Updated July 21, 2023

Excel Accounting Templates (Table of Contents)

Introduction to Accounting Templates in Excel

Excel as spreadsheet software allows finance and accounting department personnel to maintain the records nicely. In accounting various types of statements have to be kept like balance sheets, payment statements, etc.

Often, most organizations use Excel to build a template for these statements. Having templates proves useful as new users have the templates at their disposal without having to worry about creating new ones.

Key Aspect

- Every company has its own format for accounting documents based on its formatting norm and standards, but the document must be based on the standard accounting principles and guidelines followed in the country.

- The accounting documents must be updated from time to time based on the changes that take place in the accounting standards and norms.

Useful Accounting Template in Excel

Further, you will find the most comprehensive list of Excel templates used for accounting.

1. Templates for Accounting in Excel

There are various accounting documents, amongst which the important ones are Balance Sheet, Accounting Journal, Accounts Payable, Accounts Receivable, Income Statement, and Trial Balance. We shall see how the template for each of them exists in Excel. Let’s go through the following section.

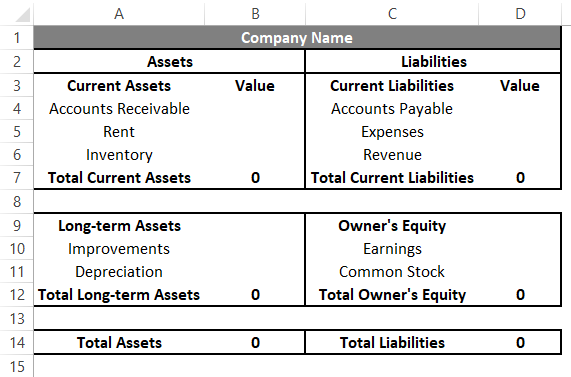

2. Template for Balance Sheet

A balance sheet is a very crucial and the most important part of accounting. It balances the assets with liabilities and gives a quick insight into which element goes into which section. There are two important components here which are Assets and Liabilities. Let’s go through the following screenshot that shows the template of the balance sheet that we created in Excel. Note, for total figures i.e. Total Current Assets, etc. we have set the formulae.

The Balance sheet can contain many elements but is essentially under two sections as described earlier. At the top, we have a company name followed by a balance sheet for a particular year and month. These things must be specified. As can be seen below, the template that we created clearly distinguishes between assets and liabilities. Go through each of the components of the balance sheet one by one, first of assets and liabilities. Note, any sort of depreciation will be subtracted in the assets section. Finally, when all the calculation is done properly, the assets and liabilities figures must match.

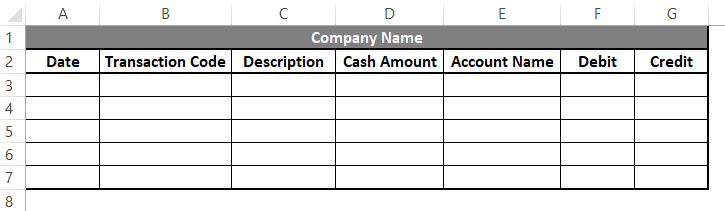

3. Template for Accounting Journal

Accounting journal records all the transactions that take place in a company. These are important statements as they allow a user to quickly have a look into how transactions happened during a particular period. The most important part of any accounting journal is debit and credit by account name, rest the details can be added as needed. We have created a template for accounting journals in Excel. Let’s have a look at the template as shown by the below screenshot.

As we can see above, we have a company name at the top. Now, we have data-wise transactions as we can see in the screenshot. To identify each transaction, we have a transaction code. The description tells us what kind of transaction it is, e.g. Purchase of Sales transaction, etc. Then we have mandatory details which are amount, account name, and debit, and credit details.

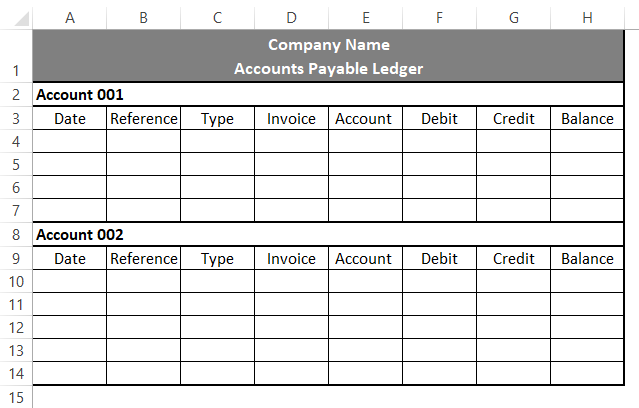

4. Template for Accounts Payable

Accounts payable is money that a company has to pay to its vendors. The accounts payable ledger captures all such dues to be paid. It is another important document in accounting as it tells the accounting staff about the current payable situation. We have created a template for accounts payable in excel as shown by the following screenshot. Observe the screenshot and go through each of the components of the accounts payable statement.

