Updated July 21, 2023

Introduction to Transfer Price

It is the price or the consideration exchanged between the related parties belonging to the same parent (unit, division, subsidiary, associate, or affiliate) established in different countries.

The primary purpose of undertaking transfer pricing transactions is to avail of the benefits associated with the entities shown in tax havens or no-tax countries.

Explanation

Transfer pricing is significant from both performance and tax perspectives.

- Management evaluates the performance of the department or unit with the other branches of the organization, which would require transfer pricing.

- Income Tax Department would require that tax be paid on the assessee’s actual income and not on manipulated prices.

The primary foundation of TP is the Arm’s Length Principle (ALP).

ALP means that prices, royalties, or other fees charged by the associated enterprises (related parties) between themselves should be the same as those of the independent parties.

Purpose of Transfer Price

As the pricing is set between the related parties, there are high chances of profit getting shifted to the entities established in tax haven countries from the increased tax nation establishments, resulting in a moving of the profits plus a reduction in the company’s tax liability as a whole.

Before Transfer Pricing norms, entities used to undertake such transactions with the motive of tax evasion, which resulted in the loss to the nation manufacturing goods. TP norms have been introduced to prevent this, which discusses ALP and unrelated parties.

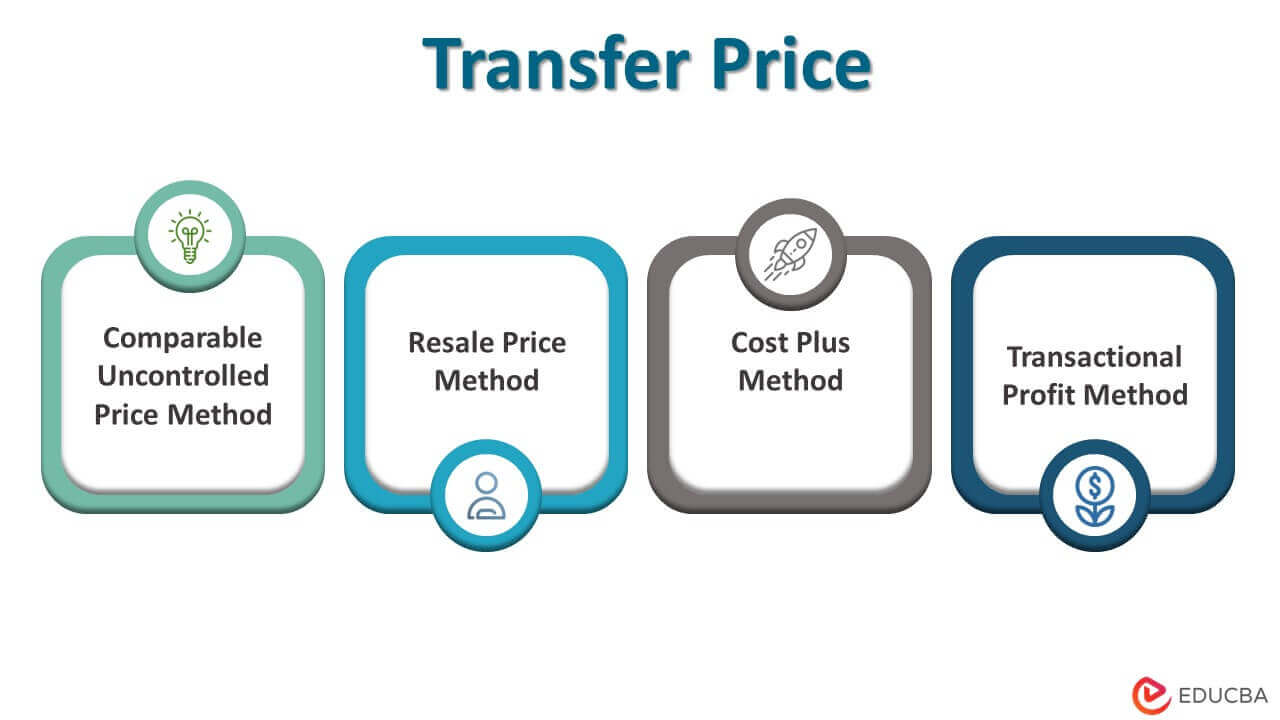

Methods of Transfer Price

Organization for Economic Co-operation and Development (OECD) has framed the following main TP methods, which can be used by the organization depending upon their business deals.

1. Comparable Uncontrolled Price Method (CUP): As the name suggests, the price that should be charged in the uncontrolled transaction is compared with the actual fee charged for arriving at the ALP.

2. Resale Price Method: This method focuses on the price of a product that an associated enterprise would charge to an unrelated party, which would help to determine an arm’s length gross margin. The residual would be considered the ALP and would be compared to the pricing charged by the related parties.

3. Cost Plus Method: This method is primarily used for manufacturing concerns, wherein the cost incurred by the seller-associated enterprise is considered. Then, a reasonable markup on the price is added to derive the ALP.

4. Transactional Profit Method: This is different from the above methods because the analysis is based on the net returns earned by the comparable companies engaged in the particular line of business.

There are two categories through which one can use this method –

- Transaction Net Margin Method (TNMM)

- Profit Split Method (PSM)

Example of Transfer Price

A software technology service provider company based out of the US, with operations in Canada and India, intends to outsource the client support functions to its subsidiaries in the respective countries.

Now the company needs to plan its strategy in sucsoit results in tax savings and ultimately brings profits to the company. In India, taxes are lower, and labor is less expensive.

In the absence of transfer pricing norms, the company would pay the Indian counterpart an arbitrary price, resulting in a loss in the revenue of the US Tax Department.

But due to TP norms, the company now needs to determine the ALP and compute its income tax liability.

Why is Transfer Price Important?

Following are the importance given below:

- For Companies: Non-compliance with the legal provisions can result in high penal consequences, which is unsuitable for the entity in terms of finance and reputation.

- For Tax Authorities: This will help them assess the transactions fairly and equitably, leading to increased company compliance.

- For Investors: When the dealings are occurring as per the laws, it boosts the investors’ confidence that the company is ethically strong, and they can look at it as their prospective investment.

Transfer Pricing vs Standard Cost

|

Basis of Comparison |

Transfer Pricing |

Standard Cost |

| Meaning | The price that has been charged from one unit by another. | The budgeted cost is being planned when framing the company’s budget. |

| Type | It is the actual cost that is being incurred. | It is the notional cost. |

| Reporting | They appear in the financial statements which are presented to the investors. | They appear in the budgeted financial statements, which are presented to the management only. |

Benefits

Some of the Benefits are given below:

- Safeguarding from High Litigation Expenses: Complying with the TP laws would help the company to avoid litigation with the income tax departments.

- Simplifying the Transactions: Accounting the transactions that would have occurred with the independent seller/buyer saves the company from extra efforts on how to avoid taxes.

Limitations

- Separate Department: For TP, the entity needs experts and a different budget to comply with the laws properly. The cost incurred for this would be huge, and the company has no option, even if the price due to this department is more than the benefits that arise due to this.

- Disputes: There are five methods of determining Transfer Pricing, and there can be disagreement between the company units on which way to choose to comply with the norms.

Conclusion

Transfer Pricing was introduced to curb the unhealthy practices that arose due to evasive tax practices being followed by the MNCs. Since its introduction, there have been remarkable changes in the world, but still today, it is not away from debates and ambiguity. The ambiguity around us would be resolved as a result of the changes taking place.

Recommended Articles

This is a guide to Transfer Price. Here we discuss the introduction to Transfer Price along with the methods, benefits, and limitations of TP. You may also look at the following articles to learn more –