cash Conversion Cycle (With Excel Template)

Let’s take an example to understand the calculation

Cash Conversion Cycle – Example #1

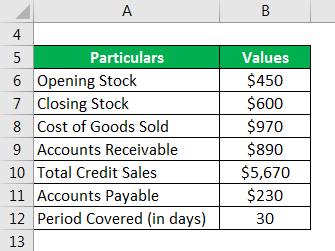

Company AB has an opening stock of $450, closing stock of $600 and Cost of goods sold of $970. The accounts receivable stands at $890, the total credit sales are $5760 and the accounts payable is $230. The period is of 30 days. Calculate the Cash Conversion Cycle.

Solution:

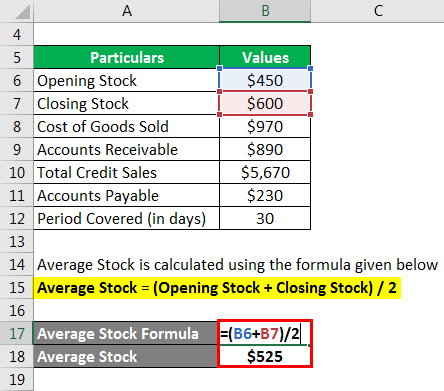

Average Stock is calculated using the formula given below

Average Stock = (Opening Stock + Closing Stock) / 2

- Average Stock = ($450 + $600) / 2

- Average Stock = $525

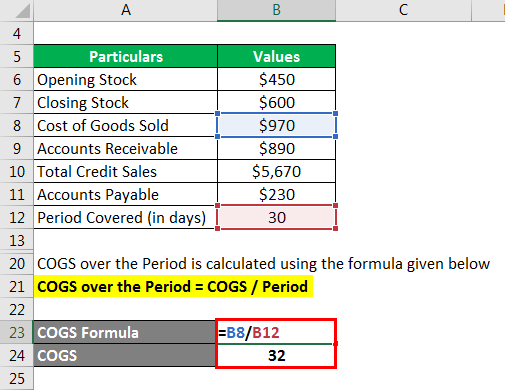

COGS over the Period is calculated using the formula given below

COGS over the Period = COGS / Period

- COGS over the Period = $970 / 30

- COGS over the Period = 32 days

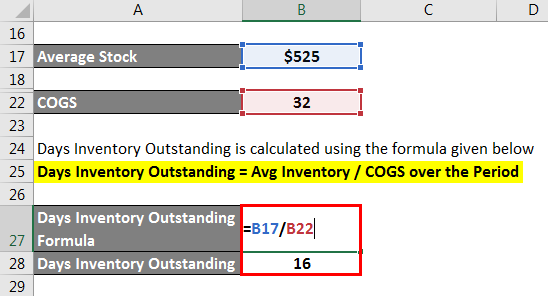

Days Inventory Outstanding is calculated using the formula given below

Days Inventory Outstanding = Avg Inventory / COGS over the Period

- Days Inventory Outstanding = $525 / 32

- Days Inventory Outstanding = 16 days

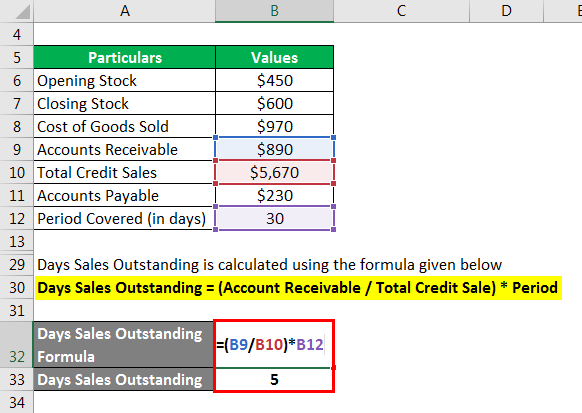

