Updated July 24, 2023

What is the Unit Contribution Margin?

The term “unit contribution margin” refers to the dollar amount of selling price per unit earned in excess of the variable cost per unit. In other words, the unit contribution margin (UCM) measures the amount of selling price that covers those costs that are fixed in nature.

The concept of UCM is very important from a company’s perspective because it indicates the minimum selling price such that the variable’s costs are covered.

It forms an important part of the cost-volume-profit (CVP) analysis. In the case of positive UCM, i.e. selling price per unit is higher than the variable cost per unit, an increase in sales volume results in higher profit. On the other hand, if the UCM is negative, i.e. selling price per unit is lower than the variable cost per unit, then an increase in sales volume will reduce profit.

Formula

The formula for unit contribution margin is fairly simple, and it can be expressed as the difference between the selling price per unit and the total variable cost per unit. Please note that variable cost refers to those costs that can be directly assigned to the production process (e.g., raw material cost, direct labor cost, etc.). Mathematically, UCM is represented as,

Alternately, the formula for UCM can be expressed as the difference of sales and total variable cost divided by the number of units sold. Mathematically, it is represented as,

Examples of Unit Contribution Margin (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

Example #1

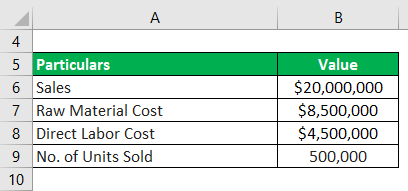

Let us take the example of a shoe manufacturing company to illustrate the computation of the UCM. During the year 2018, the company registered total sales of $20.0 million, while it incurred the raw material cost of $8.5 million and a direct labor cost of $4.5 million. Calculate the unit contribution margin of the company if it sold 500,000 shoes during the year.

Solution:

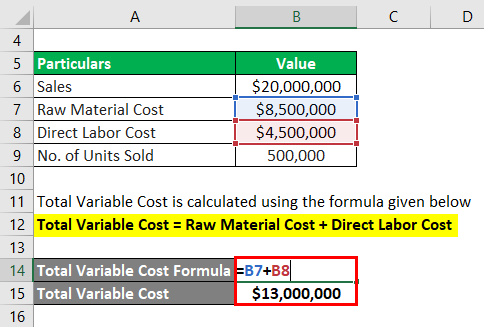

Total Variable Cost is calculated using the formula given below

Total Variable Cost = Raw Material Cost + Direct Labor Cost

- Total Variable Cost = $ 8,500,000 + $4,500,000

- Total Variable Cost = $13,000,000

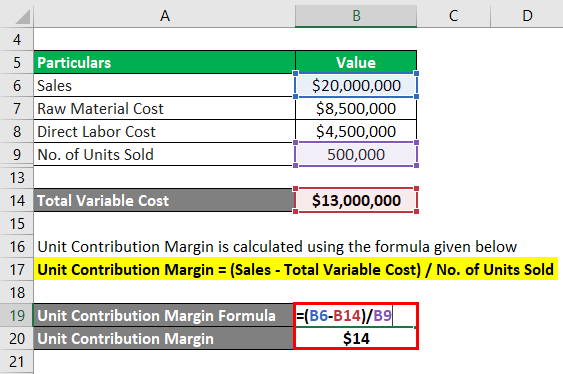

It is calculated using the formula given below

Unit Contribution Margin = (Sales – Total Variable Cost) / No. of Units Sold

- UCM = ($20,000,000 – $13,000,000) / 500,000

- UCM = $14

Therefore, the company makes $14 of UCM by selling each shoe to cover for the fixed costs.

Example #2

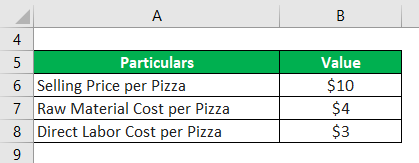

Let us take the example of another pizza selling company to illustrate the alternate method of UCM computation. The average selling price of each pizza is $10, and the cost of raw material is $4 per pizza, and the cost of labor is $3 per pizza. Calculate the unit contribution margin of the company based on the given information.

Solution:

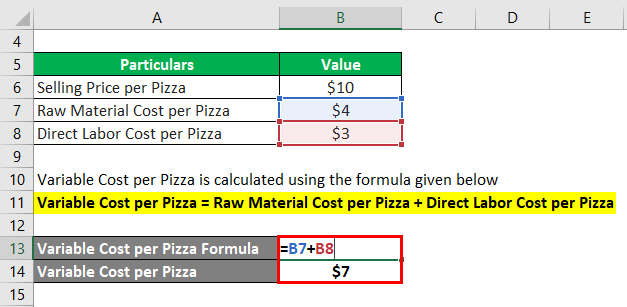

Variable Cost per Pizza is calculated using the formula given below

Variable Cost per Pizza = Raw Material Cost per Pizza + Direct Labor Cost per Pizza

- Variable Cost per Pizza = $4 + $3

- Variable Cost per Pizza = $7

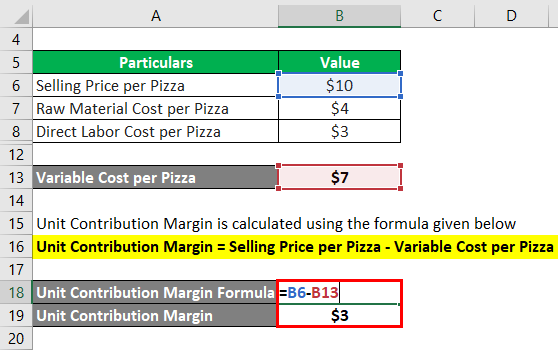

It is calculated using the formula given below

Unit Contribution Margin = Selling Price per Pizza – Variable Cost per Pizza.

