Updated July 21, 2023

Introduction to Merger and Acquisition Process

Merger & Acquisition Process is a technique through which business combinations take place wherein one or more business entities come together to either become one larger entity or also dissolve and form a completely new entity and perform other such combination variations to achieve a certain synergy or benefit from the expertise of each other.

Explanation of Merger and Acquisition Process

The process can start from a business entity or from an investment advisory firm and involves end-to-end activities of finding the right investor and investee, conducting industry and company analysis, calculating the offer price number, and finally striking the deal.

Therefore there are several pre and post-M&A activities that are conducted as part of the entire process and it is not a single step or a quick process, at times, striking a deal can take days, months, or even years to finalize.

There can be two starting points for the origination of an M&A transaction, either it can originate from the buy side or those companies that want to acquire other companies. These may approach an intermediary to find them a good investment opportunity. Or it can originate from the sell side which includes smaller companies, which wish to be acquired or merged into a bigger company. Each of these ultimately approaches an intermediary who then formulates the strategy.

Steps in Merger and Acquisition Process

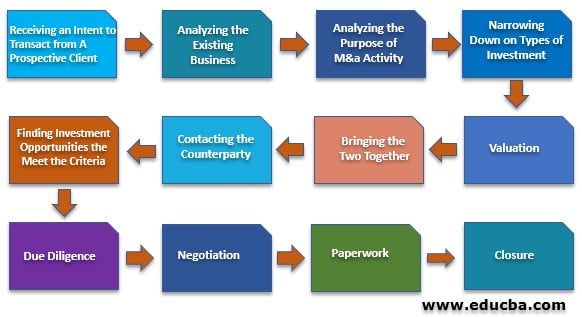

Below smart art shows a simplistic M&A process flow for idea purposes, the actual process may vary from one deal to another and therefore there is no standard process:

- Receiving an Intent to Transact from A Prospective Client: This is a two-way process. Either the buy side client may approach the advisory to find out the available investment opportunities, or the sell side may approach to find out buyers for its business. Once the requirement is established, the following steps are undertaken.

- Analyzing the Existing Business: The advisory firm will understand the industries or sectors the client is in and conduct a company and industry analysis. After which it will find out the areas of improvement and suggest the same to the client. If it is a buy side client, this analysis should present possible ways of finding appropriate targets, while if it is a sell side client, then finding a suitable buyer.

- Analyzing the Purpose of M&a Activity: After conducting the analysis of the existing business and the present and future economic scenario, the advisory firm determines a few scenarios of M&A with each scenario having a specific purpose, such as diversification, expansion, synergies, strategic investment or a financial investment, among others. These scenarios are presented to the client who conveys his inclination towards some of these for the advisory to take it forward from there.

- Narrowing Down on Types of Investment: Once the scenarios are narrowed down, the advisory begins its search of appropriate sectors to look into and also the types of suitable investment opportunity. For example if the purpose is diversification then the sectors to look for will be those other than the sectors in which the client is already having a stake while if the purpose is forward integration then the advisor needs to look at sectors which form part of the supply chain of the client’s business.

- Finding Investment Opportunities the Meet the Criteria: Selection criterion is defined in the previous step and then the suitable candidates are searched for. A list of possible opportunities is formulated and ways to invest in these is determined. This is then presented to the client along with their financials, growth perspective, appropriateness etc. Client then expresses his desires and those opportunities that both mutually agree upon are contacted.

- Contacting the Counterparty: Each of the shortlisted investment opportunities is contacted by the advisory. Out of these, some opportunities give a positive response while others give a negative response. Those responding positively are pitched the idea in the same manner it was pitched to the client.

- Bringing the Two Together: Once the counterparties are satisfied they are brought together by the advisory for discussion and interaction. This is the step where the counterparties meet for the first time. Even out of those who responded positively in the last step, after meeting the counterparty, some might feel otherwise and might back out. So this is a second screening process.

- Valuation: After the second screening, valuation of the target begins. The advisory conducts it on behalf of its own client and the counterparty appoints its own advisory to do the same for them without any bias.

- Due Diligence: Both the advisories conduct due diligence on each of the parties to verify the financials and growth prospects. This is very important because till now only public information was analysed, while in this step the private information is analysed too.

- Negotiation: Each party comes up with the valuation figures and they negotiate and come up with the final number, if it is higher than the FMV of the assets, it leads to goodwill while otherwise it is a bargain purchase

- Paperwork: This is the penultimate step wherein the forma agreement is drafted and signed and legal formalities are completed to make it a binding contract on both the parties.

- Closure: The payment exchanges hands, the advisories receive their fees and commissions and both the counterparties complete their end of the bargain.

Benefits

The following are the benefits are:

- Structured Approach: It is a stepwise approach and therefore at every step there are several evaluation checkpoints which keep the analysis on track.

- End to end Approach: The advisory helps the counterparties from start till the closure step and therefore the counterparties have experts advising them. This doesn’t imply that this is the only correct approach but it helps in minimizing the error and therefore it is more popular than partial processes.

- Due Diligence: This is one of the most important steps, the counterparties might not possess the skills to analyse all public and private information and therefore this helps them in being doubly sure of the transaction.

Disadvantages

Following are the disadvantages are:

- Costly: This process requires a lot of amount to be spent in the form of fee of the advisory. Therefore it might not always be possible for sell side companies to seek such advisory help because these are generally small companies and therefore the process might most commonly originate from the buy side clients.

- Time Consuming: This process requires a lot of time for completing each and every step and during this time some of the economic factors might change and the analysis might get dated leading to a waste of all the prior effort. Therefore the process is not appropriate in unstable economic conditions.

Conclusion

So we understand that the M&A process is a well rounded approach where in the buy side or the sell side party approaches the investment advisory, who tries to understand the need of the client and then finds the appropriate counterparty and helps in the process of M&A by conducting valuation and due diligence and also helps in the formalizing and closure of the deal.

Although it is a popular procedure, it is also costly and time consuming so this trade off remains that whether the money and time invested in the process is worth it or not and the client needs to be prepared for the failure of the process and therefore most times the fee structure is phase wise in the best interest of the client and the advisory.

Recommended Articles

This is a guide to Merger and Acquisition Process. Here we also discuss the introduction and steps in merger and acquisition process along with benefits and disadvantages. You may also have a look at the following articles to learn more –