Days Sales Outstanding is calculated using the formula given below

Days Sales Outstanding = (Account Receivable / Total Credit Sale) * Period

- Days Sales Outstanding = ($890 / $5670) *30

- Days Sales Outstanding = 5 days

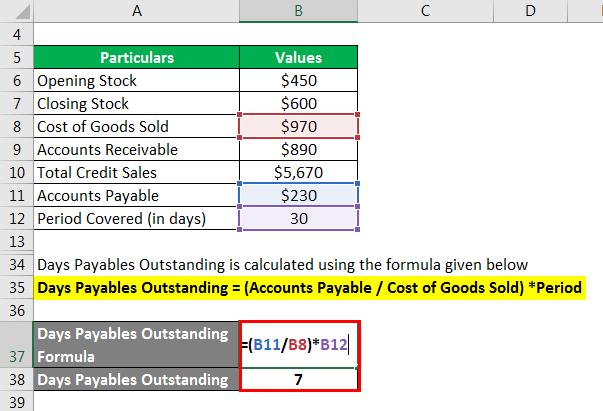

Days Payables Outstanding is calculated using the formula given below

Days Payables Outstanding = (Accounts Payable / Cost of Goods Sold) *Period

- Days Payables Outstanding = ($230 / $970) *30

- Days Payables Outstanding = 7 days

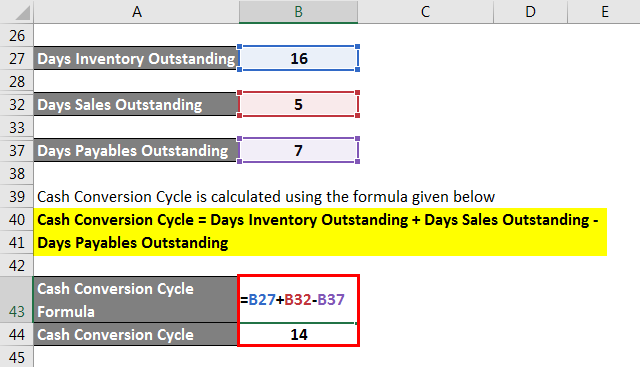

Cash Conversion Cycle is calculated using the formula given below

Cash Conversion Cycle = Days Inventory Outstanding + Days Sales Outstanding – Days Payables Outstanding

- Cash conversion cycle = (16 days + 5 days -7)

- Cash conversion cycle = 14 days

Cash Conversion Cycle – Example #2

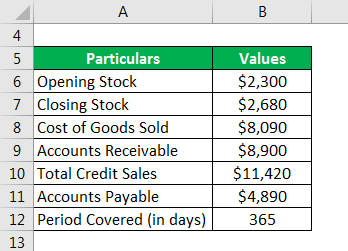

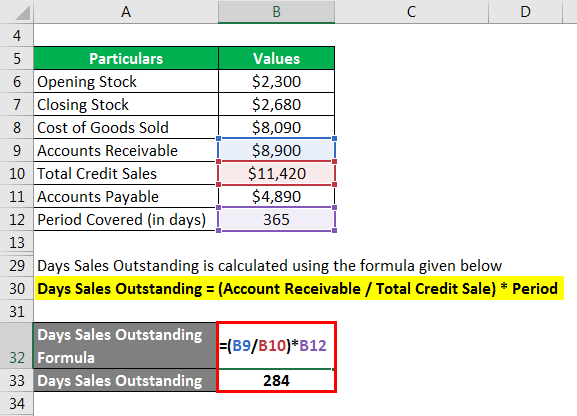

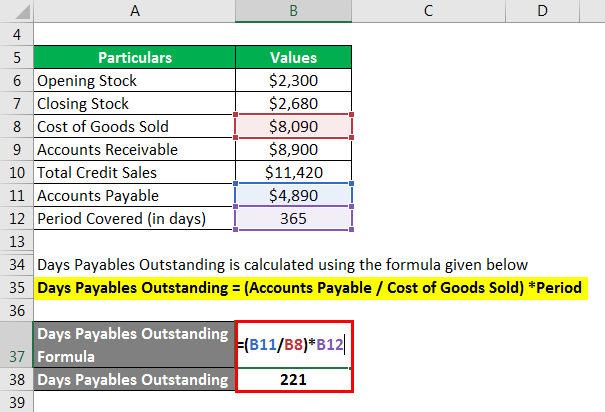

Company CD has an opening stock of $2,300, closing stock of $2,680 and Cost of goods sold of $8,090. The accounts receivable stands at $8,900, the total credit sales are $11,420 and the accounts payable is $4,890. The period is of 365 days. Calculate the cash conversion cycle.

