Updated October 27, 2023

Asset Allocation and Security Selection

Diversifying is the key to successful investing. Allocating investments across different asset classes helps to minimize risks and increase gains. If you think of dividing your investment portfolio across numerous asset classes, you have just used the asset allocation strategy. Dividing an investment portfolio across asset classes such as bonds, stocks, and money market securities can help multiply profits, and using the right asset mix can help you maintain it.

Asset Allocation: Putting Eggs In More than One Basket

Within asset allocation, there are three basic options, namely bonds, stocks, and cash. Inside these classes come the sub-classes or other categories.

Asset Allocation: Many Options, Rich Dividends

For instance, stocks are divided into large, medium, and small-cap, representing the shares issued by companies with varying market capitalization. On the other hand, if you think of foreign companies and assets issued by them on the listed foreign exchange, these are international securities.

While stocks help diversify within your country, international securities enable investors to expand beyond their country. The downside? There is always a risk a government may fail to honor its financial commitments.

If a risk is high, rewards are still higher. It holds for trading securities in emerging markets representing those issued from financial markets of developing economies.

But for every reward, the risk does not lessen. Factors like less liquidity, high country risk, and the possibility of political insecurity plague market trading in such securities.

If security is what you seek, asset allocation should be geared towards fixed-income securities. Debt securities that yield fixed interest and return of principal comprise the fixed income asset classes.

Fixed income securities are less volatile than equities due to the steady and stable income they generate. Financial instability can only arise from fixed income securities when there is a risk of default. Examples of fixed income securities include government bonds.

Money market securities are debt securities with a maturity of less than one year. They may score lower on profits, but they are high on liquidity. These types of bills also include the Tor treasury bills.

Real estate investment trusts are yet another asset class. They differ from equities in that the underlying asset revolves around a pool of properties and mortgages rather than part of company ownership.

Asset Allocation: The Golden Rule

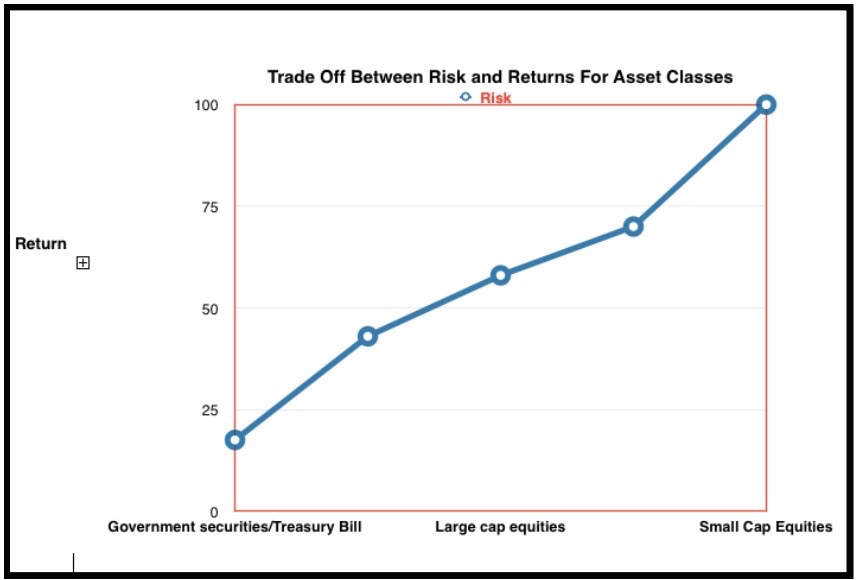

Asset allocation should lower risk and increase returns. Maximizing gains and minimizing risk is the main rule here. Risks and potentials of some popular asset classes are assessed below:

While equities have the highest return, they also carry maximum risks. T-bills have the lowest chance as governments back them but also provide low potential returns.

High-risk tolerance and a longer time horizon to gain on losses predict which side of the risk-return trade-off you will be on. Always remember that potential returns rise with increasing risk.

