Updated July 21, 2023

What is Overcapitalization?

Overcapitalization is a situation faced by a company where it has raised a lot of capital but doesn’t have sufficient revenue-generating assets to justify such a large amount of funds raised by it and therefore the required return burden of such capital is way higher than the profits generated by the company, causing a drain on the amount of retained earnings and company’s long term existence.

Explanation

Initial Expectation of the company is of greater profits and therefore it raises a higher amount of debt capital, however, these expectations are either misplaced or the execution of the company is lacking, leading to lower than expected profits and thereby causing excessive interest burden and overcapitalization.

The company uses retained earnings to invest in growth prospects and if the amount of retained earnings is facing a setback due to excessive interest burden because of overcapitalization, the company will not able to come out of the low profitability situation until and unless it reduces its debt.

Examples of Overcapitalization (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

Example #1

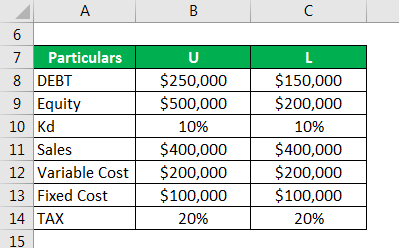

Suppose we are given the information about two companies in the same industry and conducting the same business of manufactured housing:

- We see both companies have the same EBIT but the debt of O is greater than that of R so interest expense is also higher.

- Higher interest expense causes lower EAT for O which means that it has lower earnings left for equity shareholders than R.

- Further, O has higher Equity also, which further lowers the ROE of O, therefore, O is suffering from overcapitalization because the same profit can be generated by R in much less capital.

- O needs to restructure capital to reduces excessive interest expense and boost equity.

Solution:

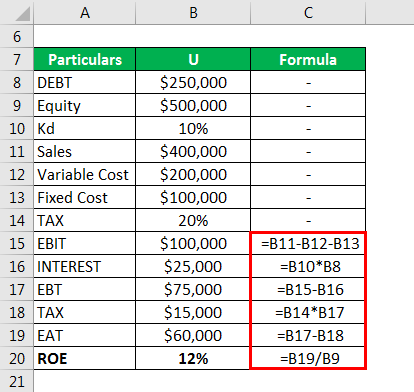

Company U is calculated as

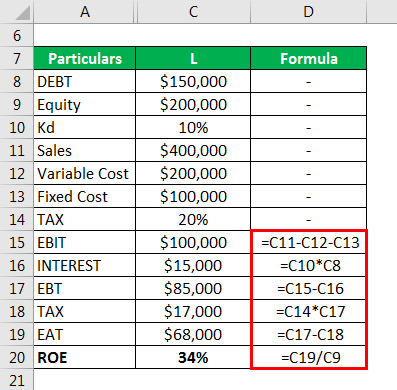

Company L is calculated as

Causes of Overcapitalization

- Overestimation: A company raises capital in expectation of future earnings when this expectation is misplaced, the company feels it needs to raise a greater amount of capital to fund such earnings. Therefore the company raises a greater amount of funds than required to generate an actual amount of profits.

- Timing Effect: When the company starts off in the period where the prices are very high, its estimation of cost of a revenue-generating asset is higher and therefore it raises more capital, however by the time the actual CAPex is required, the prices have reduced and the capital requirement has reduced.

- Estimation of Marketing Expense: Companies may feel that they need to access different marketing channels and make an assumption of the required funds, however, the actual promotion required while the capital raised for the same is way too much as compared to the requirement

- Unusually Lower Depreciation Rate: Overcapitalization also implies that the valuation of assets is higher than the intrinsic value of these assets. One of the reasons for the same could be charging unusually lower depreciation rate that would lead to depreciating lesser and thereby showing a higher value of assets

Effects of Overcapitalization

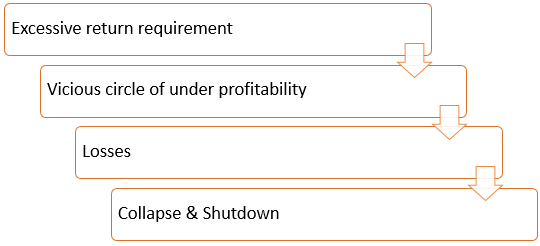

Below smart art shows a series of effects of overcapitalization:

- Interest Burden: If a lot of debt capital has been raised, then the interest burden is also very high because debt interest needs to be paid even if the company incurs losses, let alone only breaking even. Therefore the return requirement becomes excessive in comparison to the profits earned by the company.

