Updated July 24, 2023

Payout Ratio Formula (Table of Contents)

What is the Payout Ratio Formula?

The term “Payout Ratio”, also known as dividend payout ratio, refers to the proportion of the net income paid out to the shareholders in the form of dividends. In other words, it is the percentage of the company’s earnings paid out to the investors.

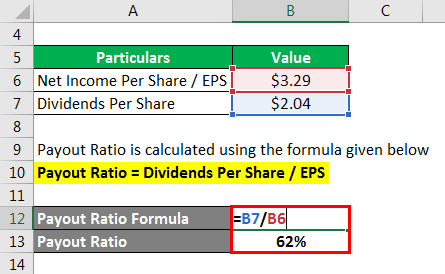

The payout ratio formula is expressed as total dividends divided by the net income during the period. Mathematically, it is represented as,

The payout ratio formula can also be expressed as dividends per share divided by earnings per share (EPS). Mathematically, it is represented as,

Example of Payout Ratio Formula (With Excel Template)

Let’s take an example to understand the calculation of the Payout Ratio in a better manner.

Example #1

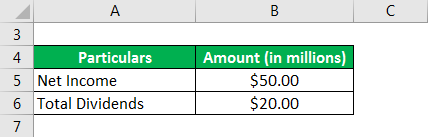

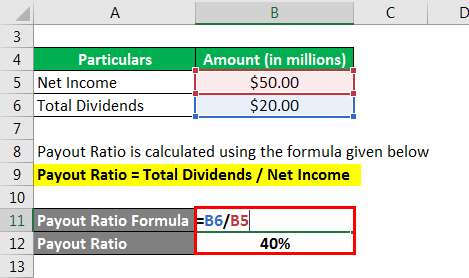

Let us take the example of a company that reported a net income of $50 million during the year, out of which it paid out $20 million as dividends to the shareholders. Calculate the payout ratio of the company.

Solution:

Payout Ratio is calculated using the formula given below

Payout Ratio = Total Dividends / Net Income

- Payout Ratio = $20 million / $50 million

- Payout Ratio = 40%

Therefore, the company’s payout ratio for the given year was 40%.

Example #2

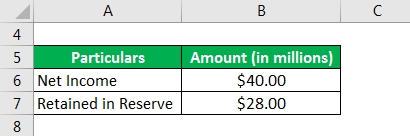

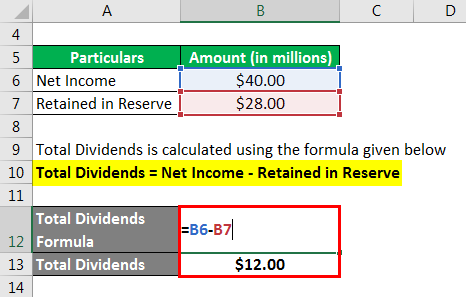

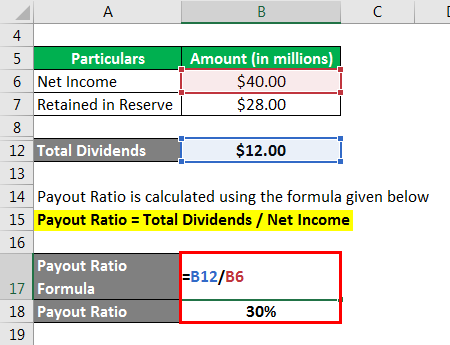

Let us now take another example to illustrate the computation of the payout ratio. During the year 2019, the company registered a net income of $40 million and decided to retain back $28 million in the reserve while paying out the rest as dividends to the outstanding shareholders. Calculate the company’s payout ratio during the year based on the given information.

Solution:

Total Dividends is calculated using the formula given below

Total Dividends = Net Income – Retained in Reserve

- Total Dividends = $40 million – $28 million

- Total Dividends = $12 million

Payout Ratio is calculated using the formula given below

Payout Ratio = Total Dividends / Net Income

- Payout Ratio = $12 million / $40 million

- Payout Ratio = 30%

Therefore, the company’s payout ratio was 30% for the year 2019.

Example #3

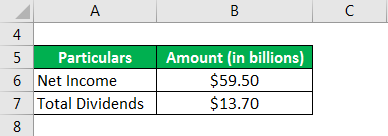

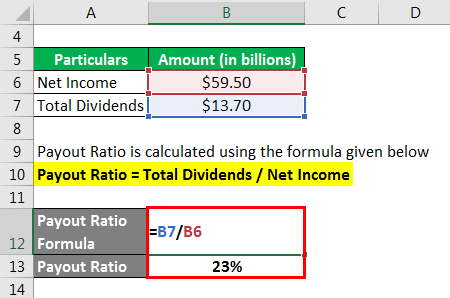

Let us take the example of Apple Inc. to illustrate the computation of the payout ratio. During 2018, the company booked a net income of $59.5 billion while it declared dividends worth $13.7 billion. Calculate Apple Inc.’s payout ratio for the year 2018.