Diversification is the way out. Why? Simply because different asset classes have other risks and market fluctuations. An efficient asset allocation strategy safeguards against the see-sawing of values seen with a single type of security.

To be a world class investor, you must give up old school investment and turn to diversification. It involves maintaining an even keel whereby part of your portfolio may be in choppy waters given high volatility, but another component is steady.

Due to this reason, asset allocation and consequent diversification is the key to lasting success in the markets.

Each asset class has varying levels of return and risk. How do you go about getting the most balanced portfolio? Factors to consider are as follows:

- Risk tolerance: Capacity to bear losses and tolerate risks

- Investment objectives: Growth versus stability or quick returns versus steady returns

- Time horizon: This can vary from long to medium and short

- Available capital: You can only drive the car based on how much fuel you have. Public money serves as an engine for driving growth through various investment vehicles.

High risk, high returns options: For this purpose, investors must have a long time horizon and large sums to invest

Low risk, low return allocations: These are perfect for investors dealing within a shorter period and smaller sums

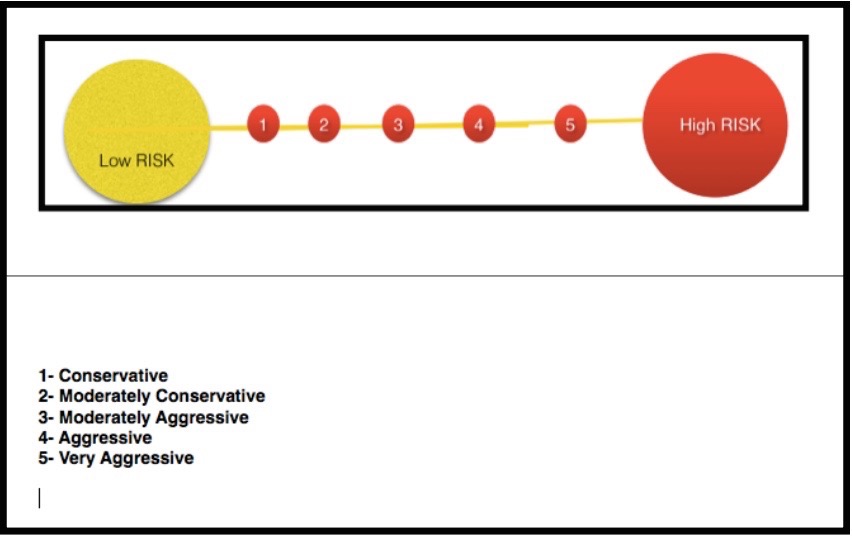

Portfolios are ranked based on how conservative or aggressive they are and as high or low risk.

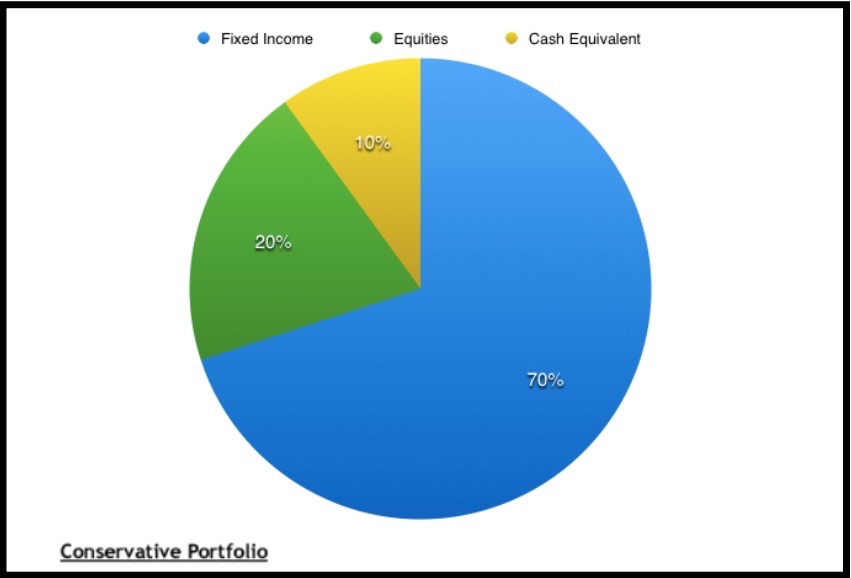

Preserving the Capital: Conservative Portfolio

This portfolio allocates a massive percentage of the total portfolio to low-risk securities. It includes T-bills, government bonds, and fixed income securities.