- Vicious Circle of Under Profitability: Due to low profitability, the amount of dividend distribution is low because whatever little profits remain after paying off the interest liability goes to retained earnings. Even so the retained earnings accumulation is also not very high to invest in the available growth opportunities and therefore the company enters into the vicious circle of under profitability as without investing into growth opportunities it is unable to increase profitability and faces this same issue year after year.

- Losses: After being able to meet the interest burden for some years, the company enters into losses as the interest burden becomes unsustainable and this is when the company reaches its rock bottom

- Collapse & Shutdown: Ultimately after the assets are reduced to almost nothing the company collapses and goes bankrupt without having enough to pay off the debt, let alone paying anything to the equity shareholders and the only option left is to shut down the business.

Difference Between Overcapitalization and OverTrading

- Meaning: Overtrading is the excessive aggressive expansion of operations of the company without raising sufficient capital to sustain such expansions. Overcapitalization is the excessive capital raising, without having any good expansion, growth or scale-up plan

- Working capital: Overcapitalization leads to excessive availability of working capital while overtrading leads to the completely opposite situation.

- Impact: Overcapitalization can lead to the complete collapse of the company and its operations, overtrading would only lead to downsizing but not complete collapse or shutdown.

Advantages and Disadvantages

Below are the advantages and disadvantages of the same:

Advantages

- Investment capital: If the company is prudent it can invest the capital and earn the return at least as much as to cover the return requirement if not greater than that. This can help the company in breaking the vicious circle of unsustainable returns so that it can steer itself to a growth trajectory.

- Flexibility: Excess capital gives the company immediate funding for CAPex when required and thereby not delay such investment and help the company in catering to urgent requirements of changing markets such as the production of an improved product, requiring advanced plant and machinery.

Disadvantages

- Unsustainable: Interest burden increases beyond the sustainable levels leading to excessive losses, collapse, bankruptcy or shutdown and investors losing a lot of their invested money as in most cases the amount of money available for paying off the interest burden is not sufficient, let alone leaving anything for the equity shareholders

- Declining ROE: Due to excessive interest, the amount of net income available for equity investors is very low leading to very low return on equity and forcing the investors to sell their shares as and when possible and in turn leading to falling market prices.

- Triggers Accounting Fraud: Too much pressure to maintain the market value leads to company cooking up the books of accounts by undertaking accounting malpractices such as recognizing excessive revenues than warranted or, taking a lot of liabilities off the balance sheet through SPVs. However, these may cause some short term relief but the company lacking substance ultimately falls apart.

- Bubble in Valuation: Accounting malpractices make the financials look a lot better than they actually are and this leads to a surge in the security prices, however, this is only a bubble as the intrinsic value of the company is much lower and when such bubble bursts, it causes huge losses in shareholder’s wealth

- Need to Refinance: When the interest rate in the market is lower, it is beneficial to raise capital but if there is overcapitalization, the company loses the opportunity of raising it at a cheaper interest rate or get stuck with paying higher interest rate until and unless it refinances the capital.

Conclusion

Overcapitalization is the practice of raising too much capital than required to produce the level of profit that the company is producing currently and also unjustified with the current level of revenue-generating assets and future expansion plans. This causes a high cost of the capital burden when such capital is raised through debt and even when raised through equity, it causes a fall in investor confidence if the return on equity is consistently low.

Restructuring excess capital is a prudent approach if the company has to sustain over a long term so that it doesn’t get stuck in the vicious circle of under profiting and reduce the chances of getting bankrupt, shutting down or losing investor faith and money.

Recommended Articles

This is a guide to the Overcapitalization. Here we discuss the explanation of overcapitalization along with practical examples. We also provide a downloadable excel template. You may also look at the following articles to learn more –