- UCM = $10 – $7

- UCM = $3

Therefore, the company’s UCM stood at $3 per pizza during the year.

Example #3

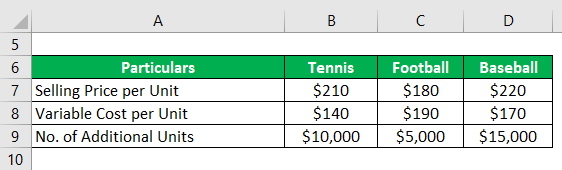

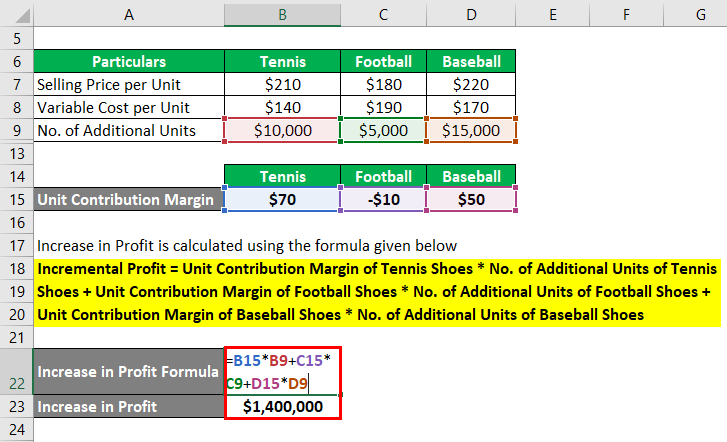

Now, let us take the example of a company named ASD Inc., which is into the manufacturing of three types of sports shoes: Tennis, Football, and Baseball. The management of the company asked the accountant to calculate how much the profit will increase if it sold additional 10,000 units of Tennis shoes, 5,000 units of Football shoes and 15,000 units of Baseball shoes. Use the following information:

- Tennis: average selling price per unit is $210, and the variable cost per unit is $140

- Football: average selling price per unit is $180, and the variable cost per unit is $190

- Baseball: average selling price per unit is $220, and the variable cost per unit is $170

Solution:

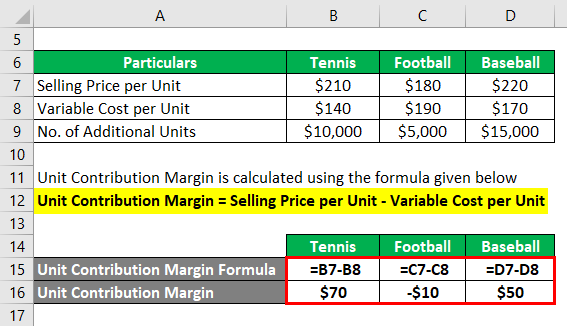

It is calculated using the formula given below

Unit Contribution Margin = Selling Price per Unit – Variable Cost per Unit.

Tennis

- UCM = $210 – $140

- UCM = $70

Football

- UCM = $180 – $190

- UCM = -$10

Baseball

- UCM = $220 – $170

- UCM = $50

An increase in Profit is calculated using the formula given below

Incremental Profit = Unit Contribution Margin of Tennis Shoes * No. of Additional Units of Tennis Shoes + Unit Contribution Margin of Football Shoes * No. of Additional Units of Football Shoes + Unit Contribution Margin of Baseball Shoes * No. of Additional Units of Baseball Shoes

- Increase in Profit = $70 * 10,000 + ($10) * 5,000 + $50 * 15,000

- Increase in Profit = $1,400,000

Therefore, with the additional production, the profit is expected to increase by $1.40 million.

Advantages and Disadvantages of UCM

Below are the advantages and disadvantages mentioned:

Advantages of UCM

Some of the major advantages are:

- Easy to use as all the numbers are already available with the management.

- It helps in deciding a minimum selling price.

- Assists in the planning of the production schedule.

Disadvantages of UCM

Some of the major disadvantages are:

- It assumes the selling price to be constant.

- It assumes costs to be linear and easily classifiable into fixed and variable components.

Although the UCM has some limitations, as mentioned above, it won’t be wrong to conclude that it is important for the prediction of profitability from the point of view of any company management.

Recommended Articles

This is a guide to the Unit Contribution Margin. Here we discuss how to calculate Unit Contribution Margin with practical examples. We also provide a downloadable excel template. You may also look at the following articles to learn more –