Updated July 21, 2023

Definition of Debt Coverage Ratio

Debt Coverage Ratio can be defined as a ratio that is calculated in order to measure the ability of an organization in clearing off all the debt obligations on time, or in other words, it is the comparison of a company’s level of cash inflows to its current total debt obligations and it is calculated by dividing the net operating profits earned by an organization during the year by its annual debt obligations.

DCR also known as the debt service coverage ratio is an important ratio as it helps the lenders in determining the credibility of a borrower. It helps the lenders to evaluate whether a borrower must be granted a loan or not and if it is feasible to grant the loan to the borrower then what must be the amount of loan to be approved along with the terms of financing of the same.

Formula to Calculate the Debt Coverage Ratio

The formula used for calculating the DCR is as follows:

Where,

Net operating Income is the income of the company which is derived by subtracting the company’s operating expense from its gross profit or the same can also be derived by adding the interest expenses, non-cash expenses, and the tax amount with the net income of the company.

Debt service is the amount of debt obligations of the company which is due within one year period and generally includes interest amount, principal amount, sinking-fund amount, and lease payments amount. Typically, debt service will be located below operating income.

Example of Debt Coverage Ratio (With Excel Template)

Let’s take an example to understand the calculation of DCR in a better manner.

Example #1

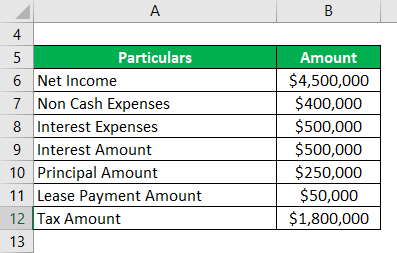

BC Company showed a net income of $4,500,000. For the period, the interest expenses of the company is $500,000, non-cash expenses is $400,000, principle repayments amount is $250,000, tax amount is $1,800,000 and the lease repayments amount is $50,000 Calculate the debt service coverage ratio of the company for the year using the information given.

Solution:

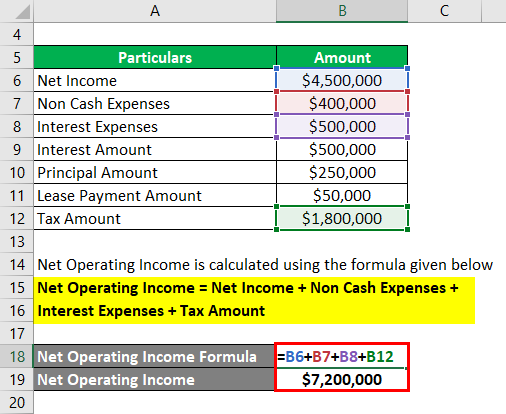

Net Operating Income is calculated using the formula given below

Net Operating Income = Net Income + Non Cash Expenses + Interest Expenses + Tax Amount

- Operating Income = $4,500,000 + $400,000 + $500,000 + $1,800,000

- Operating Income = $7,200,000

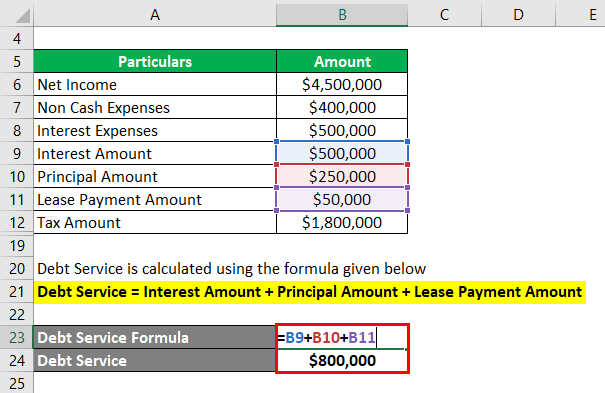

Debt Service is calculated using the formula given below

Debt Service = Interest Amount + Principal Amount + Lease Payment Amount

- Debt Service = $500,000 + $250,000 + $50,000

- Debt Service = $800,000

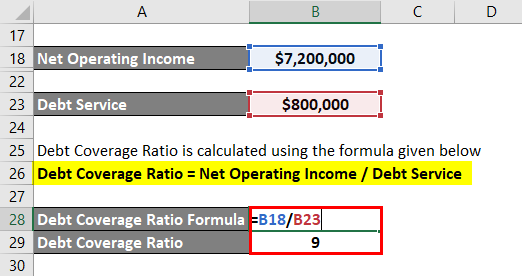

DCR is calculated using the formula given below

Debt Coverage Ratio = Net Operating Income / Debt Service

- DCR = $7,200,000 / $800,000

- DCR = 9

Hence, DCR for ABC Company as calculated above is 9 times. In this case, since the debt service coverage ratio of the company is greater than 1, it shows that the company is having the cash equivalent to the 9 times of the amount which is required in order to meet its debt obligations that is due.

Use and Importance of DCR

Debt service coverage ratio is of great use and carries huge importance on account of the fact that it is one of the financial ratios that enables the lenders to assess the eligibility of a borrower while granting the loan. It allows the users to assess that whether the particular borrower to whom the loan is to be granted will be capable of paying off the loan along with the interest in the future due date or not and such an analysis is made on the basis of the borrower’s current financial standing.

Difference Between Debt Coverage Ratio and Interest Coverage Ratio

Both the DCR and interest coverage ratio differ from each other on the different parameters.

- Interest coverage ratio is less comprehensive in nature whereas the DCR is more comprehensive in nature.

- The interest coverage ratio is used to measure the total amount of an organization’s equity in comparison to the total amount of interest that it is required to pay on all its debt obligations during a particular period of time. On the other hand, the debt service coverage ratio can be defined as a metric that is used to assess the ability of the borrower in paying off his or her debt obligations that includes the principal amount and the interest accrued during a particular period of time.

Benefits of DCR

Some of the benefits of the DCR are given as below:

- The Debt Coverage Ratio allows the lenders to assess the capability of a borrower in paying off the loan amount on the due time, that includes the principal as well as the interest accrued on the same and accordingly make a well informed decision of granting the loan to him/ her or not.

- It saves the lenders from granting loans to such borrowers that are not capable of repaying the loan back as the lender can check the repaying capacity of the borrower before granting any such loan to him.

Conclusion

Debt service coverage ratio considers all the expenses that are related to the debts that includes interest expenses, principal amount, sinking-fund amount, lease payments amount and such other obligations. The DCR indicates the ability of a borrower in paying off his or her debt obligations during a given time period. A ratio of DSCR over 1 is considered as good and more than 1 is considered desirable. The DCR of less than 1 signifies a negative cash flow.

Recommended Articles

This is a guide to Debt Coverage Ratio. Here we discuss the definition and importance of the debt coverage ratios along with the example. You may also look at the following articles to learn more –