Solution:

Payout Ratio is calculated using the formula given below

Payout Ratio = Total Dividends / Net Income

- Payout Ratio = $13.7 billion / $59.5 billion

- Payout Ratio = 23%

Therefore, Apple Inc.’s payout ratio was 23% for the year 2018.

Source Link: Apple Inc. Balance Sheet

Example #4

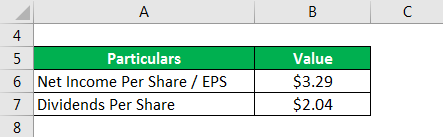

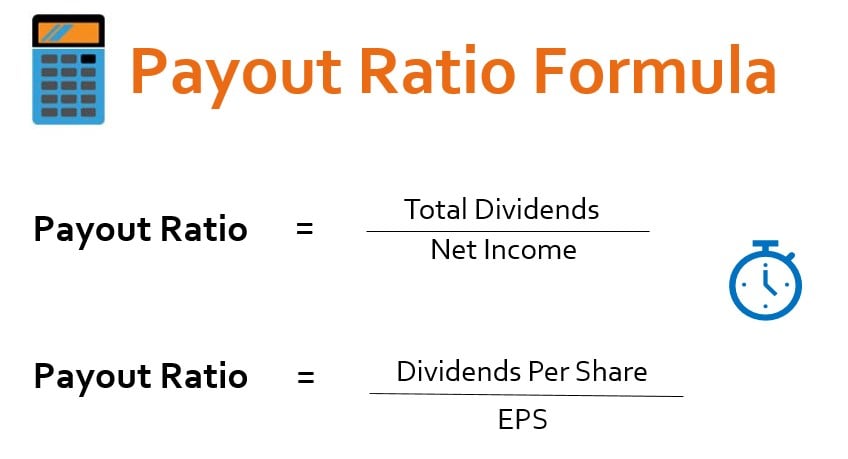

Let us take the example of Walmart Inc. to illustrate the computation of the payout ratio using per share parameters. During 2018, the company reported a net income per share of $3.29 while it declared dividends per share of $2.04. Calculate Walmart Inc.’s payout ratio for the year 2018.

Solution:

Payout Ratio is calculated using the formula given below

Payout Ratio = Dividends Per Share / EPS

- Payout Ratio = $2.04 / $3.29

- Payout Ratio = 62%

Therefore, Walmart Inc.’s payout ratio was 62% for the year 2018.

Explanation

The formula for Payout Ratio can be calculated by using the following steps:

Step 1: Firstly, figure out the company’s net income during the given period from its income statement.

Step 2: Next, determine the total dividends paid for the period to the outstanding shareholders. It can also be taken from the income statement of the company.

Step 3: Finally, the payout ratio formula can be derived by dividing the total dividends paid to the shareholders (step 2) by the company’s net income (step 1), as shown below.

Payout Ratio = Total Dividends / Net Income

Step 4: Next, determine the number of outstanding shares available.

Step 5: Next, compute the EPS by dividing the net income by the number of outstanding shares.

EPS = Net Income / No. of Shares

Step 6: Next, compute the dividends per share by dividing the total dividends by the number of outstanding shares.

Dividends Per Share = Total Dividends / No. of Shares

Step 7: In this case, the formula for the payout ratio can be derived by dividing the dividends per share (step 6) by the EPS (step 5), as shown below.

Payout Ratio = Dividends Per Share / EPS.

Relevance and Use of Payout Ratio Formula

The concept of payout ratio is very important for both companies and investors. Some of the companies usually use a higher payout ratio to keep the investors interested, and it is decided based on the company’s growth strategy and liquidity position. The dividend payout ratio indicates a strong liquidity position. However, a too high payout ratio may be indicative of low investment in future growth. There are companies that believe in retaining back the earnings on the back of strong growth strategies.

On the other hand, there are certain investors who tend to value a dividend-paying stock more as compared to a non-dividend-paying stock. In fact, most investors are delighted when they receive dividends regularly as they see it as a steady source of cash flow. As such, the dividend makes the stocks more desirable among certain investor communities, which may eventually result in increased market value.

Payout Ratio Formula Calculator

You can use the following Calculator

| Total Dividends | |

| Net Income | |

| Payout Ratio | |

| Payout Ratio = | Total Dividends / Net Income |

| 0 / 0 = 0 |

Recommended Articles

This is a guide to the Payout Ratio Formula. Here we discuss how to calculate the Payout Ratio Formula along with practical examples. We also provide a Payout Ratio calculator with a downloadable excel template. You may also look at the following articles to learn more –