Operating Expense Formula (Table of Contents)

What is the Operating Expense Formula?

The term “operating expense” refers to all the running costs incurred during the normal course of the business in a given period of time, which is not directly assignable to the production process.

In other words, operating expense is the aggregate of all the expenses other than the cost of goods sold (COGS), and it primarily includes rental expenses, marketing costs, payroll tools and expenses, etc. Thus, it is also known as an operational expenditure or “Opex.”

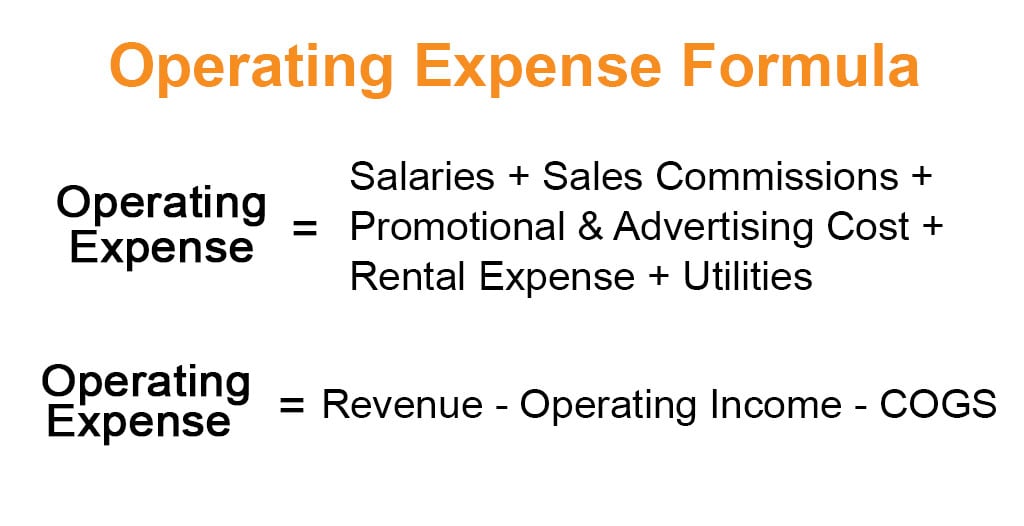

The formula for the operating expense can be simply expressed as a summation of various selling, general, and administrative (SG&A) expenses like office staff salaries, sales commissions, promotional & advertising costs, rental expenses, utilities, etc. The mathematical representation of it is:

On the other hand, the formula for operating expenses can also be expressed as revenue minus operating income (EBIT) minus COGS. The mathematical representation of it is:

Examples of Operating Expense Formula (With Excel Template)

Let’s take an example to understand the calculation of Operating Expense in a better manner.

Example #1

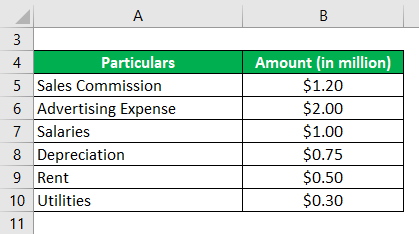

Let us take the example of a manufacturing company to illustrate the computation of operating expenses. According to the latest annual report, the following information is available from the income statement of the company:

Solution:

Calculate the operating expense of the company based on the above information.

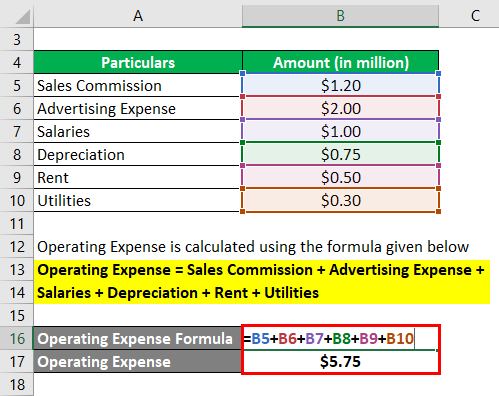

The formula to calculate Operating Expense is as below:

Operating Expense = Sales Commission + Advertising Expense + Salaries + Depreciation + Rent + Utilities

- Operating Expense = $1.20 million + $2.00 million + $1.00 million + $0.75 million + $0.50 million + $0.30 million

- Operating Expense = $5.75 million

Therefore, the company’s operating expense during the given period was $5.75 million.

