Updated July 24, 2023

Difference Between EBIT vs Operating Income

EBIT vs Operating Income refers to the measurement used for showing the profitability generated by the company in a period out of its operating without considering the interest and the tax expenses. It highlights the company’s capability to generate profits and is therefore used by the investors interested in knowing about profits that the company is generating. It is an important input used while calculating the different important calculations and the financial ratios and used to analyze performance with respect to the operations of the company without considering the costs of capital structures and expenses related to the taxes that have an impact on the profits of the company.

Generally, all the calculation related to the Earnings before Interest and Tax is not accounted for or reported at any of the places in the company’s financial statements.

Operating income can be referred to as the amount of income that the company generates out of its core operations. It does not include any of the income or expenses that are not directly related to the company’s core business operations. It is calculated or derived when the operating expenses of a period are deducted from the company’s gross income for that period. The calculation related to the operating income is accounted for or reported in the company’s financial statements as it is an important metric according to the Generally Accepted Accounting Principles. As per the Generally Accepted Accounting Principles (GAAP), companies are required to report the operating income earned during the period from the core business operation in their financial statement for that period.

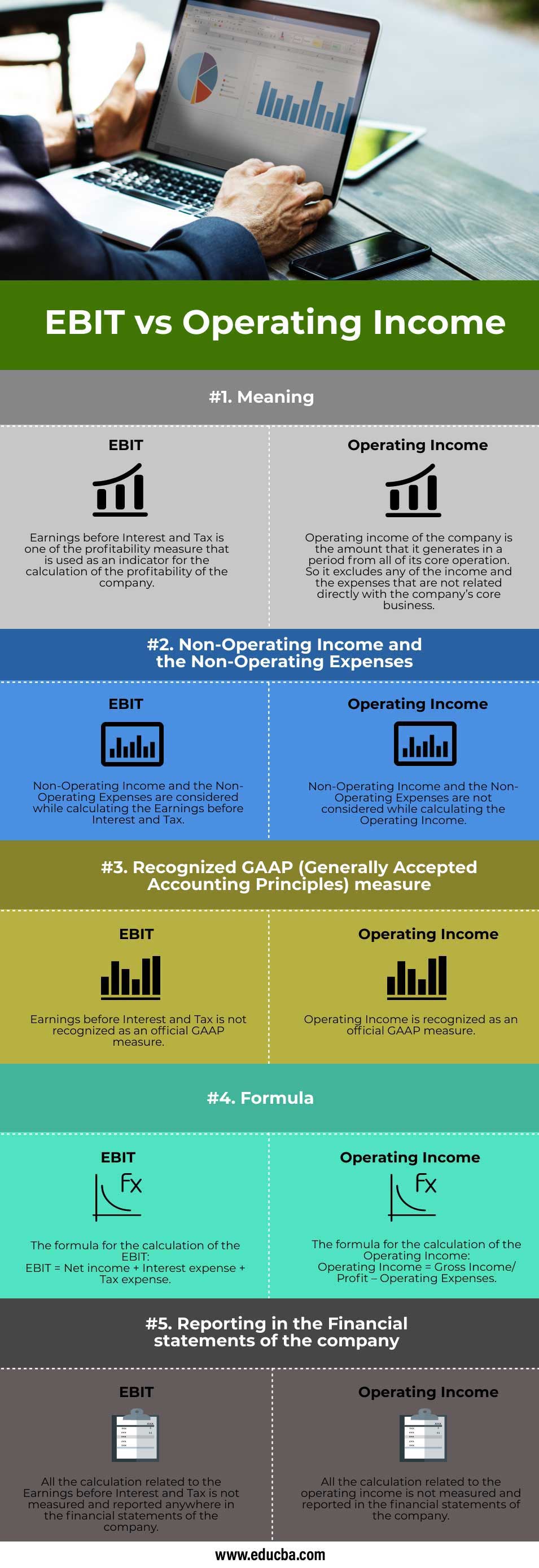

Head To Head Comparison Between EBIT vs Operating Income(Infographics)

Below are the top 5 comparisons between EBIT vs Operating Income:

Key Differences Between EBIT vs Operating Income

The key differences between Earnings before Interest and Tax (EBIT) vs Operating Income are provided and discussed as follows:

- The main difference with respect to the Earnings before Interest and Tax and the Operating Income is related to the inclusion and exclusion of the non-operating nature transactions, i.e., Non-Operating Income and the Non-Operating Expenses while arriving at their figures.

- In the case of the Earnings before Interest and Tax (EBIT) calculation, the effect of the Non-Operating Income and the Non-Operating Expenses is considered, whereas, for the calculation of the Operating Income, the effect of the Non-Operating Income and the Non-Operating Expenses is not considered.

- The formula used for the calculation of the Earnings before Interest and Tax and the Operating Income is different where the Operating Income is derived by deducting the operating expenses incurred during a period from that period’s gross income where the operating expenses include selling expenses, general expenses, administrative expense, amortization, depreciation.

- The other operating expenses. On the other side, Earnings before Interest and Tax can be derived by adding the interest expense and the tax expense in the net income as they are already deducted while calculating the net income.

- The calculation of the Earnings before Interest and Tax is generally not reported in the financial statements of the company as the same is not the metric under the Generally Accepted Accounting Principles, whereas the calculation of the Operating Income is reported in the financial statements of the company and forms its important part as the same is the metric under the Generally Accepted Accounting Principles.

EBIT vs Operating Income Comparison Table

The table below summarizes the comparisons between EBIT vs Operating Income:

| Basis of Comparison | EBIT (Earnings before Interest and Tax) | Operating Income |

| Meaning | Earnings before Interest and Tax is one of the profitability measures that is used as an indicator for the calculation of the profitability of the company. | The operating income of the company is the amount that it generates in a period from all of its core operations. So it excludes any of the income and the expenses that are not related directly to the company’s core business. |

| Non-Operating Income and the Non-Operating Expenses | Non-Operating Income and the Non-Operating Expenses are considered while calculating the Earnings before Interest and Tax. | Non-Operating Income and the Non-Operating Expenses are not considered while calculating the Operating Income. |

| Recognized GAAP (Generally Accepted Accounting Principles) measure | Earnings before Interest and Tax are not recognized as an official GAAP measure. | Operating Income is recognized as an official GAAP measure |

| Formula |

The formula for the calculation of the EBIT:

|

The formula for the calculation of the Operating Income:

|

| Reporting in the Financial Statements of the company | All the calculation related to the Earnings before Interest and Tax is not measured and reported anywhere in the financial statements of the company. | All the calculation related to the operating income is not measured and reported in the financial statements of the company. |

Conclusion

It can be concluded that the earnings before interest and tax are the profitability measure used by the investors in knowing the capacity of the company to generate the profits, and the operating income is the income that the company actually generates from its core operations of the business and excluding the income from non-core business operating for the period. It is believed and interpreted by many of the persons that there is no difference between the earnings before interest and tax (EBIT) and the operating income generated by the company and both of the terms have the same meaning, but this is not so because there is a major difference between two where earnings before interest and tax.

It also includes the non-operating income in its calculation, which the company generates during the period, but the operating income includes only the income which is generated from its operations and thereby excluding the non-operating incomes earned during the period. So there is a thin line of the difference between the two and many times the figures arrived are also the same where the company won’t have any items of the non-operating income.

Recommended Articles

This is a guide to EBIT vs Operating Income. Here we also discuss the EBIT vs Operating Income, key differences with infographics, and comparison table. You may also have a look at the following articles to learn more –