Financial Statement Examples

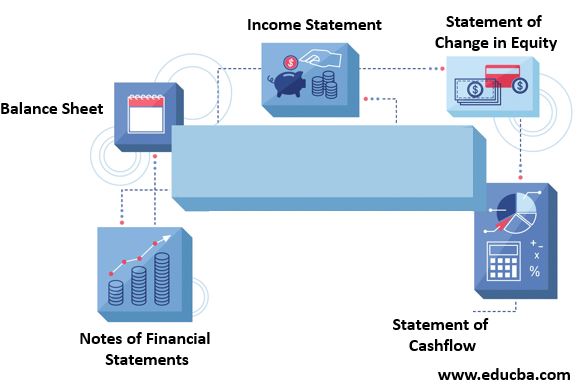

Financial Statements provide the financial information of an entity. Examples of financial statements are Income statements, Balance Sheets, Statements of Change in Equity, Statements of Cash Flow, and Notes of Financial Statements. All the different financial statement examples help stakeholders to gauge the financial position of a company. The Financial Statement needs to be audited at least annually by an independent auditor. This helps stakeholders to have faith in the statements.

Examples of Financial Statements

The examples are given below:

- Balance Sheet

- Income Statement

- Statement of Change in Equity

- Statement of Cashflow

- Notes of Financial Statements

#1. Balance Sheet Examples

Balance Sheet is the financial Position of a Company at a point in time. It means suppose a company is preparing a balance sheet on 31.12.2020. Then the figures that will reflect in the balance sheet are indicators of the financials on that particular date. The balance sheet portrays the assets, liabilities, and Equity of the company. The balance sheet is usually made in T-Format, where the assets are shown on one side and Liability and equity on the other side. Both Sides of the Balance sheet will have totally. So this brings the Universal formula of

Equity is the net worth of a company. If a particular company tries to buy another company, then the company places a bid to buy the equity of the company.

- Asset: These are resources that can be transferred and have economic value. There are several types of assets like land, machinery, cash, accounts payable, etc. All the mentioned items have economic value and can be sold to generate cash or kind. Assets can further be broken into Current and non-current. Current assets are short-term, and noncurrent assets are long-term assets. Usually, if an asset is purchased to be held for more than 12 months, then it is termed as a Long term. Assets let us know the stability of the company. Large fixed assets portray the strong capability of the company.

- Liability: These are obligations that the company owes to other parties. A few examples are Accounts Payable, Loans and Credit Purchases, etc. Liabilities can also be segregated into current and noncurrent assets. Studying the liability of a firm helps to understand the obligations that a firm holds. Too much debt will result in a high-interest burden. Too much interest burden may lead to bankruptcy. So analyzing liability will help to understand the solvency of a company.

- Equity: This refers to the net worth of the company. The components of equity are Common Stock, Preferred Stock, Share capital, and Retained earnings.

#2. Income Statement Examples

The income Statement shows the performance of the company over a period of time. The information that is provided by Income statement is Revenue, Expense or Profit/Loss. The statement lists down all the revenues in a period and the expenses. The net figure is the profit/loss. When Revenue is more than an expense, then there is profit or vice-versa.

- Revenue: All sales of a company, whether cash or credit sales, will come under the Revenue head. The revenue recognition rule as per the accounting standard should be followed. Revenue could be operating or non-operating. Non-operating refers to income generated from other sources rather than the primary source of income.

- Expense: These are costs that an entity incurs to perform its natural operation. All the costs that are directly linked to the operation are called operating expenses. Similarly, costs that are not linked to an operation, like interest expenses, are non-operating expenses.

- Profit/Loss: When Revenue is more than Expense, then that is good for the firm and it is said that the firm is earning profit. The primary goal of all organizations is to increase profit.

#3. Statement of Change in Equity Examples

This is an important statement for the owners of the firm. Equity is the portion for which the owners pay money to the firm. This statement shows the movement in equity, the contribution of shareholders, dividends paid to the shareholders, earnings retained in the business, etc. So whatever profit that the company earns is either paid as a dividend or is kept as retained earnings in the equity.

The equation that is

It should always match. If it is not matching, then there is some error.

#4. Statement of Cashflow Examples

Accounting principles are based on the accrual system of accounting. That is, revenue is recognised when earned, and expense recognised when incurred. So we don’t get an actual cash picture in this. The cash picture is rightly portrayed in cash flow statements. It shows the real cash that goes out of the business, and that flows into the business. There are three types of cash flow statements.

- Operating Cashflow: This statement gives us the exact cash that an entity generates from its operation. So if an entity has done mostly cash sales as compared to another entity that is engaged in credit sales, then the entity which is engaged in cash sales will have more operating cash inflow.

- Financing Cashflow: An entity needs money to run a business. So all the loans taken and interest paid will come into this account. It will show how much money the firm is spending to generate capital

- Investing Cashflow: Companies invest to buy assets. So the investment is an outflow. This statement shows the money that is being spent by companies to acquire assets

5. Notes of Financial Statements Examples

Notes are the most important part of financial statements. Everything in detail can’t be mentioned in the above-mentioned statements. So notes are prepared separately in order to throw light on specific items that require explanation. Suppose the company wants to explain a certain liability in detail. Then they can do it in the notes.

Conclusion

Financial Statements are the door to a company’s insight. So one needs to study financial statements carefully in order to understand a company clearly. A proper audit should be done in order to justify the credibility of the statements. The goodwill of a company depends on its timely disclosures.

Recommended Articles

This is a guide to Financial Statement Examples. Here we also discuss the introduction to Financial Statement Examples along with a detailed explanation. you may also have a look at the following articles to learn more –