Example #2

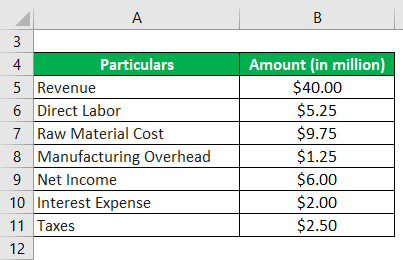

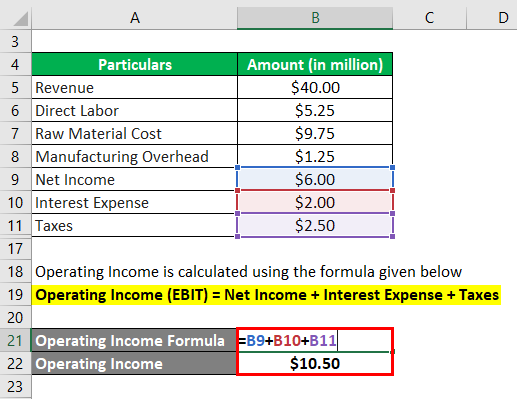

Let us take the example of a company to illustrate the computation of operating expenses using the alternate approach. The following financial information is available about the company:

Solution:

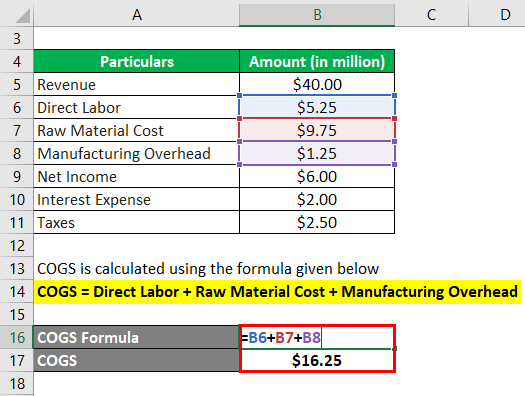

The formula to calculate COGS is as below:

COGS = Direct Labor + Raw Material Cost + Manufacturing Overhead

- COGS = $5.25 million + $9.75 million + $1.25 million

- COGS = $16.25 million

The formula to calculate Operating Income is as below:

Operating Income (EBIT) = Net Income + Interest Expense + Taxes

- Operating Income = $6.00 million + $2.00 million + $2.50 million

- Operating Income = $10.50 million

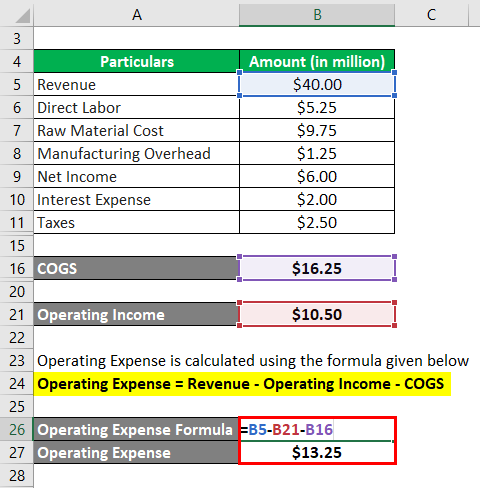

The formula to calculate Operating Expense is as below:

Operating Expense = Revenue – Operating Income – COGS

- Operating Expense = $40.00 million – $10.50 million – $16.25 million

- Operating Expense = $13.25 million

Therefore, the company’s operating expense during the given period was $13.25 million.