Solution:

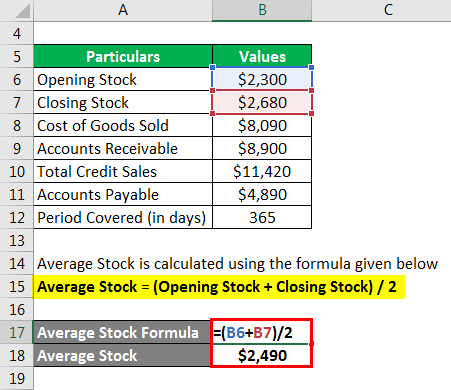

Average Stock is calculated using the formula given below

Average Stock = (Opening Stock + Closing Stock) / 2

- Average Stock = ($2300 + $2680)/ 2

- Average Stock = $2490

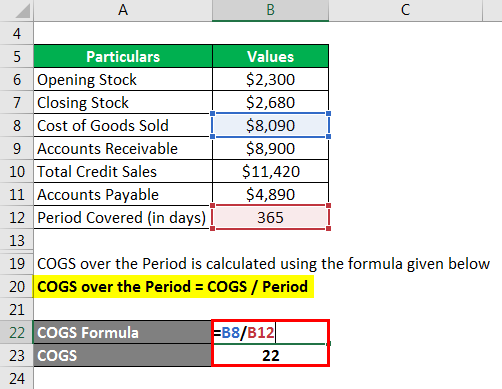

COGS over the Period is calculated using the formula given below

COGS over the Period = COGS / Period

- COGS over the Period = $8090/365

- COGS over the Period = 22

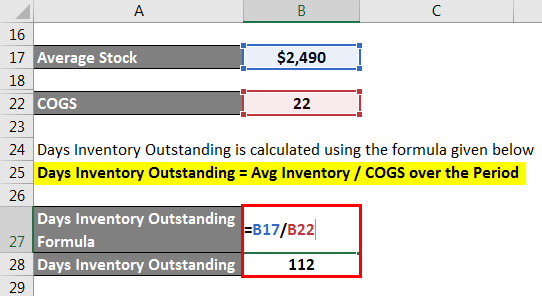

Days Inventory Outstanding is calculated using the formula given below

Days Inventory Outstanding = Avg Inventory / COGS over the Period

- Days Inventory Outstanding = $2490/2

- Days Inventory Outstanding = 112 days

Days Sales Outstanding is calculated using the formula given below

Days Sales Outstanding = (Account receivable / Total Credit Sale) * Period

- Days Sales Outstanding = ($8900/$11420) *365

- Days Sales Outstanding = 284 days

Days Payables Outstanding is calculated using the formula given below

Days Payables Outstanding = (Accounts Payable / Cost of Goods Sold) *Period

- Days Payables Outstanding = ($4890/$8090) *365

- Days Payables Outstanding = 221 days

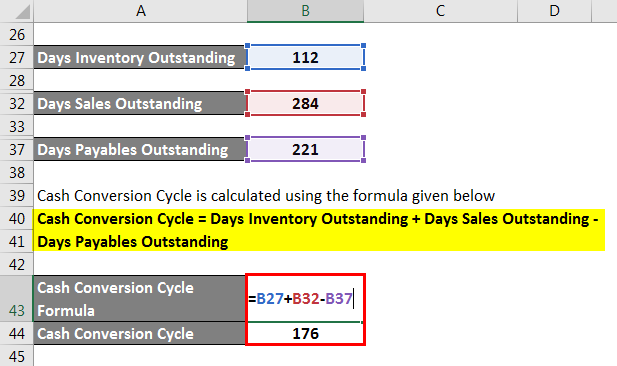

Cash Conversion Cycle = (Days Inventory Outstanding + Days Sales Outstanding – Days Payables Outstanding)

- Cash Conversion Cycle = (112 days + 284days – 221)