This type of portfolio is also called a “capital preservation portfolios.” The goal is to avoid buckling the trend but to go along.

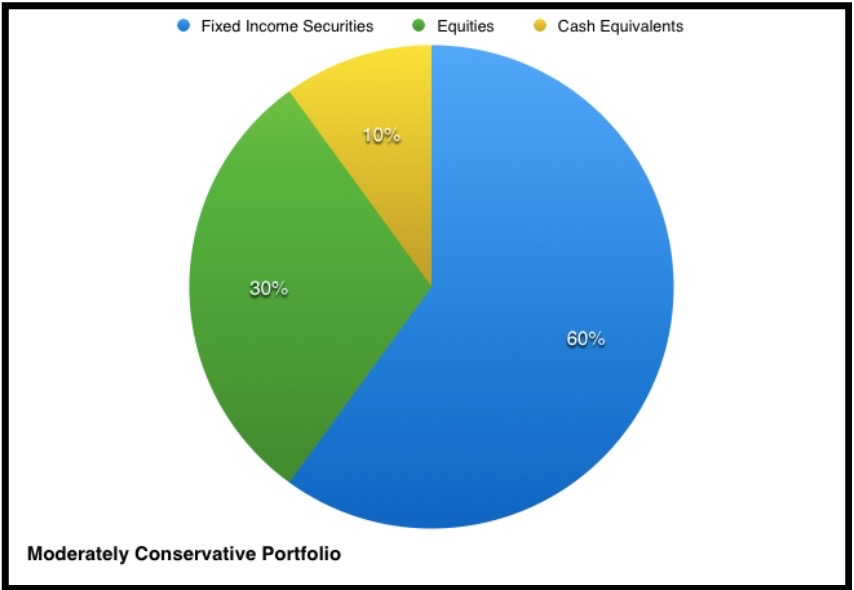

Playing with Risk: Moderately Conservative Portfolio

With this type of portfolio, capital preservation is merging with a larger appetite for risk, so securities with high dividends and coupon payments are definitely on the table. A strategy associated with this portfolio is “current income.”

Balancing the Risk: Moderately Aggressive Portfolio

This is called a “balanced portfolio” since equal money is invested in equities and fixed income securities to get the best income and growth. It carries a higher level of risk and is for investors with a longer time horizon.

