Updated July 24, 2023

Definition of Stop Loss Order

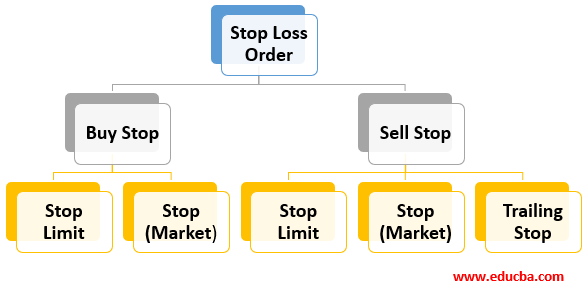

An order placed for buying or selling particular security after it reaches a predetermined price level is known as a stop-loss order, and the reason it is used is to curtail the loss of the investor by automating the trade so that the loss incurred due to execution delays is reduced and that due to oversight is minimized.

Explanation

It is a trade-off because when security is moving in the expected direction, there is a probability that the achievable profit is higher; however, in order to limit the loss, the investor forgoes excess profits. It is similar to a call or a put option which is used to hedge the risk of movement in the price of the underlying asset.

How Does Stop Loss Order Work?

It depends on the type of order explained as follows:

Buy Stop

This is bought to minimize the loss of profit; it is set at a level higher than the current market price and behaves like a call option. The order gets triggered whenever the price reaches this point and the stock is bought.

- Stop (Market): Stop (Market) order executes the order at or at a higher price than the stop price. The aim is to execute the order. This is the most common type.

- Stop Limit: Stop Limit order executes the order at the stop price only; otherwise, it doesn’t execute it.

Sell Stop

This is bought to minimize the loss; it is set at a level lower than the current market price and behaves like a put option. The order gets triggered whenever the price reaches this point and the stock is sold.

- Stop (Market): Stop (Market) order executes the order at or at a lower price than the stop price. The aim is to execute the order. This is the most common type.

- Stop Limit: Stop limit order executes the order at the stop price only; otherwise, it doesn’t execute it.

- Trailing Stop: If the investor bought the stock at $20 and set the stop loss at $10, the percentage of the Stop loss price to the purchase price is 50%, so if in the future the price rises to $40, then the stop price is updated to $20

Example of Stop Loss Order

Suppose an investor is observing that the stock price of Apple Inc. is on a declining trajectory and is currently closing at $50; the investor has a bullish expectation on this stock in the coming 6 months and therefore wishes to hold the stock. However, he might not want to lose out too much on the falling price trend. So if the investor places a stop-loss order at $45, the moment the stock price reaches this level, the stock in his trading account will be sold, and suppose after the sale, the price goes down even further to $43, the investor is saved from incurring an excessive loss of $2 per stock he held.

Similarly, let’s assume that the stock of Amazon is rising. The investor feels that he should benefit from this bullish trend, so he places a buying order if the price reaches $60 because he expects that the price can go up to $100 so he can make a profit of $40 per stock. The moment the stock price reaches $60, the desired number of stock is purchased, and if the price rises beyond that, then the investor profits. If he set the price at $65, he would have lost $5 per stock.

Per the news on 31st May 2019, the Bank Nifty index slipped by 1000 points and recovered 15 minutes later. However, several stop-loss orders were triggered in this short span of time. The concurrent fall in the market and the triggering of a large number of stop-loss contracts led to a greater fall in the index.

Advantages and Disadvantages of Stop Loss Order

Below mentioned are the advantages and disadvantages:

Advantages of Stop Loss Order

- Automatic Execution: This doesn’t require constant monitoring as this order kicks in automatically when the price level threshold is reached. Therefore chances of oversight are almost negligible.

- Limits Loss: When the investor sets the price, the loss is limited by it; the only loss that occurs beyond this is due to execution delays

- Useful in Multiple Securities Portfolios: When several securities are in a portfolio, there are greater chances of oversight; therefore, a stop loss order reduces the risk due to a lack of monitoring of all the stocks.

Disadvantages of Stop Loss Order

- Inferior to Limit Order: Stop loss order is only a level setter; it doesn’t fix the price; therefore, if the price falls even below the set level, the trade will be executed as this is automated. In the case of a limit order, the selling (buying) price is fixed, and the order is not completed if the price is lower (higher) than the limit.

- False Positive: At times, it may happen that the price level is reached as a one-off incident and is not a long-term phenomenon, it comes to a judgment call in that case, and in certain situations, it is best not to execute because the level is reached due to an anomaly. However, the order gets executed even if the investor doesn’t so want an automated execution.

- Inappropriate for High Volumes: When the exposure is high, stop loss is not the best possible alternative because the execution delays may fetch very low or high prices, as the case may be, and that would lead to a larger quantum of loss. In such situations, a limit order is preferable.

Conclusion

The main purpose of the order is to limit the loss of the investor in case of a sell stop and maximize the profit in case of buy stop. If executed timely, stop loss can be a very useful tool to avoid loss due to oversight. However, it is not appropriate for larger exposures as the quantum of loss may be very high in the case of stop (market) order, which is the most common type of stop order. A buy stop may also be useful to an investor who has short-sold security and needs to buy it at the time of contract fulfillment.

Recommended Articles

This is a guide to Stop Loss Order. Here we discuss the definition and working of stop-loss order along with various advantages and disadvantages. You may also look at the following articles to learn more –