Updated July 24, 2023

Difference Between Accounts Payable vs Notes Payable

Accounts payable can be referred to as the amount of short-term obligation which is owed to the supplier by the company with respect to the purchase of the goods or the services by the company from that supplier for which the amount has not been paid yet. The total of the entire amount owed to the supplier by the company is shown under the head current liability in the balance sheet of the company as Accounts payable. Accounts Payable vs Notes Payable in this, Companies should pay these debts within the due date in order to avoid the default. Accounts payable is an important aspect for the analysis of the stakeholder of the company as it reflects the purchasing mode of the company i.e if the figure of the accounts payable increases when compared with the previous year’s figures then it shows that more purchases are made on the credit basis rather than on cash and vice versa.

Notes payable on the other hand can be referred to as the written promissory note to repay the amount borrowed from the lender that specifies the specific amount which is required to be paid at a future date or when demanded. When the funds are borrowed from the lender, then the liability is created by the maker of note where the amount of money along with the interest as applicable is mentioned along with the date of its repayment. The total of the entire amount against the notes payable is shown as short term liability in the balance sheet of the company as notes payable is the dues are payable within the next 12 months and is shown as long term liability in the balance sheet of the company as notes payable is the dues are to be paid after 12 months.

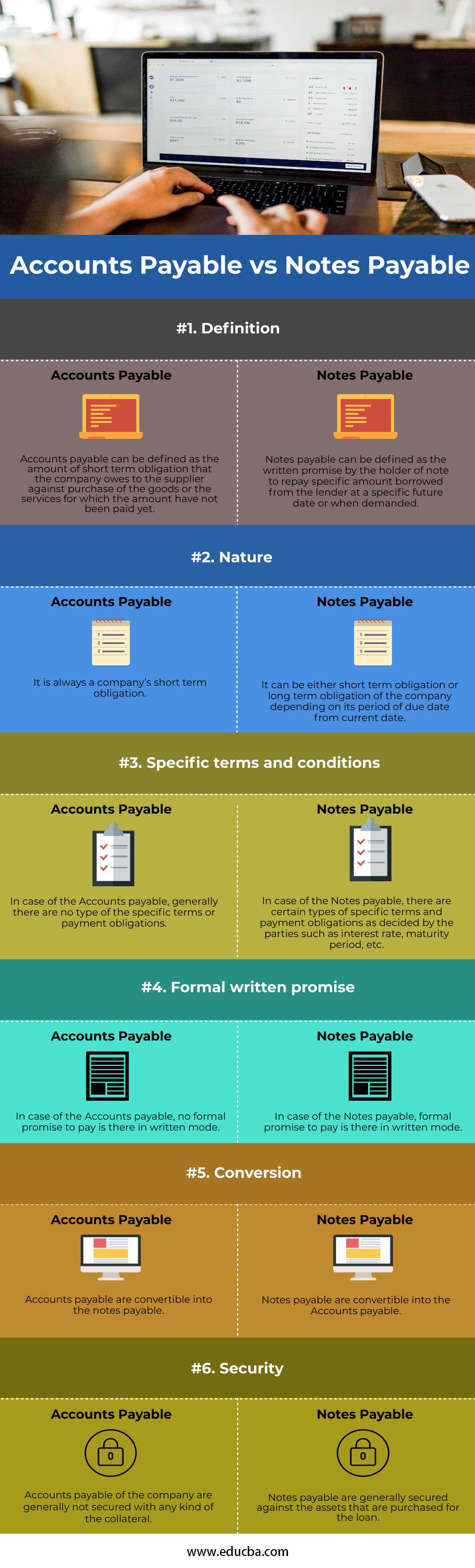

Head To Head Comparison Between Accounts Payable vs Notes Payable(Infographics)

Below are the Top 6 comparisons between Accounts Payable vs Notes Payable:

Key Differences Between Accounts Payable vs Notes Payable

The key differences between accounts payable and notes payable are as follows:

- The whole amount owed by the company to the supplier is shown as Accounts payable under the head current liability in the balance sheet of the company as these are short-term obligations of the company. On the other hand, the amount which is to be shown in the balance of the company against the notes payable is shown as short-term liability in the balance sheet of the company as notes payable depends on its period of due date from the current date. In case if the dues are payable within the period of the next 12 months, then it is shown as the short term liability in the company’s balance sheet and if the dues are to be paid after 12 months, then it is shown as long term liability in the balance sheet of the company as notes payable

- The accounts payable and the notes payable also differ on the basis of the specific terms and conditions which are levied on them. For the accounts payable, no type of specific terms and conditions or payment obligations are levied however for the notes payable, usually, there are certain types of specific terms and conditions or payment obligations such as interest rate, maturity period, payment terms, etc and these are decided mutually by the parties involved.

- Another factor of the difference between the accounts payable and the notes payable is the risk involved in them. Generally, in the case of the accounts payable, suppliers of the goods and services extend the credit of the short-term nature to their customers that have good credit and are considered to be low-risk customers. Now, if the failure is there on the part of the customer to pay the dues within a given due date then the supplier may extend the time of payment or convert accounts payable into notes payable to make the process written and formal having specific maturity and applicable interest rate. On the other hand, notes payable is made for financing the fixed asset purchase. These have formal agreements which include interest rate applicable, date of payment, and other terms. Also, the asset which is being financed is also kept as collateral.

Accounts Payable vs Notes Payable Comparison Table

Given below are the major difference between Accounts Payable vs Notes Payable:

| Basis of Comparison |

Accounts Payable |

Notes Payable |

| Definition | Accounts payable can be defined as the amount of short-term obligation that the company owes to the supplier against the purchase of the goods or the services for which the amount has not been paid yet. | Notes payable can be defined as the written promise by the holder of the note to repay the specific amount borrowed from the lender at a specific future date or when demanded. |

| Nature | It is always a company’s short-term obligation. | It can be either a short-term obligation or a long-term obligation of the company depending on its period of due date from the current date. |

| Specific terms and conditions | In the case of the Accounts payable, generally, there is no type of specific terms or payment obligations. | In the case of the Notes payable, there are certain types of specific terms and payment obligations as decided by the parties such as interest rate, maturity period, etc. |

| Formal written promise | In the case of the Accounts payable, no formal promise to pay is therein written mode. | In the case of the Notes payable, a formal promise to pay is therein written mode. |

| Conversion | Accounts payable are convertible into the notes payable. | Notes payable are convertible into the Accounts payable. |

| Security | Accounts payable of the company are generally not secured with any kind of collateral. | Notes payable are generally secured against the assets that are purchased for the loan. |

Conclusion

Thus both the accounts payable as well as notes payable are important concepts in the financing where accounts payable are the short term obligation of the company towards its suppliers when the goods are purchased or the services are availed by the company on credit from the suppliers and these are shown as under the current liability of the company, however, notes payable are issued by the maker when the funds are borrowed by the company from the lender generally for purchasing the fixed assets and these are a formal written agreement that specifies the terms as decided mutually between the parties.

Recommended Articles

This is a guide to Accounts Payable vs Notes Payable. Here we discuss the difference between Accounts Payable vs Notes Payable, along with key differences, infographics, & a comparison table. You can also go through our other related articles to learn more–