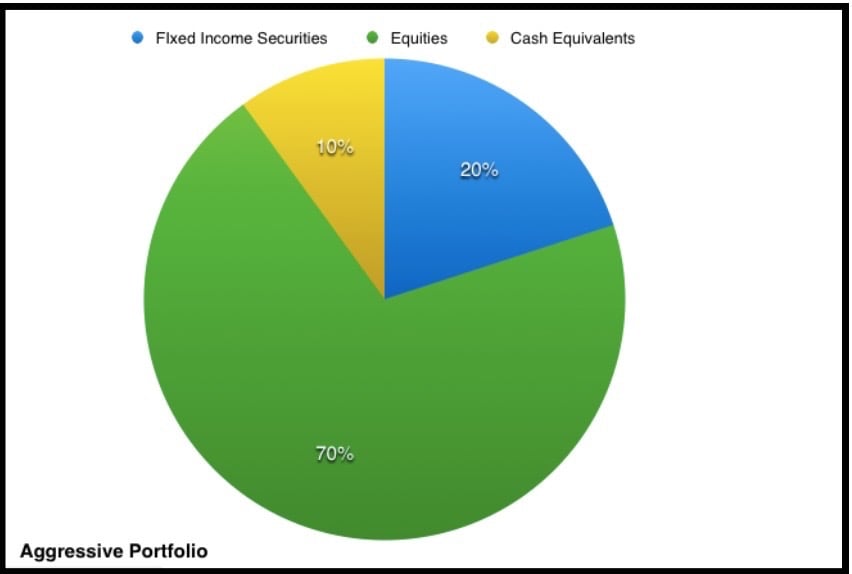

Capitalizing on Risk: Aggressive Portfolio

This refers to a portfolio where investment in equities is higher than fixed income. Investors with a very long time horizon opt for this approach as a meaningful goal is long-term capital growth. This is why an aggressive portfolio follows a “capital growth strategy”.

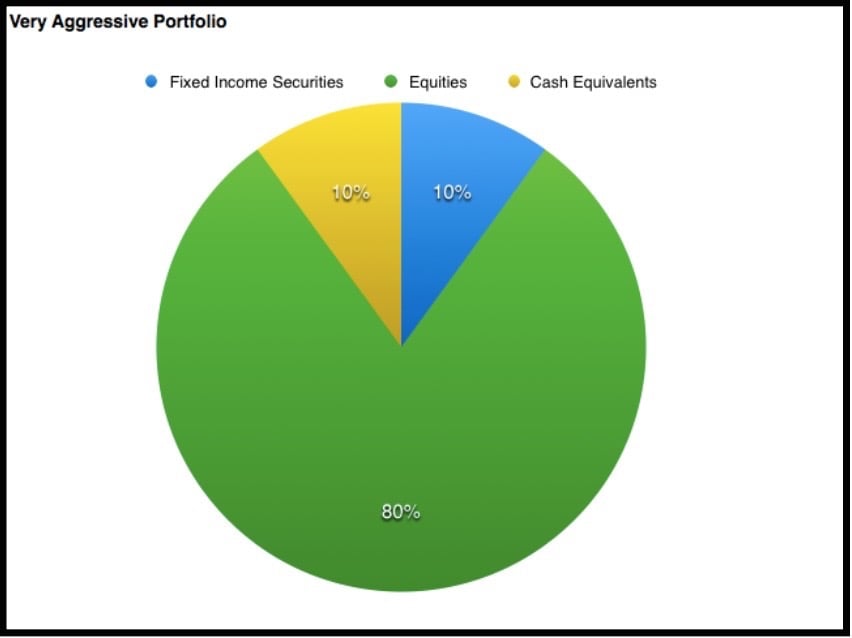

Encashing on Risk: Very Aggressive Portfolio

This comprises entirely equities with little investment in fixed income securities or cash equivalents. Aggressive capital growth over a long-term horizon is the goal here, and the risk is massive.

Choosing the right asset allocation strategy depends on future needs for capital and the category to which an investor belongs. The amount of cash equivalents relies on the extent of liquidity required.

Several asset allocation strategies and their foals depend on the investor’s time frame, goals, capital, and risk tolerance. Asset allocation strategies include constant weighing, systemic asset allocation, and strategic vs tactical asset allocation.

After selecting the asset allocation strategy, it is necessary to conduct reviews as the value of various assets changes. Asset allocation models maximize profits and lower risk. Asset allocation models should be accompanied by reverencing or selling portions of the portfolio that rose significantly and, through these, purchasing additional units of assets that have declined somewhat or increased at a lesser rate.

Different Asset Allocation Strategies: The Right Asset Mix

An appropriate asset mix is a matter of assessing overall risk and return. Depending upon the goals and appetite for risk, a certain strategy may be up for grabs.

Asset Allocation Strategy: Buy and Hold Strategy

This asset allocation method sticks to a base policy mix, a combination of assets in a proportion associated with expected rates of return. For example, if stocks returned 5% per year and bonds returned 10%, a 50% mix would yield 7.5% annual returns.

Constant-Weighting Asset Allocation Strategy: Re-balancing the Portfolio

A constant weighting approach to asset allocation involves regular re-balancing of the portfolio. It is completely against a buy and holds strategy characteristic of asset allocation.