- Cash Conversion Cycle = 176 days

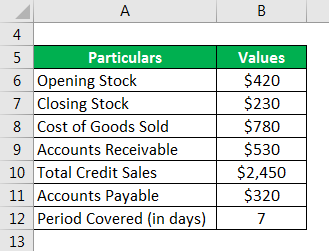

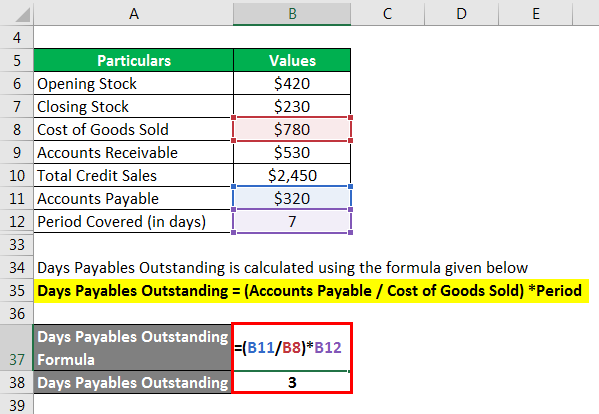

Cash Conversion Cycle – Example #3

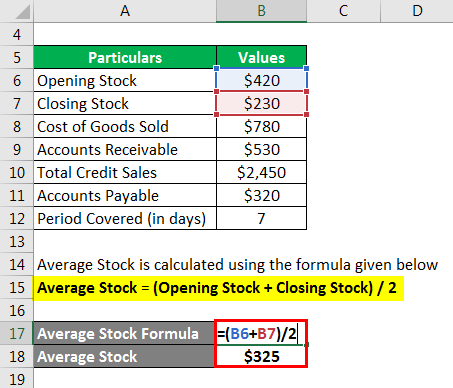

Company CD has an opening stock of $420, closing stock of $230 and Cost of goods sold of $780. The accounts receivable stands at $530, the total credit sales are $2,450 and the accounts payable is $320. The period is of 7 days. Calculate the cash conversion cycle.

