Updated July 24, 2023

Difference Between Gross sales vs Net sales

Gross sales can be defined as the sum-total of the sales that are unadjusted or, in other words, the total sales of an entity prior to making relevant adjustments pertaining to sales returns, discounts, and allowances. Gross sales must not be regarded as the net total revenue yielded by an entity during a particular time period as they signify the total amount of sales revenue earned during that period. Gross sales vs Net sales in this article, Gross sales comprise all types of sales, i.e. the sales that are executed by means of cash, debit card, credit card or even credit sales. The gross sales figure is calculated prior to the calculation of the net sales figure. The gross sales amount is always higher or sometimes equal when compared with the total net sales amount.

The net sales amount is the final amount of revenue earned by an entity after making necessary and relevant adjustments pertaining to sales returns, sales discounts, and allowances as well. In other words, net sales can be defined as the final amount of sales revenue earned by an organization after all the deductions and adjustments are accounted for. The net sales figure is the amount that analysts and investors would always want to look at while reviewing an organization’s profit and loss account.

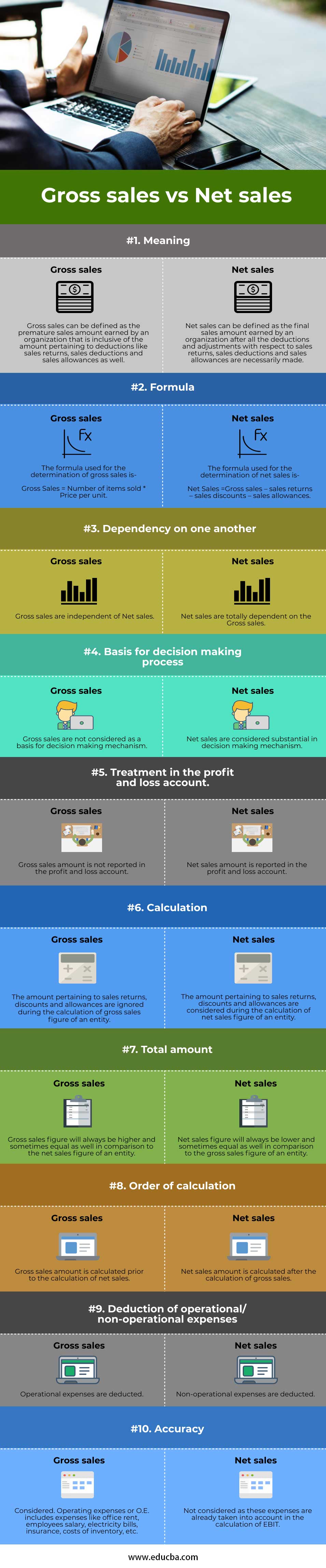

Head To Head Comparison Between Gross sales vs Net sales(Infographics)

Below are the Top 10 differences between Gross sales vs Net sales:

Key Differences Between Gross sales vs Net sales

The key differences between Gross sales vs Net sales are as follows:

- The gross sales figure is the pre-mature sales amount earned by an entity. On the other hand, the net sales figure is the final or net total sales amount earned by an entity.

- The gross sales figure ignores adjustments pertaining to sales returns, sales deductions as well as sales allowances, whereas the net sales amount considers all the necessary adjustments pertaining to sales returns, sales deductions, and sales allowances.

- The gross sales amount is calculated prior to the calculation of the net sales amount.

- The gross sales amount is always equal to or higher than as compared to the net sales amount.

- The gross sales amount is not used for decision-making, whereas the net sales amount is used for decision-making.

- The gross sales amount is ignored in an organization’s income statement, whereas the net sales amount is reported in the statement of income of an organization.

- Gross sales amount does not depend on net sales while the latter depends on the former since it can only be calculated after the ascertainment of the former amount.

- The formula used for the calculation of gross sales is:

- The formula used for the calculation of net sales is:

- Operational expenses are deducted in the gross sales figures. On the other hand, non-operational expenses are deducted in the net sales figures.

- Gross sales amount may not reflect an accurate picture of an entity’s actual sales, whereas net sales amount reflects an accurate picture of the actual sales made by an entity.

Gross Sales vs Net Sales Comparison

Given below are the major comparison between Gross sales vs Net sales:

| Basis of Comparison | Gross sales | Net sales |

| Meaning | Gross sales can be defined as the premature sales amount earned by an organization that is inclusive of the amount pertaining to deductions like sales returns, sales deductions, and sales allowances as well. | Net sales can be defined as the final sales amount earned by an organization after all the deductions and adjustments with respect to sales returns, sales deductions, and sales allowances are necessarily made. |

| Formula | The formula used for the determination of gross sales is: Gross Sales = Number of items sold * Price per unit. |

The formula used for the determination of net sales is: Net Sales = Gross sales – sales returns – sales discounts – sales allowances |

| Dependency on one another | Gross sales are independent of Net sales. | Net sales are totally dependent on Gross sales. |

| The basis for the decision-making process | Gross sales are not considered as a basis for decision-making mechanisms. | Net sales are considered substantial in the decision-making mechanism. |

| Treatment in the profit and loss account | The gross sales amount is not reported in the profit and loss account. | The net sales amount is reported in the profit and loss account. |

| Calculation | The amount pertaining to sales returns, discounts, and allowances is ignored during the calculation of the gross sales figure of an entity. | The amount pertaining to sales returns, discounts, and allowances are considered during the calculation of the net sales figure of an entity. |

| Total amount | The gross sales figure will always be higher and sometimes equal as well in comparison to the net sales figure of an entity. | Net sales figures will always be lower and sometimes equal as well in comparison to the gross sales figure of an entity. |

| Order of calculation | The gross sales amount is calculated prior to the calculation of net sales. | The net sales amount is calculated after the calculation of gross sales. |

| Deduction of operational/ non-operational expenses | Operational expenses are deducted. | Non-operational expenses are deducted. |

| Accuracy | The gross sales figure does not reflect an accurate picture of the actual sales made by an organization. | The net sales figure does reflect an accurate picture of the actual sales made by an organization. |

Conclusion

Gross sales and net sales are totally different from one another. Gross sales are calculated by simply taking the number of units sold and multiplying it by the price per unit, while adjustments like sales returns, sales allowances, and sales deductions are totally excluded. On the other hand, the net sales figure is calculated by taking all the afore-said deductions into consideration.

A wrong calculation of gross sales figures would ultimately impact the calculation and accuracy of the net sales figure of an organization. On the other hand, a wrong calculation of net sales figures will not impact the calculation and accuracy of the gross sales figure. This is because of the fact that the gross sales figure is calculated before the calculation of the net sales figure.

Recommended Articles

This is a guide to Gross sales vs Net sales. Here we discuss the difference between Gross sales vs Net sales, along with key differences, infographics, & a comparison table. You can also go through our other related articles to learn more–