Updated July 24, 2023

Definition of Asset to Sales Ratio

An asset to Sales Ratio (ASR) implies how many assets a company has per unit of sales or revenues generated by it; therefore, it is the reciprocal of the Total Assets turnover ratio and falls in the category of activity ratio under various financial ratios and ratio analysis points of view.

Formula

The formula is given below:

Total assets can be found from the company’s balance sheet, while sales can be gathered from the income statement.

Explanation

The total asset turnover ratio is the ratio of sales to total assets, while the Asset to Sales Ratio is the reciprocal of the same. It is a measure of how efficiently the company is generating sales and whether or not it is operating on full capacity or there is a lot of idle capacity.

We can compare the ratio of a given company to that of the industry standards to see whether or not the company is overly invested in the assets and analyze the reasons for over or under-investment in CAPEX.

Example of Asset to Sales Ratio (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

There can be two ways of calculating the ratio. Either we can take the end of the year values or the average of the beginning and end of the year values. The first method is called the total method, while the latter is known as the average method. Using one method instead of others depends on what the guidelines of the financial standard suggest and on the company policy.

Let’s solve an example of either method to cement our understanding of the concept.

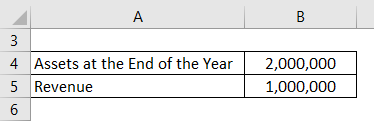

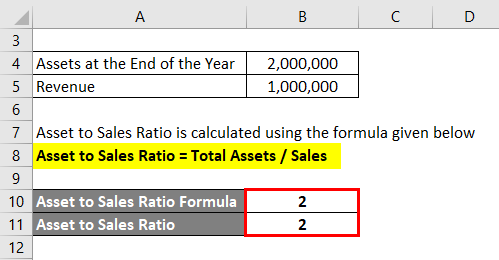

Example #1 – Total Method

Suppose the total assets at the end of the financial year 2018-19 is $2,000,000 and the revenue generated over this period is $1,000,000, then calculate the Ratio.

Solution:

Asset to Sales Ratio is calculated using the formula given below

Asset to Sales Ratio = Total Assets / Sales

- ASR = 2,000,000 / 1,000,000

- ASR = 2

So this implies that the company has twice the level of assets as compared to the number of revenues generated by the company.

Suppose if another company has a ratio of 1, we might want to analyze its assets and revenues to see why this is so. If the sales are the same and assets are half the first company’s level, then we can say that the competitor is more efficient; this might even be true if the sales are higher and the assets are at the same level. Therefore we need to understand where our company is lacking, whether on the sales front or on utilizing the assets front.

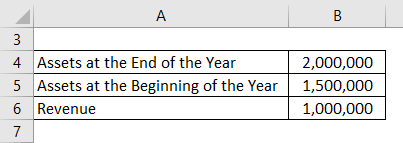

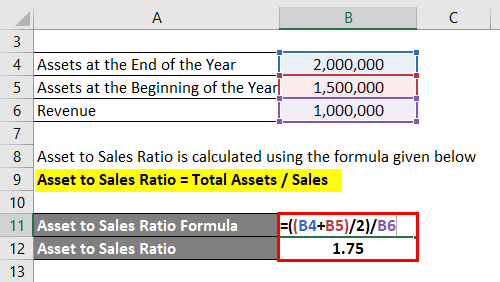

Example #2 – Average Method

Suppose the total assets at the beginning and end of the financial year 2018-19 were $1,500,000 and $2,000,000, respectively, and the revenue generated over this period is $1,000,000, then calculate the Asset to Sales Ratio.

Solution:

Asset to Sales Ratio is calculated using the formula given below

Asset to Sales Ratio = Total Assets / Sales

- ASR = ((2,000,000+1,500,000) / 2) / 1,000,000

- ASR = 1,750,000 / 1,000,000

- ASR = 1.75

So this method shows that the company is more efficient as compared to the total method. Therefore, while comparing two companies, we should be careful of the methodology used by both the companies while publishing their ratios or recalculate them ourselves before comparing.

Further, we should also have a closer look at what is being included or not included in the assets so that the numbers are not corrupt.

Importance of Asset to Sales Ratio

As compared to the Asset turnover ratio, the Asset to Sales Ratio is lesser used in the financial analysis process, but the rationale that goes into both these ratios is the same: how well a company can utilize its assets to generate sales. This is a measure of a company’s efficiency.

If the Asset to Sales Ratio is lower, it implies that the company is generating greater sales from the given amount of assets, so a lower ratio implies greater efficiency. However, we need to compare the same with industry best practices and analyze whether or not the revenue-generating resources are not getting overheated.

If this is the case, then the asset will get depreciated very quickly, and a quicker CapEX will be required. This might not be a sustainable approach; therefore, a deeper analysis is advocated by the qualitative aspects rather than the quantitative aspects.

Even so, the ratio leads its way to such an analysis.

Uses of Asset to Sales Ratio

The uses are given below:

1. Time Series Analysis

Comparing the Asset to Sales Ratio of a company over a period of, let’s say, 5 years will let us know how increasing capital investment has fared on the sales front. Recalling the concepts of economics, the production function initially increases at an increasing rate, then at a decreasing rate before reaching its maximum and then begins to fall. This happens alongside the process of increasing revenue-generating assets. By looking at the ratio, we can determine an efficient level of the asset beyond which adding more assets will actually lead to a decrease in the production of an increase in the idle capacity. Therefore, the ratio helps in determining an optimal level, assuming that the output level that the company produces is sold off.

2. Cross-Sectional Analysis

Comparing the Asset to Sales Ratio of a company to other players in the industry may tell how the company is performing compared to its competitors, whether it is more efficient or less and what it can do better to reach the industry average breach it. Financial ratios help the management or the strategy team in taking bigger decisions such as whether to increase investment in assets or what measures the company should take to improve its efficiency.

Conclusion

It is the reciprocal of the Assets turnover ratio, and therefore a lower ratio is better as it implies more sales are being generated with a given level of assets. The ratio can be helpful in both time series and cross-sectional analysis, which analyze how a company is performing over time or in comparison to its peer group.

Even though the ratio is less popular or less widely used, the information presented by it is no less than other activity ratios, and it can be highly useful for strategic decision making.

Recommended Articles

This is a guide to Asset to Sales Ratio. Here we discuss the importance of Asset to Sales Ratio along with respective examples; we also provide a downloadable excel template. You may also look at the following articles to learn more –