Solution

Average Stock is calculated using the formula given below

Average Stock = (Opening Stock + Closing Stock)/2

- Average Stock = ($420 + $230)/2

- Average Stock = $325

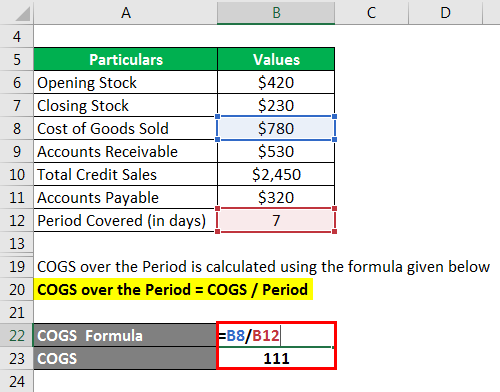

COGS Spread Across the Period is calculated using the formula given below

COGS Spread Across the Period = COGS / Period

- COGS spread across the period = $780/7

- COGS spread across the period = 111 days

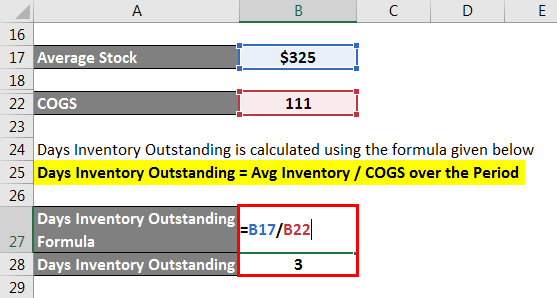

Days Inventory Outstanding is calculated using the formula given below

Days Inventory Outstanding = Avg Inventory / COGS over the Period

- Days Inventory Outstanding = $325/111

- Days Inventory Outstanding = 3 days

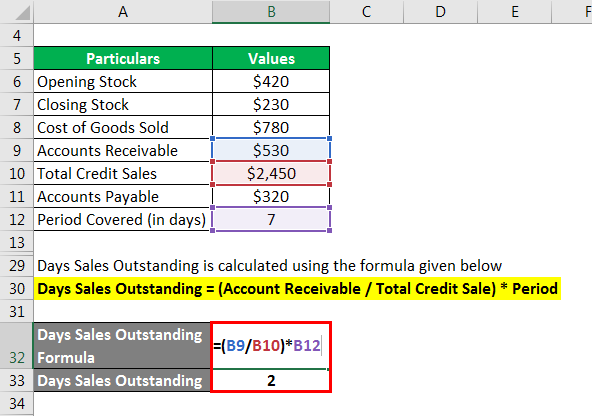

Days Sales Outstanding is calculated using the formula given below

Days Sales Outstanding = (Account receivable / Total Credit Sale) * Period

- Days Sales Outstanding = ($530 / $2450) *7

- Days Sales Outstanding = 2 days

Days Payables Outstanding is calculated using the formula given below

Days Payables Outstanding = (Accounts Payable / Cost of Goods Sold) *Period

- Days Payables Outstanding = ($320/ $780) *365

- Days Payables Outstanding = 3 days

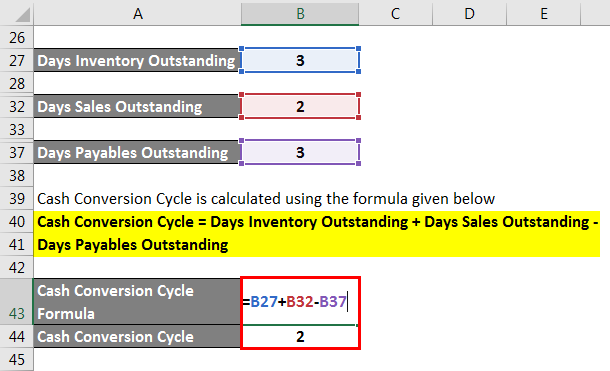

Cash Conversion Cycle = (Days Inventory Outstanding + Days Sales Outstanding – Days Payables Outstanding)

- Cash conversion cycle = (3 days + 2days -3)

- Cash conversion cycle = 2 days

Advantages and Disadvantages

Below are some of the advantages associated with the same.

Advantages

A positive augurs well for the business.

- If the conversion cycle from the debtor side is good it means less of bad debts associated with it. The company would therefore not have to depend on external agencies or input a large amount of uncollectible in their financials.

- The firm can design the incentive system to cater to its cash conversion cycle. For example, if the collection period from the debtors is to be reduced, the firm can offer discounts for instant or early payments

- Older inventory remaining in storage houses poses a risk to the company both in terms of high retention cost, chances of spoilage and lowering of quality. If the company can ensure a healthy inventory conversion rate, it can help in improving the general quality of production and the business.

- On the other side, a short conversion rate on the payables side ensures that the firm can make use of the incentives that will be offered from the suppliers for instant payments. Also, it improves the relationship and the firm can take benefit of shorter production cycle than compared to its competitors

Disadvantages

- In order to ensure that the cash conversion cycle is always positive, there is a tendency from the business to clear the dues to the suppliers at the earliest. This lets go of the use that the business can do with the funds left with it. It can instead use the funds that will be eventually paid to help with the other functions that can improve the various aspects in which it is lagging.

- It is not the best measure of the efficiency of the business. It just talks about the period in which the dues get cleared which is a good measure of the liquidity and the operational viability of the business. However, there are so many aspects that are not covered. Generally, an improved cash conversion cycle compared to the competitors is seen as a good sign by the management. However, it can create unwanted complacency in how the business would be conducted in the future.

- Also, the standards of the cash conversion cycle in the industry is subject to variation depending on the market conditions and changes in the business environment. To continue to stick to the traditional definition and acceptable standard will be foolhardy. There needs to be a committee that should continually evaluate how the conversion cycle is moving and whether there needs to be a change to better match up to the changes all around.

Important Points to Note

- Consideration should be given to the period which is being covered by the conversion cycle. Whether, it is weekly, monthly or yearly. Given the variation, the standards of the industry might change.

- Again, the conversion cycle is a good measure of liquidity and operational efficiency. However, it should not be taken an absolute measure of how well the business is functioning. There needs to be a combination of many things to help understand that.

Conclusion

The cash Conversion Cycle is an important element in deciding the future courses of action by the management and should be considered vital in keeping track of it on a regular basis.

Recommended Articles

This is a guide to Cash Cycle Conversion. Here we discuss how it can be calculated by using a formula along with a downloadable excel template and the advantages of the Cash conversion cycle. You can also go through our other suggested articles to learn more –