With this approach, falling asset values are more frequently chosen, while more assets go on sale as asset values rise. A portfolio should be re-balanced to the original mix when the asset class moves 5% from the actual values.

Tactical Asset Allocation Strategy: Deviations from the Mix

This asset allocation strategy can become rigid over the long term. It is a moderately active strategy, so the portfolio may be adjusted to the short time and then re-balanced to the long-term asset position. Short-term tactical deviations are needed to capitalize on investment and growth opportunities.

Dynamic Asset Allocation Strategy: Adjusting the Mix

In this active asset allocation strategy, investors adjust the mix depending on the state of the market and the economy. Selling assets that are declining and purchasing assets that are increasing make this the exact opposite of the constant weighting strategy.

In this asset allocation strategy, whether the bull or bear market determines your plan rather than being caught in a herd or group mentality.

Insured Asset Allocation Strategy: Adjusting the Portfolio

Active management is resorted to as long as the portfolio receives a return above its base. There is a base value below which the portfolio must not fall. If it does, investing in risk-free assets fixes the base value.

An insured asset allocation strategy is a great strategy for getting fixed returns. It is like an economic insurance policy.

Integrated Asset Allocation Strategy: Mixing All Strategies

This asset allocation strategy includes aspects of all methods with the added advantage of factoring in future market returns. Economic expectations and risk are crucial determinants of design here. Dynamic or constant weighted allocation is this approach’s two most frequently blended strategies.

Avoiding Frauds: Lessons for Investors

In one of the largest Ponzi schemes in the history of the finance world, Bernie Madoff defrauded his clients to the tune of USD 50 billion. Closer home, investors faced the music when Harshad Mehta made off with their hard earned money.

Financial fraud has always plagued the money management industry. So, how can you ensure you do not take the bait? If getting hooked on too good to be true returns is a habit, read on to learn how to avoid investment fraud.

How to Avoid Falling Prey to Scammers

Smooth investment returns could be a warning signal. It should set the alarm bells ringing if the markets are volatile. Consider steady returns in periods of abnormally high fluctuations your wake-up call.

Checking up on References

Due diligence and doing your homework help pass the test and prevent fraud. Another important investor tip to avoid getting defrauded is to engage in reference checks while entering any business partnership. Regulatory bodies frequently contain information about the investment manager as well. It can be a good place to start your research.

Utilize Outside Financial Firms

Many fraudsters operate as their broker-dealers to avoid leaking important information to clients. Outside financial firms can serve as custodians of public interest within investment transactions. Clients can also verify the nature of asset levels and returns using the services of such firms.

Does the Investment Manager Put His Money Where His Mouth Is?

Proof of the pudding lies in eating in, and a true test of investment managers is whether they can invest their money in the same strategies as clients.

It has numerous advantages, including confidence in the investment strategy, low fund expenses, and alignment of manager and customer interests.

Consider Warren Buffet’s spectacular success in investing his own money, along with that of others, if you want a success story. Michael Milking “milked” people out of their asset allocation funds, and Bernie Madoff made off with their money. But you can ensure that you are not their next victim by following these simple strategies.

Conclusion

Money management is all about efficient asset allocation. Risk is directly proportional to reward, and asset allocation minimizes and maximizes the chances. Diversification is the key to financial success, and so is investor alertness.

It’s only possible to earn returns if you are going to lose them to a financial fraudster. As Warren Buffet has remarked, “Opportunities come once in a while, so when it rains gold, put out a bucket, not a thimble”. But in the face of potential financial fraud, the very opposite holds.

Be cautious about your investments and choice of investment managers as well. It is equally important to conduct background checks and tick off all the prerequisites before investing.

The correct choice can distinguish between profit and loss, win or lose, and rewards or zero returns. So, make sure you dial the right number and do your research before choosing an investment manager because this counts the most.

Recommended Articles

This has been a guide to the Asset Allocation and Security Selection. Here, we also discuss the asset allocation strategy. You may also look at the following articles to learn more –.