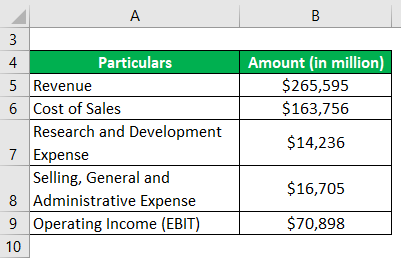

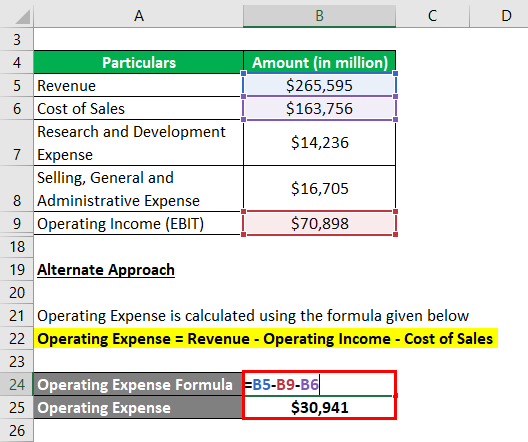

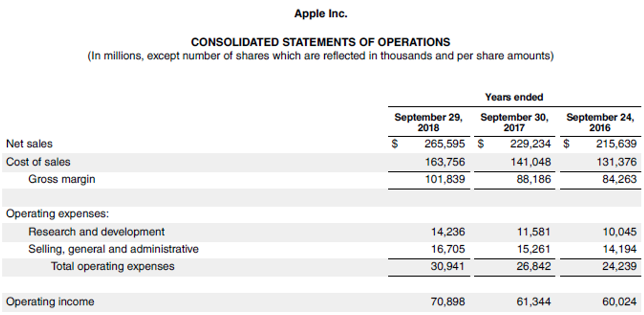

Example #3

Let us take the example of Apple Inc. to illustrate the computation of operating expenses using both approaches. According to an income statement for 2018, the following information is available:

Solution:

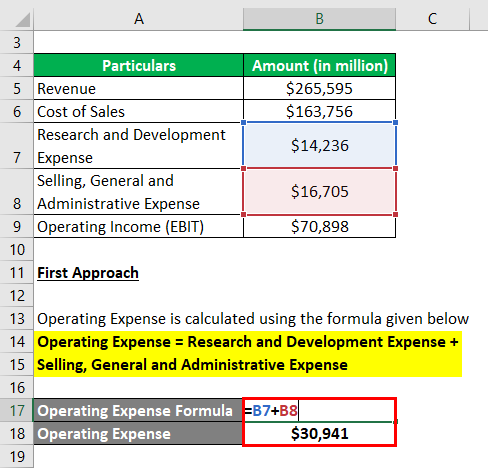

First Approach

The formula to calculate Operating Expense is as below:

Operating Expense = Research and Development Expense + Selling, General, and Administrative Expense

- Operating Expense = $14,236 million + $16,705 million

- Operating Expense = $30,941 million

Alternate Approach

The formula to calculate Operating Expense is as below:

Operating Expense = Revenue – Operating Income – Cost of Sales

- Operating Expense = $265,595 million – $70,898 million – $163,756 million

- Operating Expense = $30,941 million

Therefore, Apple Inc.’s operating expense for the year 2018 was $30,941 million.

Source Link: Apple Inc. Balance Sheet

Explanation

The formula for the operating expense can be derived by using the following steps:

Step 1: Firstly, determine the COGS of the subject company during the given period. COGS is the aggregate cost of production that is directly assignable to the production process, which primarily includes raw material cost, direct labor cost, and manufacturing overhead.

COGS = Raw Material Cost + Direct Labor Cost + Manufacturing Overhead

Step 2: Next, determine the company’s operating income for the period from the income statement.

Step 3: Next, determine the revenue achieved by the company for the period. It is usually the first line item in the income statement.

Step 4: Finally, the formula for the operating expenses can be derived by deducting COGS (step 1) and operating income (step 2) from its revenue (step 3) as shown below.

Operating Expense = Revenue – Operating Income – COGS

Relevance and Use of Operating Expense Formula

It is important to understand the concept of operating expenses because it is very crucial in the assessment of the overall profitability of a company. Given that these expenses are periodic in nature and not directly related to the production level, companies usually intend to control these expenses to improve their profitability. The management team’s competency and ability to take the initiative can be reflected in their performance assessment through the utilization of operating expenses for decision-making, which enables the construction of competitive advantage.

Operating Expense Formula Calculator

You can use the following Operating Expense Formula Calculator

| Salaries | |

| Sales Commissions | |

| Promotional & Advertising Cost | |

| Rental Expense | |

| Utilities | |

| Operating Expense | |

| Operating Expense = | Salaries + Sales Commissions + Promotional & Advertising Cost + Rental Expense + Utilities | |

| 0 + 0 + 0 + 0 + 0 = | 0 |

Recommended Articles

This is a guide to the Operating Expense Formula. Here we discuss how to calculate Operating Expenses along with practical examples. We also provide an Operating Expense calculator with a downloadable Excel template. You may also look at the following articles to learn more –