Updated July 24, 2023

Annuity Due Formula (Table of Contents)

What is the Annuity Due Formula?

Annuity means repeating payments every month at the beginning of each period. This can be considered similar to paying rent. An annuity is structured such as all the annuities paid are of the same amount and are made at equal intervals (for example payments are made every six months in one year) and are made at the beginning of each period.

One important point to note here is that annuity due will have a higher present value in comparison to an ordinary annuity because payments in annuity due are made at the beginning of each period whereas in ordinary annuity they are paid at the end of the month.

Formulas –

Where –

- Pmt: Payment Made Per Period

- r: Discount Rate

- n: No of Periods

- PVA: Present Value of Annuity Due

Example of Annuity Due Formula (With Excel Template)

Let’s take an example to understand the calculation of Annuity Due in a better manner.

Annuity Due Formula – Example #1

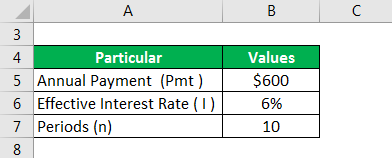

Let us take the example of Mrs. Z who deposits an amount of $600 every year for the next ten years for her daughter’s education. Let us calculate the amount that Mrs. Z will 1have at the end of ten years. The rate of interest is 6%.

Solution:

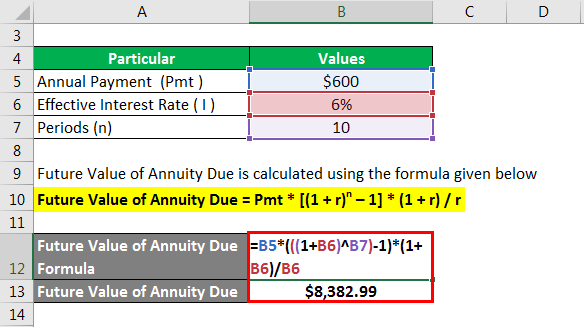

Future Value of Annuity Due is calculated using the formula given below

Future Value of Annuity Due = Pmt * [(1 + r)n – 1] * (1 + r) / r

- Future Value of Annuity Due = 600 * ((1 + 6%)10 – 1) * (1 + 6%))/ 6%

- Future Value of Annuity Due = $8,382.99

Annuity Due Formula – Example #2

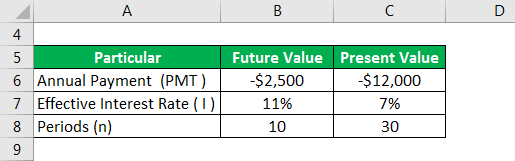

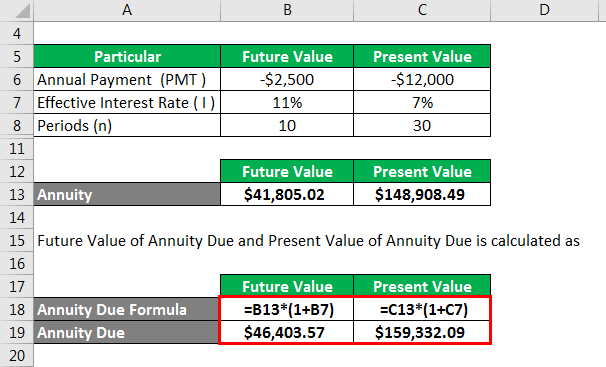

Let us look at an example of calculation of Present and Future value of an annuity due using the excel formula. Mr. A is a salaried individual and receives his salary at the end of each month. Before spending he plans to invest some portion of his salary every year. He plans to save $2500 at the beginning every year and wants to do it for the next 10 years. The return on his plan is ~11%. Let us calculate the Future value of these payments.

Solution:

The syntax of the Future value of the annuity is = FV(rate,nper,pmt, PV) and Present Value of Annuity = PV(rate, nper, pmt, fv)This function helps in determining the future value of your fixed periodic investment based on a rate. In a similar manner let us now look at an example of Present value using the above formula

Where –

- rate: Interest Rate per Period

- nper: Periods in An Annuity

- pmt: Payment Made Each Period

- Pv: Present Value

- fv: Future Value

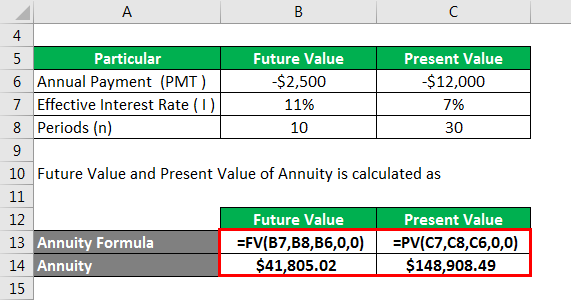

Future Value Annuity and Present Value Annuity is calculated as

Future Value of Annuity Due and Present Value of Annuity Due is calculated as

Using the above formula we get the FVA as $41,805.02. To derive at the FVAD we multiply this value by (1 + rate) to get the value of $148,908.49.

Using the above values we derive at a PVA of $1,48,908. Similar to the future value to arrive at the PVAD we multiply the PVA to (1 + rate) to get the value of $1,59,332.09.

Explanation

The formula for Annuity Due can be calculated by using the following steps:

Step 1: Firstly, determine the nature of payments for annuity i.e they should be paid at the beginning of every period. After confirmation determine the present value (PVA)

Step 2: Next, based on the current market situation determine the interest rate. To calculate the effective interest rate divides the annualized return by the number of periods in a year (R)

Step 3: Next, to identify the total number of periods multiple the number of periods in a year by the number of years the payment is expected.

Step 4: Finally, using the above-mentioned formula annuity due is calculated using the PVA determined in step 1, the rate determined in step 2 and the number of periods determined in step 3.

Relevance and Use of Average Fixed Cost Formula

Annuity due can be considered as another form of the time value of money used to value a similar amount of cash flows paid out at similar intervals. The basic use and relevance of this formula are to find the worth of your money after a certain period of time given a specific rate.

The application of this formula is huge and is applied in the insurance companies, to find out the number of lease payments. This logic is also used for the calculation of provident fund where the salary is considered as a periodic payment. Annuities are also sold as financial products and are appropriate for risk-averse investors as annuities are considered as stable and safe. These products are also appropriate for investors who have a large sum of money and want to invest a limited amount of cash flow at each specific interval.

Recommended Articles

This is a guide to Annuity Due Formula. Here we discuss how to calculate the Annuity Due along with practical examples. We also provide an Annuity Due downloadable excel template. You may also look at the following articles to learn more –