As we can see going through the above accounts payable ledger template, we find that account-wise details are kept. We should have the details based on the dates. Reference means any sort of accounting reference. Type refers to account type i.e. purchases or payment. In the invoice, we must specify the invoice details. In Account, we shall specify the details pertaining to the purpose, e.g. 50 Computers for office use, cash in the bank, etc. Then have debit and credit in which the amount must be specified based on the nature of transactions. Finally, we have a Balance column that tells us how much balance for an account is to be paid.

5. Template for Accounts Receivable

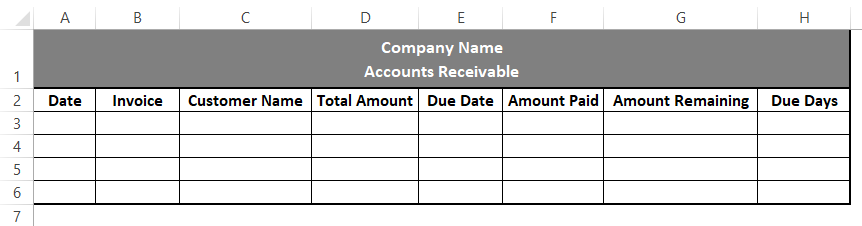

Accounts Receivable refers to the money which the company is expected to receive from stakeholders who have used a company’s service or goods. A company may provide its goods or services for use and then wait for the payment. Such types of entries go into Accounts Receivable. We have created a template for accounts receivable in Excel which is as shown by the following screenshot. Go through each of the components of it.

As we can see in the above screenshot, the transactions are kept date-wise. Invoice means the particular invoice number. Customer details are captured in the customer name column. Total amount refers to the total amount which a particular customer is expected to pay before a particular due date indicated by Due Date column, and the days in which the amount should be paid are captured in the Due Days column on the very right-hand side of the template. The Amount Paid and Amount Remaining sections give us a clear picture of how much amount is still left to be paid to the company from a customer.

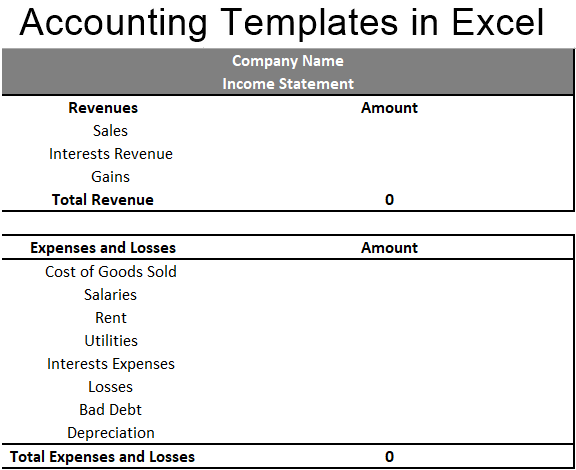

6. Template for Income Statement

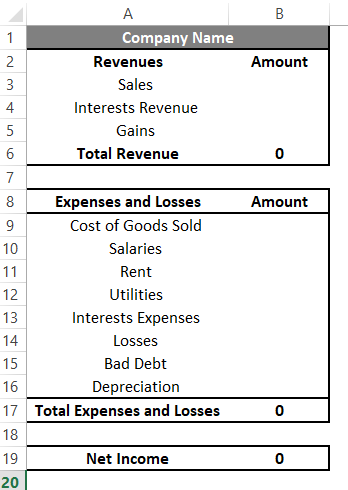

For any company income statement is a very important accounting document. It shows the financial performance of the company in terms of profit and loss. Like all other accounting statements, it is also made for a particular period and essentially shows how the organization performed during that period. We created a template in Excel for the income statement as shown below. Go through each of its elements and study them properly.

Going through the template, we can see that revenues, and expenses and losses have been specified separately. There are various elements in each of these two sections. Finally, to get net income we will subtract total expenses and losses from total revenue.

7. Template for Trial Balance

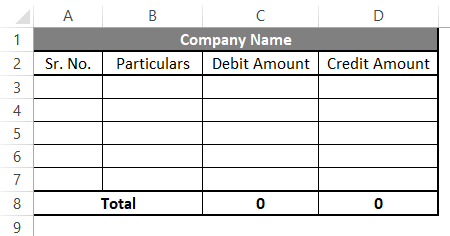

Trial Balance is an accounting document that keeps the details pertaining to balances in each of the general ledger accounts of a company. The following screenshot shows the template for Trial Balance.

As we can see above, trial balance captures particular wise debit and credit entries.

Recommended Articles

This has been a guide to Accounting Templates in Excel. Here we discuss How to use Accounting Templates in Excel along with practical examples and downloadable excel template. You can also go through our other suggested articles –